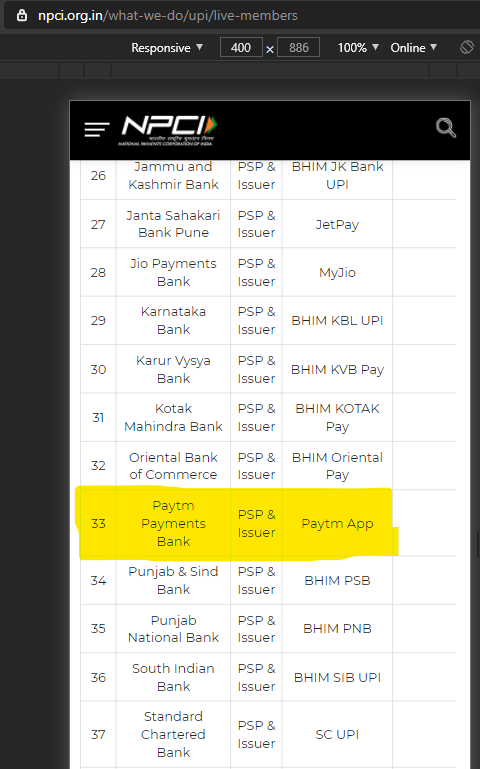

What business media covering payments will never tell you about - Is @PayTM - a third party app or not.

Why is this important ? - Because I see, @PayTM being the biggest beneficiary of the recent @NPCI_NPCI circular on #UPI cap

Why is this important ? - Because I see, @PayTM being the biggest beneficiary of the recent @NPCI_NPCI circular on #UPI cap

https://twitter.com/logic/status/1324537279998685184

According to @RBI webiste, @PayTM transferred its wallet operations from One 97 Communications Limited to @PaytmBank

According to @GooglePlay though, the wallet app is still delivered by One 97 Communications Ltd.

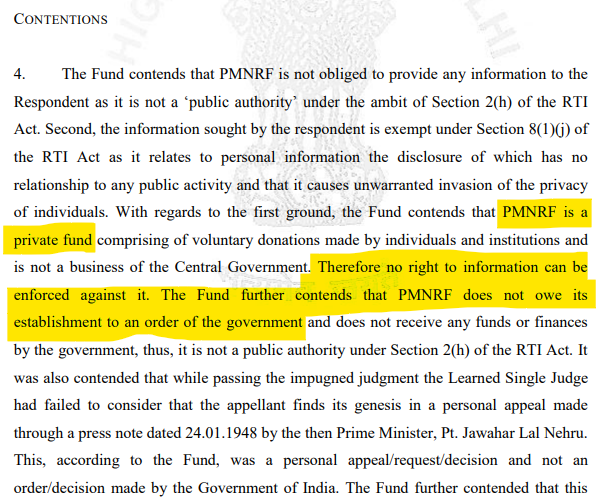

If an app run by a different entity, other than a bank uses a payments bank license to gain access to #UPI ecosystem, does it not qualify as a TPAP ? Why is @NPCI_NPCI @RBI silent on this ?

Could it be because @Paytm has some high profile advisors ?

As being one of the largest players, PayTM is bound to gain by TPAP market share caps (which per NPCI as on date, won't seem to apply to them).

This is gross ommission / discretionary rule making.

This is gross ommission / discretionary rule making.

• • •

Missing some Tweet in this thread? You can try to

force a refresh