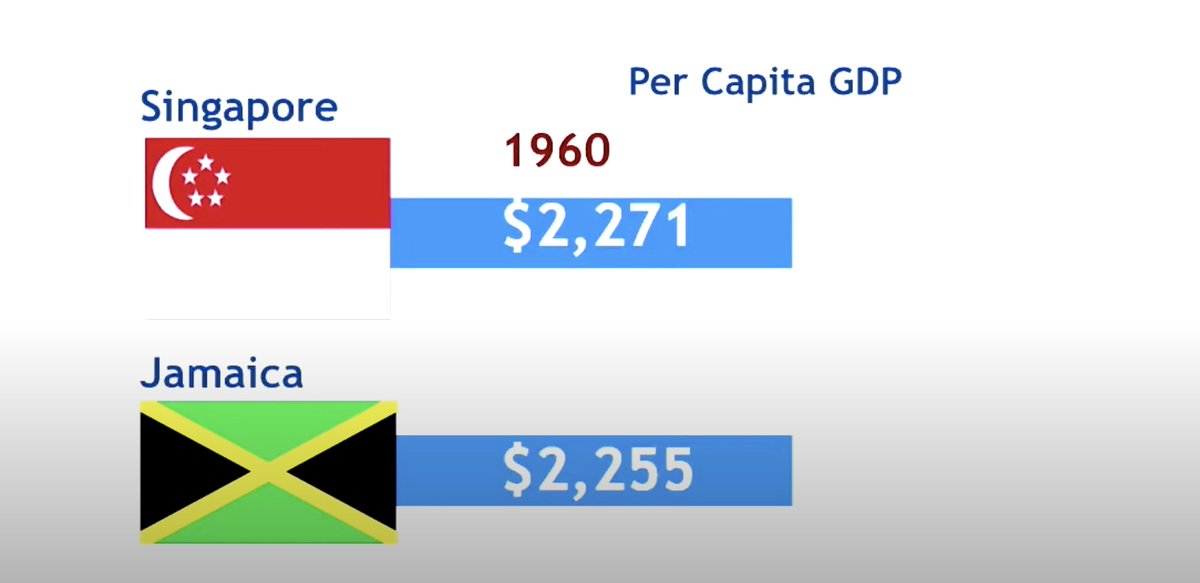

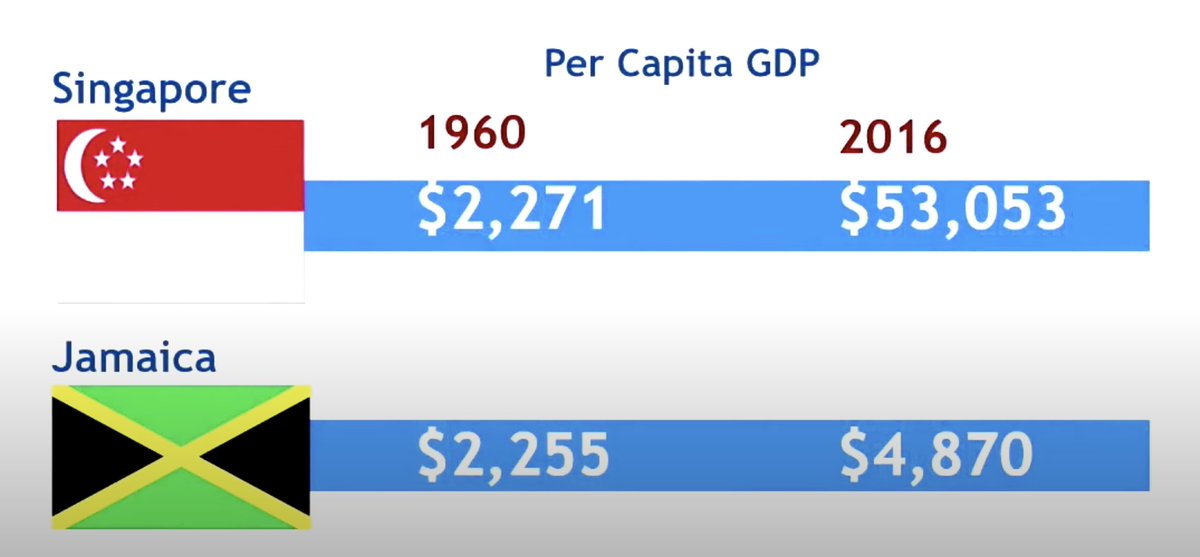

1/ In 1960, both Jamacia and Singapore separated from the great British Empire.

Both island nations, both started with similar GDP, using common law & English as a primary language of business.

Both island nations, both started with similar GDP, using common law & English as a primary language of business.

2/ At the time, Singapore was a mosquito-ridden swamp, complete under-developed, and where the heroin trade was the most dynamic (black) part of the economy.

3/ However, due to incredible foresight and vision are by one of the greatest leaders to ever live in the 20th century — Lee Kuan Yew — Singapore became one of the greatest, if not the greatest country in the world today.

4/ According to various metrics by the UN, OECD, World Bank, and many others, Singapore ranks as one of the top jurisdictions in the world in:

• GDP per capita

• health care

• eduction

• ease of doing business

• low corruption

• infrastructure

• green/clean energy

• etc

• GDP per capita

• health care

• eduction

• ease of doing business

• low corruption

• infrastructure

• green/clean energy

• etc

5/ The success of this country comes down to a fantastic set of ideas, built on strength in leadership that many countries — even some of the biggest & strongest in the world — are clearly lacking today. As the timeless saying goes:

"...strong leaders create good times"

"...strong leaders create good times"

6/ Ohhh...

By the way, if you're wondering how the story ends?

No spoiler alerts here.

Singapore obviously became one of the greatest success stories in the post-World War 2 era.

#leadership

By the way, if you're wondering how the story ends?

No spoiler alerts here.

Singapore obviously became one of the greatest success stories in the post-World War 2 era.

#leadership

• • •

Missing some Tweet in this thread? You can try to

force a refresh