#Balaji amines - Excellent results, announced new capex , CFO not up to the mark .

#Balaji amines excellent growth and capex will continue, import substitution ( some products)

#Balaji amines- superbbbbb results, already 3X for me but ye dil maange more .

Balaji concall-( Balaji sp.chemicals)India currently imports 29,000 MT of EDA and 7,000 MT of PIP and around 3,000 tons of

DETA per annum. balaji is planning to address this opportunity by progressively grabbing share of import

market in coming years.

DETA per annum. balaji is planning to address this opportunity by progressively grabbing share of import

market in coming years.

The debottlenecking exercise for Acetonitrile plant is currently being undertaken and

should get completed by end of March 2021. Post this the production of Acetonitrile is

expected to ramp up to 18 tons to 20 tons per day from 9 MT per day.

should get completed by end of March 2021. Post this the production of Acetonitrile is

expected to ramp up to 18 tons to 20 tons per day from 9 MT per day.

completed capex of about Rs. 128 Crores in our 90-acre Greenfield projects out of the

total capex of Rs. 150 Crores and expect to commission the production of Ethylamine by end of FY 2021.

total capex of Rs. 150 Crores and expect to commission the production of Ethylamine by end of FY 2021.

The sustainable EBITDA margin should be 20% to 22%. If prices come down, margins may

come down a little. But for Balaji the additional capacities will come by the time of March and

April, which will compensate the fall in margins..

come down a little. But for Balaji the additional capacities will come by the time of March and

April, which will compensate the fall in margins..

@threader_app compile

Balaji amines - some interesting points from concall

1-Volume offtake would have been better, but it was adversely affected on account of

pandemic related disruptions of both inbound and outbound logistics support as well as lack

of adequate supply of industrial oxygen

1-Volume offtake would have been better, but it was adversely affected on account of

pandemic related disruptions of both inbound and outbound logistics support as well as lack

of adequate supply of industrial oxygen

2- zero-debt company on standalone basis.

3-Balaji Specialty Chemicals Private Limited witnessed substantial

ramp up in capacity utilization due to increase in demand for ethylenediamine (EDA). The

company is currently manufacturing 1,300 to 1,500 tonnes per month,

3-Balaji Specialty Chemicals Private Limited witnessed substantial

ramp up in capacity utilization due to increase in demand for ethylenediamine (EDA). The

company is currently manufacturing 1,300 to 1,500 tonnes per month,

which will be further

ramped up going forward, once the supply of raw material eases

4-also exporting few

of products manufactured by our Balaji specialty to China which previously used to get

dumped in India.

ramped up going forward, once the supply of raw material eases

4-also exporting few

of products manufactured by our Balaji specialty to China which previously used to get

dumped in India.

5-With commencement of operations at new plant of Ethylamines, which is

part of phase 1 of 90-acre Greenfield Project Unit IV at Solapur the company has the

largest installed capacity of Ethylamines in India at 22,500 tonnes per annum.

part of phase 1 of 90-acre Greenfield Project Unit IV at Solapur the company has the

largest installed capacity of Ethylamines in India at 22,500 tonnes per annum.

6-With the

commencement of this plant, Balaji Amines is the largest manufacturer of Methylamines,

Ethylamines, and other chemicals in India

commencement of this plant, Balaji Amines is the largest manufacturer of Methylamines,

Ethylamines, and other chemicals in India

7-The new plant of Ethylamines at unit IV will lead to lower cost of production due to new

technology. Demand for Ethylamine is growing between 10% to 15% per annum in India.

In FY2022, company expect a decent revenue inflow from new Ethylamines plant.

technology. Demand for Ethylamine is growing between 10% to 15% per annum in India.

In FY2022, company expect a decent revenue inflow from new Ethylamines plant.

