Today, I spoke at the W3C improving web advertising business group about the economics of digital ad identity. Thread🧵 on some takeaways on the future of digital ads. 1/

Cross-site identity (via cookies) allows for behavioral targeting. Importantly, identity allows for less sexy but *critical* functions like ad frequency capping, ad effectiveness measurement & attribution—all at scale. 2/

What is the value of cookies? In the status quo, most studies and data agree that cookies create value: ads get 50-70% less revenue without cookies. 3/

What does advertising look like without cookies? Ad spending will fall by *less* than 50-70%, because the market will adjust. But, the ad revenue pie will shrink, and will be divided more unequally. 4/

Analogy: What happened to my industry (post-secondary education) when we offered a worse product (Zoom/hybrid)? Our industry's revenue pie shrunk, Harvard is fine, & the lower-end is haemorrhaging. 5/

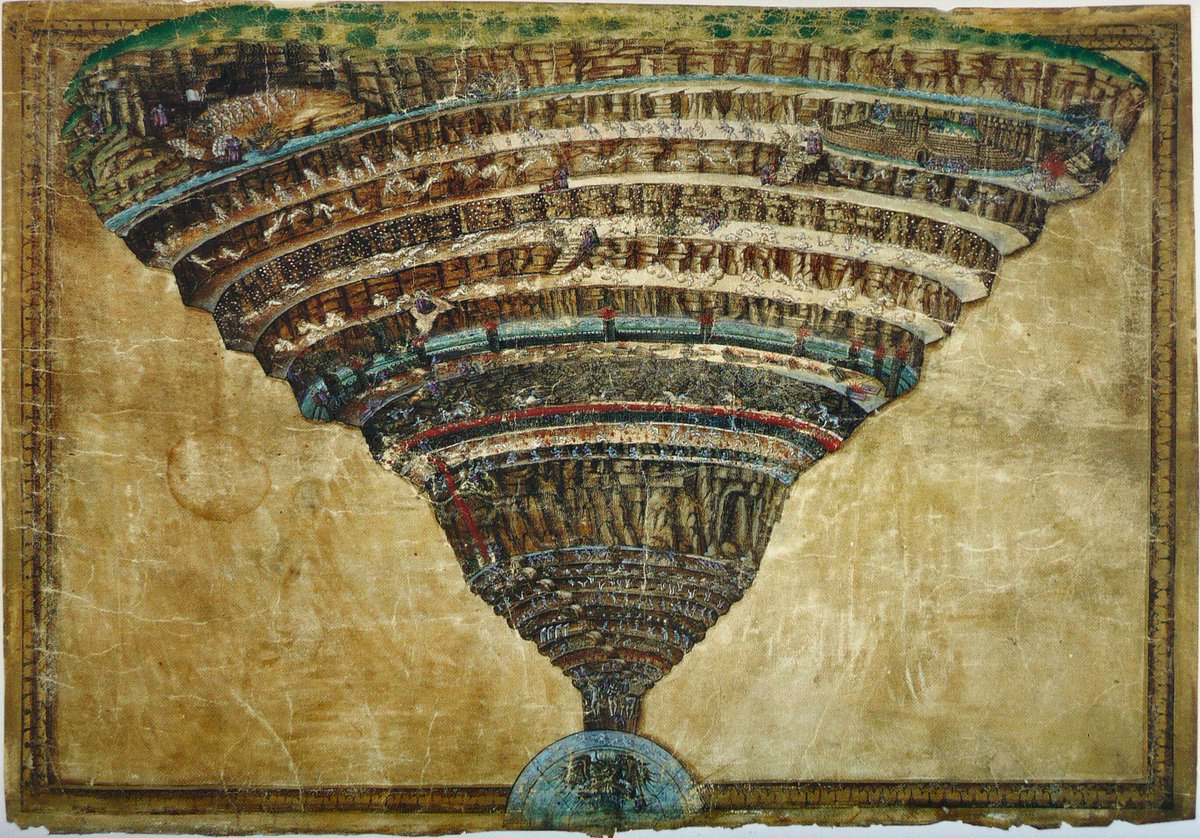

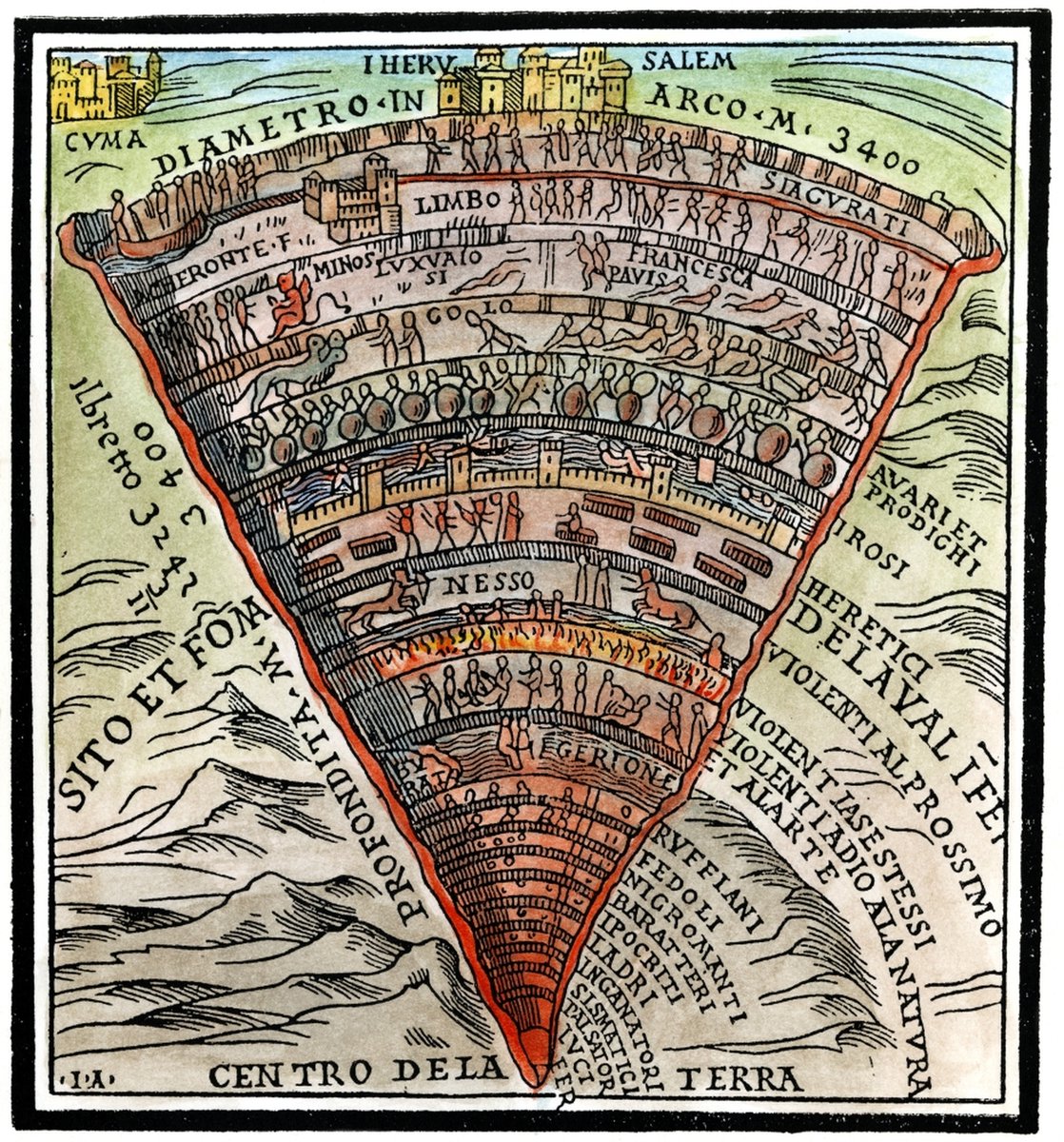

Post-cookies, digital ads have four tentpoles. Value of identity advantages the walled gardens & sign-in (i.e. hashed email identifier solutions). Context will struggle to compete: especially general & news content as well as small sites. 6/

How can privacy & modern advertising coexist? Good news: Advertisers care about audiences not individuals. Bad news: Privacy implies some hard tradeoffs. 7/

What are "the birds"? Various proposals (notably by Google Chrome’s Privacy Sandbox, Criteo) try to preserve the value of ads for the open web while protecting user privacy. This is the difficult, but important work of this W3C group. 8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh