Short sellers have been getting a lot of flack on Twitter lately.

While I'm bullish about crypto/ DeFi, here's a devil's advocate take on shorting 101 and why it's not as evil as crypto twitter make it seem to be.

Obviously not financial advice, just personal opinions.

While I'm bullish about crypto/ DeFi, here's a devil's advocate take on shorting 101 and why it's not as evil as crypto twitter make it seem to be.

Obviously not financial advice, just personal opinions.

1/ There are a lot of misconceptions about shorting. It's seen as "manipulative", even "evil".

In a space where most retails are long-biased and only want number to go up, shorting is seen as something conniving and devious hedge funds and traders do to "screw over" retails.

In a space where most retails are long-biased and only want number to go up, shorting is seen as something conniving and devious hedge funds and traders do to "screw over" retails.

2/ Investors also don't like to talk about shorting in public - it seems like something that's out of the crypto twitter party line, something anti-progress and even malicious.

If long-only VCs do their best to help founders build, what does that imply about short sellers?

If long-only VCs do their best to help founders build, what does that imply about short sellers?

3/ I think this mostly comes down to one of the biggest fallacies in the crypto space: that price = fundamentals.

While in the long term, price should be an accurate reflection of value, in the short term, price is a poor indication of quality.

While in the long term, price should be an accurate reflection of value, in the short term, price is a poor indication of quality.

4/ Important also to note that as a liquid market with venture-potential returns, crypto invites people of all time preferences.

Betting against innovation is asinine, but a trader can short intraday or intramonth. Short selling is more of a strategy, not a long term thesis.

Betting against innovation is asinine, but a trader can short intraday or intramonth. Short selling is more of a strategy, not a long term thesis.

5/ To me, there are generally three scenarios when I'd entertain a short on a token (not mutually exclusive)

1) when I don't think the team has what it takes to execute on what the market expects them to

2) when I think price has deviated too far from value

3) as a hedge

1) when I don't think the team has what it takes to execute on what the market expects them to

2) when I think price has deviated too far from value

3) as a hedge

6/ Because price is such a poor reflection of quality, fundamentals-based shorts are difficult.

