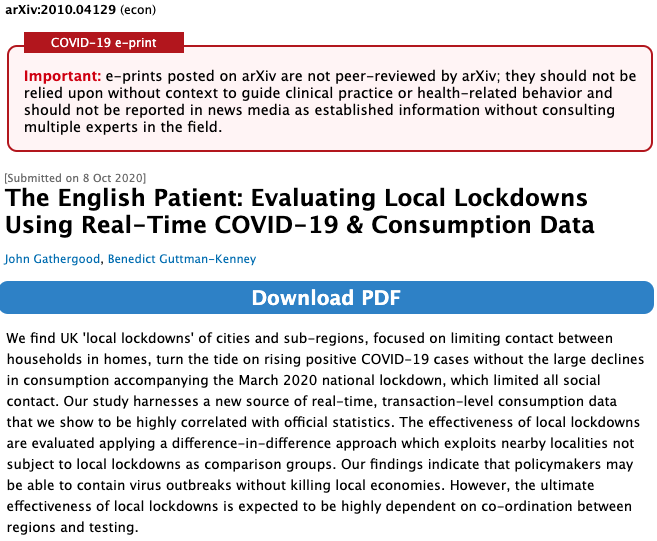

👋New work with @johngathergood evaluating recent UK local lockdowns using new real-time spending data

Paper: arxiv.org/abs/2010.04129

@EconObservatory blog: coronavirusandtheeconomy.com/question/how-c…

Thread ⬇️ 1/11

#householdfinance #coronavirusindicators #econtwitter

Paper: arxiv.org/abs/2010.04129

@EconObservatory blog: coronavirusandtheeconomy.com/question/how-c…

Thread ⬇️ 1/11

#householdfinance #coronavirusindicators #econtwitter

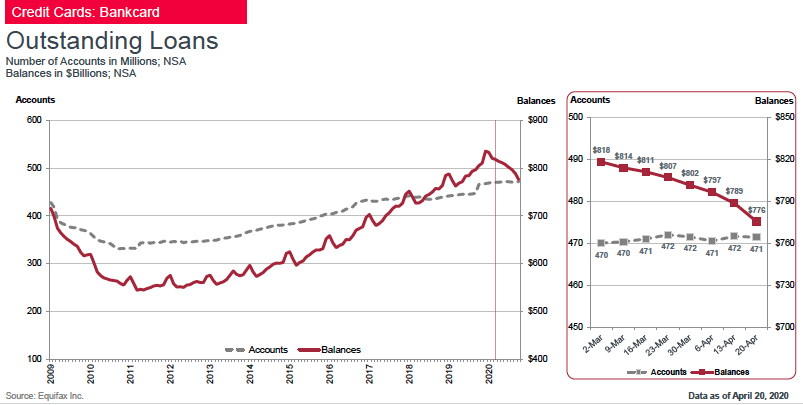

We use @fable_data - a new source of European real-time, transaction-level consumption data. We find a 0.91 correlation with comprehensive (aggregated) bank of england credit card data. Its real-time, disaggregated format facilitates studying regional consumption... 2/11

We use this to inform the big policy question: How can authorities control coronavirus without killing the economy?

3/11

3/11

Like other countries, UK had large declines in credit card spending in early 2020 when COVID-19 hit and the country went into a national lockdown...

4/11

4/11

After the national lockdown was eased the government tried to contain regional outbreaks through a system of local lockdowns restricting household mixing but permitting economic activity in COVID-secure settings (e.g. masks, socially-distanced)... 5/11

UK local lockdowns are imposed by national government - a contrast to the US where there's been little, if any, national coordination.

Local lockdowns have been a source of political tension between local and national governments & motivated some new Van Morrison songs... 6/11

Local lockdowns have been a source of political tension between local and national governments & motivated some new Van Morrison songs... 6/11

We use a descriptive difference-in-difference approach to evaluate 13 lockdowns.

For each city or sub-region affected by a local lockdown (e.g. Manchester) we compare COVID-19 cases and offline credit card spending to a similar nearby city (e.g. Liverpool)... 7/11

For each city or sub-region affected by a local lockdown (e.g. Manchester) we compare COVID-19 cases and offline credit card spending to a similar nearby city (e.g. Liverpool)... 7/11

We find lockdowns appear to turn the tide on rising COVID-19 cases in the month after being imposed

(yellow lines are areas subject to local lockdowns, black nearby control areas).... 8/11

(yellow lines are areas subject to local lockdowns, black nearby control areas).... 8/11

But we see little if any change in credit card spending.

Certainly no large drop of the magnitude accompanying the national lockdowns earlier in the year.

This suggests local lockdowns can control the virus without damaging the economy but... 9/11

Certainly no large drop of the magnitude accompanying the national lockdowns earlier in the year.

This suggests local lockdowns can control the virus without damaging the economy but... 9/11

Isolating, testing and tracing cases are key to the effectiveness of keeping lockdowns local and preventing the need for additional measures. Recent nationwide rises in cases indicate UK is not isolating cases early enough. 10/11

There’s some easter eggs in the annex of the paper e.g. spending by urban geographies.

Hope you don't hate it. 11/11

Hope you don't hate it. 11/11

P.s. Recommend following @EconObservatory - a brilliant resource edited by @econromesh to disseminate COVID-19 research in an accessible way.

Fable has been fantastic to collaborate with. John and I are planning more stuff. Email us if you want to know more.

Fable has been fantastic to collaborate with. John and I are planning more stuff. Email us if you want to know more.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh