I worry that the IMF's agenda this fall is far less ambitious than the current shock demands.

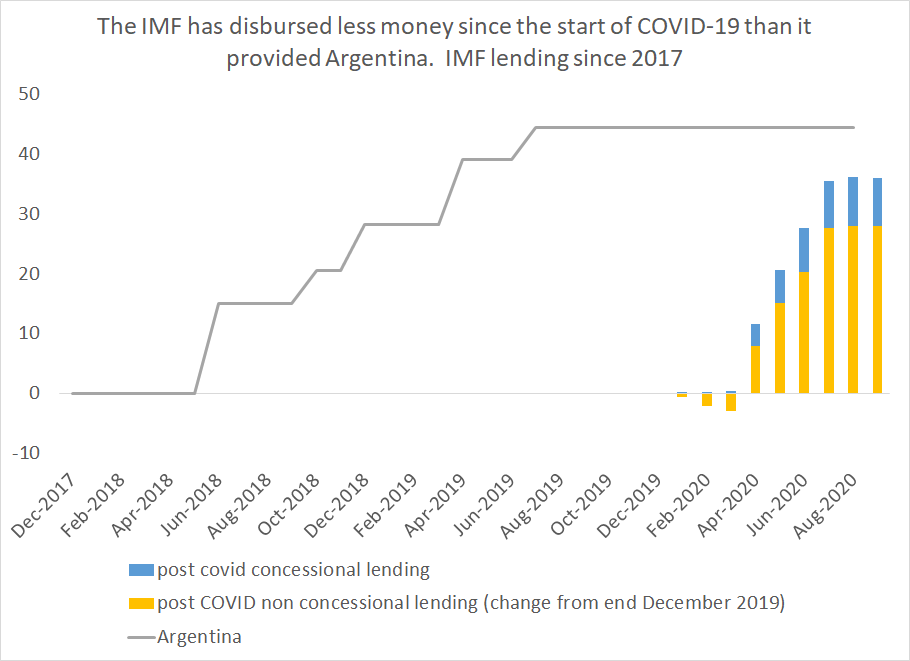

One way of framing this point is that the IMF so far has provided less financing to limit the impact the impact of COVID-19 on the world than it provided to Argentina alone.

1/x

One way of framing this point is that the IMF so far has provided less financing to limit the impact the impact of COVID-19 on the world than it provided to Argentina alone.

1/x

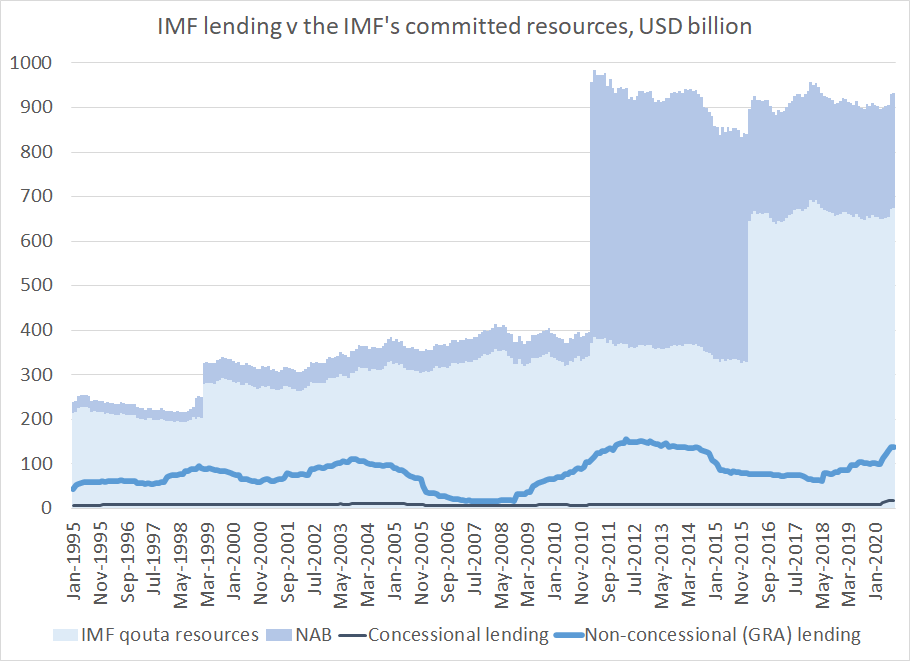

Another way of framing the issue is that the bulk of the IMF's balance sheet is sitting unused -- and there doesn't seem to be much of a plan to bring it to bear to held vulnerable countries finance higher levels of spending in the crisis.

2/x

2/x

The IMF has funds to cover the world's maturing sovereign hard currency bonds many times over. There isn't a systemic crisis from hard currency EM debt lurking just over the horizon. So the IMF could do more to help a broader set of countries meet current fiscal needs

3/x

3/x

Focusing on actual disbursements rather commitments leaves out the role that backstop credit lines have played in helping sustain market access in Latin America -- counting all commitments the IMF is using over a quarter of its balance sheet.

4/x

4/x

but the New Arrangement of Borrow will double in size at the end of the year --

the IMF has the capacity to do more, and should.

5/x

the IMF has the capacity to do more, and should.

5/x

Judging from the G-20 communique, there is no real motion toward an SDR allocation -- or even towards a facility to mobilize existing SDRs. Maybe the IMFC will surprise ...

