DeFi protocols now store billions of dollars in assets and facilitate billions of dollars in financial activity daily.

But how do they actually create and capture value?

1/

But how do they actually create and capture value?

1/

This summer it was easy to ignore longer-term questions of sustainability and competitive advantage when all DeFi asset prices were rising.

But now that the market has cooled down, more level heads may now prevail and position for the next stage of DeFi.

messari.io/article/defi-c…

But now that the market has cooled down, more level heads may now prevail and position for the next stage of DeFi.

messari.io/article/defi-c…

Value creation in DeFi all starts with a balance sheet.

DeFi protocols are coordination mechanisms that define rules and provide incentives in order to facilitate financial activity.

DeFi protocols are coordination mechanisms that define rules and provide incentives in order to facilitate financial activity.

Most DeFi protocols do this by crowdsourcing assets from their communities and putting those assets to productive use in activities such as market making and lending.

Users provide their capital to protocols in exchange for value flows that may be intrinsic (like native token rewards) or extrinsic (like stablecoins).

How much value protocols create for stakeholders is determined by how effectively protocols can monetize their balance sheets.

How much value protocols create for stakeholders is determined by how effectively protocols can monetize their balance sheets.

Balance sheet monetization as a business model is not new.

It’s how financial institutions such as banks have generated cash flow for millennia.

It’s how financial institutions such as banks have generated cash flow for millennia.

But when code is open source and capital can move freely on the internet, traditional sources of competitive advantage lose their relevance.

Even liquidity can be forked in this world.

This is why building a moat in DeFi is hard.

Even liquidity can be forked in this world.

This is why building a moat in DeFi is hard.

How then can DeFi protocols capture value if it appears as if nothing is defensible?

I believe there are five primary sources of sustainable competitive advantage:

- Community

- Integrations

- Protocol Resources

- Security

- Brand / UX

I believe there are five primary sources of sustainable competitive advantage:

- Community

- Integrations

- Protocol Resources

- Security

- Brand / UX

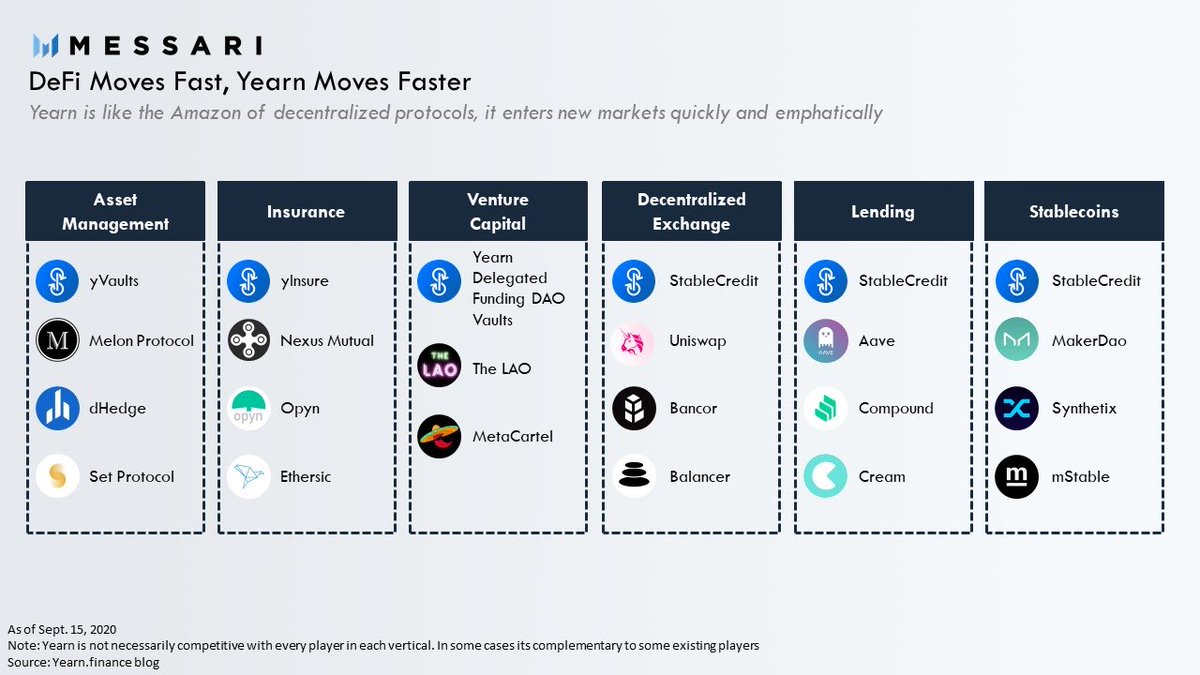

But the above is just scratching the surface.

In my latest Pro piece I detail:

1. Competitive Moats in DeFi

2. The Future of Balance Sheet Monetization as a Business Model

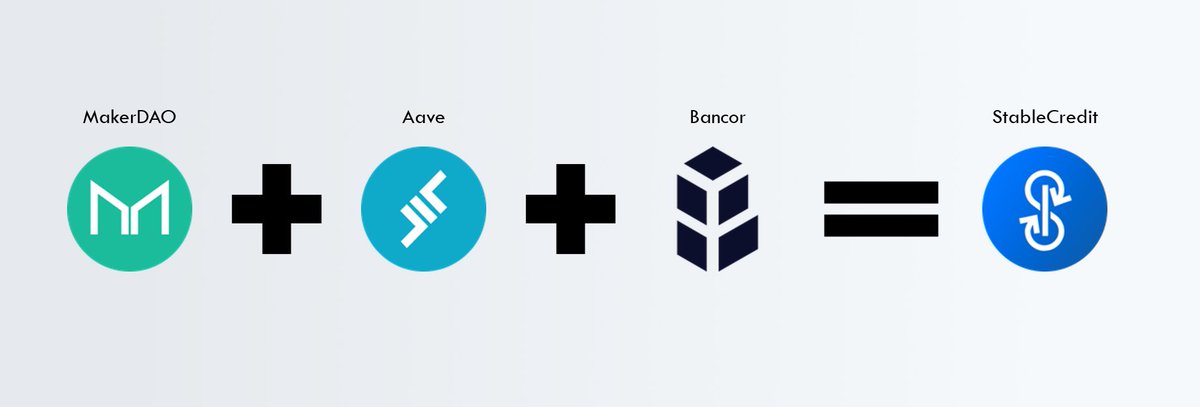

3. The Rise of Protocol to Protocol Cooperation

messari.io/article/defi-c…

In my latest Pro piece I detail:

1. Competitive Moats in DeFi

2. The Future of Balance Sheet Monetization as a Business Model

3. The Rise of Protocol to Protocol Cooperation

messari.io/article/defi-c…

What’s matters for the long-term DeFi investor is not flash-in-the-pan food coins, valueless forks, and ponzinomics.

Rather its legitimate sources of sustainable competitive advantage that will allow DeFi protocols to create and capture value now and into the future.

Rather its legitimate sources of sustainable competitive advantage that will allow DeFi protocols to create and capture value now and into the future.

• • •

Missing some Tweet in this thread? You can try to

force a refresh