volatility tips: 😉

why "volatility always came in clusters"? people ask

50% fundies & 50% technicals:

1 fundies/shocking-news triggering the first wave spike

2 people not prepared for the shock, scramble to buy protections

3 sell risky assets

4 rotate to safe-havens

#1 of 3

why "volatility always came in clusters"? people ask

50% fundies & 50% technicals:

1 fundies/shocking-news triggering the first wave spike

2 people not prepared for the shock, scramble to buy protections

3 sell risky assets

4 rotate to safe-havens

#1 of 3

5 trigger dealer & MMs Gamma flip level, exacerbating the VIX spike 2nd wave

6 which in term trigger the over-leveraged weak-hand longs, hitting stop loss levels & margin calls- 3d wave

7 risk-parity funds portf rebalance due to sudden plunge in risky assets. trimming

#2 of 3

6 which in term trigger the over-leveraged weak-hand longs, hitting stop loss levels & margin calls- 3d wave

7 risk-parity funds portf rebalance due to sudden plunge in risky assets. trimming

#2 of 3

8 60+% of commodity/futures leveraged funds, employing momentum/trend based strategies w/ trend detection & stop-loss levels for flipping to short, got flipped, huge force to the dn side: 5th wave

9 massive momentum factor-based passive smart ETFs algo rebalance & risk-off: 6th

9 massive momentum factor-based passive smart ETFs algo rebalance & risk-off: 6th

10 dumb money & speculators positioned the wrong way before the plunge; suddenly caught in the opposite direction, unwinding the Short $VX & long index futures positions

11 momentum chasing algos & tons of short-term specs chasing the momentum to the dn side

12 OS begets OS

11 momentum chasing algos & tons of short-term specs chasing the momentum to the dn side

12 OS begets OS

13 although different players have different levels, most of these levels are very close to each other

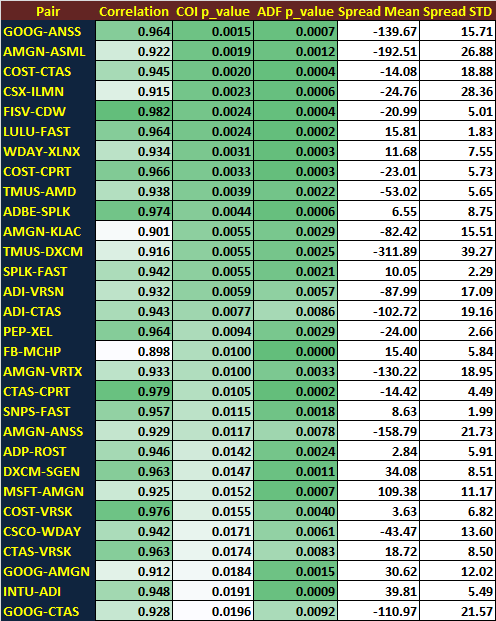

14 a simple ML/DL algos using the historical order-flows, MP & TA chart S/R analysis would be able to find the clustering of these important triggering levels

15 rug-pull++🦃

14 a simple ML/DL algos using the historical order-flows, MP & TA chart S/R analysis would be able to find the clustering of these important triggering levels

15 rug-pull++🦃

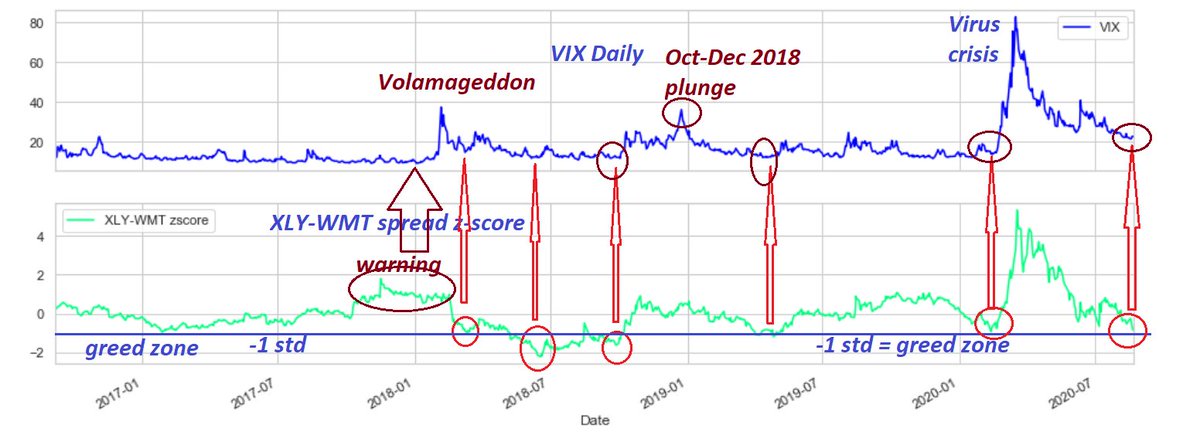

volatility clusters in real world trading since 1990

10 year volatility cluster cycle still valid

a period of LOW volatility cluster followed by a period of HIGH volatility cluster in all time frames, from intraday, short-term, long-term to 10-y cycle

10 year volatility cluster cycle still valid

a period of LOW volatility cluster followed by a period of HIGH volatility cluster in all time frames, from intraday, short-term, long-term to 10-y cycle

https://twitter.com/kerberos007/status/1275590671269756928

• • •

Missing some Tweet in this thread? You can try to

force a refresh