COVID has caused global indices to post poor YTD returns:

- FTSE 100: -26%

- Nikkei 225: -1.37%

- DAX: -12.14%

Yet one index is just crushing it:

- Japan's Mothers Index: +37%

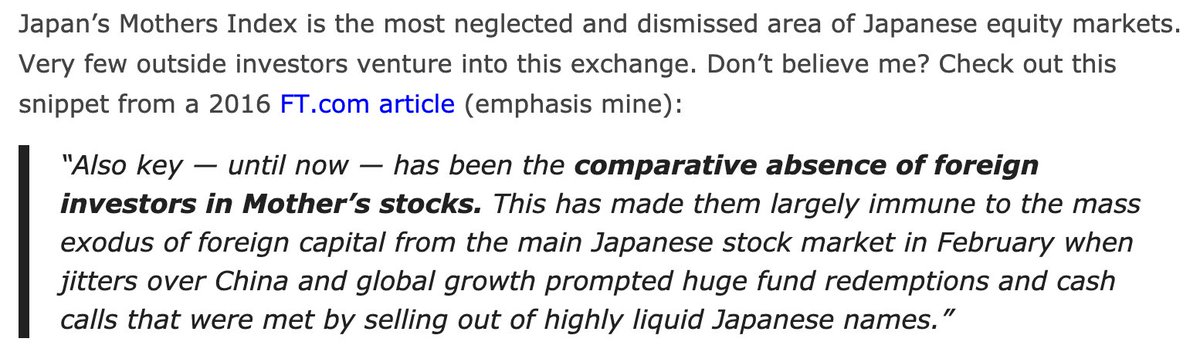

It's one of the most under-fished corners of the market.

Let's learn 👇

macro-ops.com/japans-mothers…

- FTSE 100: -26%

- Nikkei 225: -1.37%

- DAX: -12.14%

Yet one index is just crushing it:

- Japan's Mothers Index: +37%

It's one of the most under-fished corners of the market.

Let's learn 👇

macro-ops.com/japans-mothers…

1/ What is The Mothers Index (MOS)?

- The name stands for "Market of the high-growth and emerging stocks.

- It's venture capital-type companies in public markets.

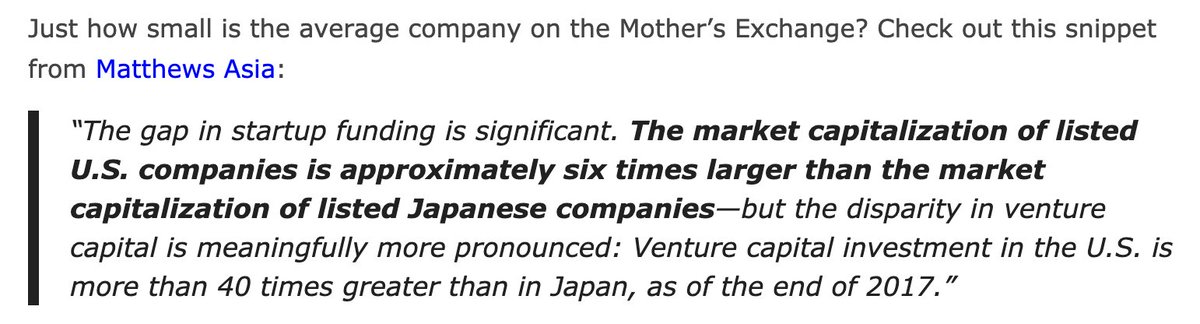

- These are SMALL biz (@iancassel enters chat) w/ average market cap of $10M USD

- Dominated by ST traders

- The name stands for "Market of the high-growth and emerging stocks.

- It's venture capital-type companies in public markets.

- These are SMALL biz (@iancassel enters chat) w/ average market cap of $10M USD

- Dominated by ST traders

2/ What You Can Buy There

What gets me excited about the MOS is the type of companies available.

Most companies on the MOS involve one of the following:

- Telemedicine

- Robotics

- Ecommerce

- Artificial Intelligence

- Teleworking

- Cloud Servicing

No wonder its up 40%!

What gets me excited about the MOS is the type of companies available.

