How has the COVID-19 crisis affected different generations in terms of their health, wealth, living conditions and living standards? Here's a quick chart thread from our Intergenerational Audit published today... resolutionfoundation.org/publications/i…

The starkest impact of COVID-19 has been on mortality, which has overwhelmingly fallen on older generations. All cohorts aged 45 and over have suffered a sharp rise in their mortality rate.

But the effects on mental health and well-being across the age range are mixed. In lockdown, 80% more 18-29-year-olds reported experiencing higher-than-normal levels of mental health problems in April. There was a sharp increase in mental health problems among 65-79 year olds.

Coming into the crisis, the latest pay data shows a persistent hangover experienced by older millennials who entered the labour market during the 2008 recession - and who are now in their 30s.

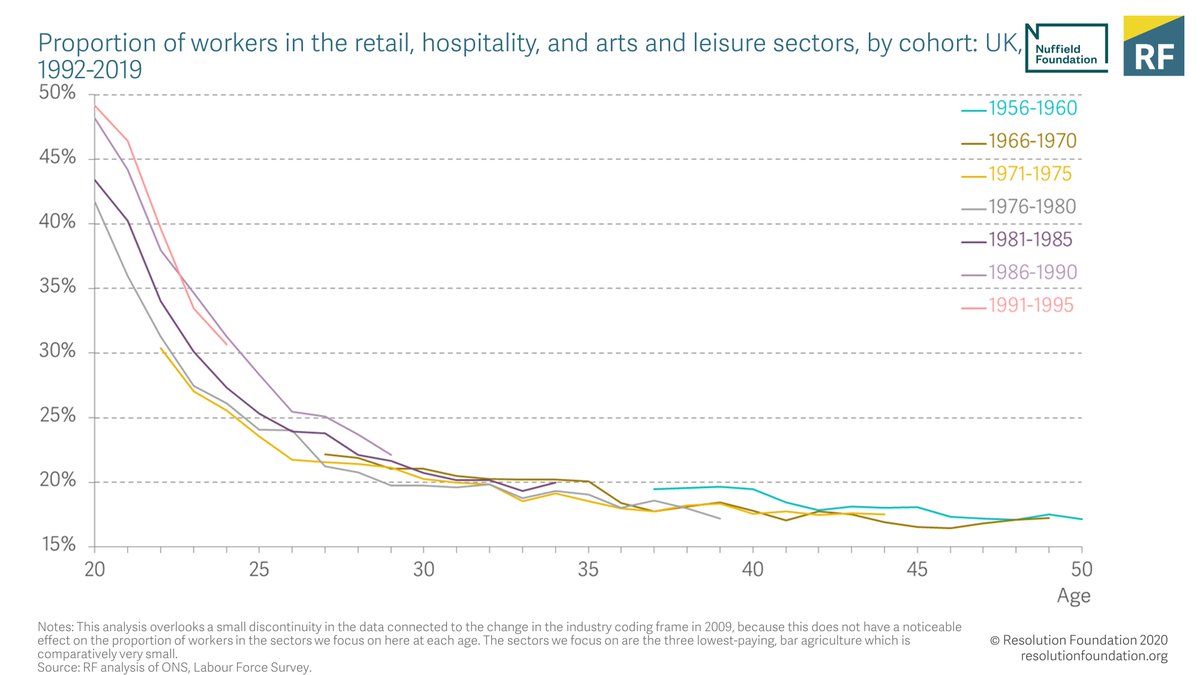

Another pre-covid trend has been the long-term increase in young people working in the low-paying retail, hospitality and leisure sectors, including over 3-in-10 24 year olds. This is why young people have been hit so hard by a jobs crisis that has fallen on these social sectors.

Another pre-covid trend that has been exposed by the current jobs crisis has been the uptick in zero-hours contract usage for the youngest and oldest workers. This was a blackspot in an otherwise-improving picture on job quality.

