Moved to @logic@freeradical.zone.

Pseudogeek | Free(dom) code, தமிழ், #CashlessConsumer, #DigitalPayments, #opendata fanboy, #publictransit #IthuUngalSoththu

3 subscribers

How to get URL link on X (Twitter) App

A. Support #ChennaiCityPartnership

A. Support #ChennaiCityPartnership

https://twitter.com/kamyachandra/status/1670692594580586496Both #PAN and #Aadhaar are tired of the billion transformations since 2017 and the only people who gave made money is KYC startups (not even fintechs)

https://twitter.com/kamyachandra/status/1670693879971205120

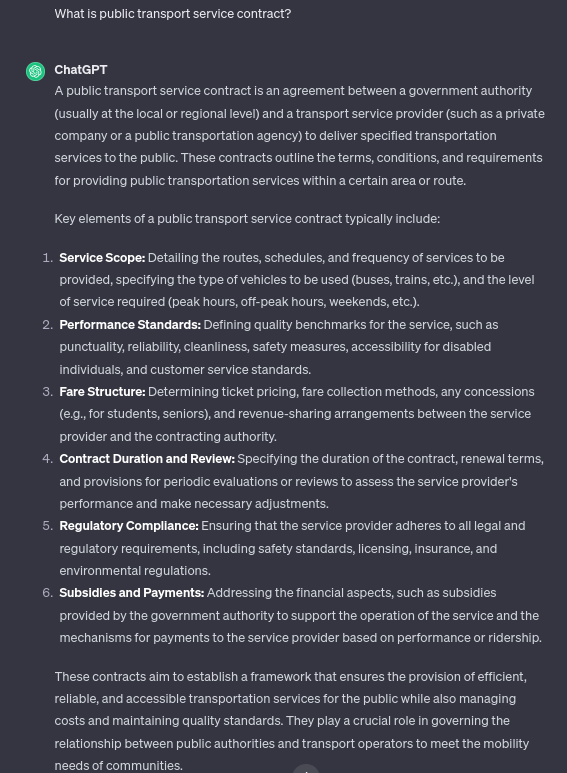

https://twitter.com/Jikkuvarghese/status/16680809339694981121. What happened? What data points are exposed?

https://twitter.com/AbhiChtrj/status/16404018131020308491. What is being announced?

https://twitter.com/angryyoungman55/status/1556878595158863872$ 3.9 M - That is how much was 'donated' by GAVI to UNDP for hosting #CoWIN system. Don't be a fool to think that data hasn't gone back to funders.

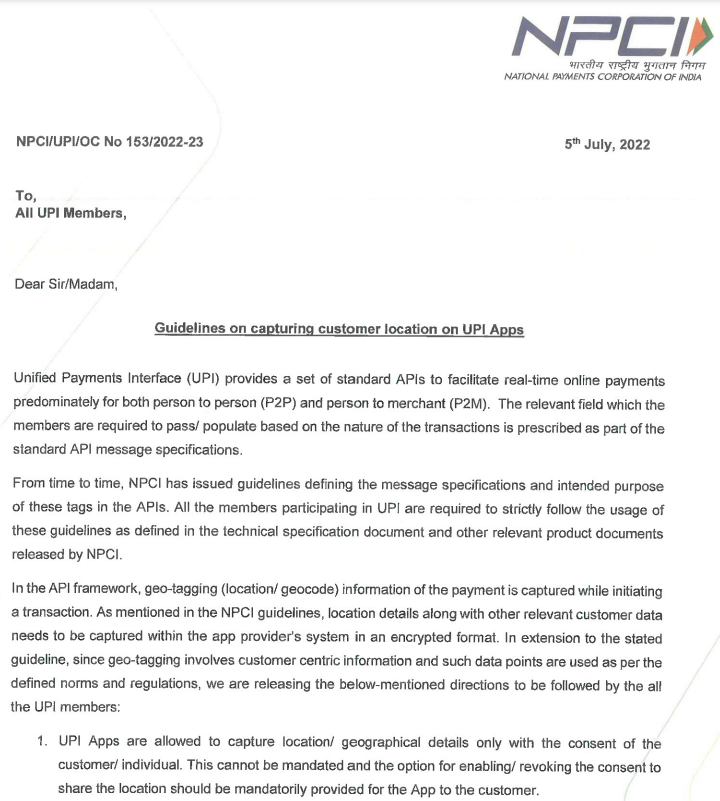

#CashlessConsumer had noted about this geo-coord collection for every txn as a key surveillance concern back in 2017 - medium.com/cashlessconsum…

#CashlessConsumer had noted about this geo-coord collection for every txn as a key surveillance concern back in 2017 - medium.com/cashlessconsum…

https://twitter.com/nikhilkumarks/status/1529355001197654017ONDC was born out of COVID pivot to "Open Shared Mobility Foundation" - a non-profit by @NandanNilekani that focussed on urban mobility and since COVID lockdown meant mobility will reduce, they pivoted to e-commerce.

https://twitter.com/nikhilkumarks/status/1529355457646981121

https://twitter.com/NandanNilekani/status/1519590934694219776bbc.com/news/world-asi… 6 June 2012 - Why India's identity scheme is groundbreaking

https://twitter.com/mayhempsingh/status/1512468059948158981How much is the revenue loss determined by CAG?

en.m.wikipedia.org/wiki/Ration_st… is digitized food stamps, but crucial digitization difference is it converts a bearer instrument like stamp / coupon into a person / purpose specific instrument, embedding automatic data emission about beneficiary upon use.

en.m.wikipedia.org/wiki/Ration_st… is digitized food stamps, but crucial digitization difference is it converts a bearer instrument like stamp / coupon into a person / purpose specific instrument, embedding automatic data emission about beneficiary upon use.

https://twitter.com/CNBCTV18Live/status/1412023732747390987Vietnam - e.vnexpress.net/news/news/hai-…

https://twitter.com/sindhan/status/1408708995150278660The site was under 'maintenance' on Jun 27. Tweet report by DMK IT Wing person.

https://twitter.com/Sathish33403113/status/1409020663172579328?s=20

The proposed regulations will supersede the Aadhaar (Authentication) Regulations, 2016 uidai.gov.in/images/regulat…

The proposed regulations will supersede the Aadhaar (Authentication) Regulations, 2016 uidai.gov.in/images/regulat…