Most companies on the MOS involve one of the following:

- Telemedicine

- Robotics

- Ecommerce

- Artificial Intelligence

- Teleworking

- Cloud Servicing

No wonder its up 40%!

3/ Management Teams Have Skin In The Game

Another thing that surprised me was the amount of insider ownership in these smaller Japanese companies.

It's normal to see 30-40% of shares owned by the founder/CEO.

In fact, most of the companies listed are run by founder-led CEOs

Another thing that surprised me was the amount of insider ownership in these smaller Japanese companies.

It's normal to see 30-40% of shares owned by the founder/CEO.

In fact, most of the companies listed are run by founder-led CEOs

4/ *Very* Little Analyst Coverage / Institution Ownshp

Thanks to $10M average market cap, many companies fly under the radar of analysts / institutions.

Here's some stats:

- 61.7% analyst coverage on TSE

- 33% coverage on MOS

What's left is short term trading (Robinhood-y)

Thanks to $10M average market cap, many companies fly under the radar of analysts / institutions.

Here's some stats:

- 61.7% analyst coverage on TSE

- 33% coverage on MOS

What's left is short term trading (Robinhood-y)

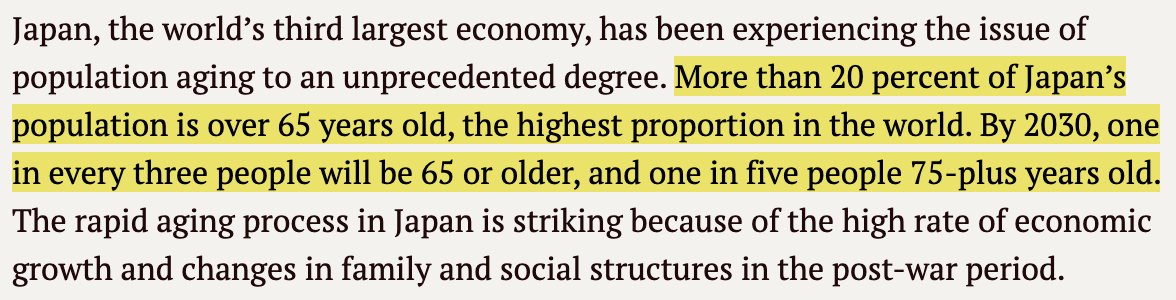

5/ That's Great, But Why Now?

Japan's population is aging ... fast.

To compete on the global stage Japan needs to innovate. They have to find a way to get more done with less people.

As such, technology will be a HUGE part of that initiative.

This = major sec. tailwinds

Japan's population is aging ... fast.

To compete on the global stage Japan needs to innovate. They have to find a way to get more done with less people.

As such, technology will be a HUGE part of that initiative.

This = major sec. tailwinds

6/ Recap of Mothers Index

Before we dive into four industries RIPE for innovation, let's review why we love the Mothers Index over the next 5-10 years:

a) Exciting industries w/ tailwinds

b) Low share count

c) Small cap

d) Founder-led w/ skin in game

e) Little analyst coverage

Before we dive into four industries RIPE for innovation, let's review why we love the Mothers Index over the next 5-10 years:

a) Exciting industries w/ tailwinds

b) Low share count

c) Small cap

d) Founder-led w/ skin in game

e) Little analyst coverage

7/ Four Industries Ripe For Disruption

Investing in companies on the MOS = going long Japanese disruption.

There's main areas we want to bet on:

- Retail

- Financial Services

- Healthcare

We'll highlight the problems, potential solutions and companies trying to do it now!

Investing in companies on the MOS = going long Japanese disruption.

There's main areas we want to bet on:

- Retail

- Financial Services

- Healthcare

We'll highlight the problems, potential solutions and companies trying to do it now!

8/ Disrupting Retail

Problems:

- Highly fragmented

- Low margins b/c zero scale

- Expanding floor space but no IT invest

- Small average transactions w/ high overhead

Solutions:

- Reduce store size

- New IT, not legacy

- Understanding cust. wants

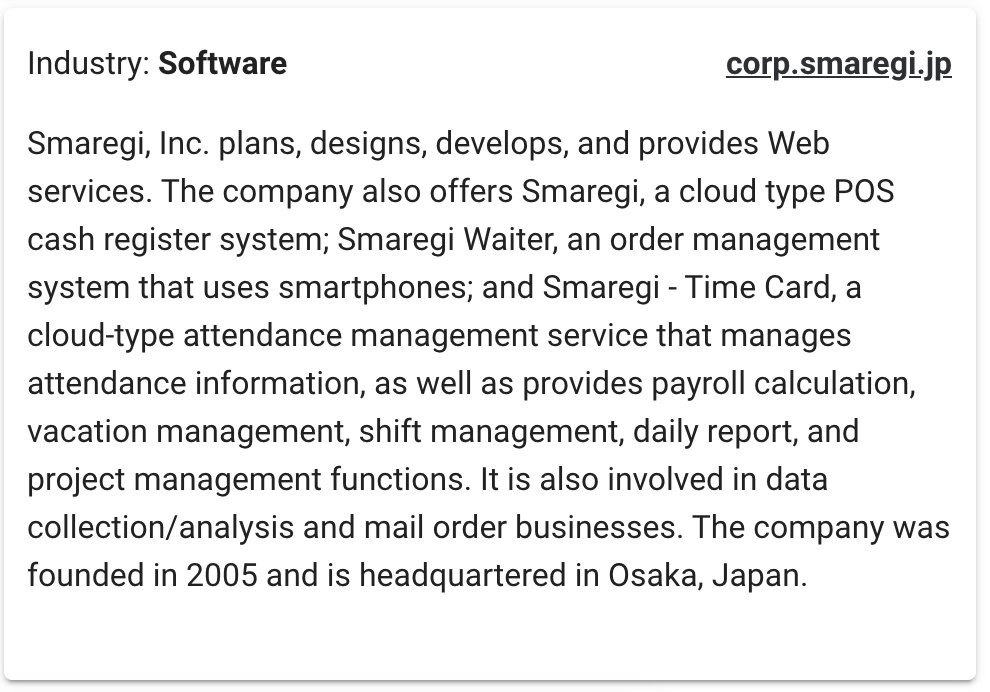

Biz Idea: Smaregi (4431)

Problems:

- Highly fragmented

- Low margins b/c zero scale

- Expanding floor space but no IT invest

- Small average transactions w/ high overhead

Solutions:

- Reduce store size

- New IT, not legacy

- Understanding cust. wants

Biz Idea: Smaregi (4431)