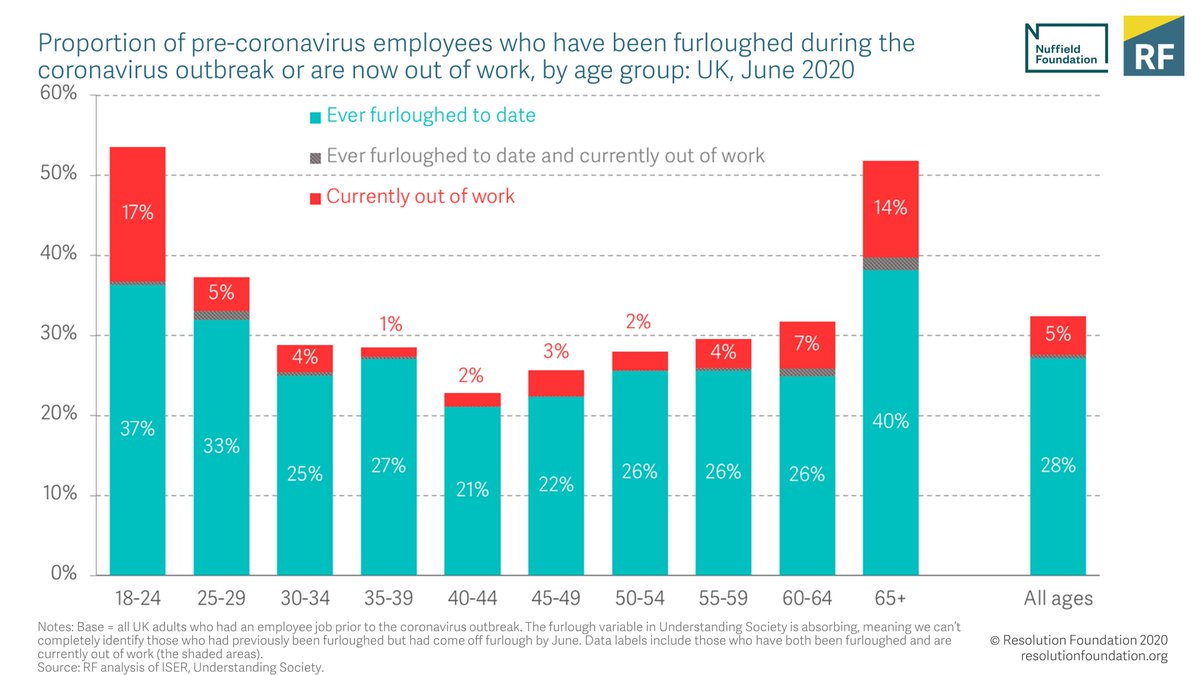

These trends have contributed to a U-shaped economic crisis, with the youngest and oldest workers hardest hit. Over half of those in their 20s and early 60s have stopped working since the pandemic begun.

