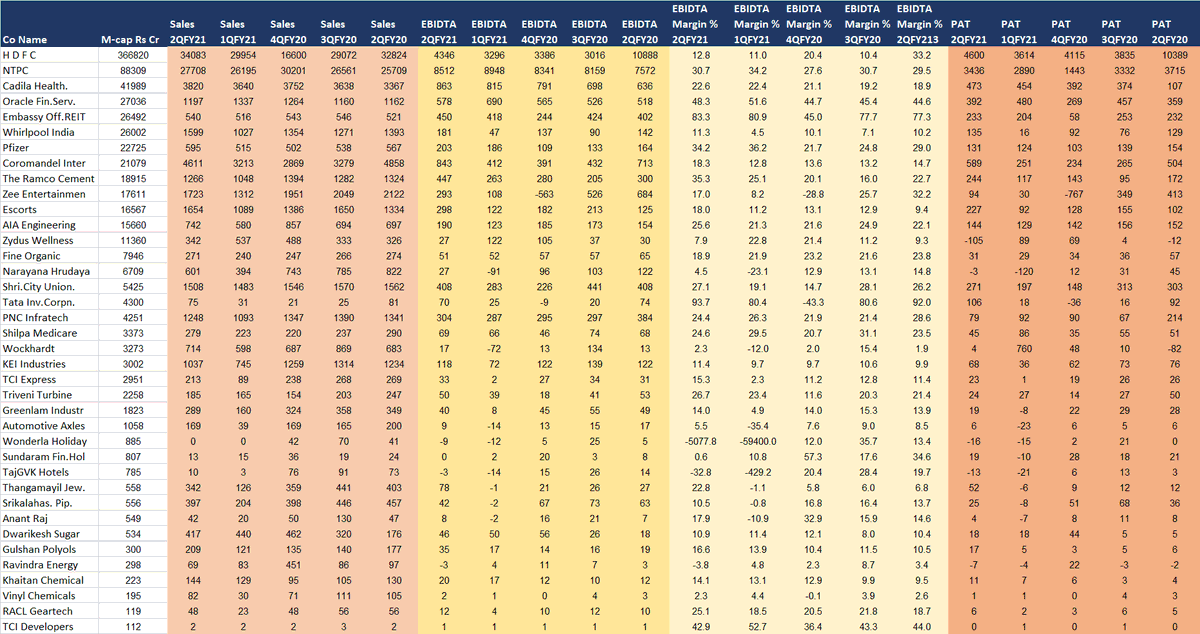

Results declared on 2nd Nov #excelgiri #resultsxray

PS: Use ur own wisdom, view on results can vary person to person. I am still learning

PS: Use ur own wisdom, view on results can vary person to person. I am still learning

Strong results

Ramco Cement

Ebidta/ tonne near 2000

Sales down 4.4% yoy, Ebidta up 49% yoy, Pat up 42% yoy

Volume miss; realisations spiked 17% YoY (a major surprise)

Jefferies: raise FY21 EPS by 60%, retain Rs1,000 PT

TTM PE at 35, 12% roce

Ramco Cement

Ebidta/ tonne near 2000

Sales down 4.4% yoy, Ebidta up 49% yoy, Pat up 42% yoy

Volume miss; realisations spiked 17% YoY (a major surprise)

Jefferies: raise FY21 EPS by 60%, retain Rs1,000 PT

TTM PE at 35, 12% roce

Strong results with reasonable valuations

Coromandel Int

Sales down 5% yoy but up 43% qoq

Ebidta up 18% yoy, up 104% qoq

Pat up 17% yoy, up 135% qoq

TTM PE at 16x, 25% roce

Coromandel Int

Sales down 5% yoy but up 43% qoq

Ebidta up 18% yoy, up 104% qoq

Pat up 17% yoy, up 135% qoq

TTM PE at 16x, 25% roce

Strong results with reasonable valuations

AIA Eng

M-cap 15660 cr

Sales up 6.6%, ebidta up 24%, pat down 5%

25x ttm pe, 4 p/b, 20% roce

AIA Eng

M-cap 15660 cr

Sales up 6.6%, ebidta up 24%, pat down 5%

25x ttm pe, 4 p/b, 20% roce

Strong results + expensive valuations

Whirlpool India

Sales up 15% yoy, Ebidta up 28% yoy, Pat up 5% yoy

Gross margin dipped by -400bps to 37.9% whereas, many Electrical / Appliance players expanded GM in Q2

