One entrepreneur went from selling fax machines door-to-door to running an international fashion empire.

She turned a $5,000 initial investment into a net worth of over $1 billion in the process.

Who's up for a story?

👇👇👇

She turned a $5,000 initial investment into a net worth of over $1 billion in the process.

Who's up for a story?

👇👇👇

1/ Sara Blakely was born in 1971 in Clearwater, Florida.

Attending Florida State, she studied communications and was a member of the Delta Delta Delta sorority.

She planned to follow in her father's footsteps and become a lawyer, but low LSAT scores derailed her plan.

Attending Florida State, she studied communications and was a member of the Delta Delta Delta sorority.

She planned to follow in her father's footsteps and become a lawyer, but low LSAT scores derailed her plan.

2/ After graduating, she struggled to find her calling, working at Walt Disney World in Orlando and trying her hand (unsuccessfully) at stand-up comedy.

She eventually landed a job with Danka, an office supply company, selling fax machines door-to-door.

She eventually landed a job with Danka, an office supply company, selling fax machines door-to-door.

3/ Despite a lot of early rejections (and slammed doors!), Blakely's relentless attitude eventually allowed her to break through.

By 25, she had risen to the rank of national sales trainer.

This might have been enough for most people.

But Sara Blakely had bigger plans...

By 25, she had risen to the rank of national sales trainer.

This might have been enough for most people.

But Sara Blakely had bigger plans...

4/ In her time in sales, she had grown frustrated with the traditional pantyhose she was forced to wear in the muggy Florida heat.

Their appearance, feel, and fit were all lacking.

She had identified a problem, so like most great entrepreneurs, she set out to devise a solution.

Their appearance, feel, and fit were all lacking.

She had identified a problem, so like most great entrepreneurs, she set out to devise a solution.

5/ In her first "prototype," Blakely simply cut the feet off her pantyhose, but was unsatisfied with the way they rolled up her legs underneath her slacks.

While maintaining her 9-to-5 at Danka, she took her $5,000 savings and began researching and iterating on the product.

While maintaining her 9-to-5 at Danka, she took her $5,000 savings and began researching and iterating on the product.

6/ Once she had finalized the design , she turned to its production.

Countless rejections followed, as she was told no by every hosiery mill she contacted.

But yet again, Blakely's relentless attitude won the day. A factory in North Carolina had finally agreed to take her on.

Countless rejections followed, as she was told no by every hosiery mill she contacted.

But yet again, Blakely's relentless attitude won the day. A factory in North Carolina had finally agreed to take her on.

7/ Doing everything on a tight budget, she wrote her own patent and did all of her own branding and imagery.

With a product, brand, and supplier in place, her next step was to find distribution.

In the days before e-commerce had really taken off, this was easier said than done.

With a product, brand, and supplier in place, her next step was to find distribution.

In the days before e-commerce had really taken off, this was easier said than done.

8/ But after successfully pitching Neiman Marcus on her new creation, it was clear Blakely was on to something.

She quickly lined up Bloomingdale's, Saks Fifth Avenue, and Bergdorf Goodman as customers.

After countless hours of hard work, Spanx was officially in business.

She quickly lined up Bloomingdale's, Saks Fifth Avenue, and Bergdorf Goodman as customers.

After countless hours of hard work, Spanx was officially in business.

