50,000 followers. Wow.

When I started this journey in May, I never could have imagined where it would take me.

I am so grateful. I hope you have learned (and laughed!) along the way.

In honor of this milestone, here are my 5 favorite threads from the journey to date!

👇👇👇

When I started this journey in May, I never could have imagined where it would take me.

I am so grateful. I hope you have learned (and laughed!) along the way.

In honor of this milestone, here are my 5 favorite threads from the journey to date!

👇👇👇

1/ Mr. FEDerico goes to the market. The one that started it all! Special thanks go out to @Chamath and @scottmelker for the original retweets that got my Twitter account off the ground!

https://twitter.com/sahilbloom/status/1259141067938557952

2/ Cantillon Effect 101. A critically important concept to understand in the current environment.

https://twitter.com/sahilbloom/status/1309145743756865536

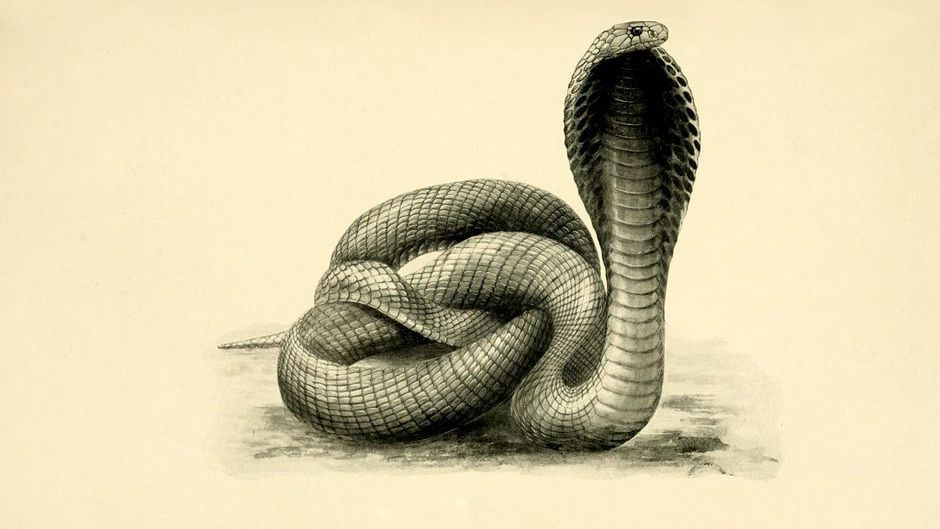

3/ Cobra Effect 101. When intervention and policy leads to unintended consequences. Policymakers beware!

https://twitter.com/SahilBloom/status/1318926201772101632

4/ Malcolm McLean’s “containerization” of the world. A fascinating story of industrial ingenuity and outside the box (literally!) thinking.

https://twitter.com/sahilbloom/status/1314586416060358657

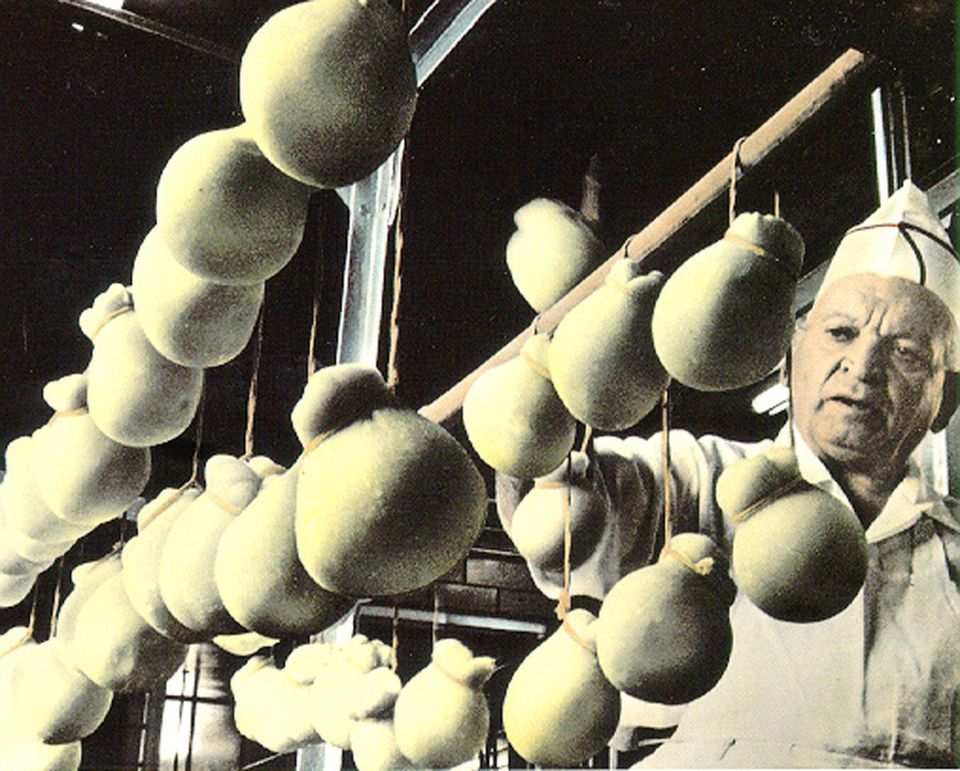

5/ The Pizza Cheese King. The fascinating story of James Leprino and how he turned a $615 investment into $3 billion.

https://twitter.com/SahilBloom/status/1320766097935593472

What were your favorites? What should I cover next? I’d love to hear from you!

If you aren’t following me already, I hope you’ll join me on this journey as I continue to demystify the world of finance, money, and economics. Check out my meta-thread below.

Much love to you all!

If you aren’t following me already, I hope you’ll join me on this journey as I continue to demystify the world of finance, money, and economics. Check out my meta-thread below.

Much love to you all!

https://twitter.com/SahilBloom/status/1284583099775324161

• • •

Missing some Tweet in this thread? You can try to

force a refresh