8- Presently

there is supply shortfall of about 9,000 tonnes of Ethylamines in India which is imported

from outside. This supply gap is expected to increase to about 15,000 tonnes in the next two

years. Balaji will be well positioned to address this increase in market demand

there is supply shortfall of about 9,000 tonnes of Ethylamines in India which is imported

from outside. This supply gap is expected to increase to about 15,000 tonnes in the next two

years. Balaji will be well positioned to address this increase in market demand

9-The debottlenecking of Acetonitrile plant has been delayed on account of lack of skilled

manpower due to pandemic led restrictions. However, the construction of new plant for Dimethyl Carbonate in phase 1 of Greenfield project (Unit IV) is undergoing as envisaged

manpower due to pandemic led restrictions. However, the construction of new plant for Dimethyl Carbonate in phase 1 of Greenfield project (Unit IV) is undergoing as envisaged

and company hope to commence production of DMC by the end of FY2022

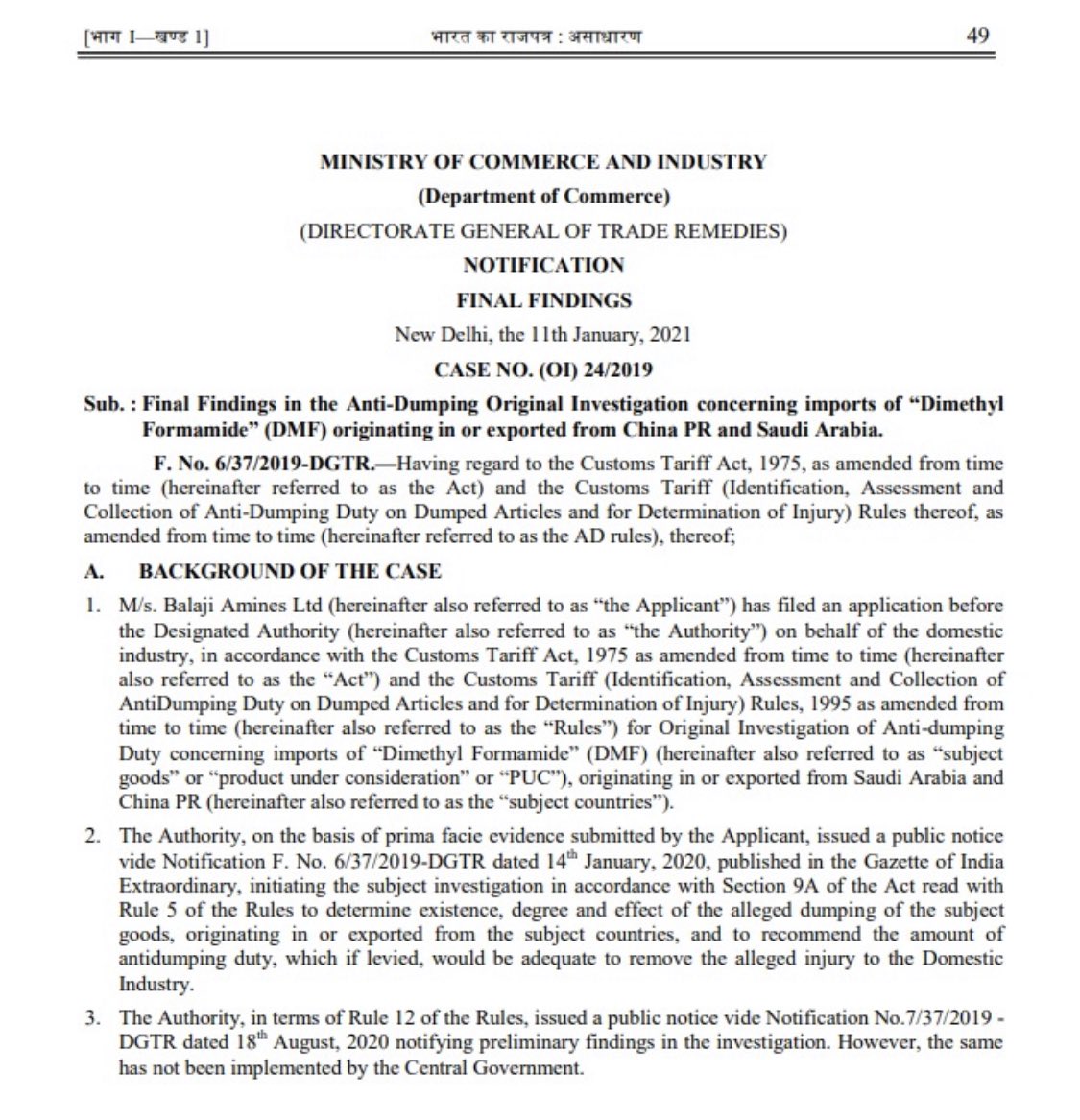

10-In the Q4 of FY2021 the capacity utilization of DMF plant was much improved at about

48%; however, from mid-April onwards due to diversion of oxygen supply our DMF

production was briefly disrupted.

10-In the Q4 of FY2021 the capacity utilization of DMF plant was much improved at about

48%; however, from mid-April onwards due to diversion of oxygen supply our DMF

production was briefly disrupted.

However now onwards the production of

DMF has been restarted, as supply of industrial oxygen has been restored.

11-Now because of increase in captive requirements, company planned to set up a separate plant for

Methylamines with a capacity of 40,000 to 50,000 tonnes per annum

DMF has been restarted, as supply of industrial oxygen has been restored.

11-Now because of increase in captive requirements, company planned to set up a separate plant for

Methylamines with a capacity of 40,000 to 50,000 tonnes per annum

under phase 2

expansion of Greenfield project (Unit IV) for which the company has already received

environmental clearances. They anticipate the commissioning of this plant by end of 2022

expansion of Greenfield project (Unit IV) for which the company has already received

environmental clearances. They anticipate the commissioning of this plant by end of 2022

12-The raw material prices for acetonitrile have gone up

13-DMC capacity will be 10,000 tonnes volume, but

it may go between 10,000 and 15,000 tonnes.

14-EBITDA should be easily sustainable around 24% to 25%. ( overall )

13-DMC capacity will be 10,000 tonnes volume, but

it may go between 10,000 and 15,000 tonnes.

14-EBITDA should be easily sustainable around 24% to 25%. ( overall )

15-Ethylamine new plant; Unit IV Greenfield with 16,500 capacity – if it goes well in full swing,

based on the current pricing basis then it should add about Rs. 300 Crores to Revenue

based on the current pricing basis then it should add about Rs. 300 Crores to Revenue

16-DMF total capacity is 30,000 tonnes . If

everything goes well, then thry can produce about 20,000 to 22,000 tonnes of DMF per annum of

DMF

17-CFL facility is totally stopped and now they are getting rent of 9lac per month

everything goes well, then thry can produce about 20,000 to 22,000 tonnes of DMF per annum of

DMF

17-CFL facility is totally stopped and now they are getting rent of 9lac per month

18-ingredient of the Covishield, Covaxin and Sputnik, all the three are having

content of EDTA, acetic acid something is there. But EDTA is produced out of

EDA which is the product of Balaji specialty . So, there may be small content going in vaccines also

content of EDTA, acetic acid something is there. But EDTA is produced out of

EDA which is the product of Balaji specialty . So, there may be small content going in vaccines also

19-. Basing on the current expansions in place, in the current

financial year revenue should be more than Rs. 1,400 Crores to 1,450 Crores, on conservative basis .

20-DMF capacity utilization should go up to

more than 60% to 70% this year

financial year revenue should be more than Rs. 1,400 Crores to 1,450 Crores, on conservative basis .

20-DMF capacity utilization should go up to

more than 60% to 70% this year

21-export was 17% to 18% of total sales.now company have target to increase it to do 30%

#Balaji amines

#Balaji amines - clientele

@threader_app compile

• • •

Missing some Tweet in this thread? You can try to

force a refresh