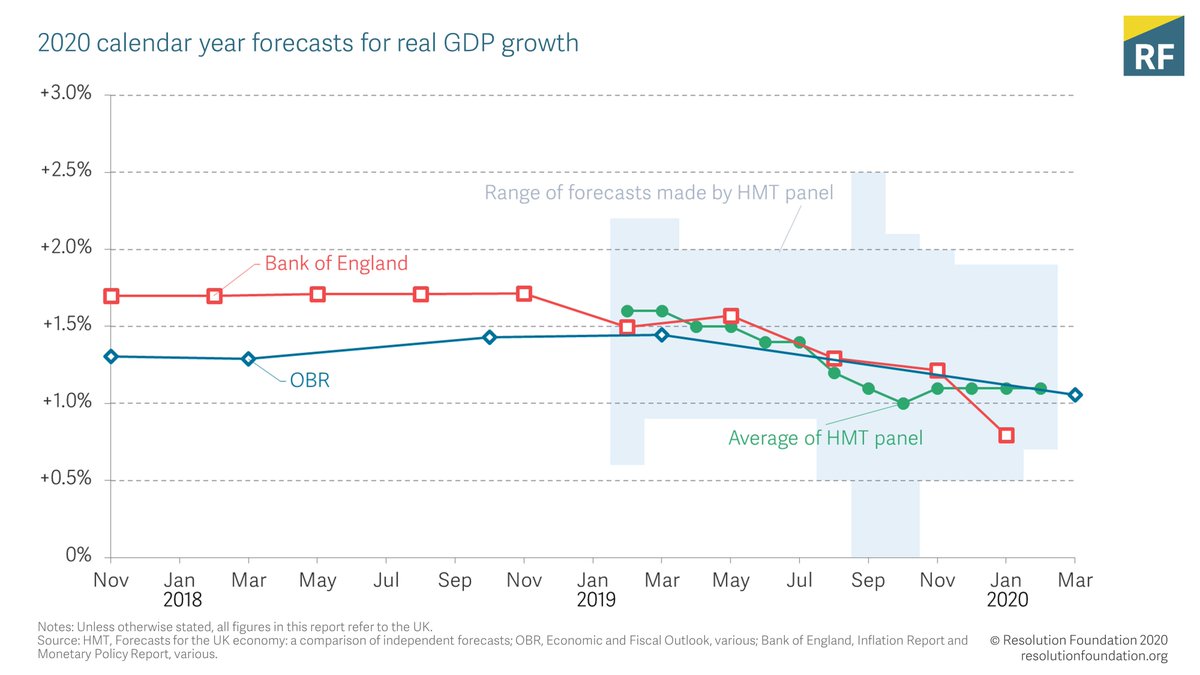

Where is our jobs crisis heading? Our analysis of @bankofengland & @OBR_UK projections shows that if rising unemployment is experienced evenly across the age range, we are heading for somewhere between 11 and 17 per cent of 18-29-year-olds being unemployed later this year.

The pre-covid picture on housing. A recent uptick in (generally lower-cost) home ownership meant that housing-cost-to-income ratios had fallen slightly for under-30s in recent years - a welcome shift after decades of going in the wrong direction.

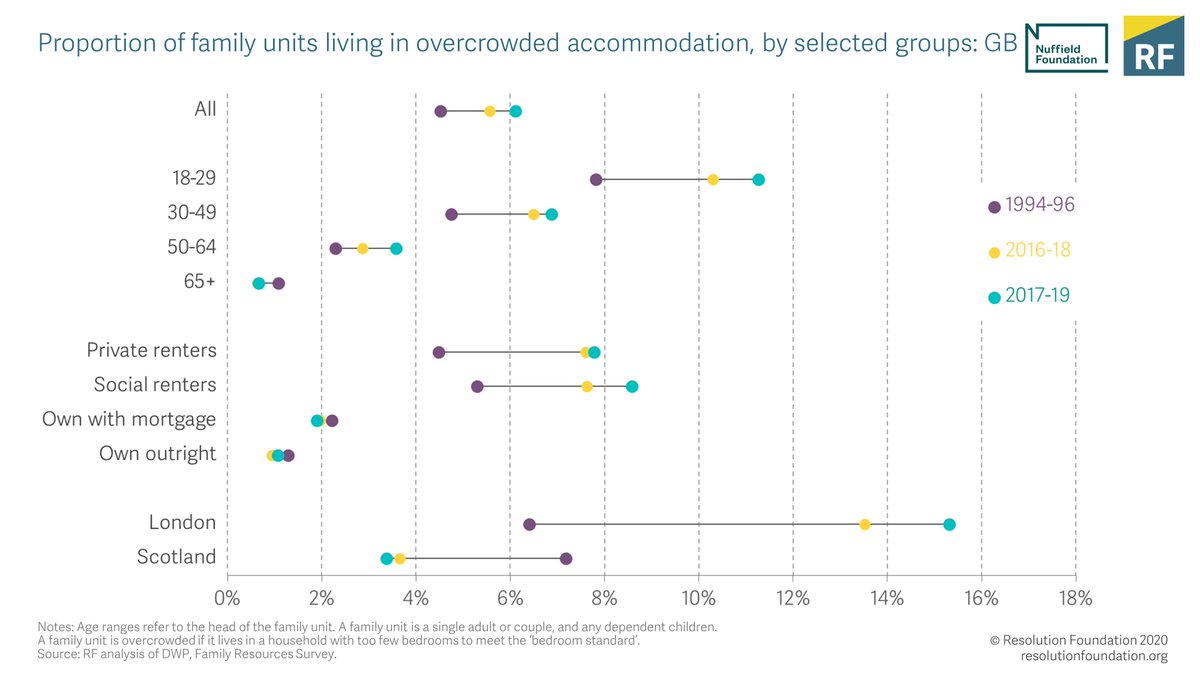

However, near-record levels of private renting for younger families, have meant that many more have had to endure overcrowded homes during lockdown. Overcrowding rates have remaining flat for families of pension age.

