Synthesizing the AMM vs. CLOB debate going on currently.

These are unrefined thoughts and there are much more informed MMs, LPs, devs out there than me.

So feel free to tell me if I miss anything!

These are unrefined thoughts and there are much more informed MMs, LPs, devs out there than me.

So feel free to tell me if I miss anything!

1/ First:

I think it's important to think of what you can/cannot do with either to figure out what the USP is for both. Apples to oranges if compare AMM IL with CLOB spreads.

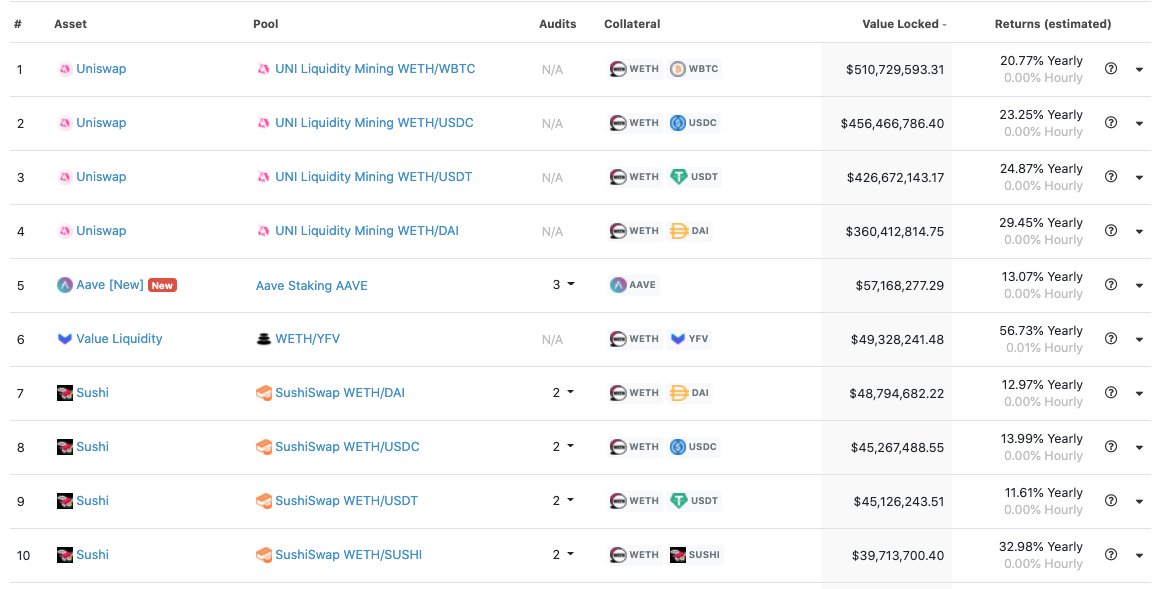

AMM: democratize market making, long tail focus

CLOB: tighter spreads, fat tail focus

I think it's important to think of what you can/cannot do with either to figure out what the USP is for both. Apples to oranges if compare AMM IL with CLOB spreads.

AMM: democratize market making, long tail focus

CLOB: tighter spreads, fat tail focus

2/ AMM's gamechanging feature #1 is anyone can be a market maker + earn passive fees!

Most people who fit the LP profile probably don't care too much about IL unless asset prices diverge significantly over time, in which case fees need to be sufficient to cover.

Most people who fit the LP profile probably don't care too much about IL unless asset prices diverge significantly over time, in which case fees need to be sufficient to cover.

2a/ If you want to see real numbers for the above, check out uniswaproi.com

3/ AMMs probably have strong network fx feedback loops.

Winners: More LP liqudity -> better price -> more trading -> more fees -> cover for IL over time and profit -> back to 1

Losers: Low LP liquidity -> worse price -> less trading -> less fees -> IL rekts LPs -> back to 1

Winners: More LP liqudity -> better price -> more trading -> more fees -> cover for IL over time and profit -> back to 1

Losers: Low LP liquidity -> worse price -> less trading -> less fees -> IL rekts LPs -> back to 1

4/ AMMs gamechanging feature #2 is anyone can list assets (subset of "anyone can be MM").

I can mint today and give it liquidity in an instant.

No need for complex MM bots. I think most long tail assets go to AMMs - things like social tokens, new issuances.

I can mint today and give it liquidity in an instant.

No need for complex MM bots. I think most long tail assets go to AMMs - things like social tokens, new issuances.

