1/ Real estate chit chat.

Got off a phone call with a multifamily GP from Southeast USA today.

Great guy, with a solid track record, who I been following for a long time via his email subscriptions due to his honesty & integrity (very rare).

(Thread)

Got off a phone call with a multifamily GP from Southeast USA today.

Great guy, with a solid track record, who I been following for a long time via his email subscriptions due to his honesty & integrity (very rare).

(Thread)

2/ We got into a conversation regarding several things, but three stood out. Here they are:

• the amount of capital sloshing around the US

• fraud & scams multifamily GPs are running across the country

• incredible rate of return we are receiving in the UK

Notes below.

• the amount of capital sloshing around the US

• fraud & scams multifamily GPs are running across the country

• incredible rate of return we are receiving in the UK

Notes below.

3/ The gentleman launched a multifamily 134 unit deal in Georgia (US) on Thursday with a $6.7 million raise & 48 hours later it is 85% subscribed. By Monday it will be done & dusted.

Sure, there is some repeat business there since he has a fantastic track record, but still...

Sure, there is some repeat business there since he has a fantastic track record, but still...

4/ ...the amount of hot money out there chasing too few good deals is incredible — especially considering how hard it is to find an honest, fair GPs who has actually been around to tell you about the last crisis, too.

We are basically living in an artificial sea of liquidity...

We are basically living in an artificial sea of liquidity...

5/ ...and how & when this monetary experiment ends is anyone guess, but when it does (as always) there will be some serious pain.

Unless, of course, we are all turning Japanese (as the famous song goes) which basically means 0% interest rates for the next two decades. 😂

Unless, of course, we are all turning Japanese (as the famous song goes) which basically means 0% interest rates for the next two decades. 😂

6/ Conversation turned towards fraud and scams, including rumors of some high profile GPs in the multifamily space. Here are some takeaways...

Properties are purchased off-market with funds capital. Later, the same property is marked up by 5%-7% higher before the raise...

Properties are purchased off-market with funds capital. Later, the same property is marked up by 5%-7% higher before the raise...

7/ ...with LPs starts, where the GP will pocket the difference. Unbelievable stuff!

Furthermore, a lot of noise about how value add deals are done where CAPEX money goes missing & into GPs pockets.

Basically, agency debt is borrowed just for the property purchase, because...

Furthermore, a lot of noise about how value add deals are done where CAPEX money goes missing & into GPs pockets.

Basically, agency debt is borrowed just for the property purchase, because...

8/ ...a GP borrowing agency debt for purchase + capex will have to clearly show real invoices of how capital is spent.

Instead, what happens is the GP raises the capex capital on the side, promising a very intense renovation of 2-3 million while only 30-50% is actually spent.

Instead, what happens is the GP raises the capex capital on the side, promising a very intense renovation of 2-3 million while only 30-50% is actually spent.

9/ That way, no one needs to prove anything to anyone. No invoices are seen & most LPs don't even bother doing the due diligence on these things.

As the old saying goes "where ever there is smoke, there is fire" as be very very careful who you trust & verify/check all the time.

As the old saying goes "where ever there is smoke, there is fire" as be very very careful who you trust & verify/check all the time.

10/ Finally, we talked about our allocations in UK & EU via bridging finance or mezzanine loans we often do.

The gentleman told me in the US mezz finance is going from 7% to 10% for value add & up to 12% for opportunistic / development.

I shared with him a recent deal we...

The gentleman told me in the US mezz finance is going from 7% to 10% for value add & up to 12% for opportunistic / development.

I shared with him a recent deal we...

11/ ...invested in & his mind was BLOWN away!

His comments: "You guys are pulling off returns that are far higher than us equity guys are doing (20% pa), but you're managing to do it with LTV in line with senior debt (71% LTV). Unbelievable."

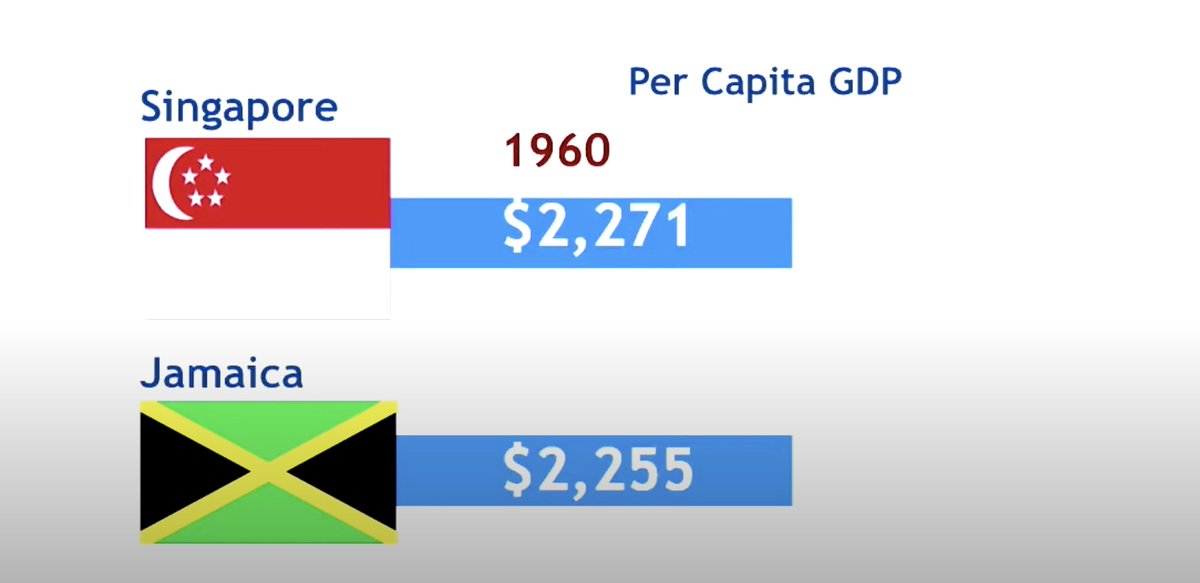

Screenshot from the pitch-deck.

His comments: "You guys are pulling off returns that are far higher than us equity guys are doing (20% pa), but you're managing to do it with LTV in line with senior debt (71% LTV). Unbelievable."

Screenshot from the pitch-deck.

12/ It just goes to show, if you're an investor and you want your capital to do the heavy lifting, while mitigating risk, run away from the competition & go where others aren't looking.

The competition reduces current rates of return & suppressed future expected returns, too.

The competition reduces current rates of return & suppressed future expected returns, too.

• • •

Missing some Tweet in this thread? You can try to

force a refresh