#WEEKEND_LEARNING - #CaseStudy of #AVANTIFEEDS

I decided to do case studies of super performers of past few years for research purposes. Will publish some of them here for learning purposes. Today am publishing case study of #AvantiFeeds of year 2017. (1/n) #CS1

I decided to do case studies of super performers of past few years for research purposes. Will publish some of them here for learning purposes. Today am publishing case study of #AvantiFeeds of year 2017. (1/n) #CS1

We need a beginning point to start studying, and here we will use the point from where we'll determine that the stock is in Stage 2. This is Jan 2017 chart on weekly.

I used bar replay feature of tradingview for this study. On weekly charts these are 10 & 40 period EMAs. (2/n)

I used bar replay feature of tradingview for this study. On weekly charts these are 10 & 40 period EMAs. (2/n)

And we got our first setup very soon. This is a weekly inside bar, which can be used for a swing trade. WIBs are not bases, they're only temporary pause in upmove, so our expectations should be according to the setup. (3/n)

After examining the setup on weekly, we need to move to daily to see what is the situation inside the consolidation. And our entry & SL will also be determined on the basis of daily TF.

Here am using 10, 20, 50 & 200EMAs on daily which are very common & widely followed. (4/n)

Here am using 10, 20, 50 & 200EMAs on daily which are very common & widely followed. (4/n)

It has been a week & we didn't got the entry! Looks like the stock is gonna make a proper base which is actually way better! Lets switch to weekly & see what's happening!

Blue callouts are written on daily while red ones are written on weekly TF. (5/n)

Blue callouts are written on daily while red ones are written on weekly TF. (5/n)

So the stock gave us a 3 bar consolidation inside the mother bar. The volume had been average and the setup looks good, hence will take trade as per planned earlier.

And it gave us entry!

Mistake- I forgot to switch back to weekly layout here!

And it gave us entry!

Mistake- I forgot to switch back to weekly layout here!

In daily, the consolidation looks even better. A great trade would have been a pocket pivot entry! We would have got the breakout of the consolidation marked by orange callout through this Pocket Pivot entry.

Now see the trade management here! Wonderful tennis ball action seen, and we decided to add some position but with small target! (8/n)

Position trimmed significantly ahead of untested BRN. Price are extended hence expect profit booking here.

The megenta color callout is used to indicate selling. (9/n)

The megenta color callout is used to indicate selling. (9/n)

And price reacted as per expected & took out our TSL! And here we learnt 3 important lessons about trade management & profit booking! (10/n)

Now moving back to weekly! Price gave us a 4 week consolidation at BRN, with last week appeared with narrowest spread! Volume contraction on the last week would have made setup better. Anyways!

Price moved better than how we would have expected, but without us! 😖

Price moved better than how we would have expected, but without us! 😖

Kept on tracking on weekly & sooner price made a 3IB setup here. The move post gap up is a huge sign of strength & the price holding tightly near the highs of the gap up week is another good sign. Lets move to daily & see what's going on there.

While everything is good, we had another untested BRN at 500 placed nearby. Need to be cautious while planning a trade here! (13/n)

Moving back to the weekly chart. After shaking us out, price moved back up & sets up again! Lets move to daily & plan a trade there! (15/n)

The setup improved, and we plan another trade here on daily! Shakeout brings a lot of confidence in the setup! (16/n)

We got entry in this third trade, and a quick pyramiding opportunity appeared very soon! Excellent!

Lets make it big when things are falling into place! (17/n)

Lets make it big when things are falling into place! (17/n)