TTM PE at 81, 26% roce

Whirlpool India

Sales up 15% yoy, Ebidta up 28% yoy, Pat up 5% yoy

Gross margin dipped by -400bps to 37.9% whereas, many Electrical / Appliance players expanded GM in Q2

TTM PE at 81, 26% roce

Weak results + reasonable valuations

Oracle Financial

M-cap 27000 cr

Sales down 10.5%, ebidta down 16%, PAT down 18% QoQ

17x ttm pe, 4x p/b

Oracle Financial

M-cap 27000 cr

Sales down 10.5%, ebidta down 16%, PAT down 18% QoQ

17x ttm pe, 4x p/b

Weak results + reasonable valuations

KEI Industries

M-cap 3000 cr

Sales down 16%, ebidta down 3%, PAT down 10% YoY

12x ttm pe, 2 ttm pb, 28% roce

Debtor days up 23% YoY; watch for normalisation by 4Q

Jefferies: EBITDA was 48% above expectations

KEI Industries

M-cap 3000 cr

Sales down 16%, ebidta down 3%, PAT down 10% YoY

12x ttm pe, 2 ttm pb, 28% roce

Debtor days up 23% YoY; watch for normalisation by 4Q

Jefferies: EBITDA was 48% above expectations

Weak results + expensive valuations

Fine Organics; trade at 10x sales

M-cap 8000 cr

Sales down 1%, Ebidta down 21%, Pat down 45% yoy

TTM PE at 51, 32% roce

Fine Organics; trade at 10x sales

M-cap 8000 cr

Sales down 1%, Ebidta down 21%, Pat down 45% yoy

TTM PE at 51, 32% roce

Weak results + expensive valuations

Zydus Wellness

M-cap 11360 cr

Sales up 5%, ebidta down 11%, net loss at 105 cr

70 ttm pe, 6% roce

Zydus Wellness

M-cap 11360 cr

Sales up 5%, ebidta down 11%, net loss at 105 cr

70 ttm pe, 6% roce

Weak results + expensive valuations

Narayana Hrudaya

Sales down 27%, ebidta down 78%, net loss at 3 cr vs loss of 120 cr qoq

70 ttm pe, 6 ttm pb, 6% roce

Narayana Hrudaya

Sales down 27%, ebidta down 78%, net loss at 3 cr vs loss of 120 cr qoq

70 ttm pe, 6 ttm pb, 6% roce

Weak results + expensive valuations

TCI Express

M-cap 2951 cr

Sales down 21%, PAT down 10%

TTM PE 42x, PB 8x, 38% roce

TCI Express

M-cap 2951 cr

Sales down 21%, PAT down 10%

TTM PE 42x, PB 8x, 38% roce

Weak results + expensive valuations

Pfizer

M-cap 22735 cr

Sales up 5%, PAT down 15%

TTM PE 45x, PB 6.7x, 12x sales

Pfizer

M-cap 22735 cr

Sales up 5%, PAT down 15%

TTM PE 45x, PB 6.7x, 12x sales

Small-cap surprises – any?

Dwarikesh Sugar M-cap 534 cr

Sales up 137%, ebidta up 149%, pat up 275%

Ttm pe 7x, pb 1x, roce 8%

Gulshan Polyols M-cap 300 cr

Sales up 18%, ebidta up 87%, pat up 200%

Ttm pe 16x, pb 1x, roce 9%

Dwarikesh Sugar M-cap 534 cr

Sales up 137%, ebidta up 149%, pat up 275%

Ttm pe 7x, pb 1x, roce 8%

Gulshan Polyols M-cap 300 cr

Sales up 18%, ebidta up 87%, pat up 200%

Ttm pe 16x, pb 1x, roce 9%

Small-cap surprises – any?

Khaitan Chemical M-cap 223 cr

Sales up 11%, ebidta up 64%, pat up 195%

Ttm pe 11x, pb 1.5x, roce 14%

Khaitan Chemical M-cap 223 cr

Sales up 11%, ebidta up 64%, pat up 195%

Ttm pe 11x, pb 1.5x, roce 14%

• • •

Missing some Tweet in this thread? You can try to

force a refresh