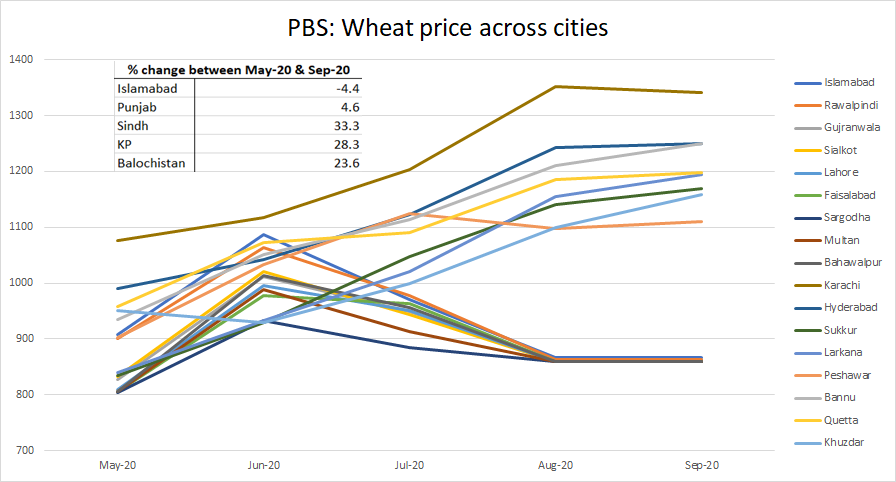

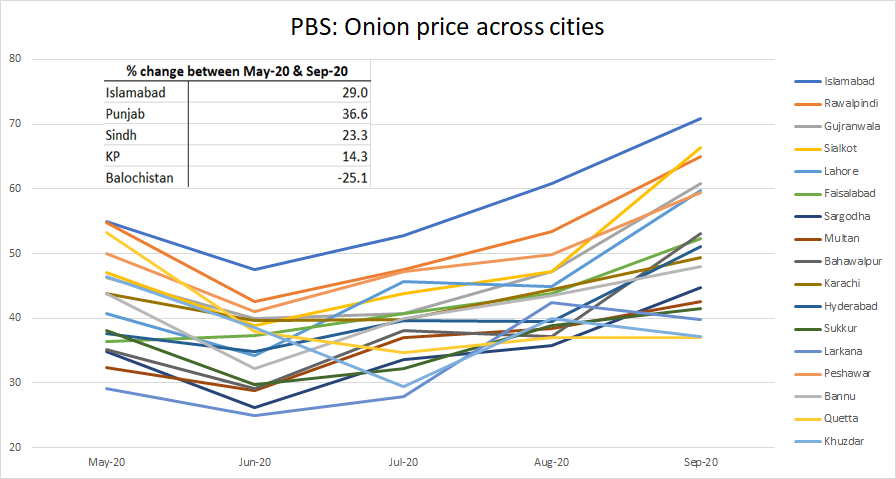

(1/n) While there is a general upward trend in food prices in #Pakistan, there is also a lot of heterogeneity is how prices of key food items have changed across cities. This points to a mix of local, national and global factors underlying the upsurge in food prices recently.

(2/n) For example, average wheat flour price has increased by almost 5% in Punjab since May but the increase is much higher in Sindh, KP & Balochistan.

(3/n) In contrast, average onion prices have increased most in Punjab, Islamabad & Sindh but fallen significantly in Balochistan (due to imports from Iran?). Prices in KP have also increased but by less than half of the increase in Punjab, Isb & Sindh.