5/ Also recall that CFMM/CPMM are just one form of AMM.

I predict that @UniswapProtocol v3 probably incorporates different curve types, different fee params, more gas optimization.

That means pair- or feature- optimized AMMs are gonna have a hard time. Can Uniswap eat Curve?

I predict that @UniswapProtocol v3 probably incorporates different curve types, different fee params, more gas optimization.

That means pair- or feature- optimized AMMs are gonna have a hard time. Can Uniswap eat Curve?

6/ Now onto CLOB. The killer feature = flexibility.

Not everyone can earn fees and be an MM on CLOBs, but sophisticated MMs can offer tighter spreads for traders especially for liquid pairs.

See @willwarren89 explanation below:

Not everyone can earn fees and be an MM on CLOBs, but sophisticated MMs can offer tighter spreads for traders especially for liquid pairs.

See @willwarren89 explanation below:

https://twitter.com/willwarren89/status/1316622355947425794?s=20

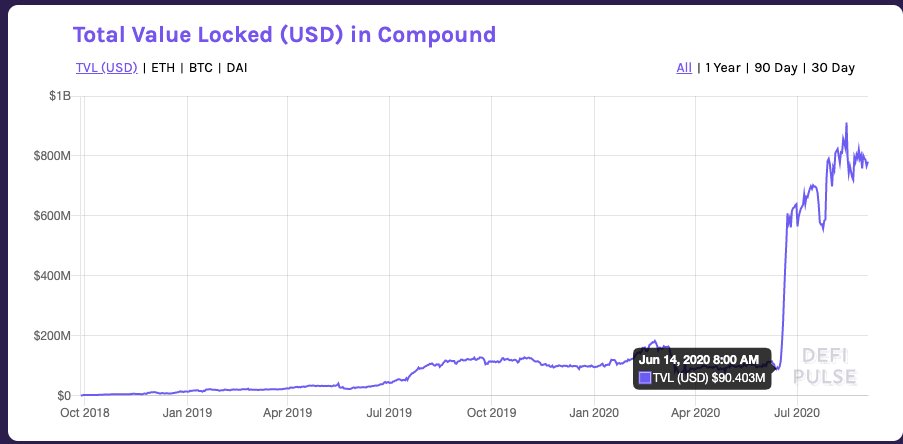

7/ "But ETH CLOB dex's are super illiquid compared to AMMs now!"

If you compete with CEXs by offering the same thing at higher fees, more latency but without KYC, it's going to take time. AMMs offer a different experience. Curve + yield farming drove a lot of recent volumes.

If you compete with CEXs by offering the same thing at higher fees, more latency but without KYC, it's going to take time. AMMs offer a different experience. Curve + yield farming drove a lot of recent volumes.

8/ In other words, I don't think we can look at AMM volumes for past year and conclude that dex CLOBs are doomed.

9/ In summation

Where I think AMMs win: democratizing liquidity, long-tail assets, mean-reverting coins.

Conditions for winning: the main one needs to generate enough fees to account for IL over time. Less high of a barrier if most volume is from mean reverting coins.

Where I think AMMs win: democratizing liquidity, long-tail assets, mean-reverting coins.

Conditions for winning: the main one needs to generate enough fees to account for IL over time. Less high of a barrier if most volume is from mean reverting coins.

9/ Where I think CLOB dex win: better execution cost especially for more fat tail liquid pairs.

Conditions for winning: displacing CEX by offering comparable experience with no KYC. Successfully leveraging composability with other DeFi protocols to make it market expansionary

Conditions for winning: displacing CEX by offering comparable experience with no KYC. Successfully leveraging composability with other DeFi protocols to make it market expansionary

10/ Some back of envelope envelope map:

If dex volume over take spot CEX volume, that's a 100x growth.

Figuring out whether that's likely, how it splits between AMM/CLOB, whether that's the right dichomy, or if the vision for dex is more ambitious, that's alpha.

If dex volume over take spot CEX volume, that's a 100x growth.

Figuring out whether that's likely, how it splits between AMM/CLOB, whether that's the right dichomy, or if the vision for dex is more ambitious, that's alpha.

ps/ The exchange between @KyleSamani @danrobinson @haydenzadams @SBF_Alameda @willwarren89 @cyounessi1 is why crypto twitter was great before the "wen moon ser" and "target ser". When smart people disagree we all learn.

Follow the above and mute the moonbois!

Follow the above and mute the moonbois!

• • •

Missing some Tweet in this thread? You can try to

force a refresh