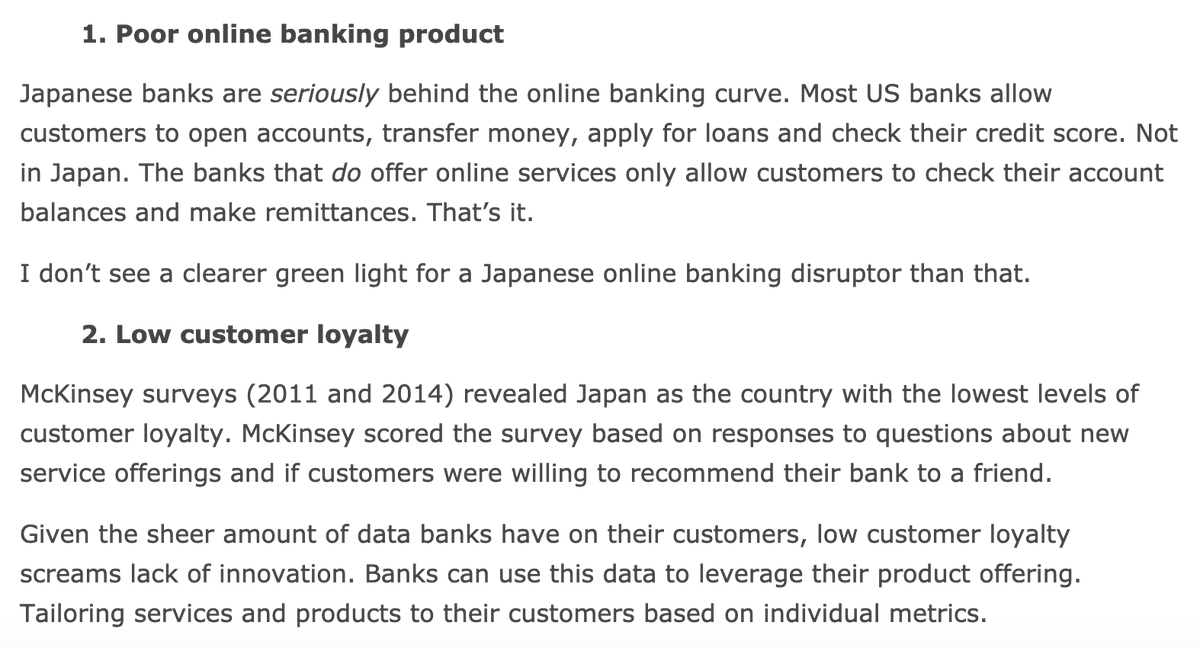

9/ Disrupting Fin. Services

Problems:

- Low customer loyalty

- Risk-averse client base

- Little online footprint

- 2012, >50% assets in cash

Solutions:

- Back-end automated software

- Develop better online banking solutions

- Better cust. analytics

Biz idea: Freee (4478)

Problems:

- Low customer loyalty

- Risk-averse client base

- Little online footprint

- 2012, >50% assets in cash

Solutions:

- Back-end automated software

- Develop better online banking solutions

- Better cust. analytics

Biz idea: Freee (4478)

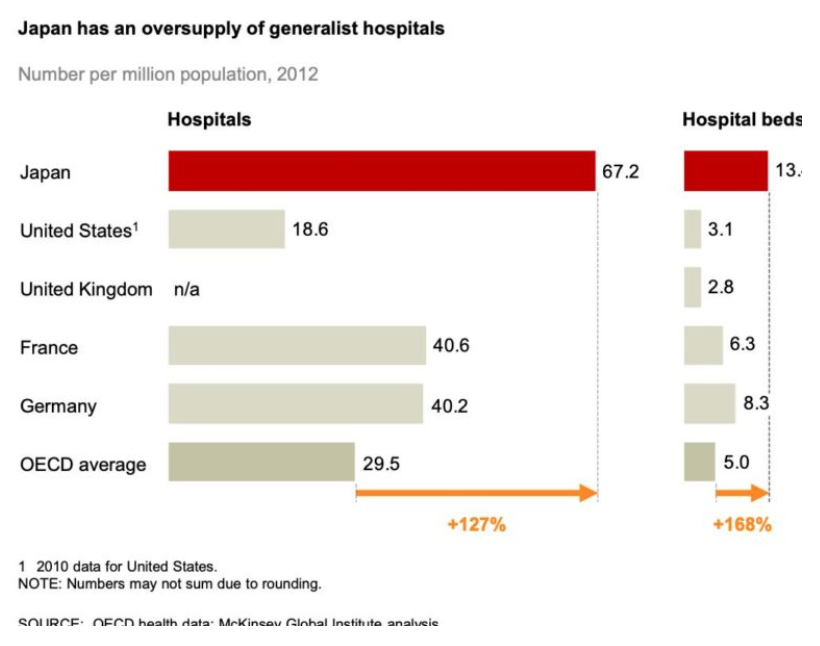

10/ Disrupting Healthcare

Problems:

- Long patient stays = economic losses

- Lack of secondary care facilities

- Avg. stay is 3x > than other countries

Solutions:

- Electronic medical records

- Connecting hospital tech

- Hospice

- PT clinics

Biz idea: Japan Hospice (7061)

Problems:

- Long patient stays = economic losses

- Lack of secondary care facilities

- Avg. stay is 3x > than other countries

Solutions:

- Electronic medical records

- Connecting hospital tech

- Hospice

- PT clinics

Biz idea: Japan Hospice (7061)

11/ Must-Follows in Japan

If any of the above sounds interesting, you *must* follow these peeps:

- @willschoebs

- @WillThrower3

- @janeo1934

- @japan_value

I was told @TheStalwart would enjoy reading this. Joe, if you're reading, thank you!

/Fin

collective.securechkout.com

If any of the above sounds interesting, you *must* follow these peeps:

- @willschoebs

- @WillThrower3

- @janeo1934

- @japan_value

I was told @TheStalwart would enjoy reading this. Joe, if you're reading, thank you!

/Fin

collective.securechkout.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh