It's here - @BloombergNEF's 2020 New Energy Outlook. Peak energy emissions, peak oil demand, peak coal demand, 56% wind and solar power in 2050, hydrogen pathways, and $78-130 trillion (with a T) in investment 2020-50. Highlights: about.bnef.com/new-energy-out… #BNEFNEO THREAD:

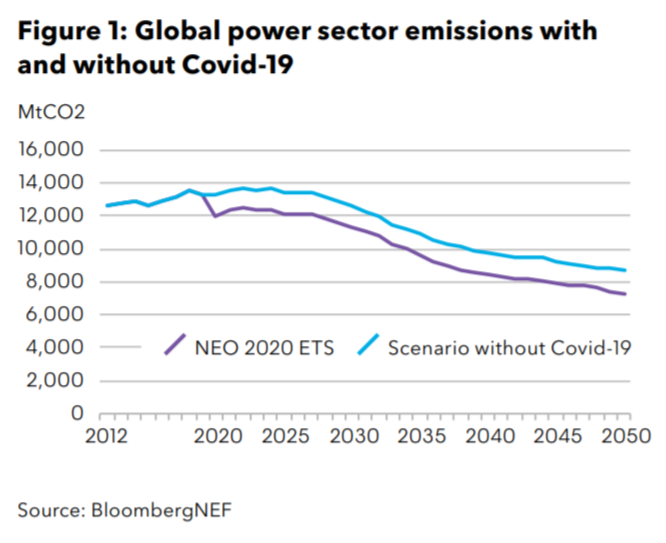

1/ @BloombergNEF #BNEFNEO 2020: In our core Economic Transition Scenario, global carbon emissions from energy use drop 8% in 2020 and now appear to have peaked in 2019. Covid subtracted 2.5 years of emissions' we're on track for 3.3 degrees of warming about.bnef.com/new-energy-out…

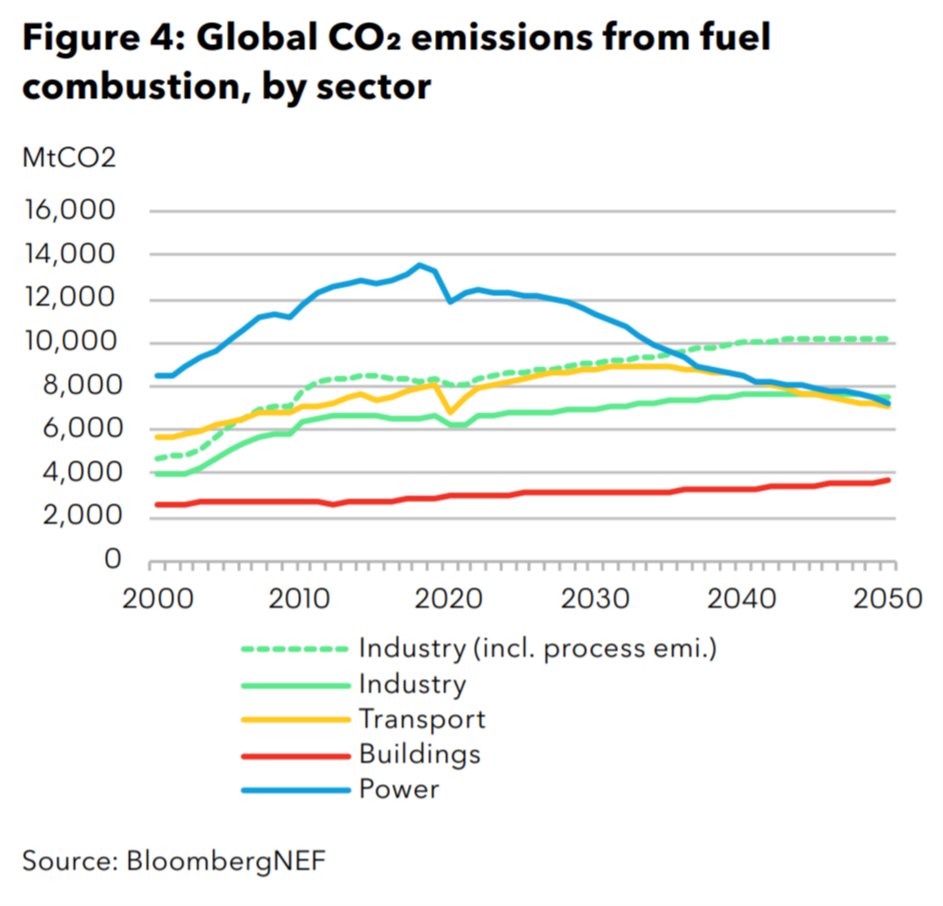

2/ @BloombergNEF #BNEFNEO 2020: Emissions from all transport peak in 2033, two years after the road segment, as a result of ongoing growth in aviation and shipping. Building emissions grows at 0.7% year-on-year from 9% of emissions in 2019 to 14% in 2050. about.bnef.com/new-energy-out…

