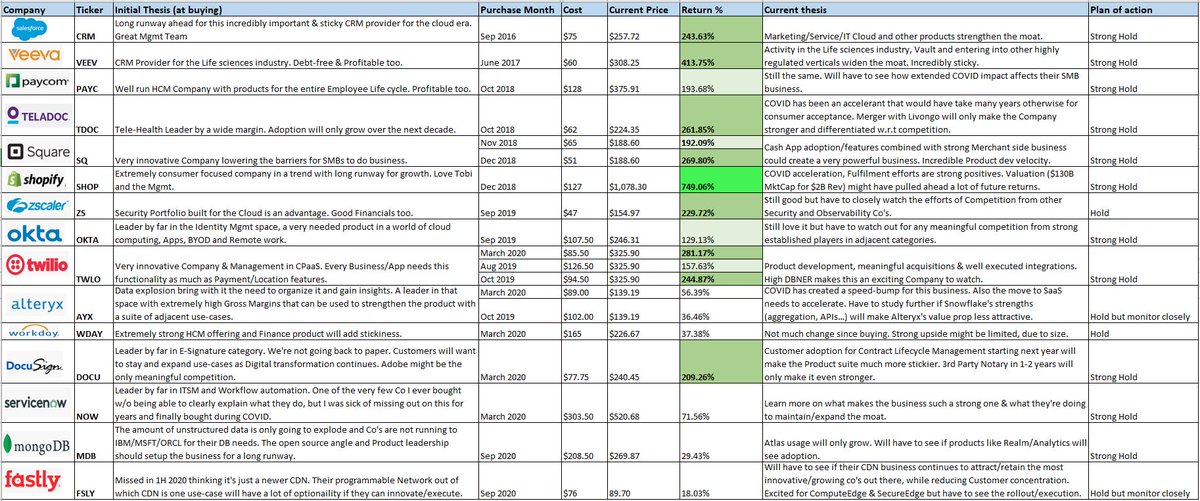

#SaaS week, Ep5⃣. My SaaS journey, scorecard & lessons learnt. Oh yeah! My original & current thesis for my SaaS holdings too.

Sharing with few (SaaS) friends🙂.

@TMFJMo @saxena_puru @FromValue @richard_chu97 @BrianFeroldi @adventuresinfi @7Innovator @dhaval_kotecha

Scorecard⬇️

Sharing with few (SaaS) friends🙂.

@TMFJMo @saxena_puru @FromValue @richard_chu97 @BrianFeroldi @adventuresinfi @7Innovator @dhaval_kotecha

Scorecard⬇️

SaaS Journey ⬇️

2008 : The first Cloud/SaaS company I came across in the Market was $CRM (obviously), back in Dec'08 when it was at split adjusted $6.

2008 : The first Cloud/SaaS company I came across in the Market was $CRM (obviously), back in Dec'08 when it was at split adjusted $6.

Cloud has been a buzz word in Media for 2 years by then, but being a new investor, I didn't want to research a new trend when pretty much everything else (many strong/stable/profitable co's) was available for very low prices due to GFC .

2012-2013 : This is when a lot of IaaS or Cloud storage Co's debuted in the Market but I still wasn't comfortable with investing in high growth but unprofitable (couldn't see a moat) companies.

2014-2016 : Was when SaaS co's started to IPO more. I spent a lot of time in Summer 2016 learning about few Companies ($VEEV, $PAYC, $SHOP...), basics of SaaS economics & metrics but still wasn't comfortable investing in seemingly high (although backward looking) valuations.

2017-now : Reading Clayton Christensen's & Adam Hartung's work opened my eyes to look strongly at the actual trends, Businesses (competition) and their future outlook first, and then getting into Fin statement analysis & then finally into Valuations (& contextualize them).

Luckily the volatile periods of 4Q-2018, Fall 2019, and March-2020 offered some incredible opportunities to get into some strong SaaS businesses at attractive entry points.

/END of Journey story. 🛣️

/END of Journey story. 🛣️

Lessons learnt 🤦♂️⬇️

1. Before Buying 🔎:

1.1 Trends : Accelerated Business growth usually happens in the Companies at the forefront of strong trends (Technology/Demographic/Regulatory...). Study and learn the major trends, on the actual benefits to the consumers

1. Before Buying 🔎:

1.1 Trends : Accelerated Business growth usually happens in the Companies at the forefront of strong trends (Technology/Demographic/Regulatory...). Study and learn the major trends, on the actual benefits to the consumers

(cheaper/faster/better/brand new use cases...), the acceptance/adoption curves & sustainability of those trends.

