Why did I invest in $SDGR? (Thread)

Business model:

1⃣Software: 1,300+ customers - enables rapid discovery of new molecules for drug development & materials

2⃣Drug discover: >25 collab programs AND a wholly-owned pipeline

3⃣Equity in other biz

Business model:

1⃣Software: 1,300+ customers - enables rapid discovery of new molecules for drug development & materials

2⃣Drug discover: >25 collab programs AND a wholly-owned pipeline

3⃣Equity in other biz

1⃣Software biz:

Use software to create new compounds

237 BILLION compounds explored in software in 1h 2020

Uses AI to drive faster, cheaper, higher quality molecules/drugs

35% rev growth in 1h 2020

82% gross margin

Top 20 pharma cos use software, average of 15 years

Use software to create new compounds

237 BILLION compounds explored in software in 1h 2020

Uses AI to drive faster, cheaper, higher quality molecules/drugs

35% rev growth in 1h 2020

82% gross margin

Top 20 pharma cos use software, average of 15 years

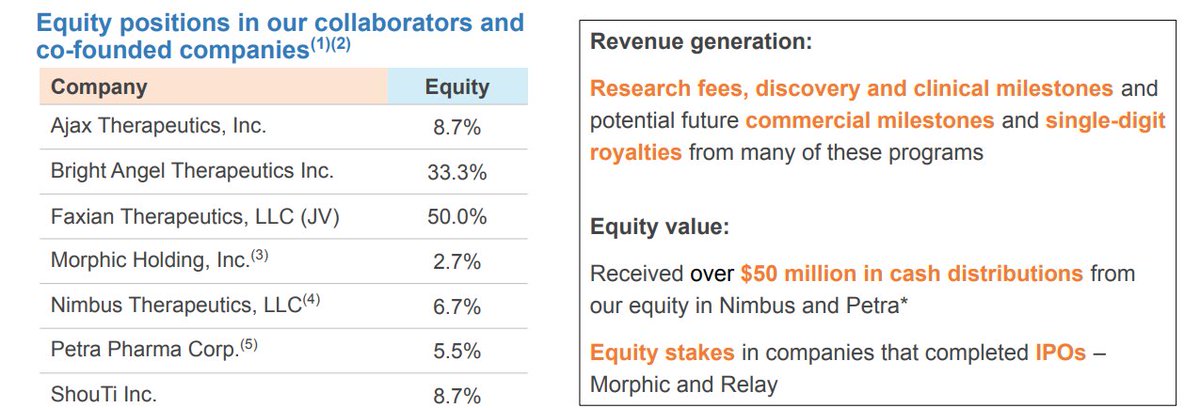

3⃣History of success w/ equity

Co-founded Nimbus in 2009

Spun off, yet retained equity

In 2016, Nimbus sold a drug to Gilead Sciences for $1.2 billion

Co-founded Nimbus in 2009

Spun off, yet retained equity

In 2016, Nimbus sold a drug to Gilead Sciences for $1.2 billion

Financial:

Software profits fund R&D programs

Net loss only $17 MM 1H 2020, mostly due to huge growth in R&D spending

FCF -$16 MM in 1H 2020

~$631 MM in cash -- TONS of liquidity

Software profits fund R&D programs

Net loss only $17 MM 1H 2020, mostly due to huge growth in R&D spending

FCF -$16 MM in 1H 2020

~$631 MM in cash -- TONS of liquidity

Valuation:

Winner since IPO (+70%)

But down ~50% from July high

Valuation still high (39x sales), but high-quality companies deserve premiums

Winner since IPO (+70%)

But down ~50% from July high

Valuation still high (39x sales), but high-quality companies deserve premiums

Risks:

Valuation still too high

Pipeline falls apart

Software growth slows to a crawl

Valuation still too high

Pipeline falls apart

Software growth slows to a crawl

I like the one-two-three punch here

Software biz is a high-quality asset that should continue to grow and pump out profits

Drug discovery & equity business provides TONS of optionality

Going to be a bumpy ride, but I bet this stock is higher in 2030 than it is today

Software biz is a high-quality asset that should continue to grow and pump out profits

Drug discovery & equity business provides TONS of optionality

Going to be a bumpy ride, but I bet this stock is higher in 2030 than it is today

Score on my checklist:

Financials: 8/17

Moat: 20/20

Potential: 17/18

Customers: 7/10

Revenue: 8/10

Mgmt/Culture: 10/14

Stock: 3/11

Gauntlet: 0

Total Score: 73 (investable)

85 possible in time

Financials: 8/17

Moat: 20/20

Potential: 17/18

Customers: 7/10

Revenue: 8/10

Mgmt/Culture: 10/14

Stock: 3/11

Gauntlet: 0

Total Score: 73 (investable)

85 possible in time

Recent presentation: ir.schrodinger.com/static-files/a…

• • •

Missing some Tweet in this thread? You can try to

force a refresh