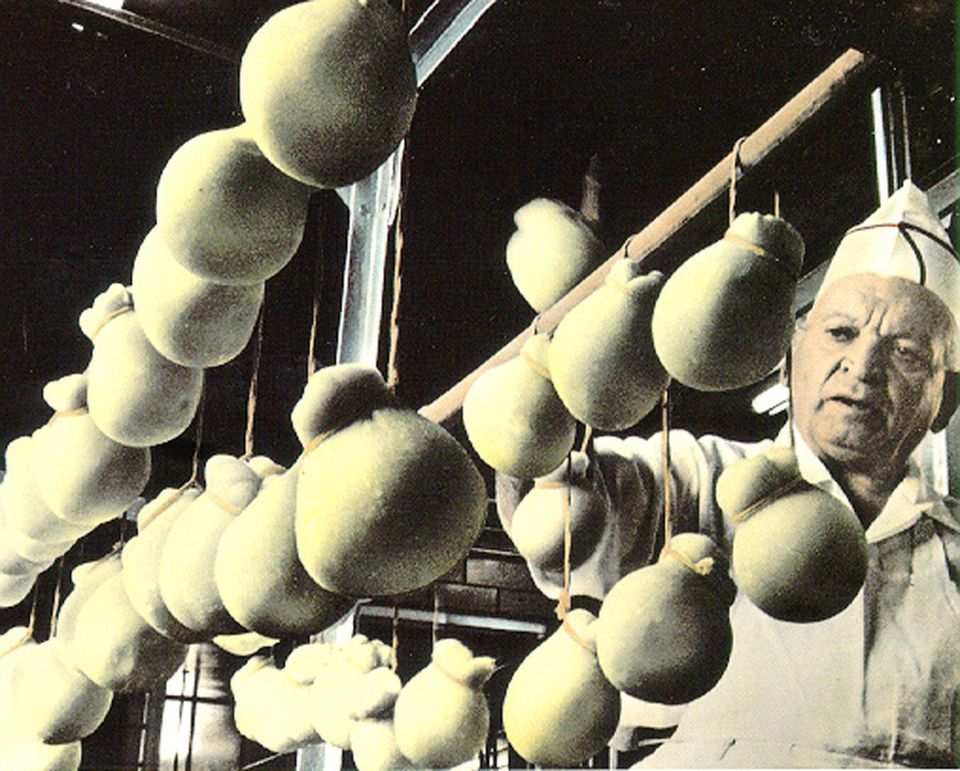

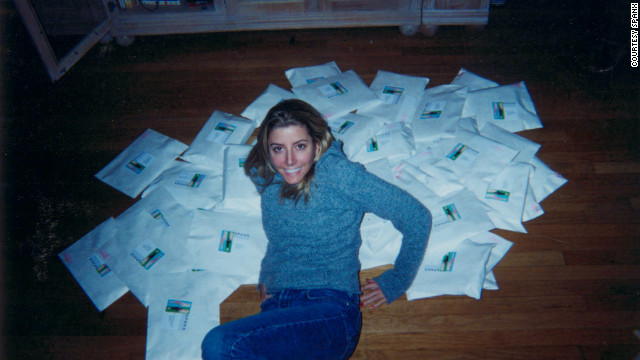

9/ Sales slowly ramped up, with Blakely personally covering everything from shipping to marketing to customer service, all while maintaining her day job at Danka.

Spanx did ~$4 million in revenue in 1999 and was profitable.

But in 2000, Spanx had its first big break.

Spanx did ~$4 million in revenue in 1999 and was profitable.

But in 2000, Spanx had its first big break.

10/ This came when @Oprah named Spanx as her favorite product of the year.

It was a classic bit of engineered serendipity. Blakely had shot her shot, sending samples to Oprah's trusted stylist, Andre Walker.

From this point forward, it was off to the races for the young brand.

It was a classic bit of engineered serendipity. Blakely had shot her shot, sending samples to Oprah's trusted stylist, Andre Walker.

From this point forward, it was off to the races for the young brand.

11/ Blakely quit her day job just weeks before Oprah's show aired, taking the time to create a website in preparation for the surge.

Spanx did ~$10 million in revenue in 2000, but this was just the beginning.

Within just a few years, it was doing many multiples of that number.

Spanx did ~$10 million in revenue in 2000, but this was just the beginning.

Within just a few years, it was doing many multiples of that number.

12/ Blakely's star rose alongside Spanx's sales.

She went on @RichardBranson's Rebel Billionaire reality show, where her force of will was on full display. She didn't win, but Branson wrote her a $750K check to start a foundation.

All the while, Spanx continued to thrive.

She went on @RichardBranson's Rebel Billionaire reality show, where her force of will was on full display. She didn't win, but Branson wrote her a $750K check to start a foundation.

All the while, Spanx continued to thrive.

13/ By 2012, Spanx had grown to ~$250M of sales and was highly profitable.

Several investment banks valued the business at over $1 billion.

According to @Forbes, with her ~100% ownership stake, Sara Blakely officially became the youngest self-made female billionaire.

Several investment banks valued the business at over $1 billion.

According to @Forbes, with her ~100% ownership stake, Sara Blakely officially became the youngest self-made female billionaire.

14/ Spanx has continued to thrive as a large and profitable business.

Sara Blakely and her husband, entrepreneur @JesseItzler, have remained deeply committed to philanthropy, giving to a variety of causes.

In 2020, Blakely pledged $5 million to female-run small businesses.

Sara Blakely and her husband, entrepreneur @JesseItzler, have remained deeply committed to philanthropy, giving to a variety of causes.

In 2020, Blakely pledged $5 million to female-run small businesses.

15/ The story of Sara Blakely and Spanx is an inspiring one. She identified a problem, developed a solution, and pursued it relentlessly.

Special thank you to @Clare_OC, whose incredible piece in @Forbes was the basis for this thread. Check it out below! forbes.com/global/2012/03…

Special thank you to @Clare_OC, whose incredible piece in @Forbes was the basis for this thread. Check it out below! forbes.com/global/2012/03…

16/ For more on her story, I also highly recommend the @NPR @HowIBuiltThis podcast with Sara Blakely, hosted by @guyraz, which you can find at the link below! podcasts.apple.com/us/podcast/spa…

17/ And for more educational threads on business, finance, money, and economics, check out my meta-thread below!

https://twitter.com/SahilBloom/status/1284583099775324161

• • •

Missing some Tweet in this thread? You can try to

force a refresh