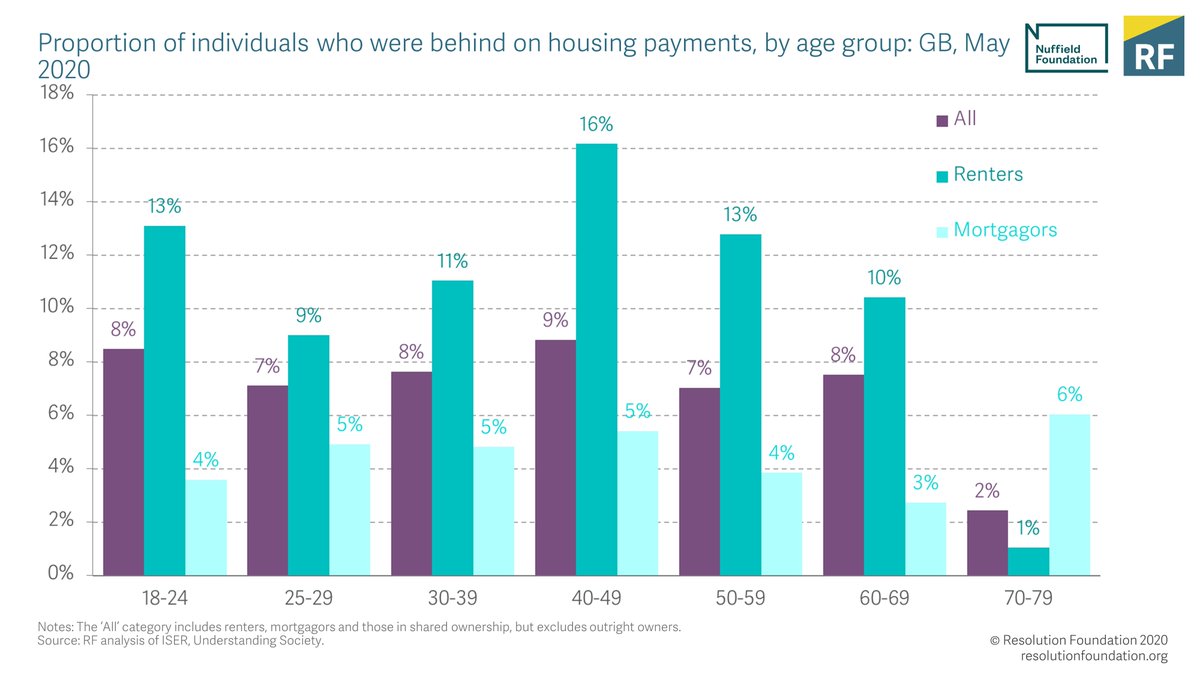

Younger generations - who are far more likely to rent than own - have experienced problems with housing costs too. During lockdown, significant minorities of working-age families fell behind on housing payments, particularly renters.