3/ @BloombergNEF #BNEFNEO 2020: Covid-19 brought forward a triple peak in the power sector. Even with recovery, coal use and emissions both peak in 2018 and gas in 2019, under our Economic Transition

Scenario, and don’t return to pre-Covid levels. about.bnef.com/new-energy-out…

Scenario, and don’t return to pre-Covid levels. about.bnef.com/new-energy-out…

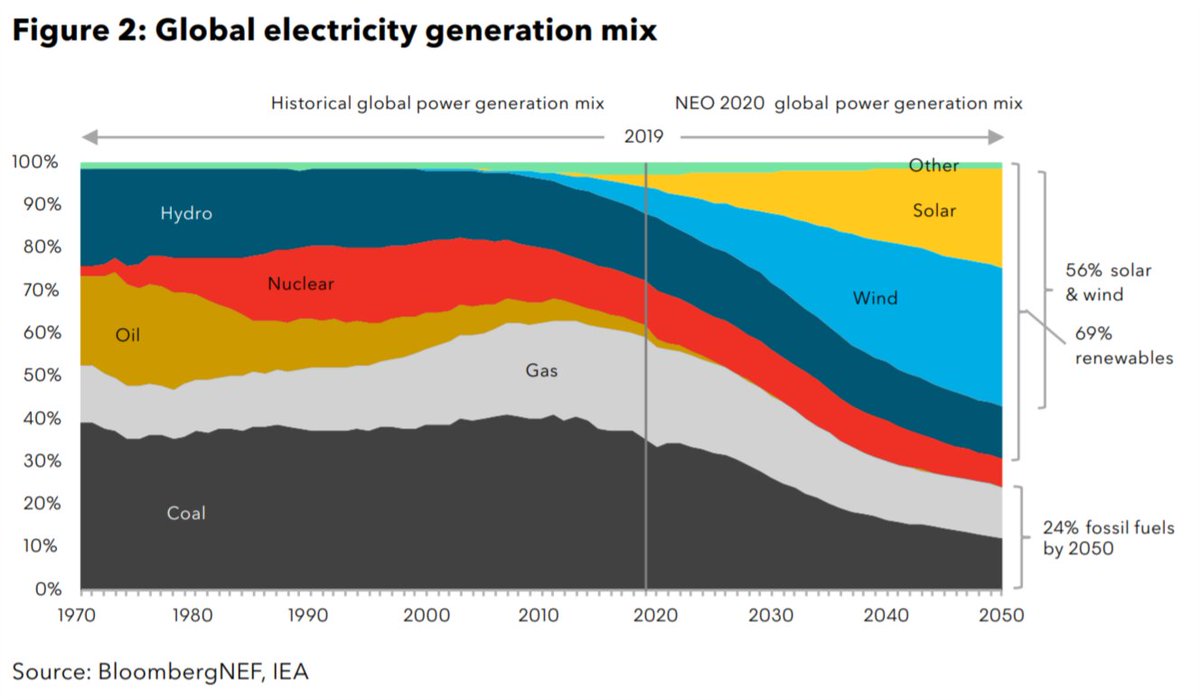

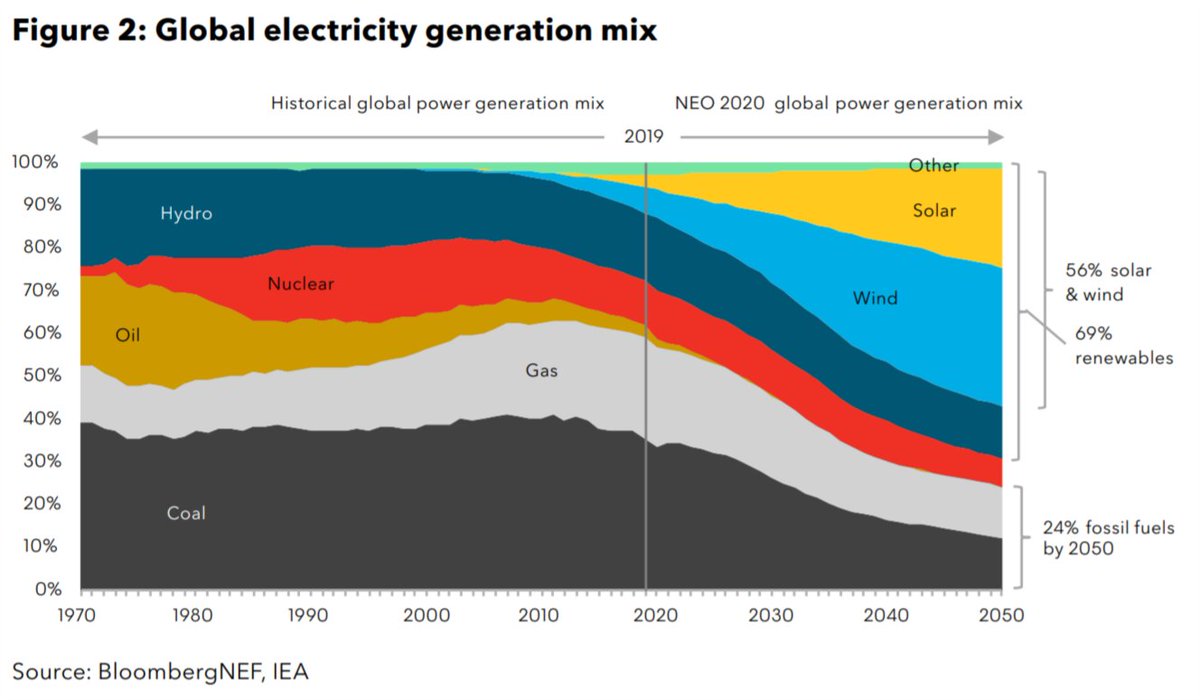

4/ @BloombergNEF #BNEFNEO 2020: Wind and PV supply 56% of electricity globally in 2050, up from 9% today, with nuclear, hydro and other renewables providing a further 20%, under our Economic Transition Scenario. about.bnef.com/new-energy-out…

5/ @BloombergNEF #BNEFNEO 2020: Cheaper solar, wind and batteries drive a ten-fold increase in variable renewables generation over the next 31 years. Fossil fuels fall to just 24% of generation over the same period, down from 62% today. about.bnef.com/new-energy-out…

6/ @BloombergNEF #BNEFNEO 2020: Renewables and batteries capture 80% of the total $15.1 trillion invested in new power capacity. Around $2 trillion or 13% is invested by households and businesses. Asia Pacific attracts 45% of all new capital. about.bnef.com/new-energy-out…

7/ @BloombergNEF #BNEFNEO 2020: To enable the power system of the future, $14 trillion in grid investment is needed between now and 2050. about.bnef.com/new-energy-out…

8/ @BloombergNEF #BNEFNEO 2020: Oil demand peaks in 2035 and then falls 0.7% year-on-year to return to 2018 levels in 2050. Electric vehicles (EVs) reach upfront price parity with Internal Combustion Engine vehicles before 2025, spurring faster adoption. about.bnef.com/new-energy-out…

