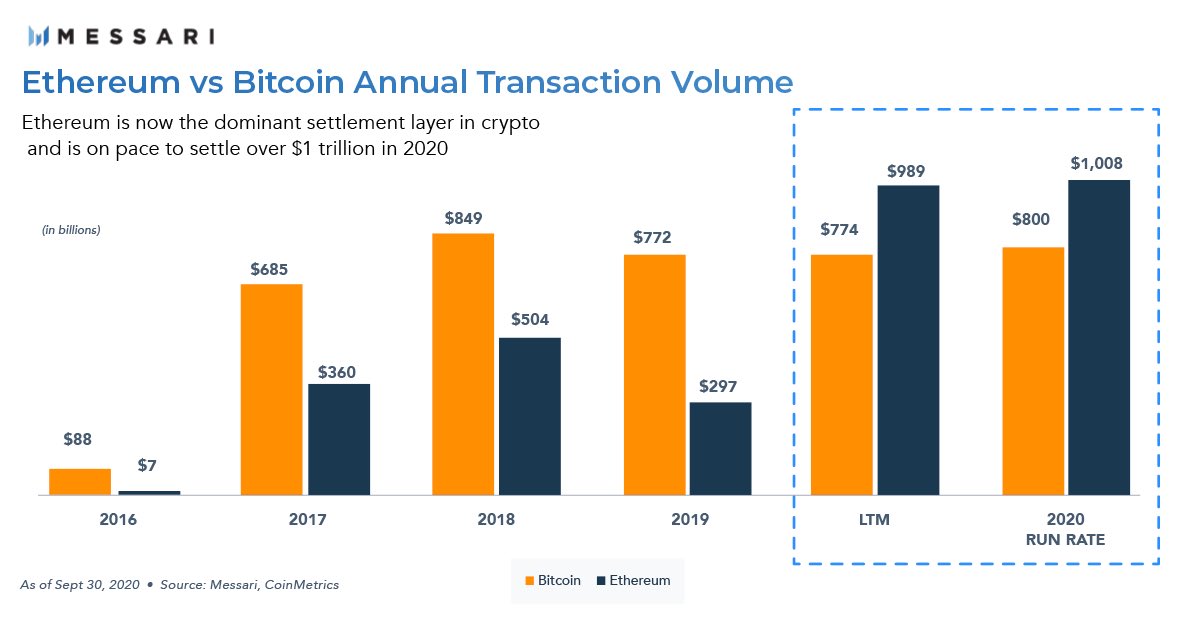

🤯 Ethereum now transacts two times more value than Bitcoin daily.

This is what a cryptoeconomy looks like when it starts to find product-market fit.

1/

This is what a cryptoeconomy looks like when it starts to find product-market fit.

1/

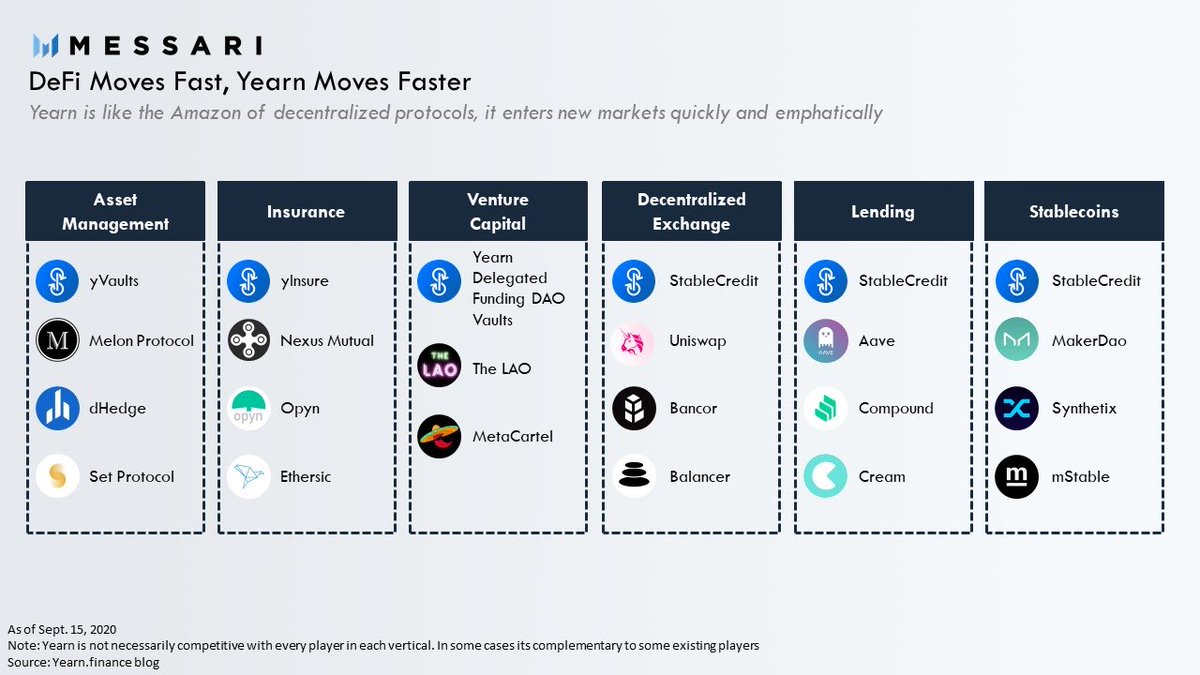

There are two key developments over the past year that made this all possible: stablecoins and DeFi.

The two provided a strong foundation for real financial activity to take place on Ethereum.

messari.io/article/ethere…

The two provided a strong foundation for real financial activity to take place on Ethereum.

messari.io/article/ethere…

Ethereum’s progress has been so incredible that it will likely becomes the first public blockchain ever to settle $1 trillion in a year.

Much of this activity is attributable to Etherum’s stablecoin volumes.

Tether alone now transacts more daily than Bitcoin.

Most of this volume is ERC-20 Tether.

Tether alone now transacts more daily than Bitcoin.

Most of this volume is ERC-20 Tether.

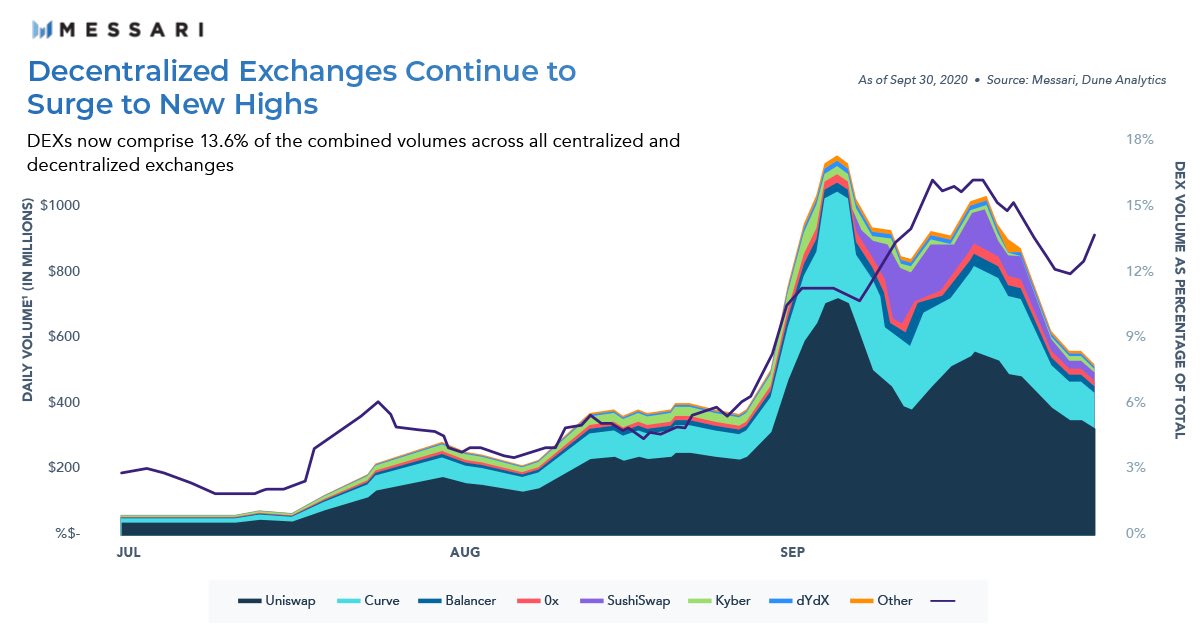

The second leading reason for this is Ethereum’s boom in on-chain liquidity.

Uniswap and Curve did more than $20 billion in combined volume for September.

DEXs now comprise 13.6% of total volumes from all exchanges both centralized and decentralized.

Uniswap and Curve did more than $20 billion in combined volume for September.

DEXs now comprise 13.6% of total volumes from all exchanges both centralized and decentralized.

But the above is just scratching the surface of what happened this quarter.

Check out our latest Q3 report for detailed commentary and analysis on:

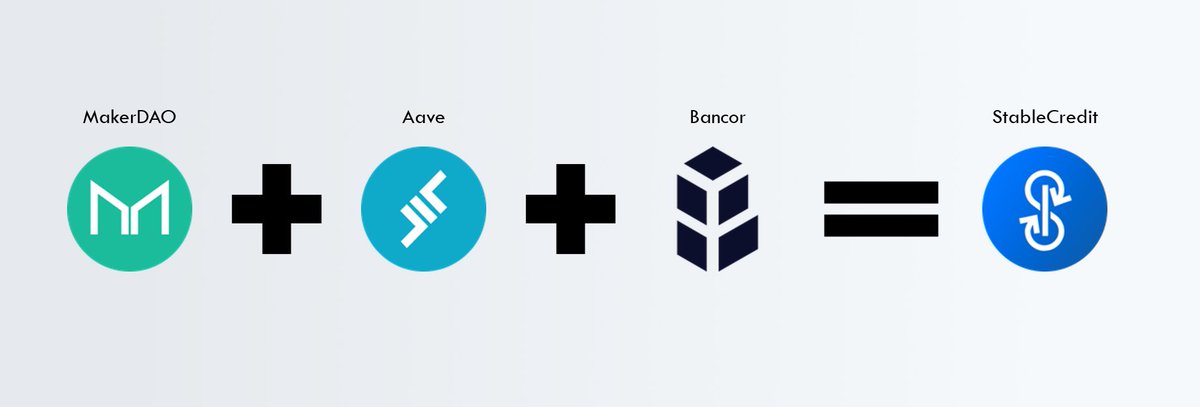

1. Stablecoin Growth

2. Yield Farming

3. The Rise of the Smart Dollar

3. Stablecoin protocol competition

messari.io/article/ethere…

Check out our latest Q3 report for detailed commentary and analysis on:

1. Stablecoin Growth

2. Yield Farming

3. The Rise of the Smart Dollar

3. Stablecoin protocol competition

messari.io/article/ethere…

• • •

Missing some Tweet in this thread? You can try to

force a refresh