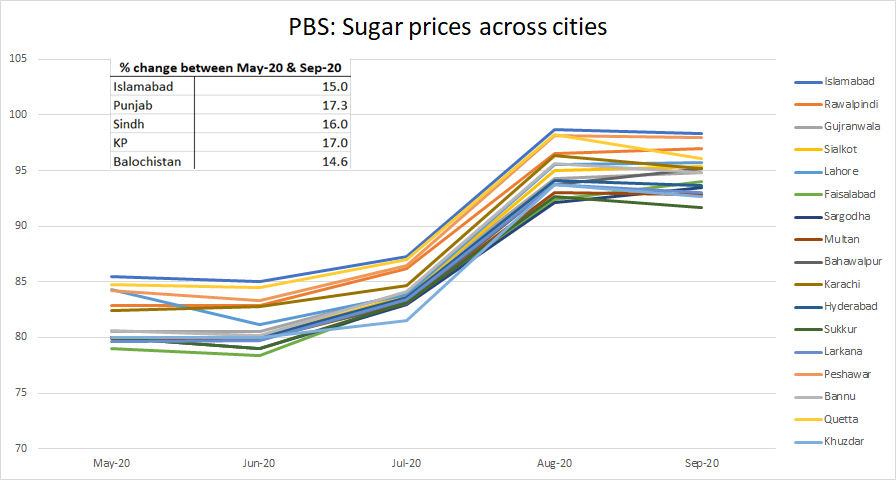

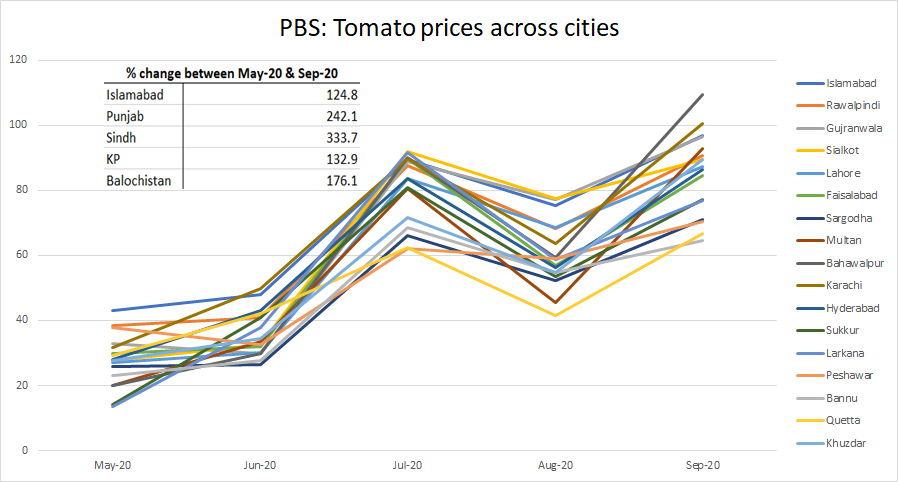

(4/n) Sugar prices have increased by roughly the same amount everywhere. Tomato prices have doubled everywhere but increased by more than 3 times in Sindh and more than 2 times in Punjab.