Few could turn out to be fads or minor trends, but the major ones (like Mobile, Cloud, E-Commerce, War on Cash) have decades long runways.

Few could turn out to be fads or minor trends, but the major ones (like Mobile, Cloud, E-Commerce, War on Cash) have decades long runways.

1.2 Industry metrics : Every industry will have their own industry specific metrics. Learn & focus on the metrics that determine quality/strength (For SaaS that could be MRR/ARR growth, LTV/CAC, Retention, DBNER....) and learn how to use them in context of Fundamental analysis.

1.3 Company Analysis : Research the leading co's (what differentiates their products/services), their Management & understand the reasons on why they're winning and whether or not that could continue. Unless you're an industry insider or Power user, or pay for expensive research

it's difficult to dig deep into the Product quality/differentiation/moat of B2B SaaS businesses.

This is where following the work of super smart Industry insiders like @StackInvesting @hhhypergrowth or deep dives by Services from @FromValue @investing_city etc will help greatly.

This is where following the work of super smart Industry insiders like @StackInvesting @hhhypergrowth or deep dives by Services from @FromValue @investing_city etc will help greatly.

2. Buying 💰:

2.1 Valuation : It's easy/lazy to glance at Valuation ratios and quickly call it cheap or expensive. Putting Valuation into context (based on Business/Mgmt Quality, growth, runway, Moat, Balance sheet strength, Margin profile etc)

2.1 Valuation : It's easy/lazy to glance at Valuation ratios and quickly call it cheap or expensive. Putting Valuation into context (based on Business/Mgmt Quality, growth, runway, Moat, Balance sheet strength, Margin profile etc)

is one of the most important skills in investing.

Understand where the Company is investing (lowering COGS, R&D, S&M...) and check whether it's resulting in the Co getting stronger and delivering (value added topline) growth

Understand where the Company is investing (lowering COGS, R&D, S&M...) and check whether it's resulting in the Co getting stronger and delivering (value added topline) growth

2.2 Buy in parts : Very often, after some good research you come to the conclusion that you like everything about the Company but would love to buy it little cheaper. In these situations, if you understand/like the...

..Company/Management/Vision & execution a lot, can see the long runway ahead, and the Marketcap is still small (it's $5-10B these days in SaaS), buy a little like 1/3rd of what your overall (cost) position would be.

3 After Buying 📑:

3.1 Monitoring thesis and adding more as it plays out : With skin in the game, you can follow the Co better and add more as the Co proves your thesis or a Volatile mkt suddenly gives you attractive prices to increase your position.

3.1 Monitoring thesis and adding more as it plays out : With skin in the game, you can follow the Co better and add more as the Co proves your thesis or a Volatile mkt suddenly gives you attractive prices to increase your position.

Businesses do not operate in a vacuum (or your initial thesis scenario). Capitalism and Competition are extremely dynamic. Check the thesis (based on current operating conditions) and see if your original thesis is the same, getting better or worse.

3.2 Eventual over and under valuation : Yes, Companies are supposed to be ideally valued based on long-term FCFs but most co's do not have that level of quality or visibility where you can make projections for 5-10 yrs and beyond.

The stock prices in any year will have huge swings making us feel like a genius at times and a fool at other times for investing in this company. Don't let stock prices alone dictate your conviction in the position (especially when the hit is due to Macro fears).

As long as the Company is executing and still has growth and a great future ahead (based on the facts), learn to stick to your positions thru the cycles of over/under valuations and take advantages of opportunities along the way.

If you have a large gain on a great Business with plenty of growth ahead, but the valuation is giving you concern, in my experience, I found selling slowly or in stages is better than completely exiting the position in a great Co and then risk getting into a mediocre one.

Business quality/stability/growth + Stock Volatility : I'll take it. ✅

Business volatility : I'll pass. ❌

Hope you all found something useful in this long thread.

Business volatility : I'll pass. ❌

Hope you all found something useful in this long thread.

Boring ending disclosure 🥱 : Each person's situation is unique. So none of this is supposed to be interpreted as direct investment advice. Just sharing my experience.

All the Best in your (SaaS or other) journey. 👍

/END.

All the Best in your (SaaS or other) journey. 👍

/END.

• • •

Missing some Tweet in this thread? You can try to

force a refresh