Explain it like I'm 5, please.... wtf is "NFT mining"?

"NFT" is an abbreviation for "non-fungible token" which is perhaps the worst name for a piece of technology ever invented

An NFT is just a rare digital good

More 👇

"NFT" is an abbreviation for "non-fungible token" which is perhaps the worst name for a piece of technology ever invented

An NFT is just a rare digital good

More 👇

Example: I bought an insurance policy that was an NFT recently. No one else can own that policy but me.

I've bought NFT art.

I also own NFT collectibles (i.e. digital packs of Garbage Pail Kids @GeePeeKay issued by @ToppsDigital on @WAX_io).

2/x

I've bought NFT art.

I also own NFT collectibles (i.e. digital packs of Garbage Pail Kids @GeePeeKay issued by @ToppsDigital on @WAX_io).

2/x

But back to the original Q: what is #NFT mining?

A:

It's a way of fairly distributing rare NFTs into the world. Instead of selling them to the highest bidder, you give them to people who do things for your platform.

$MEME is leading the charge NFT mining.

3/x

A:

It's a way of fairly distributing rare NFTs into the world. Instead of selling them to the highest bidder, you give them to people who do things for your platform.

$MEME is leading the charge NFT mining.

3/x

Here's how it works:

you buy $MEME tokens

you stake $MEME tokens on the @DontBuyMeme platform

while staking $MEME, you earn pineapples

There is no other way to earn pineapples

You gotta stake $MEME

4/x

you buy $MEME tokens

you stake $MEME tokens on the @DontBuyMeme platform

while staking $MEME, you earn pineapples

There is no other way to earn pineapples

You gotta stake $MEME

4/x

And the maximum number of $MEME that any one $ETH address can stake = 5 (that's the dagger through the heart of you blubbery 🐳s!)

Once you have a fat bag of pineapples, you can trade them for NFTs that are only issued on the $MEME platform

5/x

Once you have a fat bag of pineapples, you can trade them for NFTs that are only issued on the $MEME platform

5/x

In effect, you spend pineapples to "mint" NFTs

So that's the basics. That's NFT mining.

Once you've minted a new piece of artwork, it's yours for all time. Or you can sell it on $RARI @rariblecom or @opensea or wherever you want.

6/x

So that's the basics. That's NFT mining.

Once you've minted a new piece of artwork, it's yours for all time. Or you can sell it on $RARI @rariblecom or @opensea or wherever you want.

