1/ Building a Better Commodities Portfolio (Kay, Levine, Ooi, Pedersen)

"Investors can potentially build a better commodities portfolio that is risk-balanced across sectors and that targets a steady level of volatility through time."

aqr.com/-/media/AQR/Do…

"Investors can potentially build a better commodities portfolio that is risk-balanced across sectors and that targets a steady level of volatility through time."

aqr.com/-/media/AQR/Do…

2/ "Because commodities have exhibited low correlations to stocks and bonds, a portfolio comprised of all three has produced higher risk-adjusted returns than a 60/40 portfolio of stocks and bonds alone."

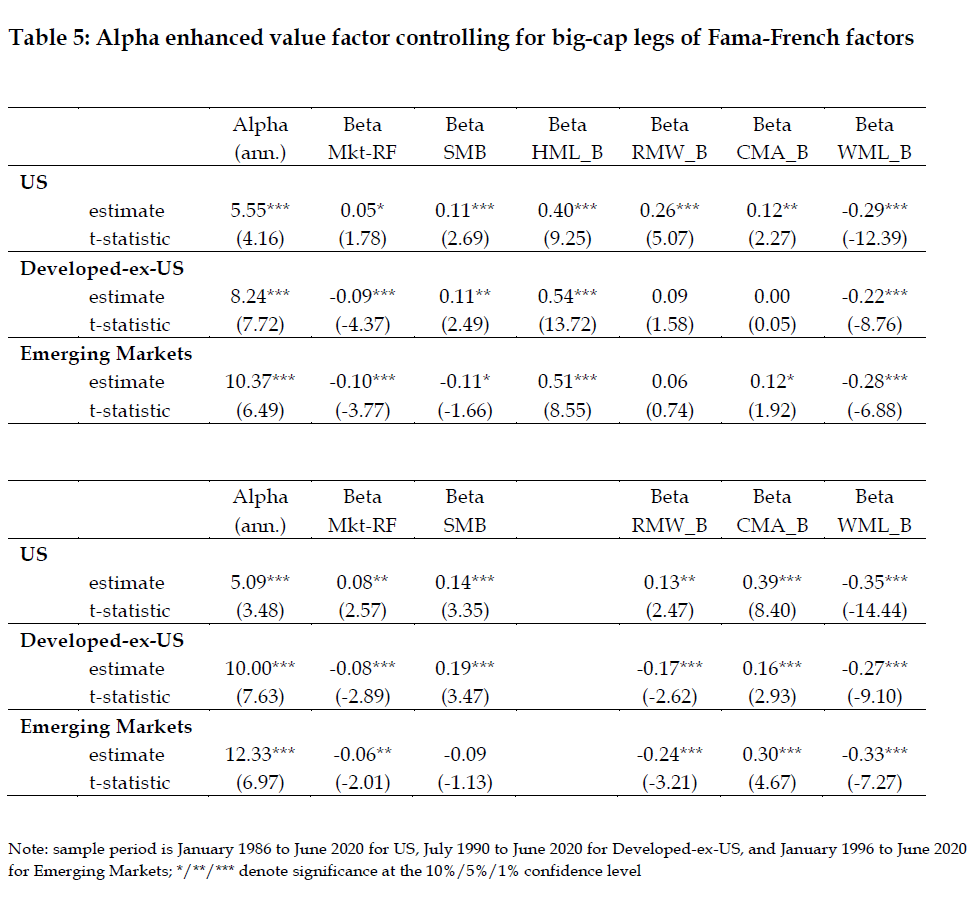

3/ "Commodity returns have historically shown a low correlation to other asset classes. Other common inflation protection assets – such as publicly traded REITs, natural resources equities, and TIPS – have shown far higher correlations to either stocks or nominal bonds."

4/ "During periods of positive inflation surprises, stocks and bonds have historically generated negative real returns, while commodities have performed well."

“Inflation surprise” = realized 12-month inflation minus average 12-month inflation forecast from a year prior

“Inflation surprise” = realized 12-month inflation minus average 12-month inflation forecast from a year prior

5/ "Using monthly returns (1990-2011), the average pair-wise correlation across ten of the most traded commodity futures was 0.22 vs. 0.62 across ten developed country equity index futures and 0.53 for G6 10-year bond futures. Diversifying across commodity sectors is valuable."

6/ The volatility-targeted, sector risk balanced, drawdown-controlled portfolio improves Sharpe ratios and drawdowns. (The Appendix, in Tweet 5, has methodology details.)

"It requires much more frequent rebalancing and allocates larger weights to less liquid contracts."

"It requires much more frequent rebalancing and allocates larger weights to less liquid contracts."

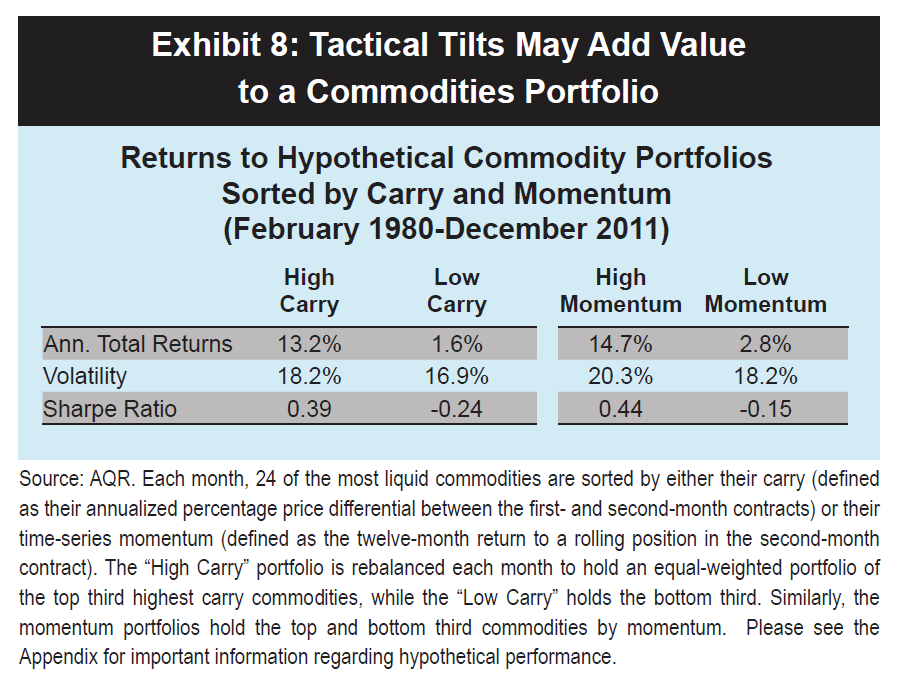

7/ High-carry and high-momentum tercile portfolios outperform low-carry and low-momentum terciles.

There may also be some benefit to modifying roll methodology to avoid paying excessive carry and getting picked off by front-runners.

There may also be some benefit to modifying roll methodology to avoid paying excessive carry and getting picked off by front-runners.

8/ Related research:

Exploiting Commodity Momentum Along the Futures Curves

Commodity Futures Risk Premium: 1871–2018

Comparing First, Second and Third Generation Commodity Indices

Exploiting Commodity Momentum Along the Futures Curves

https://twitter.com/ReformedTrader/status/1268037070276096000

Commodity Futures Risk Premium: 1871–2018

https://twitter.com/ReformedTrader/status/1197396668968128513

Comparing First, Second and Third Generation Commodity Indices

https://twitter.com/ReformedTrader/status/1269090755164778497

• • •

Missing some Tweet in this thread? You can try to

force a refresh