It's not every day that a niche question of statistical definition represents a significant step forward for global policy. But today... is that day!

(Excessively long thread follows)

(Excessively long thread follows)

A little background. Since the Millennium Development Goals overlooked non-aid finance, pressure has been building to recognise the centrality of tax, and for global policy measures against the broad threat posed by 'illicit financial flows'...

Illicit financial flows, or IFF, is an umbrella term for cross-border capital movements covering corporate and individual tax abuse, the laundering of the proceeds of crime, abuses of market regulation, and the theft of state assets, first popularised by @Raymond_Baker

The @ECA_OFFICIAL/@_AfricanUnion High Level Panel on IFF out of Africa, chaired by Thabo Mbeki, provided a comprehensive look at the issue, and put it on the global agenda just in time for it to be adopted into the UN Sustainable Development Goals, the successor to the MDGs

And so with the birth of the Sustainable Development Goals in 2015 (they run to 2030), the world agreed SDG 16.4, to curtail illicit financial flows, and also recognised tax as the primary 'means of implementation' in SDG 17.1. Result!

Unfortunately... some leading OECD countries, and some major multinationals, immediately began trying to unpick SDG 16.4.

Why? Either over a turf war, or to prevent meaningful action...

Why? Either over a turf war, or to prevent meaningful action...

Some didn't want corporate tax abuse to be included in order to 'protect' the OECD's role from a turf war with the UN (the first BEPS process was then underway); and the corporate lobbyists wanted to avoid multinationals being seen as 'illicit' actors, or being taxed more fairly

But of course, corporate tax abuse - both legally dubious 'avoidance' , and outright illegal 'evasion' - was central to the conception of illicit financial flows of the Mbeki panel and others, that underpinned the agreed SDG. So the lobbying aimed to subvert the global consensus.

There's a lot more detail on this definitional question in the first chapter of our new *open access* @OUPEconomics book with @petr_jansky #openaccessweek2020 global.oup.com/academic/produ…

And a fair bit more on the politics, and the actors behind the attempted subversion of the illicit financial flows target, in my book The Uncounted (ebook available now) wiley.com/en-us/The+Unco…

Such was the strength of lobbying against SDG 16.4, and the definition of IFFs, that @icrict @GA4TJ and @TaxJusticeNet went as far as writing to the UN Secretary General in 2017, calling on him to defend the globally agreed position taxjustice.net/2017/06/23/un-…

Thereafter, @UNCTAD worked with @UNODC to develop detailed indicators for SDG 16.4 and to confirm a definition. @petr_jansky and I contributed to the process, e.g. unctad.org/system/files/o…

Late last year, an important step: the UN expert commission moved 16.4 from Tier 3 (no internationally established methodology) to Tier 2 "Indicator is conceptually clear, has an internationally established methodology & standards are available" unstats.un.org/sdgs/iaeg-sdgs…

And now, the big one: @UNCTAD and @UNODC publish a 'CONCEPTUAL FRAMEWORK FOR THE STATISTICAL MEASUREMENT OF ILLICIT FINANCIAL FLOWS' **h/t @sakshirai92** unodc.org/documents/data…

The big point here is that the report ends once and for all the attempt to subvert SDG 16.4 by retrospectively taking multinational tax abuse out of scope:

"aggressive tax avoidance is included as an illicit financial flow, while noting that such activities are generally legal."

"aggressive tax avoidance is included as an illicit financial flow, while noting that such activities are generally legal."

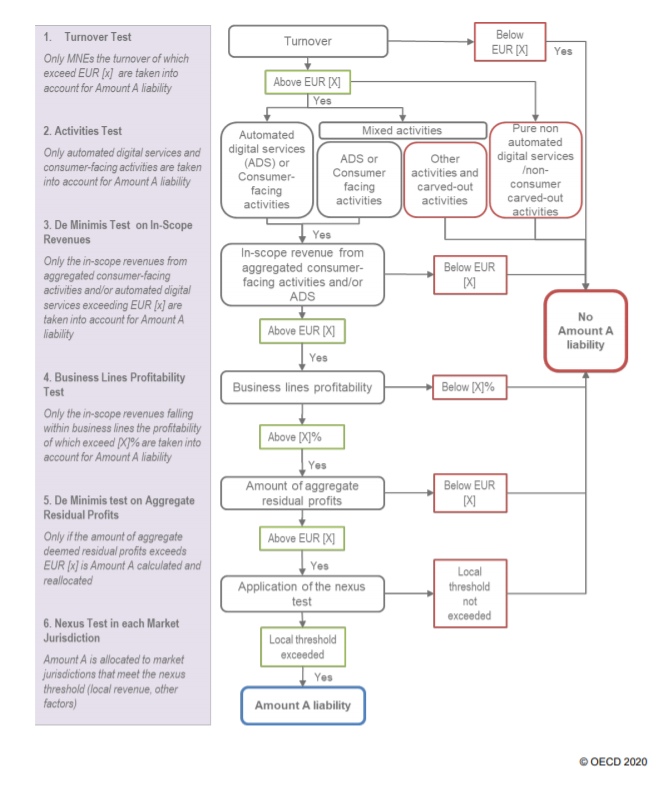

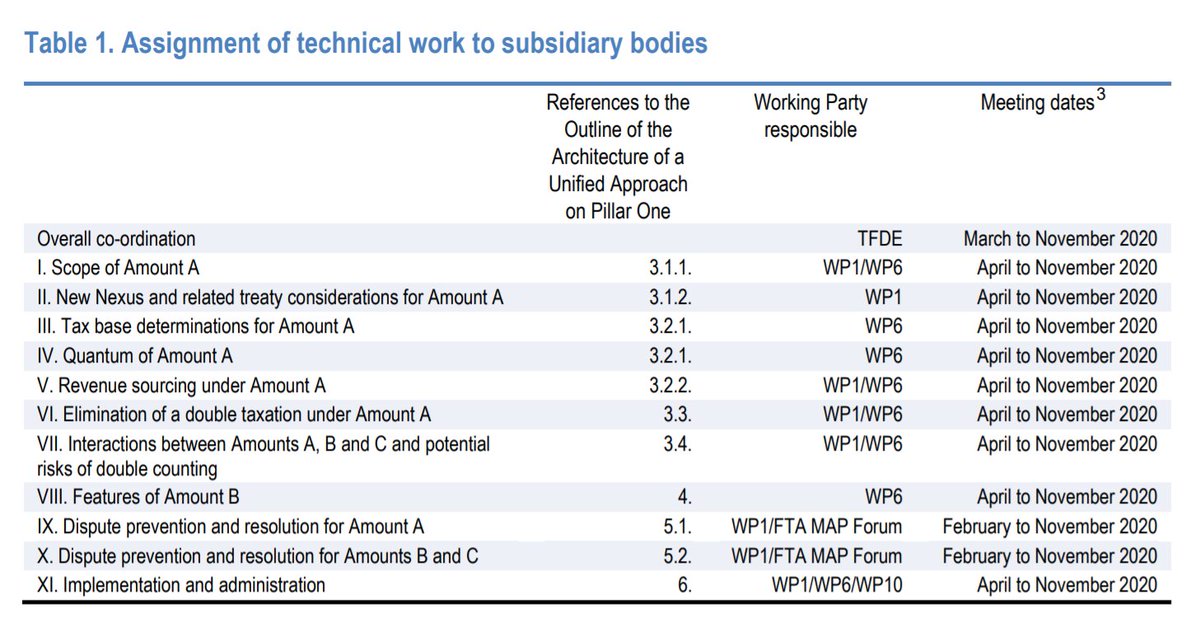

In addition, the report is explicit that this 'aggressive tax avoidance' is the same as the 'base erosion and profit shifting' activity that the OECD BEPS process.

That is: the UN now has a target which requires progress on what has thus far been an (unmet) OECD responsibility.

That is: the UN now has a target which requires progress on what has thus far been an (unmet) OECD responsibility.

The report also offers some key specifics. @petr_jansky and I proposed an indicator for SDG 16.4.1 which would rely on OECD country by country reporting to track the scale of corporate tax abuse. The report highlights exactly this possibility.

Excitingly, the report sets out how illicit financial flows could be embedded in the system of national accounts, to ensure systematic data in future, as well as the detailing the national pilot studies that are ongoing to establish feasible IFF measurement approaches.

At @TaxJusticeNet, we're also seeing a great expansion in the range of national authorities engaging on this issue, and working with us and others to develop their own IFF estimates and risk measures to guide policy.

You can find analysis of possible SDG targets and more in our book, see chapter 6 in particular for our proposed indicators: fdslive.oup.com/www.oup.com/ac…

And the granular IFF risk measures that we first developed for the @_AfricanUnion / @ECA_OFFICIAL panel report, and which support country-level policy analysis, are now fully available on our data portal here iff.taxjustice.net/#/

Thread ends. (Like I said, niche but important!)

But the work goes on... Not least, at @FACTIpanel which is now discussing with UN member states how to make sure that the necessary global policy+institutional architecture to combat IFF is in place... taxjustice.net/2020/09/24/our…

But the work goes on... Not least, at @FACTIpanel which is now discussing with UN member states how to make sure that the necessary global policy+institutional architecture to combat IFF is in place... taxjustice.net/2020/09/24/our…

• • •

Missing some Tweet in this thread? You can try to

force a refresh