[THREAD]

I loved @ARKInvest 2020 Bad Ideas Report.

Great way to red-team conventional "value-based" ideas.

Here's the 5 Bad Ideas:

1. Physical Banks

2. Brick & Mortar Retail

3. Linear TV

4. Freight Rail

5. Traditional Transport

source: bit.ly/3l0FXQw

Let's learn

I loved @ARKInvest 2020 Bad Ideas Report.

Great way to red-team conventional "value-based" ideas.

Here's the 5 Bad Ideas:

1. Physical Banks

2. Brick & Mortar Retail

3. Linear TV

4. Freight Rail

5. Traditional Transport

source: bit.ly/3l0FXQw

Let's learn

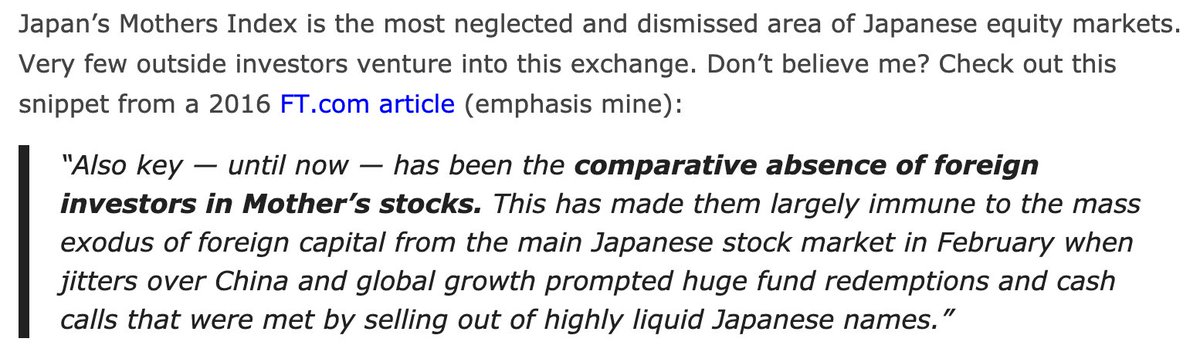

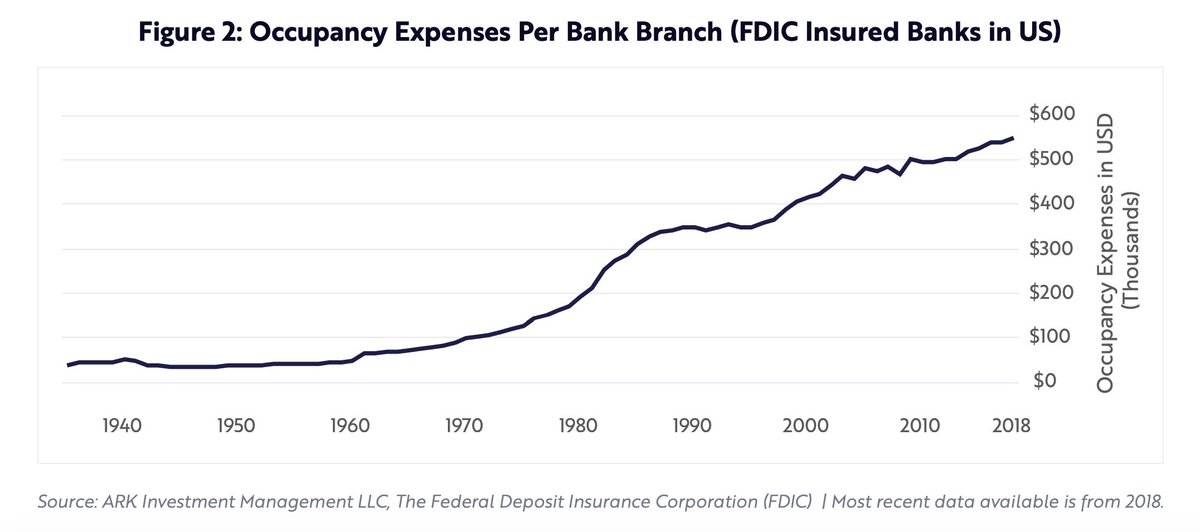

1/ Physical Banks

Why it's bad: "The cost burden that branches place on traditional banks is increasing while their utility is decreasing."

What's better: "In contrast, digital wallets are acquiring millions of customers at a cost 98% lower than that for banks"

Why it's bad: "The cost burden that branches place on traditional banks is increasing while their utility is decreasing."

What's better: "In contrast, digital wallets are acquiring millions of customers at a cost 98% lower than that for banks"

2/ Brick & Mortar Retail

Why it's bad: "If square feet were to stabilize at current levels, brick and mortar retail sales would continue

to fall as e-commerce takes share. Roughly

$1 trillion worth of real estate would have to be repurposed by 2025."

What's better: E-commerce

Why it's bad: "If square feet were to stabilize at current levels, brick and mortar retail sales would continue

to fall as e-commerce takes share. Roughly

$1 trillion worth of real estate would have to be repurposed by 2025."

What's better: E-commerce

3/ Linear TV

Why it's bad: "We believe the better economic value and user experiences have paid off, so much so that linear TV providers are suffering from cord cutting at an accelerated rate."

What's better: Streaming services / streaming bundles

Why it's bad: "We believe the better economic value and user experiences have paid off, so much so that linear TV providers are suffering from cord cutting at an accelerated rate."

What's better: Streaming services / streaming bundles

4/ Freight Rail

Why it's bad: "the commercialization of autonomous

electric trucks will reverse both share and pricing dynamics, putting freight rail providers at risk."

What's better: Autonomous & Electric Vehicles taking share of rail infrastructure

Why it's bad: "the commercialization of autonomous

electric trucks will reverse both share and pricing dynamics, putting freight rail providers at risk."

What's better: Autonomous & Electric Vehicles taking share of rail infrastructure

5/ Traditional Transport

Why it's bad: "If robo-taxis become the dominant form of urban transit, ARK expects US auto sales to drop from 17 million units today to roughly 10 million by the end of the decade."

What's Better: Robotaxis / Autonomous Drivers

Why it's bad: "If robo-taxis become the dominant form of urban transit, ARK expects US auto sales to drop from 17 million units today to roughly 10 million by the end of the decade."

What's Better: Robotaxis / Autonomous Drivers

6/ Fin

Great insights as usual from @ARKInvest. Also shout-out to @TashaARK for writing most of this report.

I know ARK gets dunked on by a lot of "value" bros on FinTwit. But they do great work and offer interesting investment ideas/thematics.

Thanks for reading!

Great insights as usual from @ARKInvest. Also shout-out to @TashaARK for writing most of this report.

I know ARK gets dunked on by a lot of "value" bros on FinTwit. But they do great work and offer interesting investment ideas/thematics.

Thanks for reading!

• • •

Missing some Tweet in this thread? You can try to

force a refresh