6/x

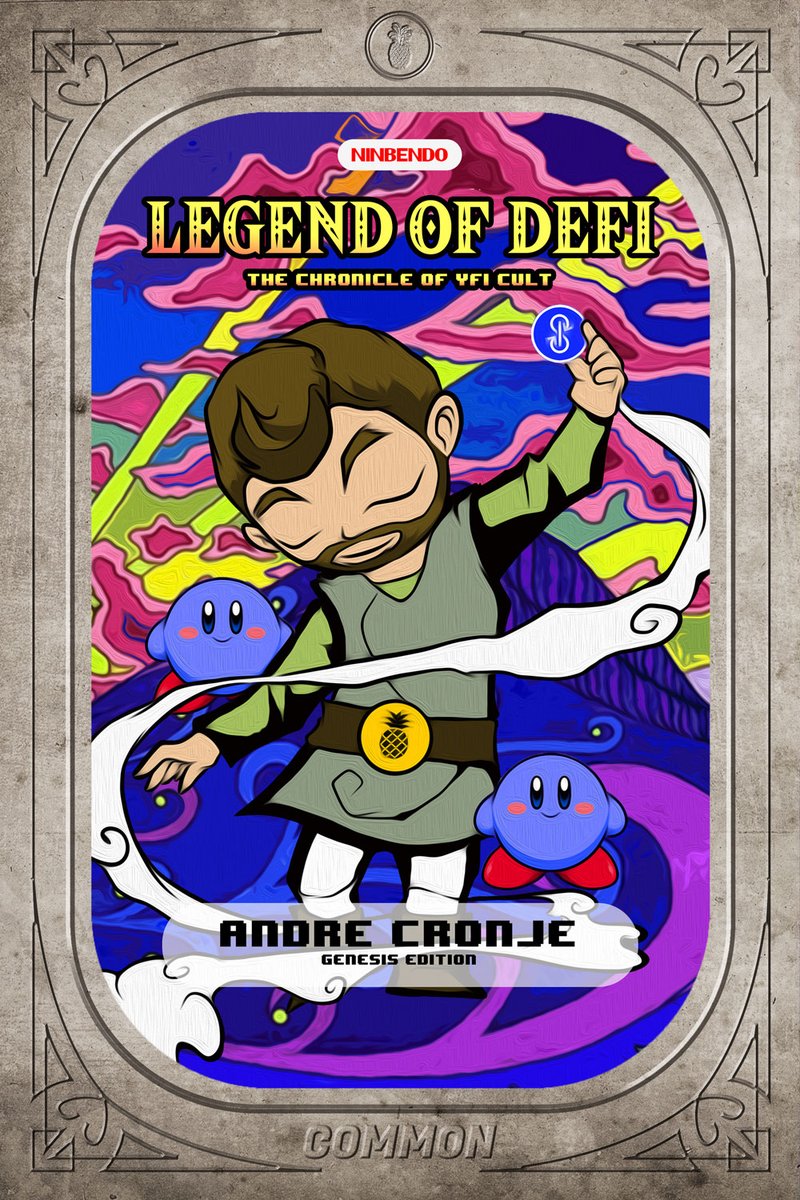

Over time, $MEME releases new pieces of art... here are some badass examples (both of coding legend, @AndreCronjeTech)

Love the crypto cards... but here's what really has me excited about $MEME: their artist series.

7/x

Love the crypto cards... but here's what really has me excited about $MEME: their artist series.

7/x

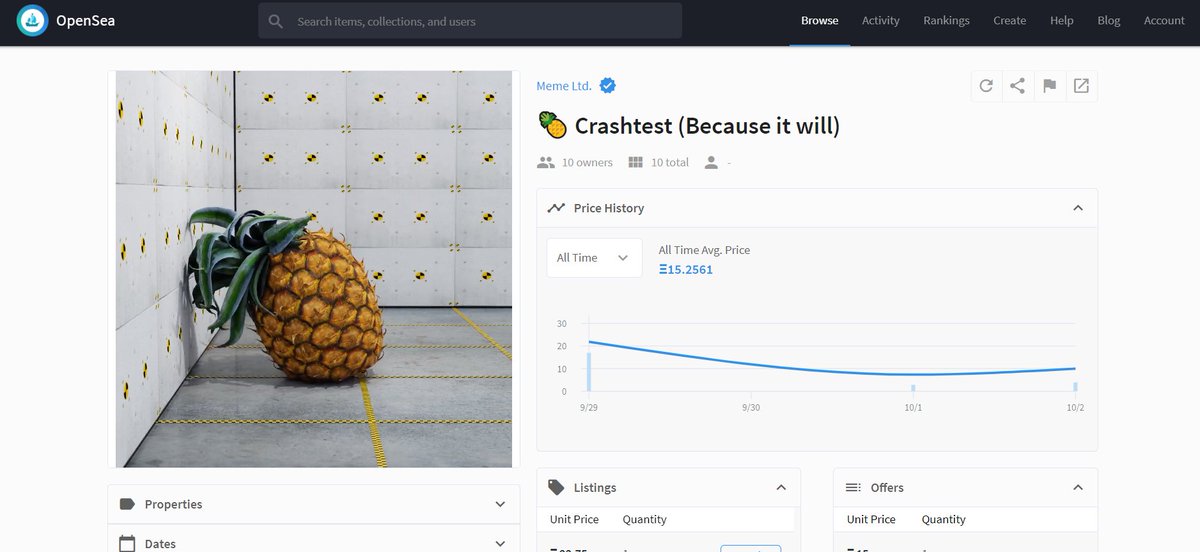

Their first artist is @sven_eberwein

He's put out 4 pineapple-themed, animated NFTs so far. This is my favorite. It's titled "Crashtest (Because it will)".

Me want to roll around w/ you pineapple

8/x

He's put out 4 pineapple-themed, animated NFTs so far. This is my favorite. It's titled "Crashtest (Because it will)".

Me want to roll around w/ you pineapple

8/x

There are 10 copies of "Crashtest" in existence. That's all there will ever be. The cheapest one is listed for 23+ $ETH on @opensea right now. The last one sold for just under 10 $ETH.

9/x

9/x

Here are the names and quantities of all the pieces @sven_eberwein has released on the $MEME platform so far:

1) Don't Buy Meme (500 copies)

2) Volatile Pineapples (250 copies)

3) The Meme Shitcoin Cycle (100 copies)

4) Crashtest (Because it will) (10 copies)

10/x

1) Don't Buy Meme (500 copies)

2) Volatile Pineapples (250 copies)

3) The Meme Shitcoin Cycle (100 copies)

4) Crashtest (Because it will) (10 copies)

10/x

Now, ladies and gentlemen...

@sven_eberwein's fifth and final piece will... of course... be one of a kind. It's titled Pineapple Ponzi.

I likey it.

I likey a lot.

11/x

@sven_eberwein's fifth and final piece will... of course... be one of a kind. It's titled Pineapple Ponzi.

I likey it.