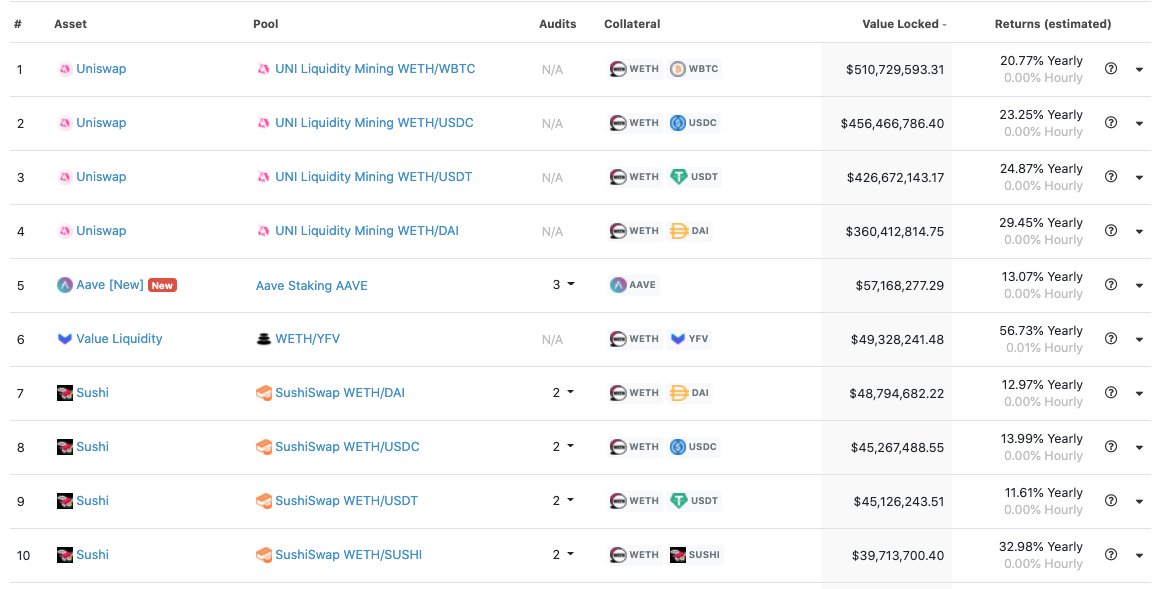

e.g. even after 3 back-to-back 51% attacks in August, $ETC still commands a higher valuation than $UNI today - the most used protocol in DeFi.

e.g. even after 3 back-to-back 51% attacks in August, $ETC still commands a higher valuation than $UNI today - the most used protocol in DeFi.

7/ Above is a cherry-picked example, but one of many that points to the difficulty of shorting things based on perceived value: because there's no clear consensus for value for many assets in crypto!

8/ On #2 - if an asset rallies significantly with no meaningful catalysts, it is likely to mean revert and retrace part of the move.

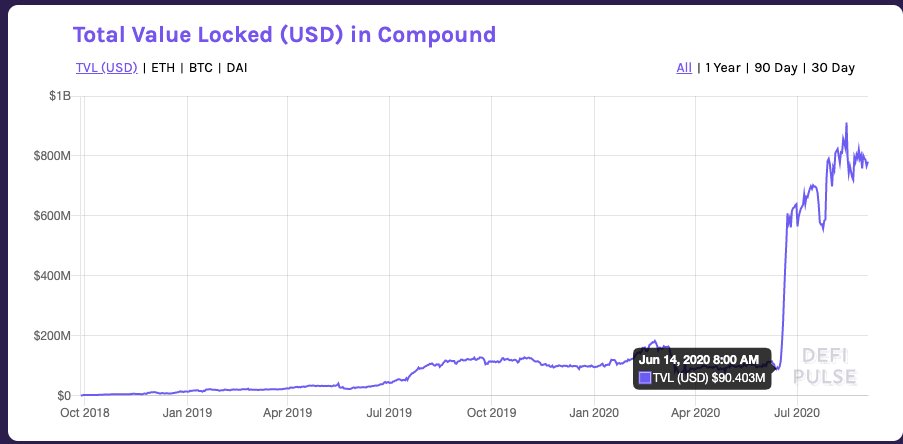

For instance, those who think the August rally in DeFi was price running ahead of fundamentals may have shorted some of the overheated assets.

For instance, those who think the August rally in DeFi was price running ahead of fundamentals may have shorted some of the overheated assets.

9/ This does not mean they are betting on the projects themselves to fail, or that they're an enemy of DeFi.

People who reply with a list of reasons why X is a Strong Project after someone on Twitter has disclosed a short X position have largely missed the point.

People who reply with a list of reasons why X is a Strong Project after someone on Twitter has disclosed a short X position have largely missed the point.

10/ Anecdotally, most of the people I know who are meaningfully short the market (2-10% of portfolio short) recently are actually long term DeFi bulls.

In the short term, shorting correlated assets helped with minimizing short term drawdowns and portfolio volatility.

In the short term, shorting correlated assets helped with minimizing short term drawdowns and portfolio volatility.

11/ In the long term, shorting also allows investors to go more long on projects they feel strongly about.

i.e. if investor feels strongly bullish about X, he can short sell Y (borrow Y, sell for cash) and go more long on X.

i.e. if investor feels strongly bullish about X, he can short sell Y (borrow Y, sell for cash) and go more long on X.

12/ This also fits into reason #3 many investors go short in crypto - to hedge. There are many ways to create offsetting exposures to hedge different types of risks.

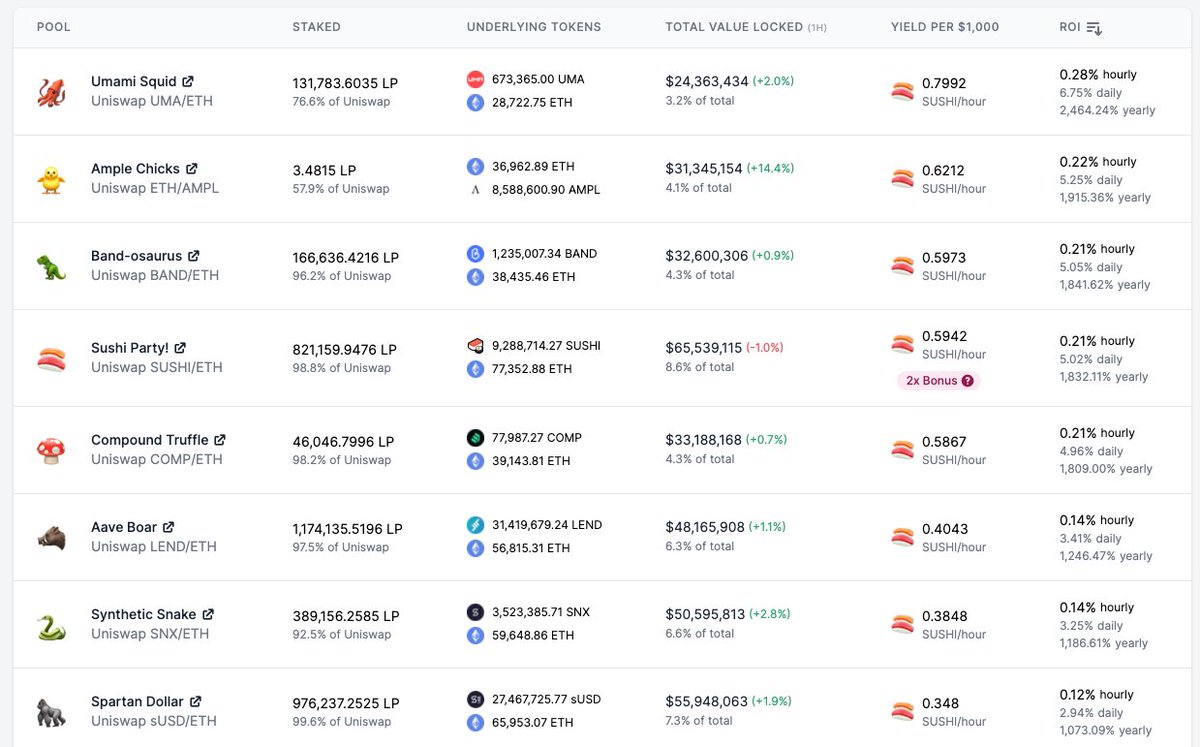

13/ One of the common ways shorting is used is a pairs trade, where an investor bets on 2 assets that are deviating in price but historically correlated to revert.

He does this usually by short selling one asset and going long on the other.

He does this usually by short selling one asset and going long on the other.

14/ So tl;dr - for investors, shorting is a handy tool in managing risk and volatility.

It may reflect his opinion on the price of an asset, the stage of the market cycle, but not necessarily the long term potential of the underlying project, or the space.

It may reflect his opinion on the price of an asset, the stage of the market cycle, but not necessarily the long term potential of the underlying project, or the space.

15/ From a market perspective - shorting is also essential to more effective price discovery. If you feel geeky, here's a research paper on that.

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

16/ Now obviously there is a whole history on regulations around short selling (see: Uptick Rule) and their impact on markets.

I'm no expert in this - this thread only hopes to shed some color on why market participants may choose to go short.

I'm no expert in this - this thread only hopes to shed some color on why market participants may choose to go short.

ps/ As a side note, Spartan is generally a long-biased fund. We rarely go short, and even if we do it's for very specific events - and more often than not to hedge our book so we can maintain, or even increase, our investments in projects we believe in.

ps2/ To allow us to have less sensitivity to market swings, we also deploy out of our separate venture fund, where we have a more cycle-agnostic strategy. More on this soon.

• • •

Missing some Tweet in this thread? You can try to

force a refresh