Investors are often not aware that they have a negativity bias. A short thread that explains why so many people sell their stocks for the most futile reasons that look negative.

Examples about $SQ, $JD and mental support for $FSLY shareholders who start to doubt.

(1/10)

Examples about $SQ, $JD and mental support for $FSLY shareholders who start to doubt.

(1/10)

Let me first explain what the negativity bias is. It means that you feel that bad news is much more important than good news. In short, we all tend to focus on bad news and let it weigh much more in our decisions that good news. (2/10)

Let me give an example. If a company brings out a press release about a huge contract or a very promising acquisition, there is often a lukewarm reaction, even if it can be the biggest step the company has ever taken and the contract may put it in a whole different league. (3/10)

But if, for example, a company's factory burns down, there is huge attention for that negative news, while often the news is worse for the insurance company than for the company itself. We are all attracted to negativity and often downplay positive evolutions. (4/10)

That's also why pessimism sounds smarter, while optimism is often seen as naive.

Often the drop in the stock price is already enough to trigger the negativity bias. And as people are storytellers and they want an explanation, they try to make things fit into a story. (5/10)

Often the drop in the stock price is already enough to trigger the negativity bias. And as people are storytellers and they want an explanation, they try to make things fit into a story. (5/10)

That's why you see so many negative tweets now about $FSLY. I have seen that story often before.

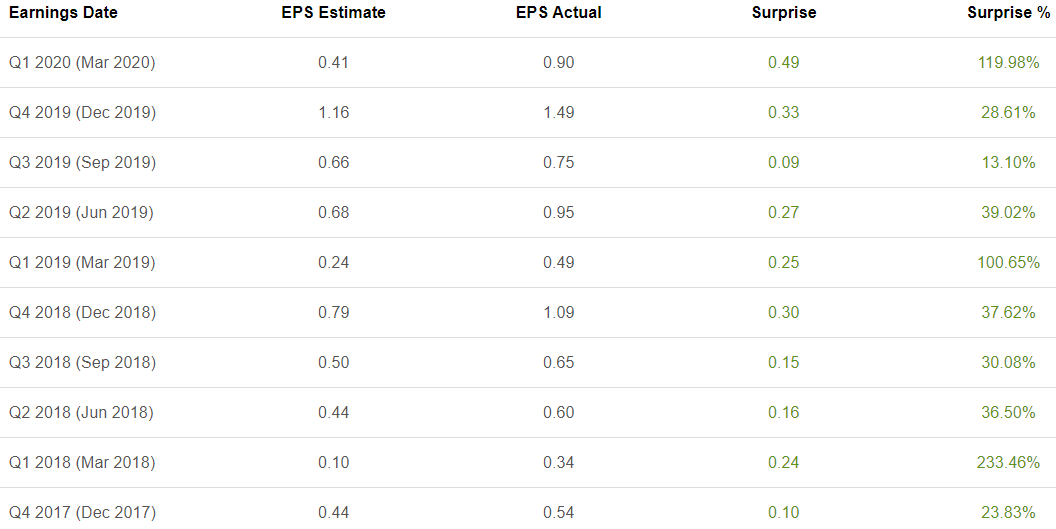

$SQ was one of the previous victims... until it shot up. When I published an article on @Square when it was at $41 in March 2020, I never got so many negative comments. e.g. (6/10)

$SQ was one of the previous victims... until it shot up. When I published an article on @Square when it was at $41 in March 2020, I never got so many negative comments. e.g. (6/10)

If you look at the fundamentals (revenue growth, margins...) you can see the real story and tune out the noise of Wall Street. And that's why I stayed bullish on $SQ.

$JD was another story like this. It was down 60% in Nov 2018 from where I picked it in January 2018.

(7/10)

$JD was another story like this. It was down 60% in Nov 2018 from where I picked it in January 2018.

(7/10)

And there were really serious issues in $JD: lower revenue growth, low margins, lower user growth, the Q4 guidance that was underwhelming, the rape case against CEO Richard Liu, the trade tensions, and much more.

But I focused on the fundamentals and added to my position. (8/10)

But I focused on the fundamentals and added to my position. (8/10)

This is what I wrote in my summary bullets on top of my article:

* I put all of the issues into perspective, and I think every investor should.

* The company acts with a long-term vision, and as an investor, you should take the same approach. (9/10)

* I put all of the issues into perspective, and I think every investor should.

* The company acts with a long-term vision, and as an investor, you should take the same approach. (9/10)

The stock is up almost 300% since then.

In @chriswmayer 's book 100 baggers, he shows 365 stocks that have gone up 10,000% and more. ALL of them, all 365, had seen a 50% drop at least once. Most several.

If you want #multibaggers, you should tune out the noise. (10/10)

In @chriswmayer 's book 100 baggers, he shows 365 stocks that have gone up 10,000% and more. ALL of them, all 365, had seen a 50% drop at least once. Most several.

If you want #multibaggers, you should tune out the noise. (10/10)

• • •

Missing some Tweet in this thread? You can try to

force a refresh