I likey a lot.

11/x

A lot of work by @sven_eberwein reminds me of @jeffkoons. Reference the alluring, blank-faced massive balloon dog below...

Current bid for Pineapple Ponzi = 22 $MEME (about $7,000)

Bidding will last 5 days + payment must be made in $MEME.

How high could bidding go?

12/x

Current bid for Pineapple Ponzi = 22 $MEME (about $7,000)

Bidding will last 5 days + payment must be made in $MEME.

How high could bidding go?

12/x

Well, let's look at the "book value" on the four pieces @sven_eberwein has already released on $MEME.

1) Don't Buy Meme (500 copies)... 7-day avg. price on @opensea = $17.83. Multipy that by 500 to get a market cap of $8,915.

13/x

1) Don't Buy Meme (500 copies)... 7-day avg. price on @opensea = $17.83. Multipy that by 500 to get a market cap of $8,915.

13/x

2) Volatile Pineapples (250 copies).... 7-day avg. price = $83.15. Multipy that by 250 to get a market cap of $20,788.

3) The Meme Shitcoin Cycle (100 copies)... 7-day avg. price = $187. Multiply that by 100 to get a market cap of $18,702.

14/x

3) The Meme Shitcoin Cycle (100 copies)... 7-day avg. price = $187. Multiply that by 100 to get a market cap of $18,702.

14/x

4) Crashtest (Because it will) (10 copies)... 7-day avg. price = $2,932. Multipy that by 10 to get a market cap of $29,320.

Average MC of an @sven_eberwein piece = $17,931.25.

(Keep in mind, we've been in a shitty bear market over the past 7 days)

15/x

Average MC of an @sven_eberwein piece = $17,931.25.

(Keep in mind, we've been in a shitty bear market over the past 7 days)

15/x

So maybe this new piece, Pineapple Ponzi, will bring in $18,000 or so...

But wait. That seems low.

We've seen a piece's rarity impacts its valuation.

Piece No. 3 is 10x more common than Piece No. 4. So Piece No. 4 trades at a premium to Piece No. 3.

16/x

But wait. That seems low.

We've seen a piece's rarity impacts its valuation.

Piece No. 3 is 10x more common than Piece No. 4. So Piece No. 4 trades at a premium to Piece No. 3.

16/x

In fact, Piece No. 3 trades for about 1/15 the price of Piece No. 4.

OK then. If Pineapple Ponzi commands a 15x premium over Piece No. 4 (since it's 10x rarer), it could potentially go for as much as $270,000. That's about 4% of MEME's market cap or 850 $MEME tokens!

17/x

OK then. If Pineapple Ponzi commands a 15x premium over Piece No. 4 (since it's 10x rarer), it could potentially go for as much as $270,000. That's about 4% of MEME's market cap or 850 $MEME tokens!

17/x

Sounds insane, and it could obvious be a ludicrously high estimate... In fact, I'd discount that number by 50% to be safe, and guess it will go for ~$135,000.

10% of bids will go to charity. 10% of bids will go to $MEME. And 80% of bids will go right where it should...

18/x

10% of bids will go to charity. 10% of bids will go to $MEME. And 80% of bids will go right where it should...

18/x

...directly to @sven_eberwein.

$MEME is scarce. Only 28k tokens. Currently, the single largest $MEME wallet is "only" holding 470 MEME (~$150,000)

So, I expect this single auction to noticeably push $MEME prices up... esp. since bidders must lock up their $MEME to bid

19/x

$MEME is scarce. Only 28k tokens. Currently, the single largest $MEME wallet is "only" holding 470 MEME (~$150,000)

So, I expect this single auction to noticeably push $MEME prices up... esp. since bidders must lock up their $MEME to bid

19/x

Final takeaway: $MEME looks like fun and games, but NFTs are going to be so legit, they'll not only melt faces, they'll melt thoraxes and pelvises, too

20/x

20/x

There's a worn-out meme in the $BTC community that "institutions are coming"... meaning big banks and hedge funds will soon pour trillions into the old gray-haired mayor $BTC.

In NFTs, the meme should be "artists are coming."

21/x

In NFTs, the meme should be "artists are coming."

21/x

Wait until we see a Damien Hirst NFT... or a @JeffKoons... or, the fucking anon king himself, Banksy

NFTs are not merely an offshoot of "crypto", they're an asset class

Please con't to ignore them while I accumulate the good ones + the tokens like $MEME that enable them...

NFTs are not merely an offshoot of "crypto", they're an asset class

Please con't to ignore them while I accumulate the good ones + the tokens like $MEME that enable them...

Want more? Read this and learn how to bid on Pineapple Ponzi...

https://twitter.com/DontBuyMeme/status/1313962010288123905?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh