1/

In finance and investing, it pays to be a little paranoid.

To develop a strong "survival instinct".

To *always* be prepared for adversity -- even when things are going well.

Here's a story about Warren Buffett's grandfather that drives this home.

In finance and investing, it pays to be a little paranoid.

To develop a strong "survival instinct".

To *always* be prepared for adversity -- even when things are going well.

Here's a story about Warren Buffett's grandfather that drives this home.

2/

Warren's grandfather -- Ernest Buffett -- had a simple business.

He owned and operated a grocery store in Omaha.

Both Warren and Charlie worked for Ernest when they were young (though not at the same time). They both came away impressed.

Warren's grandfather -- Ernest Buffett -- had a simple business.

He owned and operated a grocery store in Omaha.

Both Warren and Charlie worked for Ernest when they were young (though not at the same time). They both came away impressed.

3/

Ernest never finished high school.

But he intuitively understood financial risk -- both in business and in personal life.

Early on, he realized the importance of a rainy day fund -- a stash of money that's set aside for emergencies.

Ernest never finished high school.

But he intuitively understood financial risk -- both in business and in personal life.

Early on, he realized the importance of a rainy day fund -- a stash of money that's set aside for emergencies.

4/

Ernest had 5 children.

So he set up a rainy day fund for each of them.

And when they were old enough, he gave them the money -- along with a beautiful letter explaining its purpose.

