yUSD is an incredible product, but it’s also one of the riskiest stablecoins available on Ethereum.

In addition to compounded smart contract risk, yUSD’s risk of peg loss is the sum risk of all its underlying stablecoins losing their peg, combined.

1/

In addition to compounded smart contract risk, yUSD’s risk of peg loss is the sum risk of all its underlying stablecoins losing their peg, combined.

1/

If even a single one of the underlying stablecoins in the yPool (USDT, TUSD, USDC, DAI) underlying yUSD loses its peg, yUSD will also lose its “peg”.

There is nothing insuring against this risk and Curve is clear about this on the risk section of their website.

There is nothing insuring against this risk and Curve is clear about this on the risk section of their website.

This peg risk may be addressed in the future by allocating the underlying stablecoins elsewhere to protocols that backstop against this risk, or don’t introduce it altogether, but for now it’s there.

Other ideas for how to insure against this would also be welcomed.

Other ideas for how to insure against this would also be welcomed.

Further challenging yUSD from a risk perspective is liquidity.

Currently, there’s no great way to get in or out of yUSD besides interacting with Yearn’s yCRV vault.

To ultimately get to or from the underlying stablecoins it takes multiple steps and transactions.

Currently, there’s no great way to get in or out of yUSD besides interacting with Yearn’s yCRV vault.

To ultimately get to or from the underlying stablecoins it takes multiple steps and transactions.

As we’ve seen with Black Thursday this would be a nightmare in a high fee, high congestion environment.

Luckily however this risk is slowly being mitigated by the development of yield aware stablecoin optimized AMM protocols like SnowSwap, CreamY, and Curve (new pool).

Luckily however this risk is slowly being mitigated by the development of yield aware stablecoin optimized AMM protocols like SnowSwap, CreamY, and Curve (new pool).

Sufficient liquidity for these yield aware tokens like yUSD would make them significantly more accessible and useful.

Not only would increased liquidity allow users to avoid the complexities and fees involved in moving in and out of smart stablecoins today, but they would also allow larger users to move in and out of them with less slippage.

Smart stablecoins like yUSD are an exciting addition to DeFi and if they can overcome their challenges today, they could have a bright future.

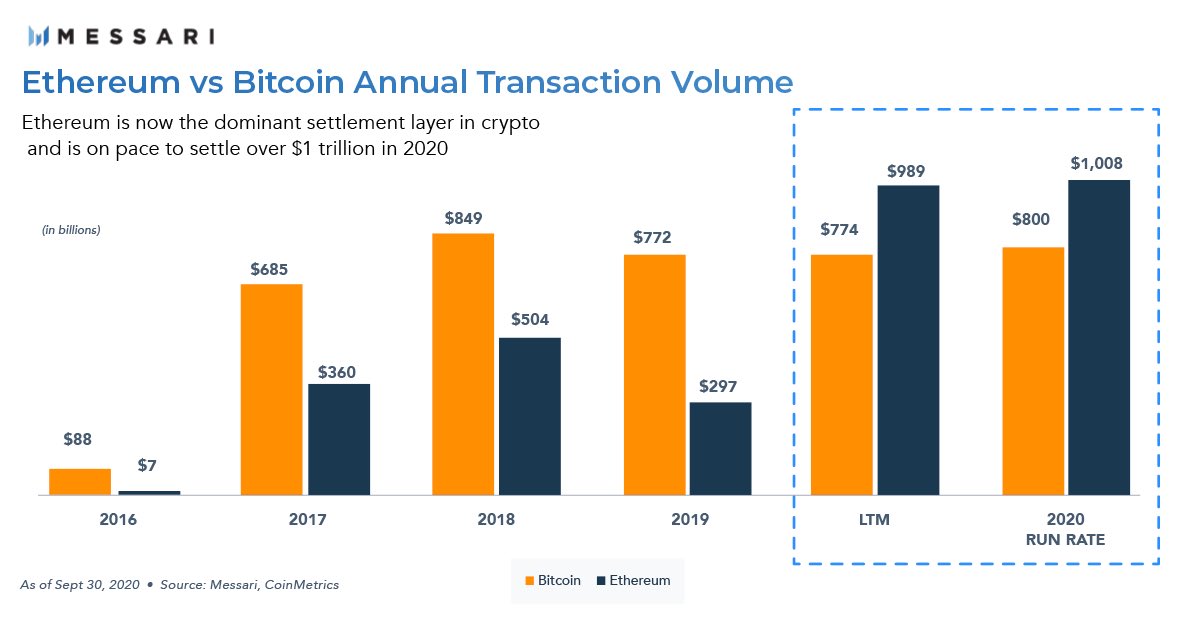

This and much more in our latest Q3 report on stablecoins.

messari.io/article/ethere…

This and much more in our latest Q3 report on stablecoins.

messari.io/article/ethere…

• • •

Missing some Tweet in this thread? You can try to

force a refresh