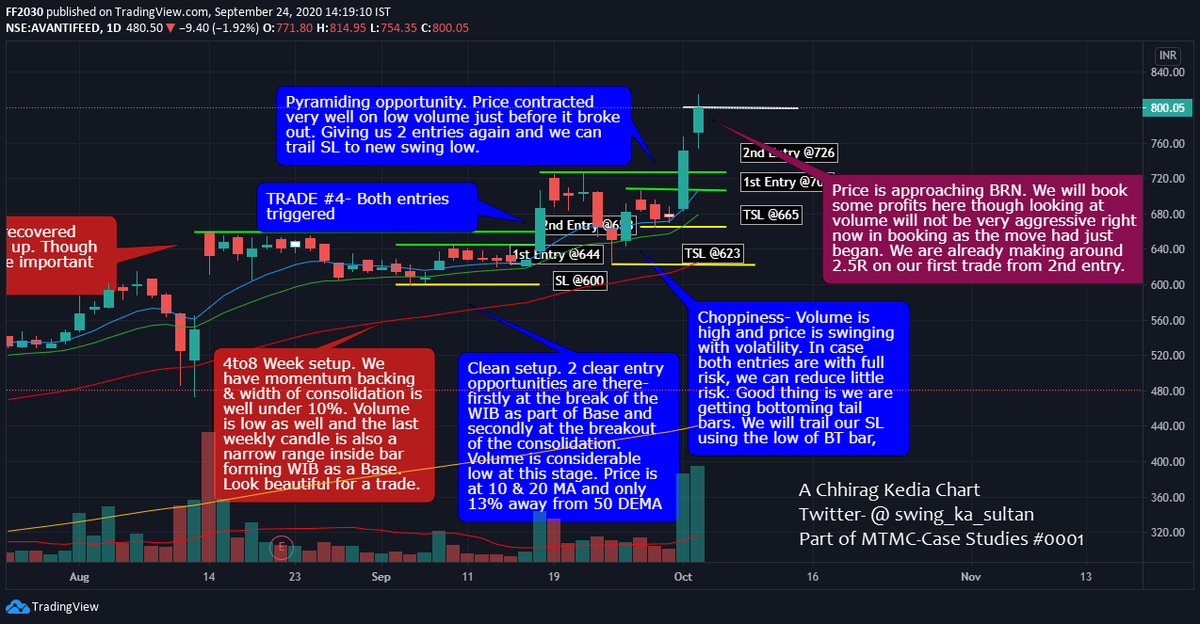

And 2nd pyramiding opportunity comes! Should we add- we can, if we are aggressive, if not, then trail SL. (18/n)

So price is approaching another BRN, will book some profit for our safety as we are sitting on healthy profits here! (19/n)

And BRN acted sharply then what we were expecting! Took out our TSL!

Looks like a probable shakeout, but need confirmative action!(20/n)

Looks like a probable shakeout, but need confirmative action!(20/n)

Switching to weekly! Sudden gap up, but didn't held the gapped up level! Unusual volatility, better to remain sideways & observe! 👀

(21/n)

(21/n)

And WIB appears! Probable trade setup. Will see on daily & plan trade here.

Daily is also posted with Weekly! (23/n)

Daily is also posted with Weekly! (23/n)

Entry didn't got executed! Need to move back to weekly & see what is happening! The contraction is still looking awesome. (24/n)

Awesome Flat Base setup forming. Price is nearby 10 Week EMA as well.

See the last week in setup, WIB with least volume. Can act as a pre emptive entry point if we have any breakout level on there on daily.

Switching back to daily to plan trade. (25/n)

See the last week in setup, WIB with least volume. Can act as a pre emptive entry point if we have any breakout level on there on daily.

Switching back to daily to plan trade. (25/n)

Price consolidates little & moved back up. Now on indecisive candles. Trend is becoming steeper! Signs of caution! (30/n)

Abnormal action! Lot of built-up supply in price & the trend has become old now. Need proper time to exhaust supply! (31/n)

Range expansion! Fakeout! We hadn't planned any trade here, but if we have any open position left, this range expansion had given exit to them. (32/n)

And Stage 2 exhausts right ahead of BRN. Range expansion caused major break in price & it never came back to prior highs anymore!

Both on Weekly & Daily! (33/n)

Both on Weekly & Daily! (33/n)

With this out 1st #CaseStudy concludes. I hope it would've added value. Will love to listen questions & feedbacks on this study.

Express your love if you liked it, kindly like & retweet- it really matters to me! Will share more such studies if I get encouraging response!

END!

Express your love if you liked it, kindly like & retweet- it really matters to me! Will share more such studies if I get encouraging response!

END!

• • •

Missing some Tweet in this thread? You can try to

force a refresh