As I noted earlier today, Anna Gelpern and I have been the project directors for the Group of Thirty Working Group Report on Sovereign Debt and Financing for Recovery.

The report broadly speaking is a call for the international community to do more

1/x

prweb.com/releases/g30_c…

The report broadly speaking is a call for the international community to do more

1/x

prweb.com/releases/g30_c…

More to provide financing to low income countries that have been hard hit by the pandemic -- external inflows (from exports, reduced remittances, reduced FDI) to the DSSI countries will likely fall by $150b this year

2/x

2/x

The $12-13b from a fully implemented DSSI with full CDB participation wouldn't have offset this shock -- and certainly the $5 to $5.5b in relief actually provided is wildly insufficient. It doesn't even cover the $10b in interest on on commercial and bilateral debt

3/x

3/x

Deferral of debt service is essential for equity -- the world should not provide concessional financing to low income countries just to allow payment to existing (generally high coupon) commercial and Chinese debts. But it isn't enough --

4/x

4/x

Among other things, it doesn't help those with little debt to start with; it is thus fundamentally an inequitable way of providing support to low income countries in a pandemic

5/x

5/x

The benefits of low rates in advanced economies do not flow automatically to low income countries -- no African country has issued a bond since February, and any issuance would carry a spread of 600-800 bp and thus generate risks to future debt sustainability

6/x

6/x

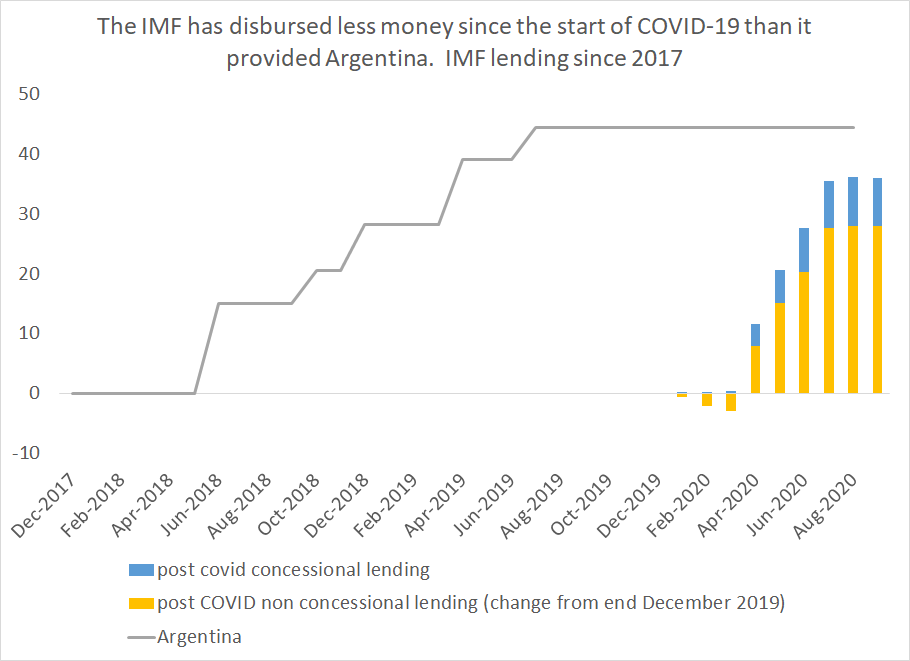

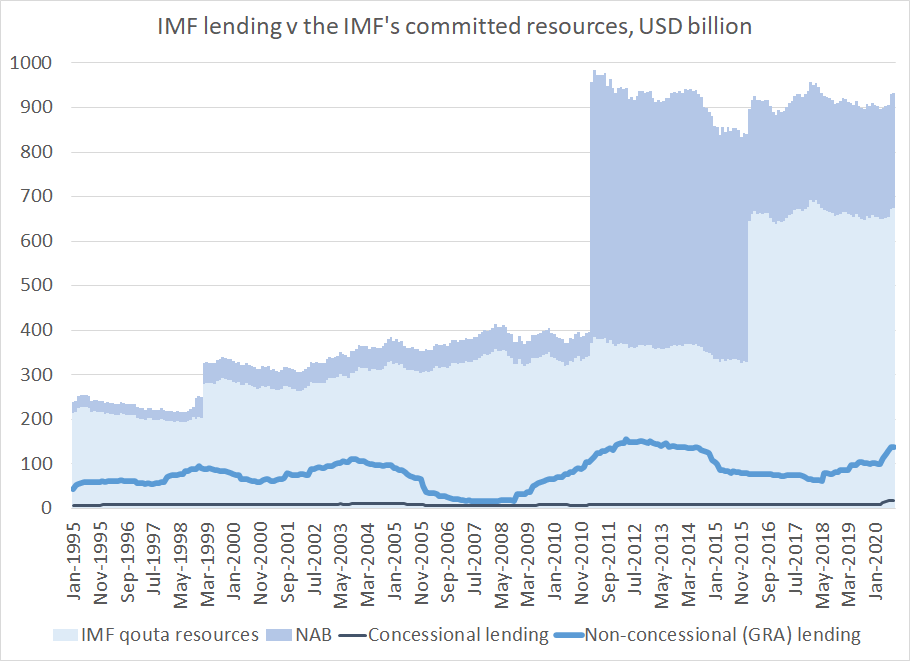

That is why the report calls for a large SDR allocation ($500b would do more help to the low income countries than a fully implemented DSSI, & the DSSI was at best half implemented), an expansion in the IMF's concessional window and new surge financing capacity from the Bank

7/x

7/x

But the new financing needs to be paired with a more aggressive approach to clearing away sovereign debt overhangs than has been adopted so far.

8/x

8/x

Zambia isn't the only country that will need debt reduction now - yes, there is uncertainty, but that is no excuse not to clear away debt overhands. Some IMF program countries in Africa have debt to GDP (public and external debt) of over 100%. Angola for example

9/x

9/x

And will a wall of existing bond maturities from 2024 to 2025, even those countries that don't need immediate debt reduction need a comprehensive reprofiling that provides time and space for recovery. the DSSI's terms were far too modest ...

10/x

10/x

And finally there are countries that poor and don't have much debt -- and differentiated approach that insists on private participation where it is needed could also recognize those case where it isn't needed.

11/x

11/x

There is much more in the report, including some innovative proposals that would have the effect of limiting the ability of creditors to enforce undisclosed secret debts, creating a real incentive for transparency

12/x

12/x

And in world of low interest rates, I am a big fan of simple forms of contingency that provide flexibility -- interest capitalization options and maturity extension options. GDP bonds are hard to price, options that allow an extension of duration are not!

13/x

13/x

Those options are most valuable if they are written flexibly -- hurricane bonds don't help in a pandemic. if more broadly used they would have provided a contractual debt service standstill in the face of the pandemic, with no concerns about downgrades

14/x

14/x

There is more -- check out the full report.

And since it is an interim report, feedback is most appreciated ... my work, and that of @AGelpern and the members of the G30 working group, is not yet done.

group30.org/publications/d…

And since it is an interim report, feedback is most appreciated ... my work, and that of @AGelpern and the members of the G30 working group, is not yet done.

group30.org/publications/d…

• • •

Missing some Tweet in this thread? You can try to

force a refresh