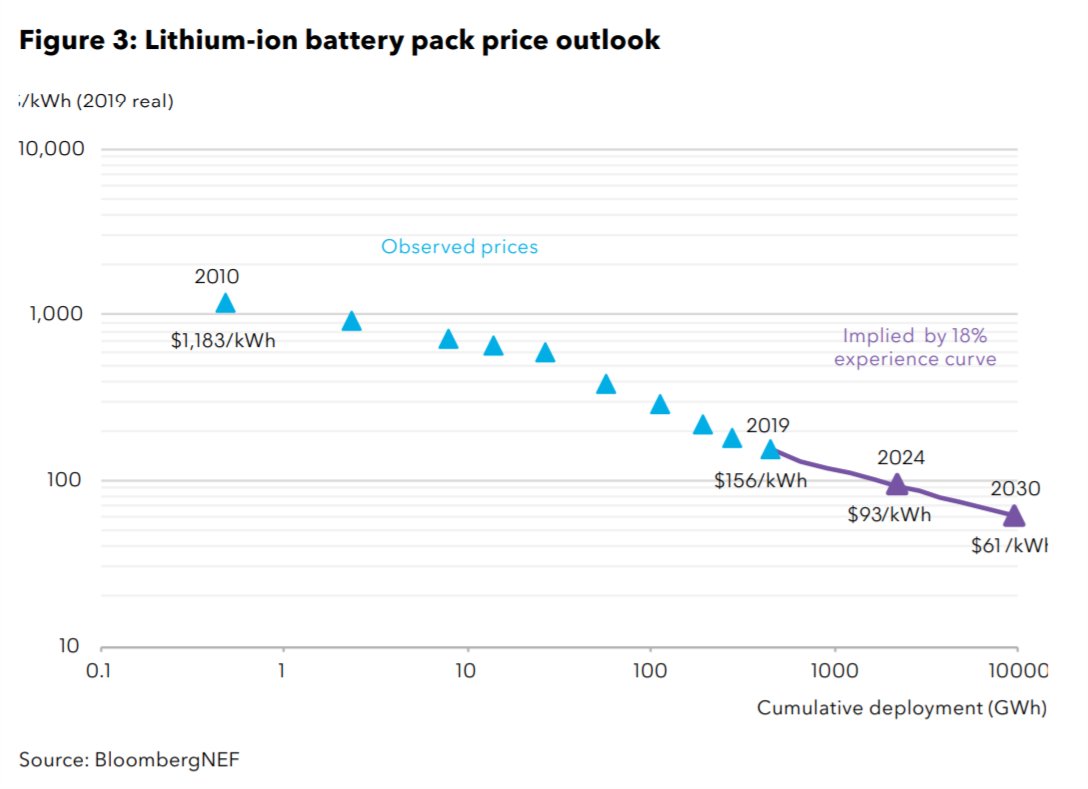

9/ @BloombergNEF #BNEFNEO 2020: Electrification is the main driver of transition in the transport sector to 2050. It is strongest in road and rail, thanks to cheaper lithium-ion batteries. It is weakest in shipping and aviation. about.bnef.com/new-energy-out…

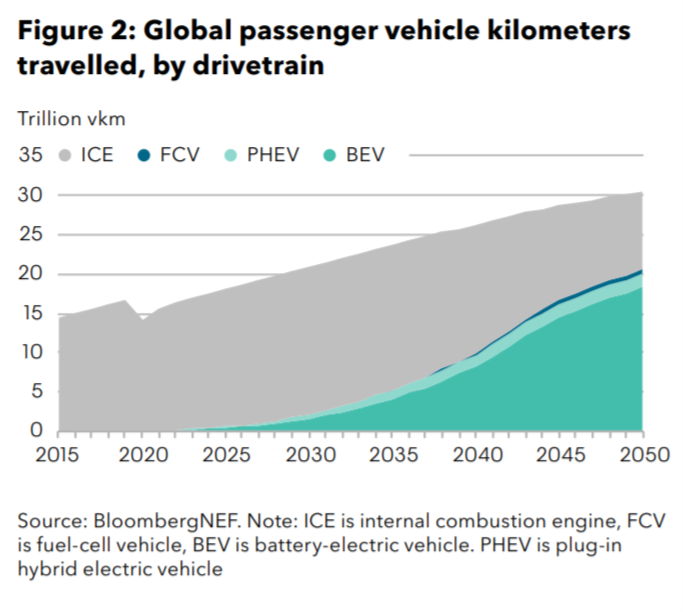

10/ @BloombergNEF #BNEFNEO 2020: Demand for road transport increases worldwide in line with population and income growth. Passenger vehicles hit 30 trillion annual km in 2050, most of it electric by then. about.bnef.com/new-energy-out…

11/ @BloombergNEF #BNEFNEO 2020: Lithium-ion battery pack prices fall 18% for every cumulative doubling of capacity. $1,183/kWh in 2010; $156/kWh in 2019; $61/kWh (est) in 2030 about.bnef.com/new-energy-out…

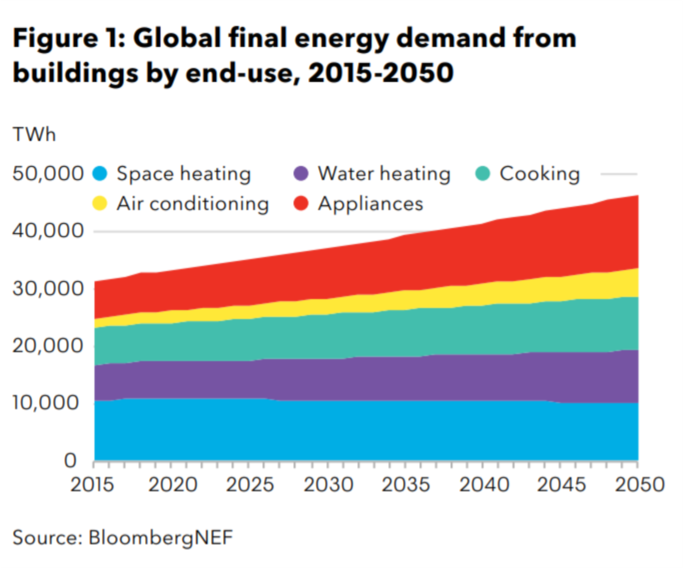

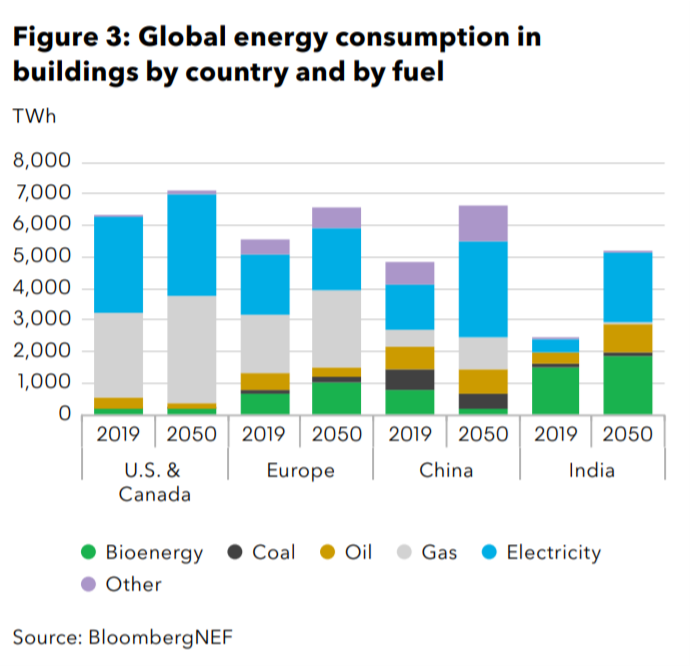

12/ @BloombergNEF #BNEFNEO 2020: Demand for energy in residential and commercial

buildings grows 42%, reaching 47,000TWh by

2050, in our Economic Transition Scenario. This is

up from around 33,000TWh in 2019. about.bnef.com/new-energy-out…

buildings grows 42%, reaching 47,000TWh by

2050, in our Economic Transition Scenario. This is

up from around 33,000TWh in 2019. about.bnef.com/new-energy-out…

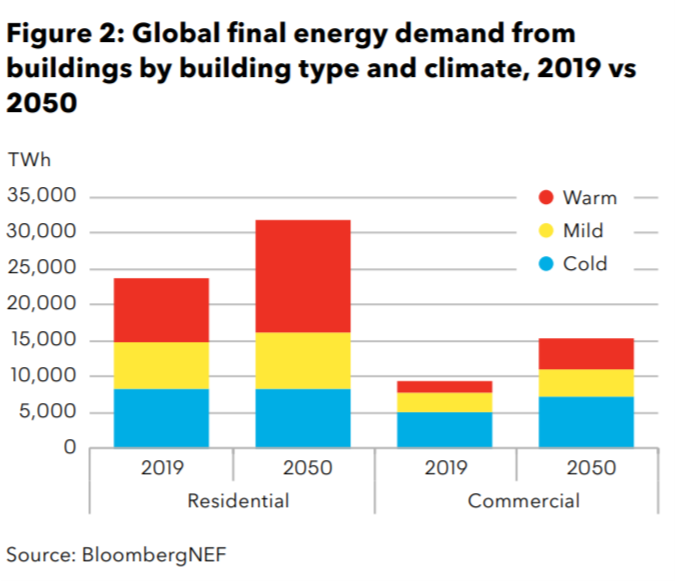

13/ @BloombergNEF #BNEFNEO 2020: Demand for energy in residential and commercial

buildings grows 42%, reaching 47,000TWh by

2050, in the Economic Transition Scenario. Demand grows fastest in warm climates. about.bnef.com/new-energy-out…

buildings grows 42%, reaching 47,000TWh by

2050, in the Economic Transition Scenario. Demand grows fastest in warm climates. about.bnef.com/new-energy-out…

