$btc $btcusd #BTC

OK, so @cryptoquant_com is doing a closed beta and I'm lucky enough to be able to test it.

Let's make a Big thread right here to connect Onchain Analysis & Technical Analysis

Is $btc in a bull market or what ?

1/x

OK, so @cryptoquant_com is doing a closed beta and I'm lucky enough to be able to test it.

Let's make a Big thread right here to connect Onchain Analysis & Technical Analysis

Is $btc in a bull market or what ?

1/x

$btc $btcusd #BTC

Let's begin with Difficulty, Hashrate & Price, on a log scale.

A 10 year uninterrupted increase.

2/x

Let's begin with Difficulty, Hashrate & Price, on a log scale.

A 10 year uninterrupted increase.

2/x

$btc $btcusd #BTCUSD

Price following closely the Number of Active Adresses

More people in the ecosystem -->

more money comin -->

$btc price increase

3/x

Price following closely the Number of Active Adresses

More people in the ecosystem -->

more money comin -->

$btc price increase

3/x

$btc $btcusd #BTCUSD

$btc Reserve: Number of $btc held on exchanges.

Sharp increase of $btc on exchanges gives us the capitulation

A slow increase of $btc on exchange give us the distribution (slow process)

A DECREASE of $btc on exchange is accumulation.

People are buyin.

4/x

$btc Reserve: Number of $btc held on exchanges.

Sharp increase of $btc on exchanges gives us the capitulation

A slow increase of $btc on exchange give us the distribution (slow process)

A DECREASE of $btc on exchange is accumulation.

People are buyin.

4/x

$btc $btcusd #BTCUSD

Number of $btc held on exchanges in $$ value

Almost at all time high. No liquidity crisis in sight.

We have $btc increase in price while nbr of $btc held on exchanges is decreasing since March 12th Corona drop

5/x

Number of $btc held on exchanges in $$ value

Almost at all time high. No liquidity crisis in sight.

We have $btc increase in price while nbr of $btc held on exchanges is decreasing since March 12th Corona drop

5/x

$btc $btcusd #BTCUSD

This is probably the most important chart yet imo.

For the past year, we have a sharp increase in Stablecoins

𝙒𝙃𝙄𝙇𝙀 the nbr of $btc held on exchanges is decreasing.

This.

is.

Bullish.

It's called accumulation. People are buying.

6/x

This is probably the most important chart yet imo.

For the past year, we have a sharp increase in Stablecoins

𝙒𝙃𝙄𝙇𝙀 the nbr of $btc held on exchanges is decreasing.

This.

is.

Bullish.

It's called accumulation. People are buying.

6/x

$btc $btcusd #BTCUSD

$btc exchanges inflows mean, giving pretty good signals for capitulations.

At a market bottom, falling prices eventually force out large numbers of traders, resulting in volatility and increased volume.

7/x

$btc exchanges inflows mean, giving pretty good signals for capitulations.

At a market bottom, falling prices eventually force out large numbers of traders, resulting in volatility and increased volume.

7/x

To be continued later on...

$btc $btcusd #BTCUSD

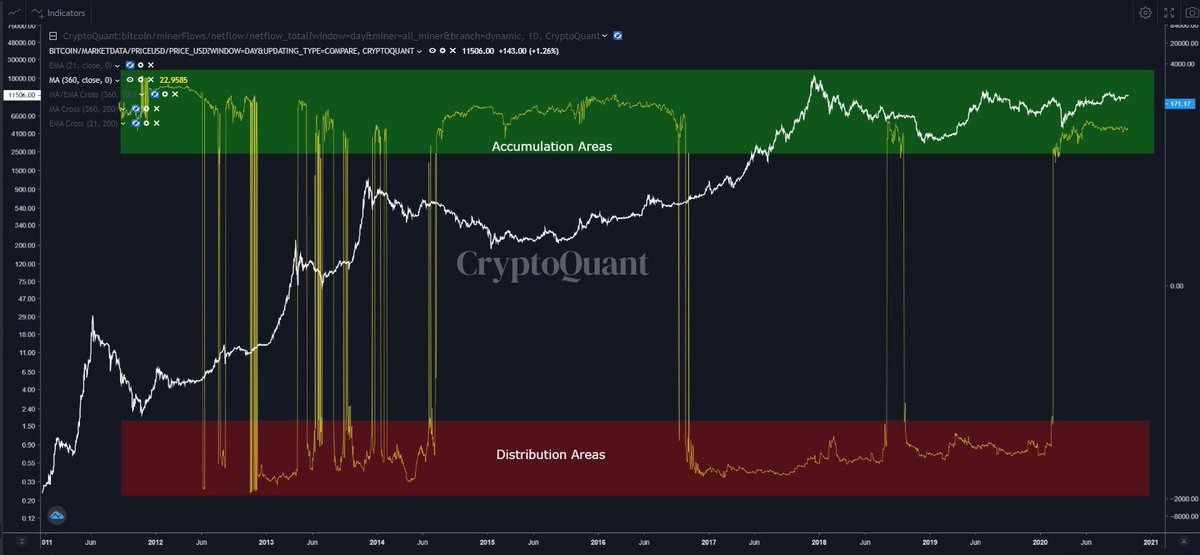

Very interesting stuff.

When using a 360 MA (to smooth the data) on the Netflow, we get a raw

Accumulation / Distribution areas indicator

@cryptoquant_com

8/x

Very interesting stuff.

When using a 360 MA (to smooth the data) on the Netflow, we get a raw

Accumulation / Distribution areas indicator

@cryptoquant_com

8/x

$btc $btcusd #BTCUSD

MA cross 360 EMA & 360 MA on Exchange Inflows gave us the exact 2 first tops in 2013, and the exact 2018 bottom

Good inflections point.

need to tweak this and play with MAs

9/x

MA cross 360 EMA & 360 MA on Exchange Inflows gave us the exact 2 first tops in 2013, and the exact 2018 bottom

Good inflections point.

need to tweak this and play with MAs

9/x

$btc $btcusd #BTCUSD

Positive slope on 360 MA for the Miners Reserve give us the early phase of bull-runs ?

( = miners accumulation ?)

10/x

Positive slope on 360 MA for the Miners Reserve give us the early phase of bull-runs ?

( = miners accumulation ?)

10/x

$btc $btcusd #BTCUSD

100/360 EMA cross on Miners Reserve giving pretty good buy signals.

Soon another buy signal (˵ ͡° ͜ʖ ͡°˵)

11/x

100/360 EMA cross on Miners Reserve giving pretty good buy signals.

Soon another buy signal (˵ ͡° ͜ʖ ͡°˵)

11/x

$btc $btcusd #BTCUSD

Similar to tweet 8.

When using a 360 MA (to smooth the data) on the Miners Netflow, we get a raw

Accumulation / Distribution areas indicator

12/x

Similar to tweet 8.

When using a 360 MA (to smooth the data) on the Miners Netflow, we get a raw

Accumulation / Distribution areas indicator

12/x

$btc $btcusd #BTCUSD

21 EMA / 200 MA cross on NVM

Basically, you want to be long when 21 is above 200

And short when 21 is below 200

$btc 21 is above 200 since Oct 12th

13/x

21 EMA / 200 MA cross on NVM

Basically, you want to be long when 21 is above 200

And short when 21 is below 200

$btc 21 is above 200 since Oct 12th

13/x

To be continued later on... :)

$btc $btcusd #BTCUSD

21 EMA of the MPI (An MPI reading above 2 suggests miners are selling their BTC after mining, while a negative value shows they're avoiding selling as much as possible in favor of accumulation)

Except H1 2015, you want to follow what miners are doing

14/x

21 EMA of the MPI (An MPI reading above 2 suggests miners are selling their BTC after mining, while a negative value shows they're avoiding selling as much as possible in favor of accumulation)

Except H1 2015, you want to follow what miners are doing

14/x

$btc $btcusd #BTCUSD

10EMA of Exchange whale ratio (Exchange Whale Ratio is the relative size of the top 10 inflows to total inflows by day of each exchange)

OK this one is a VERY good one too. Follow the whales.

multi tweets explanation:

15-1/x

10EMA of Exchange whale ratio (Exchange Whale Ratio is the relative size of the top 10 inflows to total inflows by day of each exchange)

OK this one is a VERY good one too. Follow the whales.

multi tweets explanation:

15-1/x

$btc $btcusd #BTC

-When 10EMA> 0.48 (Green vertical lines), it's a BUY signal, meaning whale inflows compared to total inflows are small (whales dont want to sell)

15-2/x

-When 10EMA> 0.48 (Green vertical lines), it's a BUY signal, meaning whale inflows compared to total inflows are small (whales dont want to sell)

15-2/x

$btc $btcusd #BTC

-When 10EMA<0.38 (Red vertical lines), it's a SELL signal, meaning whale inflows compared to total inflows are important(whales want to sell)

At 13k currently, it would suggest that the rally is close to the top

15-3/x

-When 10EMA<0.38 (Red vertical lines), it's a SELL signal, meaning whale inflows compared to total inflows are important(whales want to sell)

At 13k currently, it would suggest that the rally is close to the top

15-3/x

$btc $btcusd #BTC

The signal seems to be better if the slope of 10 EMA is very aggressive into the zone

15-4/x

The signal seems to be better if the slope of 10 EMA is very aggressive into the zone

15-4/x

What this also suggest, is that whales got tricked into buying the 6k floor in 2018

Hahaha, suckers

Hahaha, suckers

Overall, I like a lot @cryptoquant_com Onchain analysis tools and when their beta is finished, i'll subscribe to cq.live .

Here is my referral, if you're interested in testing it too.

cryptoquant.com/sign-up?my-fri…

Here is my referral, if you're interested in testing it too.

cryptoquant.com/sign-up?my-fri…

Plus I have already set 3 alarms on the $BTC flow I was watching manually

Pour mes lecteurs français, voici la traduction du thread Twitter, posté en article sur bitcoin.fr, merci à @bitcoinpointfr !

$btc $btcusd #btc

bitcoin.fr/analyse-de-la-…

$btc $btcusd #btc

bitcoin.fr/analyse-de-la-…

$btc $btcusd #btc

21 daily EMA on Stablecoins Inflow

Could be used as an indicator (similar to OBV)

simple TA:

A break of trendline = increase in stablecoins inflow compared to latest period = BUY signal

17/x

21 daily EMA on Stablecoins Inflow

Could be used as an indicator (similar to OBV)

simple TA:

A break of trendline = increase in stablecoins inflow compared to latest period = BUY signal

17/x

saw Blackbeard post , so i checked by myself

someone is buying every $btc possible or what ?

that's the largest downspike visible

someone is buying every $btc possible or what ?

that's the largest downspike visible

https://twitter.com/crypto_blkbeard/status/1324014913510121474?s=20

lol, a zoom in into exchanges reserve

Reserves were depleted from Binance / Huobi mainly, & Bitfinex

$btc $btcusd #btc

Reserves were depleted from Binance / Huobi mainly, & Bitfinex

$btc $btcusd #btc

• • •

Missing some Tweet in this thread? You can try to

force a refresh