#SaaS week, Ep3⃣.

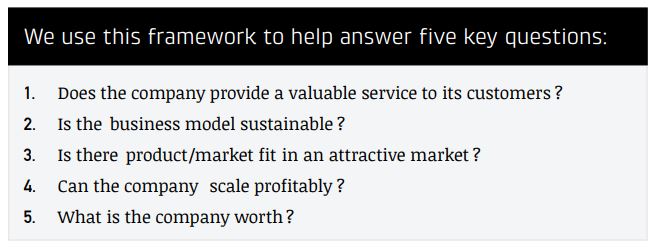

Excellent presentation by @AlbionVC👏on framework for evaluating SaaS companies. Goes thru some of the qualitative criteria and the related metrics/analysis. Lot of useful info for Public market investors also.

albion.vc/sites/default/…

Excellent presentation by @AlbionVC👏on framework for evaluating SaaS companies. Goes thru some of the qualitative criteria and the related metrics/analysis. Lot of useful info for Public market investors also.

albion.vc/sites/default/…

Although few of these metrics are not released by the Public Co's, it's still useful background knowledge for Public investors.

Especially in SaaS, it's beneficial to put on the hat of a Venture investor as you're dealing with high growth, but (mostly) unprofitable businesses.

Especially in SaaS, it's beneficial to put on the hat of a Venture investor as you're dealing with high growth, but (mostly) unprofitable businesses.

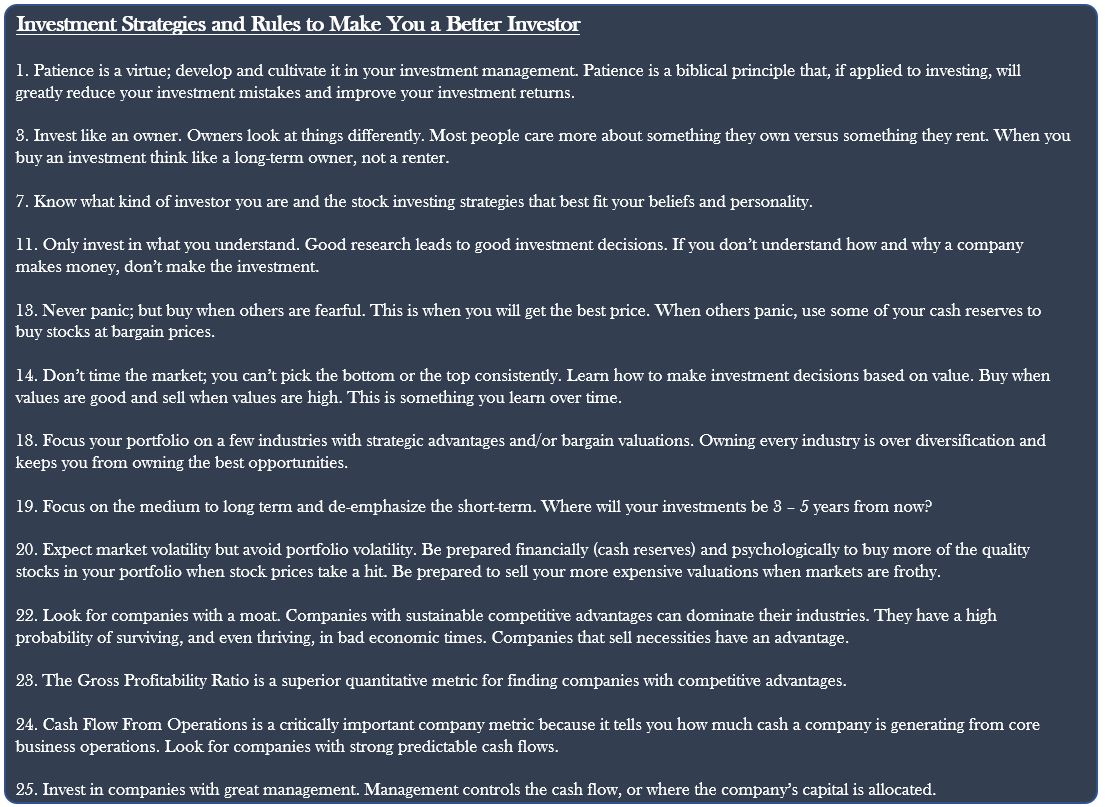

So lot more importance needs to be given to understanding qualitative metrics like

- The actual products/services of the Co.

- Trends and competition.

- Reasons for Rev growth & Mgmt plan for continued growth.

- Go To market strategy and LTV/CAC metrics & trend.

- The actual products/services of the Co.

- Trends and competition.

- Reasons for Rev growth & Mgmt plan for continued growth.

- Go To market strategy and LTV/CAC metrics & trend.

- What churn, DBNE and NPS etc are telling us.

- Scalability of the Product, decent idea of TAM (and it's expansion with time).

- Current Margin profile of the Co, % levels of COGS/R&D/S&M/G&A and their direction.

- Cash position, burn rate and dilution risk.

- Scalability of the Product, decent idea of TAM (and it's expansion with time).

- Current Margin profile of the Co, % levels of COGS/R&D/S&M/G&A and their direction.

- Cash position, burn rate and dilution risk.

Of course, doing all this for every SaaS position is not practical for (individual) investors but it doesn't hurt to know more, and be on the lookout for great Co's to add, also for catching any red flags in any major positions in the Portfolio.

/END.

/END.

• • •

Missing some Tweet in this thread? You can try to

force a refresh