14/ @BloombergNEF #BNEFNEO 2020: Natural gas remains the dominant energy source for heating and cooking in the U.S. and Europe, where it grows 27% and 30%, respectively, by 2050. Electricity will dominate in China in 2050 about.bnef.com/new-energy-out…

15/ @BloombergNEF #BNEFNEO 2020:Emissions from energy use in buildings rises 26% between 2019 and 2050 in the Economic Transition Scenario. This is almost all due to growth in gas and oil use in India and other rapidly

developing countries. about.bnef.com/new-energy-out…

developing countries. about.bnef.com/new-energy-out…

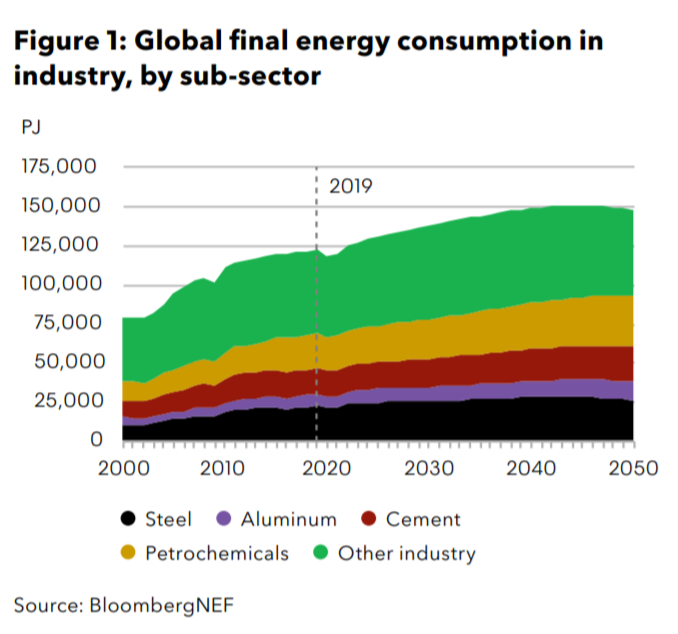

16/ @BloombergNEF #BNEFNEO 2020: Industry consumes 29% of total final energy, with the vast majority used for heat production. Energy consumption grows at an average of 0.6% per year to 2050, reaching 149,000PJ, but leveling off in the mid-2040s about.bnef.com/new-energy-out…

16/ @BloombergNEF #BNEFNEO 2020: Direct energy emissions grow 0.4% per year to 2050 - however if we factor in indirect electricity emissions, combined emissions peak in about 10 years. about.bnef.com/new-energy-out…

17/ @BloombergNEF #BNEFNEO 2020: Global materials demand growth for steel, aluminum, cement, and plastics is at least 50% by 2050 about.bnef.com/new-energy-out…

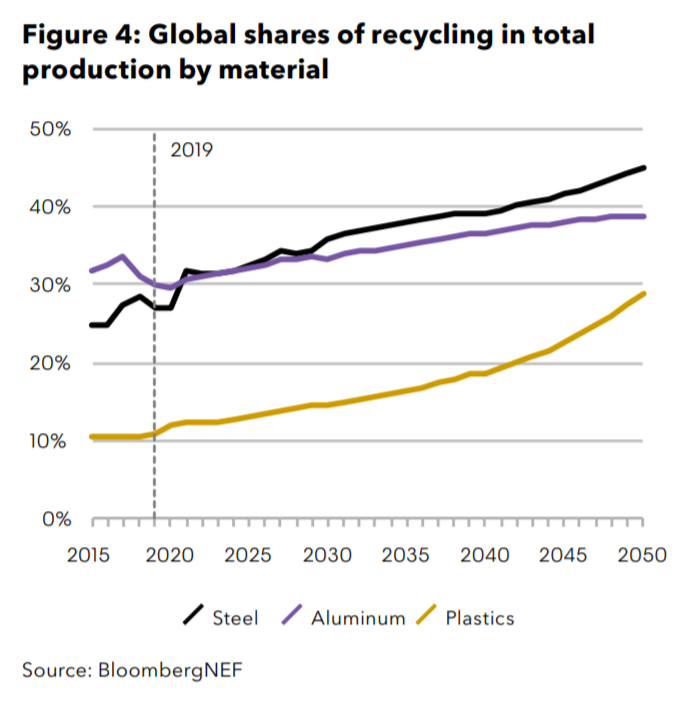

18/ @BloombergNEF #BNEFNEO 2020: Steel, aluminum, and plastics will all be recycled in higher volumes between now and 2050, with plastics recycling rate nearly tripling about.bnef.com/new-energy-out…