6/x

6/x

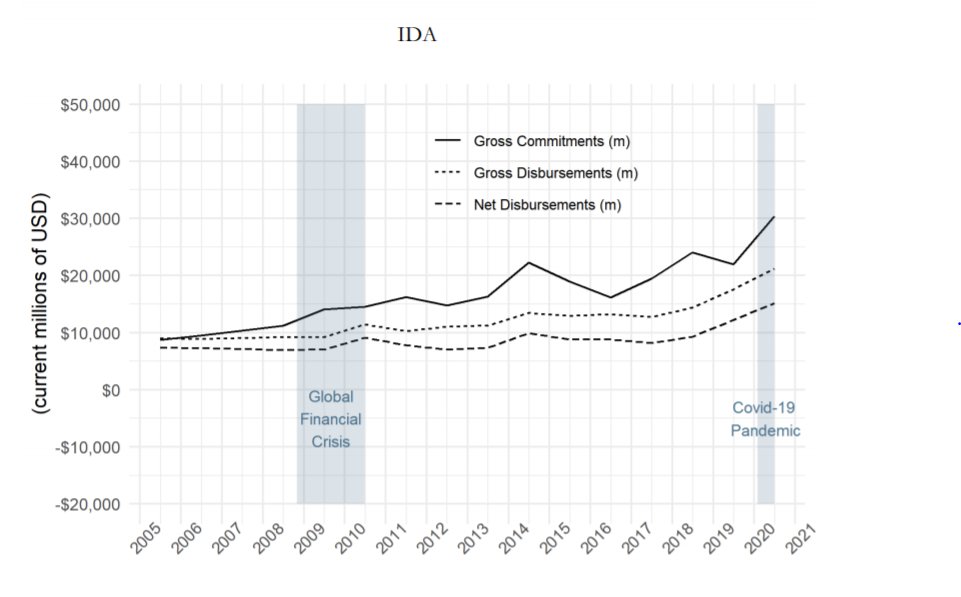

The Bank hasn't done any better at actually deploying its balance sheet to help its members in the face of a massive shock ...

Non-concessional lending (in net terms) hasn't increased

(chart from @Morris_ScottA and @JustinSandefur)

Non-concessional lending (in net terms) hasn't increased

(chart from @Morris_ScottA and @JustinSandefur)

The Bank has increase net disbursements from IDA -- but that was largely a plan that was already set in motion before the COVID-19 shock

cgdev.org/publication/wo…

cgdev.org/publication/wo…

Without additional resources and a bit of creativity, IDA's lending may fall too, as more countries automatically fall to income levels that under current policy guidelines imply a shift to grant financing (takes more $)

9/x

9/x

The G-20 cannot agree on who is and who isn't a bilateral creditor (admittedly a big issue, given the debate about the status of the CDB and uncertainty if all China Exim debt is "official"). Pushing 6ms of debt service out a few years won't clear away a debt overhang

10/x

10/x

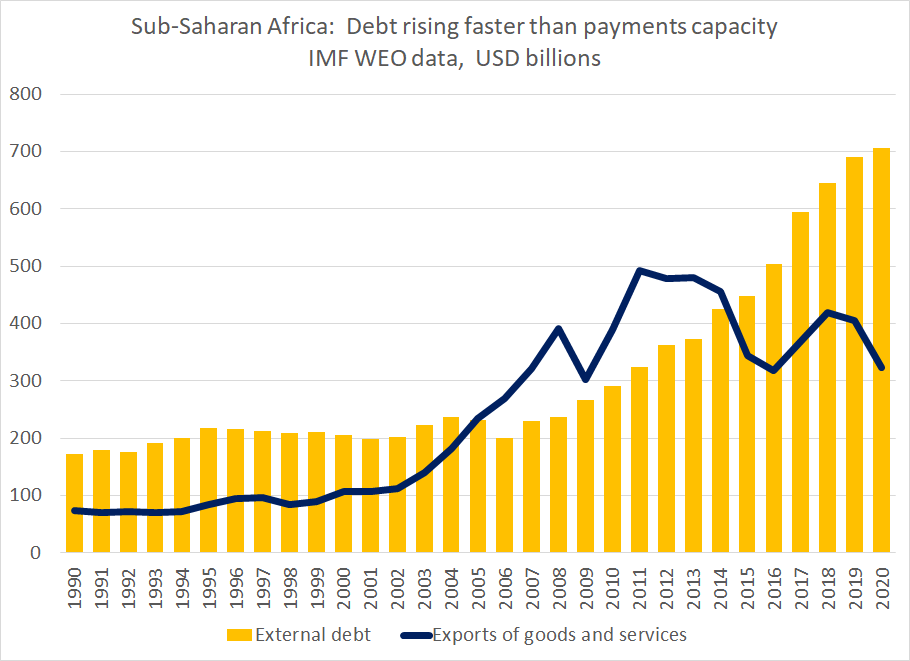

While not all low income countries are overly indebted, some are -- that's the consequence of the rapid increase in external borrowing that happened before COVID-19, together with a large fall in exports

11/x

11/x

Sub-Saharan Africa's debt burden -- measured by interest relative to exports -- is above where it was in 2000 (before HIPC reduced a lot of bilateral debt to Paris Club creditors)

12/x

12/x

It is a bit of a communique cliche to warn against complacency, but in this case, I think there is ample cause to warn against complacency.

The COVID-19 shock is almost certainly a 2y shock for many low income countries, not a 3m shock ...

13/x

The COVID-19 shock is almost certainly a 2y shock for many low income countries, not a 3m shock ...

13/x

Most of these points can also be found -- perhaps phrased a bit less sharply -- in the Group of Thirty's new report on Sovereign Debt and Financing for the Recovery after the COVID-19 Shock.

14/14

group30.org/publications/d…

14/14

group30.org/publications/d…

• • •

Missing some Tweet in this thread? You can try to

force a refresh