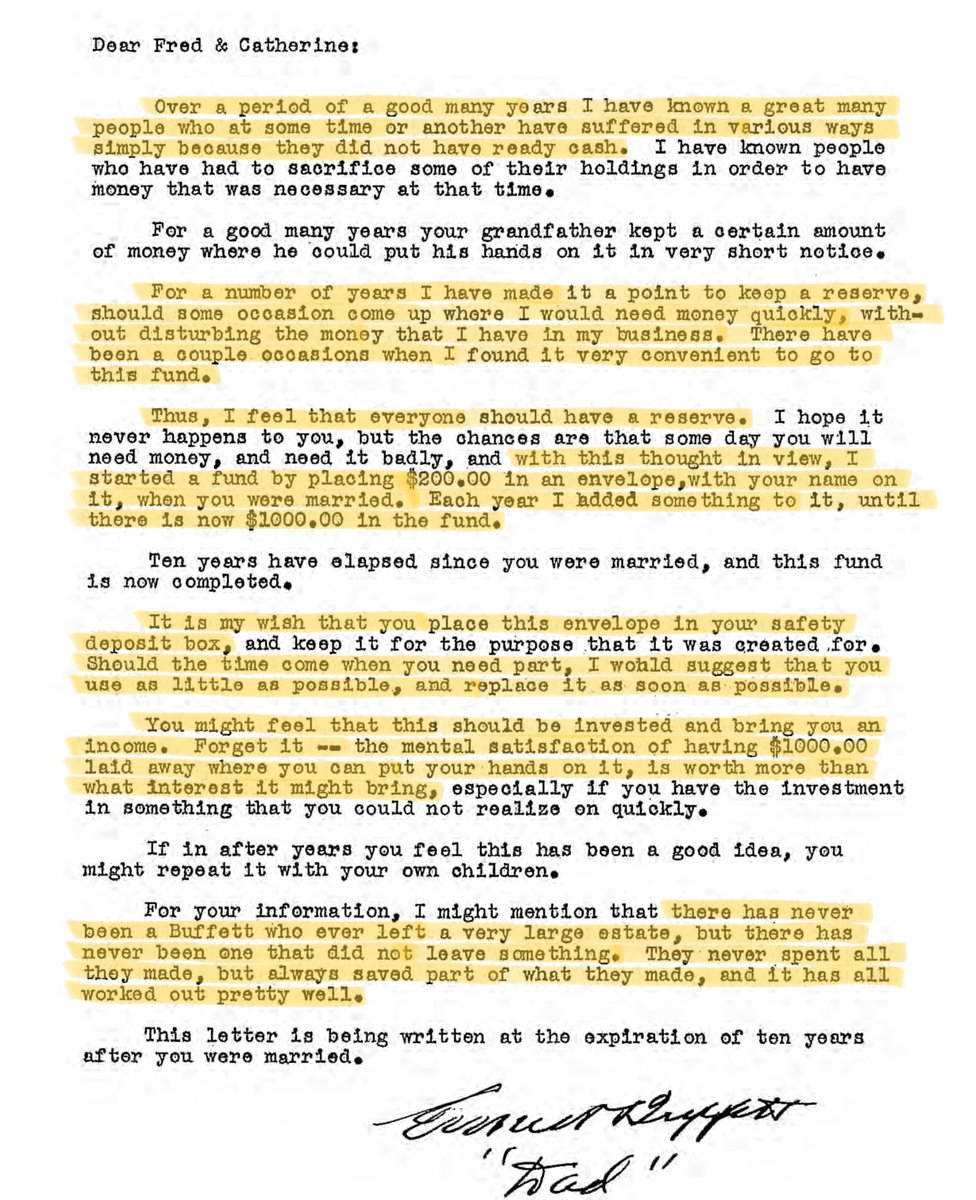

Here's the letter he wrote to his son Fred (Warren's uncle):

Ernest had 5 children.

So he set up a rainy day fund for each of them.

And when they were old enough, he gave them the money -- along with a beautiful letter explaining its purpose.

Here's the letter he wrote to his son Fred (Warren's uncle):

5/

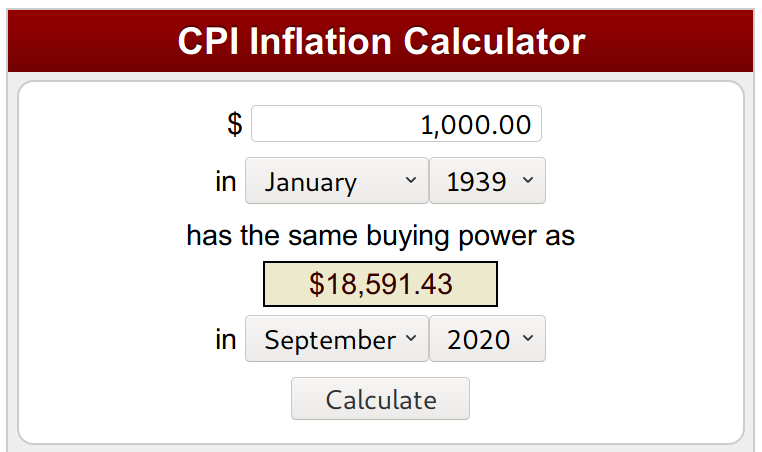

Ernest wrote that letter in 1939, leaving $1000 to Fred.

In case you're wondering, $1000 in 1939 is equivalent to about $18,600 today.

Ernest wrote that letter in 1939, leaving $1000 to Fred.

In case you're wondering, $1000 in 1939 is equivalent to about $18,600 today.

6/

Most Americans today don't have $18,600 -- or anything close to that -- set aside for emergencies.

This is sad.

Most Americans today don't have $18,600 -- or anything close to that -- set aside for emergencies.

This is sad.

7/

*Before* investing in stocks and such, I think we should first focus on 2 things:

1) Getting rid of high-interest debt (like credit card debt), and

2) Creating a rainy day fund. I think $10K to $15K would make a decent fund for most people.

*Before* investing in stocks and such, I think we should first focus on 2 things:

1) Getting rid of high-interest debt (like credit card debt), and

2) Creating a rainy day fund. I think $10K to $15K would make a decent fund for most people.

8/

In FinTwit, we tend to focus on stock ideas, company research, quarterly earnings, DCF projections, etc.

But all that should come only *after* taking care of these 2 basic items.

This is Financial Survival 101.

And survival comes first. Returns second.

In FinTwit, we tend to focus on stock ideas, company research, quarterly earnings, DCF projections, etc.

But all that should come only *after* taking care of these 2 basic items.

This is Financial Survival 101.

And survival comes first. Returns second.

9/

Some people are hardwired to think this way. They have the "financial survival" gene.

Buffett and Munger clearly have it.

And from his books, I think Taleb (@nntaleb) is cut from the same cloth.

Some people are hardwired to think this way. They have the "financial survival" gene.

Buffett and Munger clearly have it.

And from his books, I think Taleb (@nntaleb) is cut from the same cloth.

10/

In investing, it's such people who survive -- and tend to do well -- over long periods of time.

I don't think that's coincidence.

/End

In investing, it's such people who survive -- and tend to do well -- over long periods of time.

I don't think that's coincidence.

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh