Business

-Credit Rating has been upgraded by ICRA on back of the upgrade by Crisil in the last quarter.

-Topline was up by 12% (YOY) and 23% on QoQ basis.

-Margins remained at 32% and experienced 150BPS reduction in expenses primarily due to power cost and RM cost coming down,

-Credit Rating has been upgraded by ICRA on back of the upgrade by Crisil in the last quarter.

-Topline was up by 12% (YOY) and 23% on QoQ basis.

-Margins remained at 32% and experienced 150BPS reduction in expenses primarily due to power cost and RM cost coming down,

and change in mix of the business.

-Staff cost increased by 22% to 161 crores as compared to 132 Crores last year, which led to a 15% increase in employee cost.

-Currently we have 5200 employees as compared to 4700 employees last year

-Staff cost increased by 22% to 161 crores as compared to 132 Crores last year, which led to a 15% increase in employee cost.

-Currently we have 5200 employees as compared to 4700 employees last year

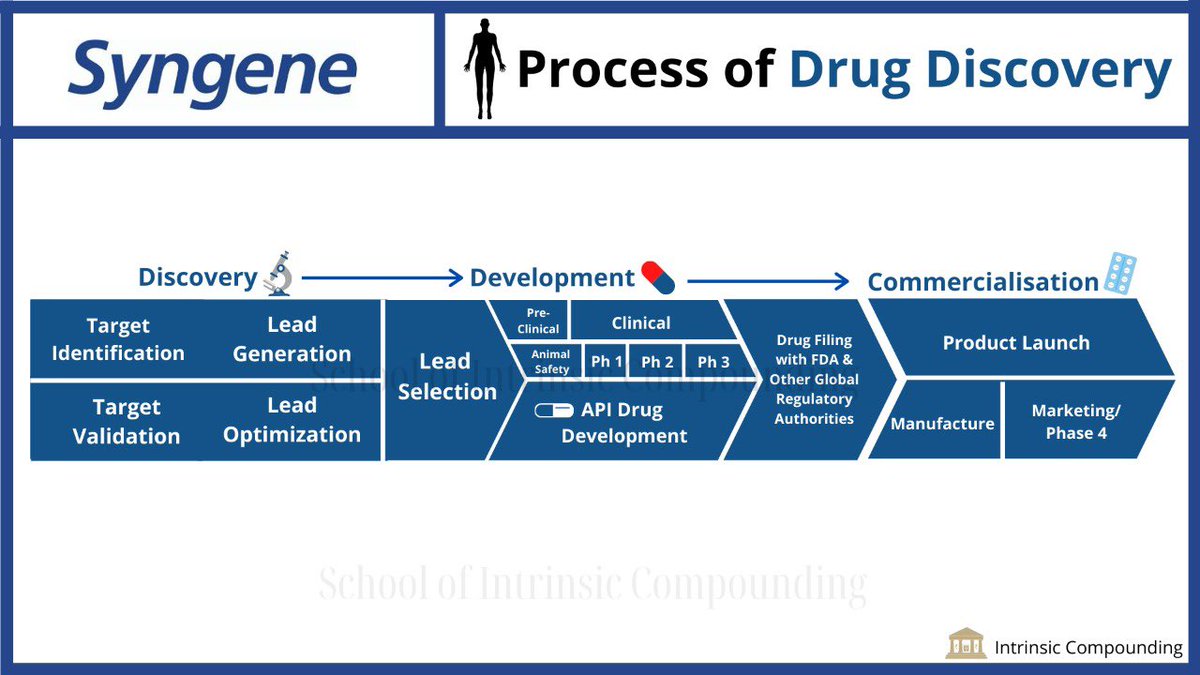

-Mangalore API Plant has started accruing operating expenses. The last 2 years were spent in building the plant and the current year will be spent in validations, audits, etc. From next year onwards, we will talk about the growth prospects and utilization of the facility.

-Excluding other income, EBITDA margins at 30% in the first half of the financial year, which is an improvement of 1% as compared to the last financial year.

-Operating losses in the newly commissioned Mangalore plant and the decline in interest income, contributed to 200bps

-Operating losses in the newly commissioned Mangalore plant and the decline in interest income, contributed to 200bps

reduction in tax rates and other 200bps reduction in tax rates came from the reversal of tax position from earlier years. The effective tax rate was at 11%.

-PAT margin came in at 16% vs 17% YOY. Impacted due to depreciation and lower interest income.

-PAT margin came in at 16% vs 17% YOY. Impacted due to depreciation and lower interest income.

-Capex incurred was $26million: (Capex break up)

1)$7million on the Mangalore API plant

2)$8million in the discovery business

3)$3million on the biologics facility

4)$8million on dedicated centres and development business

1)$7million on the Mangalore API plant

2)$8million in the discovery business

3)$3million on the biologics facility

4)$8million on dedicated centres and development business

Currently, $450 million in fixed assets (inclusive of $32million in assets under construction), earlier plans of closing the financial year with $550 million of fixed assets might spill over to the next year. In long term our Asset turnover would likely be at 1x.

-Since, most of the receipts are in $, we can borrow US Dollar-denominated money without posing risks. Interest rates are very low, decided to refinance the $50 million loan that we repaid last year during this quarter to strengthen liquidity.

-Near full operating capacity in-spite of covid. If the interest income is taken out, operating EBITDA, we had EBITDA Margin improvement. Revenue has grown faster than the costs by a bit, but large gap would only be visible once operating leverage kicks in.

-On Agchem, Animal Health and Speciality Chemical Business

1)Don’t do a great deal in manufacturing in Animal health, Spechem, and Animal Health.

2)Our role is front-ended (Providing quality research etc)

3)In Animal Health, due to the margin structure customers are

1)Don’t do a great deal in manufacturing in Animal health, Spechem, and Animal Health.

2)Our role is front-ended (Providing quality research etc)

3)In Animal Health, due to the margin structure customers are

very cost-sensitive. We can create value for them as India provides low-cost advantages.

4)On Agchem, it’s more of a sideline work than a major driver. Not a good fit for us, as it is scale based+High capex industrial approach.

4)On Agchem, it’s more of a sideline work than a major driver. Not a good fit for us, as it is scale based+High capex industrial approach.

Management

-Think long term do not go by quarters. Think of how Asset will develop over next 30 years rather than next few quarters. (When Asked about for a guidance from Mangalore API Plant)

-We don’t think we have reached half way in terms of industry potential.

-Think long term do not go by quarters. Think of how Asset will develop over next 30 years rather than next few quarters. (When Asked about for a guidance from Mangalore API Plant)

-We don’t think we have reached half way in terms of industry potential.

-On potential conflict of interest with Biocon being in novel biologics: That was a question asked 20 years ago, not been a relevant question since the last decade as we operate independently.

-Expect to meet the guidance of low Revenue growth and Flat PAT levels by the end of

-Expect to meet the guidance of low Revenue growth and Flat PAT levels by the end of

the FY. Expect to continue the momentum that has been built up in the first half to the second half of the year.

My view in terms of risks: business has been re-rated ahead of the eventual earnings growth and ROCE expansion in the next 2-3 years. However, what most people fail

My view in terms of risks: business has been re-rated ahead of the eventual earnings growth and ROCE expansion in the next 2-3 years. However, what most people fail

to realize is that the manufacturing of patented molecules is inherently a lumpy business. Given the recent commercialization of the Mangalore plant, it can take some time for it to reflect in revenues and achieve utilization levels. Any disappointment can lead to some correction

.Be patient and have a long term view. Not a SEBI registered advisor, not a recommendation to buy/sell

• • •

Missing some Tweet in this thread? You can try to

force a refresh