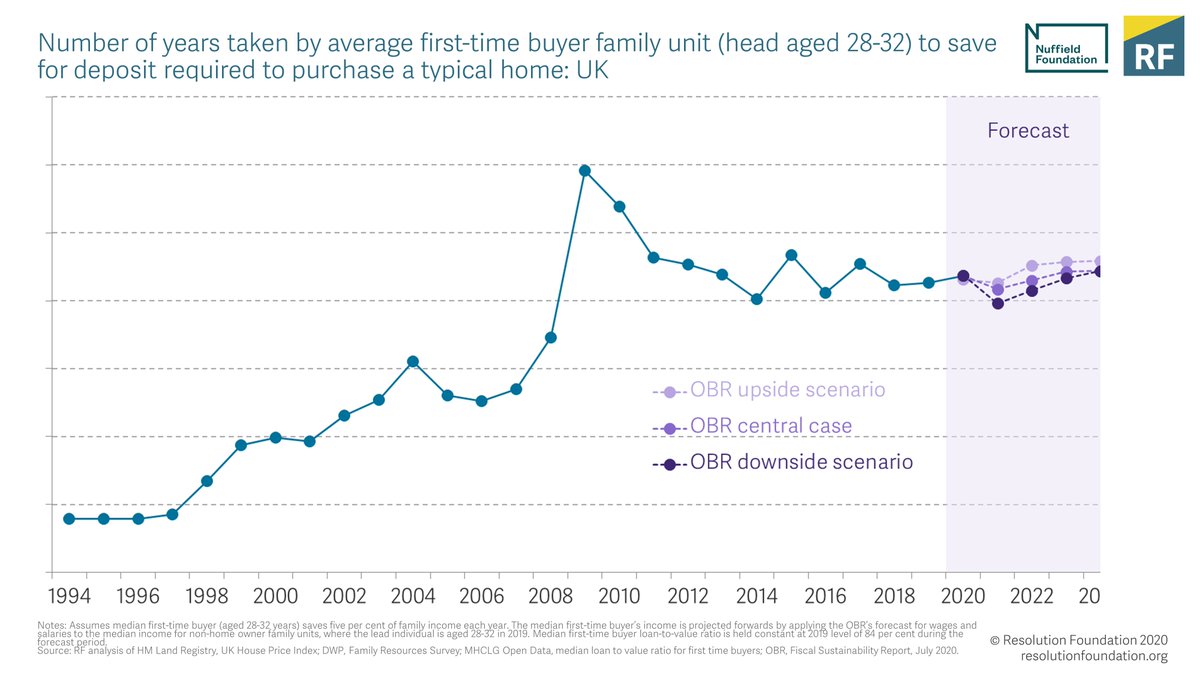

With house prices expecting to start falling soon, some may think this could be a silver living for first-time buyers as homes become more affordable. We are sceptical though - concurrent income falls mean that it takes just as long to save for a deposit.

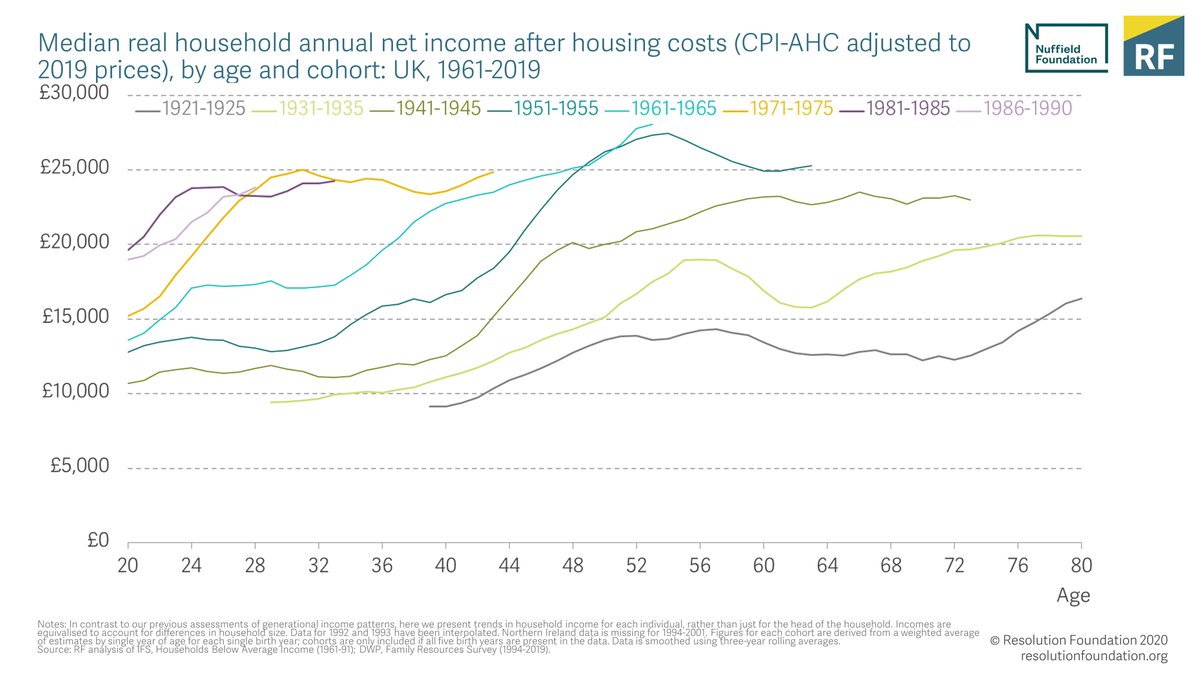

Perhaps the biggest pre-covid living standards trend has stronger real disposable household income growth among pensioners, compared to people of working age. Generational income progress has stalled for all cohorts of working age in recent years.

Contributing to this outcome has been reductions in working-age welfare generosity – the ongoing roll-out of past policy continues to bear down on working-age incomes.

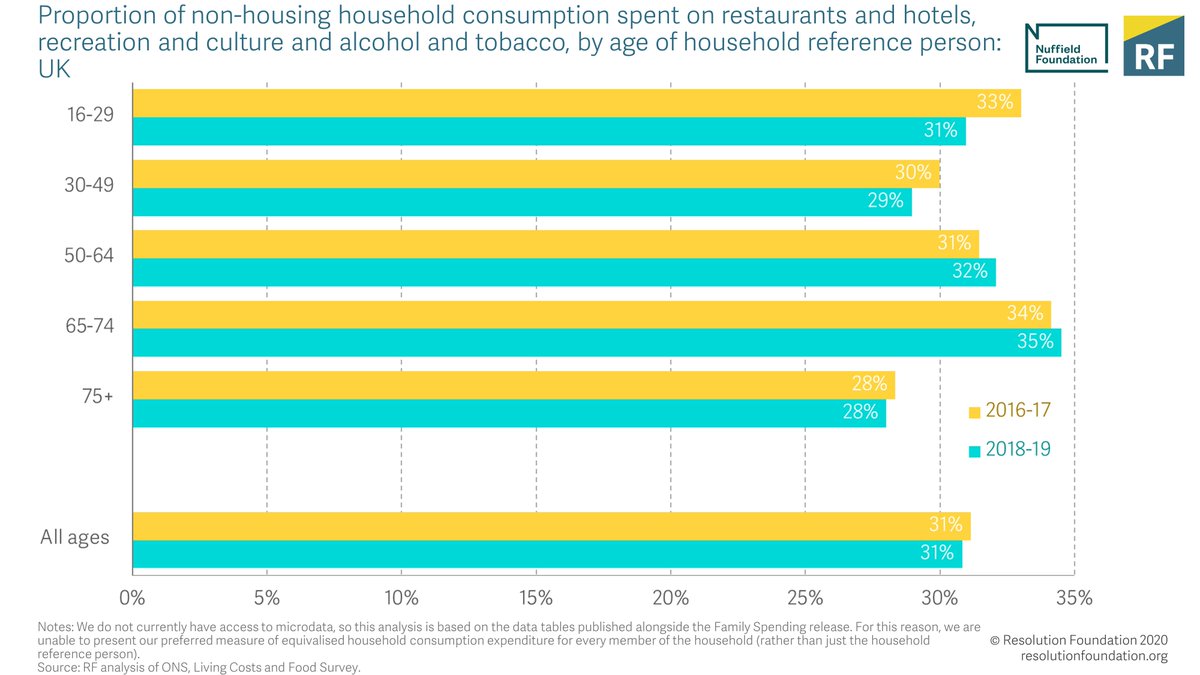

Big social spenders. Older households spend a greater a greater share of their post-housing expenditure income on non-necessities like restaurants and culture than young households - a gap that continues to widen.