19/ @BloombergNEF #BNEFNEO 2020: Now, for the climate scenarios. The Economics Transition Scenario

would likely lead to an estimated 2.2 degrees

Celsius of global warming by 2050, and a jump of

3.3 degrees by the end of the century.

about.bnef.com/new-energy-out…

would likely lead to an estimated 2.2 degrees

Celsius of global warming by 2050, and a jump of

3.3 degrees by the end of the century.

about.bnef.com/new-energy-out…

20/ @BloombergNEF #BNEFNEO 2020: The emissions targets in our Climate Scenario would require the global power sector to expand to 43TW in 2050, double the size compared with our Economic Transition Scenario. about.bnef.com/new-energy-out…

21/ @BloombergNEF #BNEFNEO 2020: Renewable capacity triples to 16TW of PV and 11TW of onshore wind. That means around 540GW of PV and 375GW of wind is added each year. It took two decades to deploy the first terawatt of wind and PV about.bnef.com/new-energy-out…

22/ @BloombergNEF #BNEFNEO 2020: Electrification of end-uses in the Climate Scenario increases electricity demand to 65,894TWh in 2050. This is 25,443TWh, or 63%, more than in the Economic Transition Scenario. about.bnef.com/new-energy-out…

23/ @BloombergNEF #BNEFNEO 2020: Electricity generation in the Climate Scenario shows intense ramp rates of renewables - see Germany in 2050 about.bnef.com/new-energy-out…

24/ @BloombergNEF #BNEFNEO 2020: Global hydrogen demand under our cleanelectricity and green-hydrogen pathway reaches 801Mt in 2050. Around 30% of this goes to power generation and another 30% goes to industry. about.bnef.com/new-energy-out…

25/ @BloombergNEF #BNEFNEO 2020: Investment needed to stay on 1.75 deg C of warming

*$35T power gen and batteries

*$28.7T power grid

*$11-35T for power-to-Hydrogen

*$0.7-2.7T hydrogen storage

*$1.9-28T for hydrogen transport about.bnef.com/new-energy-out…

*$35T power gen and batteries

*$28.7T power grid

*$11-35T for power-to-Hydrogen

*$0.7-2.7T hydrogen storage

*$1.9-28T for hydrogen transport about.bnef.com/new-energy-out…

26/ @BloombergNEF #BNEFNEO 2020: Switching from a mostly-fossil fuels to one that is powered by zero-carbon electricity, either directly in end-use sectors, or indirectly via hydrogen, makes for a more energy-efficient world economy. about.bnef.com/new-energy-out…

27/ @BloombergNEF #BNEFNEO 2020: Primary energy in

2050, under this scenario, is 8% lower than today

and 16% less than in the Economic Transition

Scenario. Coal and gas are only 8% of 2050 primary energy demand in the Climate Scenario! about.bnef.com/new-energy-out…

2050, under this scenario, is 8% lower than today

and 16% less than in the Economic Transition

Scenario. Coal and gas are only 8% of 2050 primary energy demand in the Climate Scenario! about.bnef.com/new-energy-out…

28/ @BloombergNEF #BNEFNEO 2020 key messages are here, and executive summary is available for download: about.bnef.com/new-energy-out…

Clients: find it @TheTerminal and bnef.com

Clients: find it @TheTerminal and bnef.com

29/ @BloombergNEF #BNEFNEO 2020: There is so much more in the report! Bravo @sebhenbest @EthanAll @solar_chase @vhcuming @JamesTFrith @SLEnergy @LoganGoldieScot @colinmckerrache @YayoiSekine @kobadb @TheNewGoldRush and 100+ BNEF analysts. about.bnef.com/new-energy-out… END

• • •

Missing some Tweet in this thread? You can try to

force a refresh