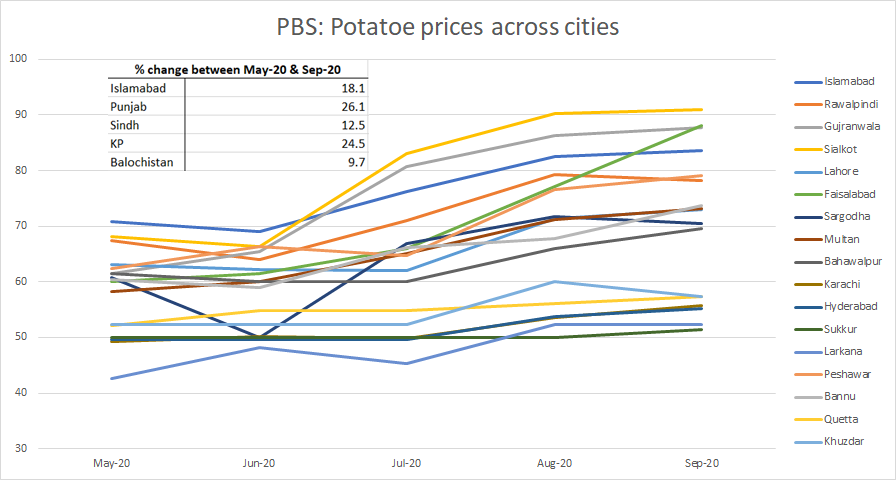

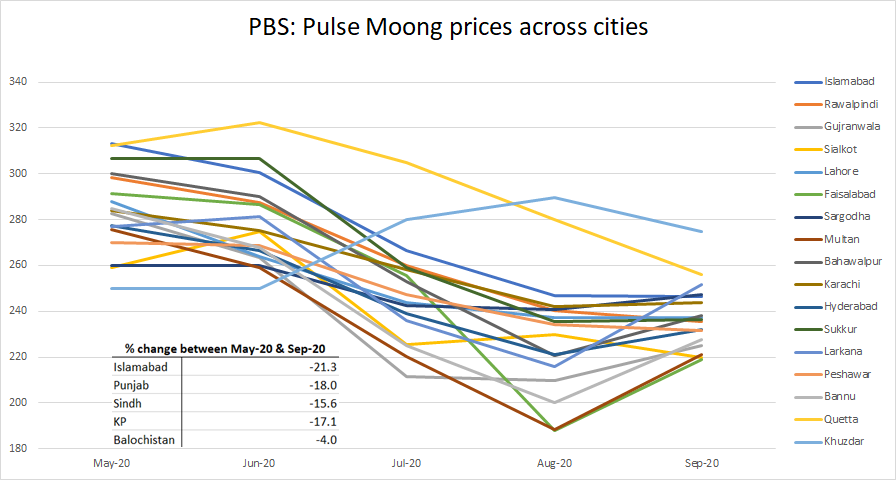

(5/n) Potato prices have increased much more in Punjab and KP than in other provinces. Finally, Pulse Moong prices have fallen everywhere but more so in Isb, Punjab and KP.

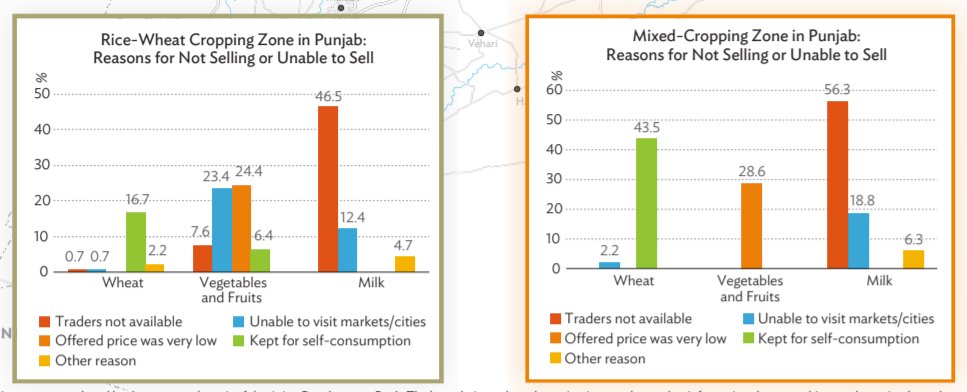

(6/n) This suggests, while there is a general upward trend in food prices, there is substantial regional disparity pointing to wide range of factors. A survey of Punjab based farmers by ADB does point to several factors which affected agri supply chain: adb.org/sites/default/…

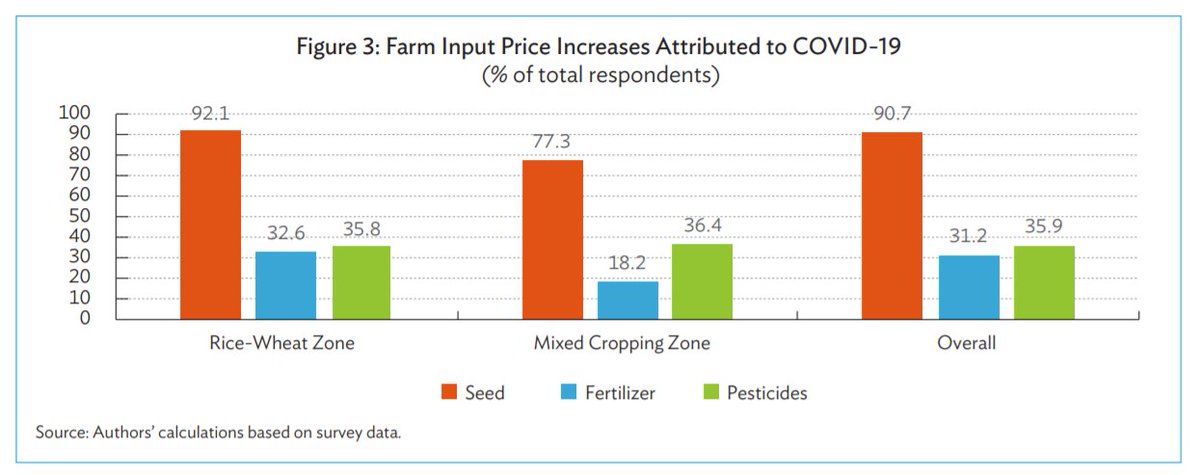

(7/n) For example, some farmers reported that they could not visit markets to sell their produce due to COVID related disruptions. Most also reported an increase in cost of inputs including seeds, fertilizers and pesticides.

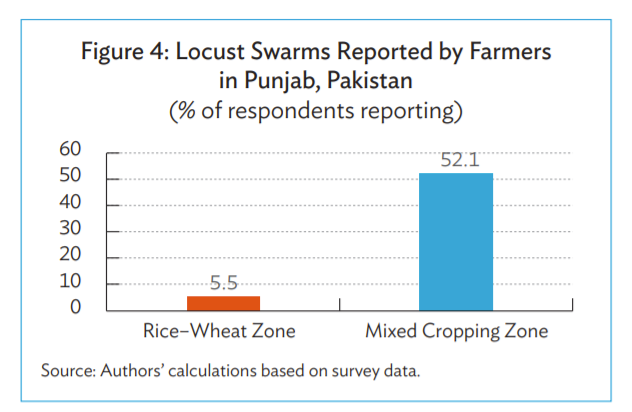

(8/n) More than half of respondents operating in 'mixed cropping zone' also reported Locust related disruptions. The report notes, "A locust infestation of such magnitude has not occurred in Pak for more than 25 yrs &, with outdated infrastructure, the govt is ill-equipped to..."

(9/n) The report also cites FAO estimates, "The Food and Agricultural Organization of the United Nations estimated that, without effective measures, locust infestations would cause up to PRs688.5 billion ($4.1 billion) damage of kharif crops and PRs705.8 billion ($4.2 billion)"

(10/n) While the report only covers Punjab, other regions also experienced floodings which must have affected agri production in those areas.

(11/n) The wide variety of shocks to agri sector over last few months set the stage for prices to increase. More so, since different regions were being hit by different shocks, the effect on prices was not uniform both across the country and across agri items.

(12/n) Finally, our govts' fixation with import controls amplified the effect of shocks on food prices. While the agri sector was constantly hit by a variety of shocks, govt machinery was ill equipped to stay up-to-date with the fast changing environment & make timely decisions.

(13/n) Even now imp decisions on wat to import & how much to import r still being taken by the cabinet. Perhaps it is time for the cabinet to devolve these decisions to the private sector & just focus on maintaining buffer stocks as a credible threat against speculative activity.

(n/n) Or else, a similar disruption in agri supply chains in future will result in a similar cycle of rising prices. Govt machinery is almost always ill equipped to stay up-to-date with ever evolving information set in such disruptive environments. Why risk embarrassment again?

• • •

Missing some Tweet in this thread? You can try to

force a refresh