With the company's latest earnings report last week, Elon Musk satisfied the requirements for his 4th stock option tranche.

Here's how it all works...

[THREAD]

Here's how it all works...

[THREAD]

1/

At the beginning of 2018, Tesla filed a proxy statement, outlining the proposed comp plan for Musk.

He wouldn't receive a salary, options, RSUs, etc. Everything would rely on this comp plan.

Source:

sec.gov/Archives/edgar…

At the beginning of 2018, Tesla filed a proxy statement, outlining the proposed comp plan for Musk.

He wouldn't receive a salary, options, RSUs, etc. Everything would rely on this comp plan.

Source:

sec.gov/Archives/edgar…

2/

The plan consists of 2 parts:

1) Operational goals (16 of them)

2) Market cap goals (12 of them)

Here are the operational goals:

The plan consists of 2 parts:

1) Operational goals (16 of them)

2) Market cap goals (12 of them)

Here are the operational goals:

3/

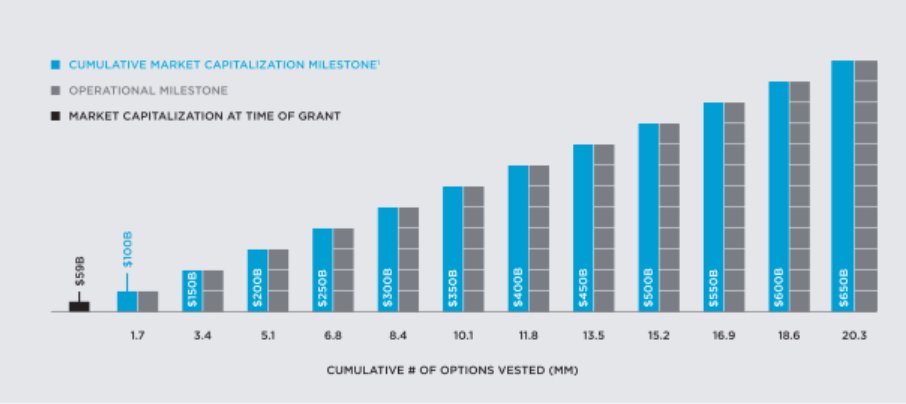

And below are the market cap goals.

They start at $100 billion and go up by $50 billion until topping out at $650 billion.

And below are the market cap goals.

They start at $100 billion and go up by $50 billion until topping out at $650 billion.

4/

When the plan was proposed, the market cap of Tesla was $59 billion.

For Musk to receive a tranche of stock options, one operational AND one market cap goal have to be achieved.

When the plan was proposed, the market cap of Tesla was $59 billion.

For Musk to receive a tranche of stock options, one operational AND one market cap goal have to be achieved.

5/

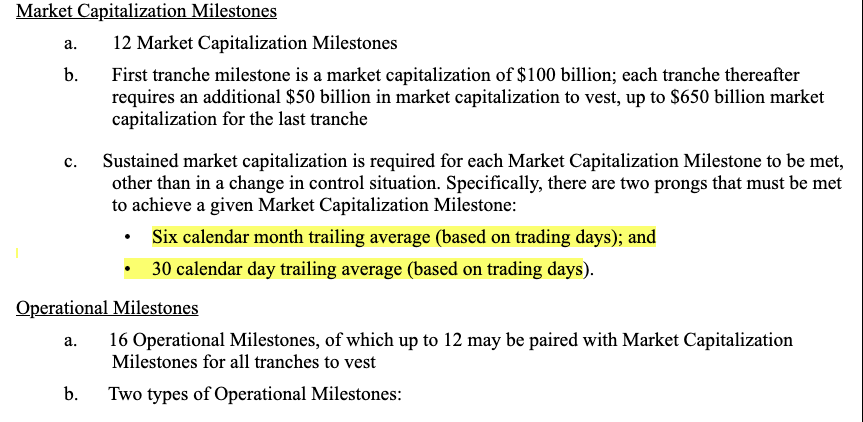

So the first tranche could only be exercised if:

1) the market cap reached $100 billion (and stayed there for 6 calendar months)

AND

2) revenue reached $20 billion OR adjusted EBITDA reached $1.5 billion

So the first tranche could only be exercised if:

1) the market cap reached $100 billion (and stayed there for 6 calendar months)

AND

2) revenue reached $20 billion OR adjusted EBITDA reached $1.5 billion

6/

Notice that there are only 12 market cap goals but 16 operational goals.

So if Tesla reached $14 billion in adjusted EBITDA (satisfying 8 operational goals), Tesla would "only" need $75 billion in revenue for Musk to exercise all 12 tranches if the market cap > $650 billion.

Notice that there are only 12 market cap goals but 16 operational goals.

So if Tesla reached $14 billion in adjusted EBITDA (satisfying 8 operational goals), Tesla would "only" need $75 billion in revenue for Musk to exercise all 12 tranches if the market cap > $650 billion.

7/

Again, for Musk to get a tranche, one market cap AND one operational goal have to be reached.

For each tranche, Musk receives 8.44 million shares (the chart in tweet #3 says 1.7 million but that was before the 5-for-1 split).

And the exercise price is $70 ($350 pre-split)

Again, for Musk to get a tranche, one market cap AND one operational goal have to be reached.

For each tranche, Musk receives 8.44 million shares (the chart in tweet #3 says 1.7 million but that was before the 5-for-1 split).

And the exercise price is $70 ($350 pre-split)

8/

Each tranche represented 1% of shares outstanding on the date of the proxy (January 19, 2018). This was roughly 1.7 million. The exercise price was also set on this date.

Without the split, Tesla's stock price would be around $2,120, up 6x since 1/19/18.

Each tranche represented 1% of shares outstanding on the date of the proxy (January 19, 2018). This was roughly 1.7 million. The exercise price was also set on this date.

Without the split, Tesla's stock price would be around $2,120, up 6x since 1/19/18.

9/

The current market cap is ~$400 billion so it actually satisfies 7 of the market cap goals (though probably more like 5 since it hasn't been 6 calendar months yet on each rung).

Tesla hit $20 billion in revenue in Q4 2018 but Musk could only exercise tranche 1 in May 2020.

The current market cap is ~$400 billion so it actually satisfies 7 of the market cap goals (though probably more like 5 since it hasn't been 6 calendar months yet on each rung).

Tesla hit $20 billion in revenue in Q4 2018 but Musk could only exercise tranche 1 in May 2020.

10/

This was because of the 6-month requirement.

Here is the language from the proxy to satisfy the market cap goal:

This was because of the 6-month requirement.

Here is the language from the proxy to satisfy the market cap goal:

11/

But now that Tesla is becoming more profitable, it is clearing the adjusted EBITDA goals.

In its recent earnings, it reached $5 billion in TTM ad. EBITDA so it cleared 3 more operational milestones on top of the 1st revenue goal.

But now that Tesla is becoming more profitable, it is clearing the adjusted EBITDA goals.

In its recent earnings, it reached $5 billion in TTM ad. EBITDA so it cleared 3 more operational milestones on top of the 1st revenue goal.

12/

So Musk has now cleared the bar for 3 tranches and the 4th has already started exercising.

4 tranches ➡️ (8.44 * 4 = 33.8 million shares total that can be exercised at $70/share)

Coincidentally, the current stock price is ~$420

So Musk has now cleared the bar for 3 tranches and the 4th has already started exercising.

4 tranches ➡️ (8.44 * 4 = 33.8 million shares total that can be exercised at $70/share)

Coincidentally, the current stock price is ~$420

13/

Officially, Musk received his first tranche in May, his second in July, the third in September, and the fourth this month, in October.

To make the math easy, let's say he exercised everything today:

33.8 million * ($424-70) = $12 billion

#skininthegame

Officially, Musk received his first tranche in May, his second in July, the third in September, and the fourth this month, in October.

To make the math easy, let's say he exercised everything today:

33.8 million * ($424-70) = $12 billion

#skininthegame

14/

But Musk has a 5-year lock-up so he can't sell any of these shares.

One last thing is that he could clear tranche 5 & 6 within the next year as the company will likely hit $35 billion sometime in Q2/Q3 of next year which would allow them to hit $6 billion in EBITDA.

But Musk has a 5-year lock-up so he can't sell any of these shares.

One last thing is that he could clear tranche 5 & 6 within the next year as the company will likely hit $35 billion sometime in Q2/Q3 of next year which would allow them to hit $6 billion in EBITDA.

15/

Before the latest earnings, Tesla filed a 10-Q calling the $4.5 billion EBITDA target "probable" which has been hit.

They also call tranche 5 & 6 "probable"

Musk has made nearly $12 billion in 3 years off this comp plan. And that's not counting any of his previous equity.

Before the latest earnings, Tesla filed a 10-Q calling the $4.5 billion EBITDA target "probable" which has been hit.

They also call tranche 5 & 6 "probable"

Musk has made nearly $12 billion in 3 years off this comp plan. And that's not counting any of his previous equity.

End/

Is this the biggest payday in the history of comp plans?

The stock is up 6x in this time frame though so how could you complain?

Musk has walked the walk.

Incredible.

Is this the biggest payday in the history of comp plans?

The stock is up 6x in this time frame though so how could you complain?

Musk has walked the walk.

Incredible.

One more detail.

If Tesla’s share price hits $700 sometime in the future and Tesla’s revenues hit $75 billion, this comp plan could be worth over $60 billion for Musk.

If Tesla’s share price hits $700 sometime in the future and Tesla’s revenues hit $75 billion, this comp plan could be worth over $60 billion for Musk.

• • •

Missing some Tweet in this thread? You can try to

force a refresh