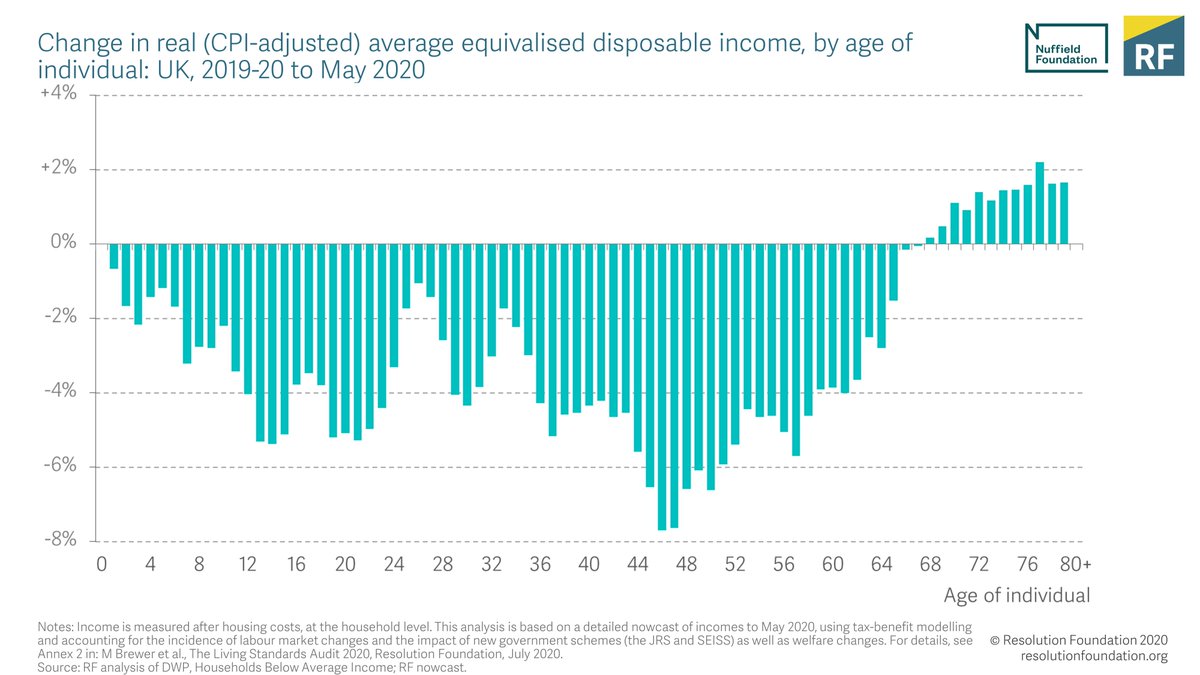

Britain experienced the biggest short-term income shock since the mid-1970s during lockdown. Our analysis finds that real incomes fell by mid-lockdown by 4.5 per cent for non-pensioners, with the biggest falls (of 6-8 per cent) occurring for those in their late 40s.

The coming living standards shock? The Government needs to decide whether the temporary benefit boost to should be extended. The age implications of the current benefit regimes are significant, especially when the economic shock from coronavirus is likely to be far from over.

From the social safety net to private safety nets. Prior to the current crisis, Britain’s wealth boom was continuing, and also continuing to drive much more cohort-on-cohort wealth progress for those born before the 1960s than for those born since.

Focusing on housing, net property wealth was only improving cohort-on-cohort for older families. The small recent uptick in home ownership at younger ages has not altered their trajectory for wealth accumulation. And it will be hugely affected by any future house price falls.

Turning to savings, we find that younger working-age families were most likely to increase the amount they saved each month during the initial lockdown rather than reduce it, and higher-income young adults particularly likely to do so.

Consumer debt take-up was most common in prime-age: 35-44-year-olds were most likely (among those of working age) to increase their use of consumer debt during the lockdown.

Finally, UK equity prices fell sharply in the early months of the covid crisis. For those in their 50s, we expect this effect to have dominated the resilience of house prices so far and dented net wealth (all else equal), by £500 in nominal terms for those in their early 50s.

This thread is the tip of the iceberg in terms of analysis in our Intergenerational Audit, supported by @NuffieldFound Read the full report by @gustafmaja @lauracgardiner @MikeBrewerEcon @karlhandscomb @kathleenhenehan @fahmidarahman & Lindsay Judge here resolutionfoundation.org/publications/i…

And then tune in to our webinar at 11am with @jreynoldsMP @JenniferTHF @gustafmaja & David Willetts where we'll be discussing the impact of the covid crisis across generations. Sign up and submit your questions here resolutionfoundation.org/events/lives-l…

• • •

Missing some Tweet in this thread? You can try to

force a refresh