Gold is now in the third month of consolidating; I view this chart pattern as a bullish consolidation as Managed Money speculative positions are now down 65% from previous highs. One fundamental positive last week, was India returning to a premium to world markets. Indian...

& Chinese consumer demand were major support for Gold during the bear market. Both consumers backed off once Gold broke out last summer, we expect pent up demand out of these 2 huge buyers of physical Gold. So far, Chinese consumers do not appear to be on the bid. The dollar...

appears to be in a bearish consolidation pattern. So I do not view this as a negative for Gold. Treasury market continues to look like it is no longer a market, but is now fixed in a trading range. News that the Fed purchased larger amounts of Treasuries than usual last week as..

prices fell and yields rose, support this theory. Specifically, we continue to believe the Fed has implemented a defacto interest rate cap; they have just not announced it to the public. Regardless, a .7% 10 year note, with core CPI up 1.7%, gives you a negative 1% real yield...

Central bank demand for Gold is only reported with a lag. Our belief is major support for Gold is Eurasian Central Banks, technical analysis would suggest that bid is very large and between $1850 & $1900. With the supply of $s all but guaranteed to continue to rise at whatever..

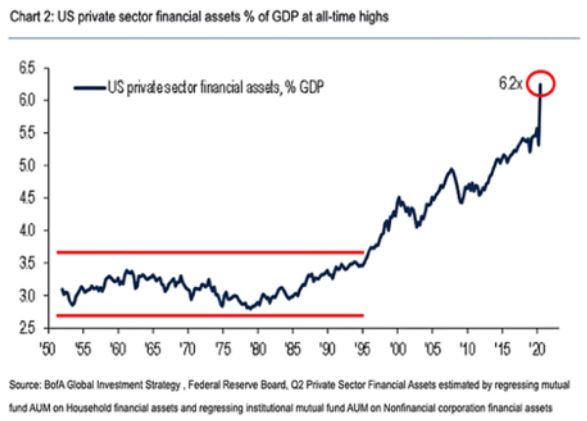

rate is necessary to support financial assets & Treasury's finances, we continue to believe "this time is different". Deflation is a myth, holders of U.S. financial assets are being diluted, debased, you own less than you think. Please do not reply with but there is no velocity,.

just unfollow me, you will not change my professional opinion. I have been doing macro for 35 years. Velocity will occur when holders of $100T plus of U.S. financial assets collectively realize they are being diluted on a daily basis, money will begin to shift out of these...

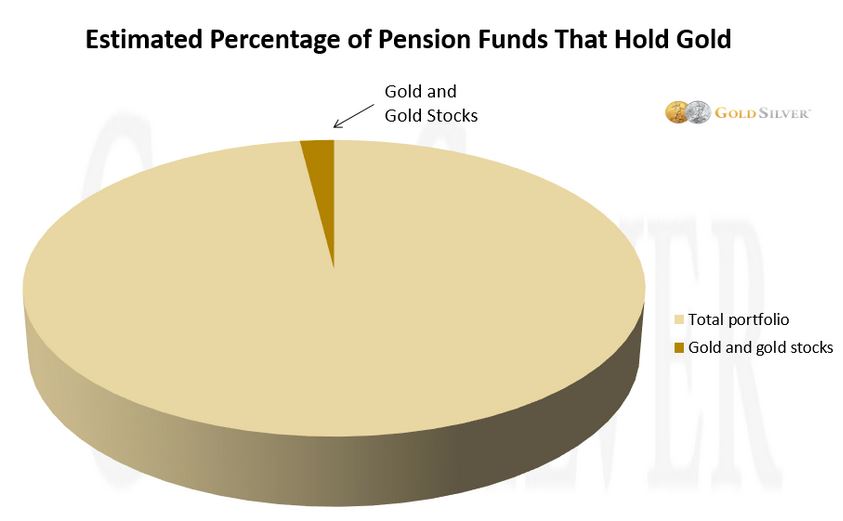

assets. The Feds continued support of these assets means money supply will continue to grow at whatever rate is necessary. As the 60-40 does not perform as expected, U.S. investor demand for Gold will continue to grow. Currently, U.S. investors are incredibly under weight Gold..

Well run producing Gold Miners are doing very well at current Gold prices. @ $1900 Gold, this sector is now filled with growth stocks. Precious Metals Equities were the best performing sector for a reason in the 1930's, 1970's, & 2000's. In weak economic times, the demand for..

Gold rises. We are expecting very strong earnings from our portfolios. We do not need higher Gold prices; as long term investors, we are very happy with 90-110% operating margins & forecasted production growth of 20% from internal cash flow. The mining ETFs have no clue..

what I am talking about. They simply buy the highest valued miners & avoid the cheap ones. Our analysis is the largest mining ETF #GDX is trading at 21x consensus 2021 EPS. Our portfolios closed last night @ 9x consensus 2021 EPS. I slept fine last night as I expect over time..

& @ current Gold prices our miners will eventually move to a premium over the no growth seniors, which all of the mining ETFs are loaded with. This is not investment advice; if you are an accredited investor & would like more information, please visit our website.

• • •

Missing some Tweet in this thread? You can try to

force a refresh