I have a new big read out, on the renewed challenges that active fund managers have had in fulfilling their promise to outperform in rockier markets - and the implications of that. ft.com/content/621d51…

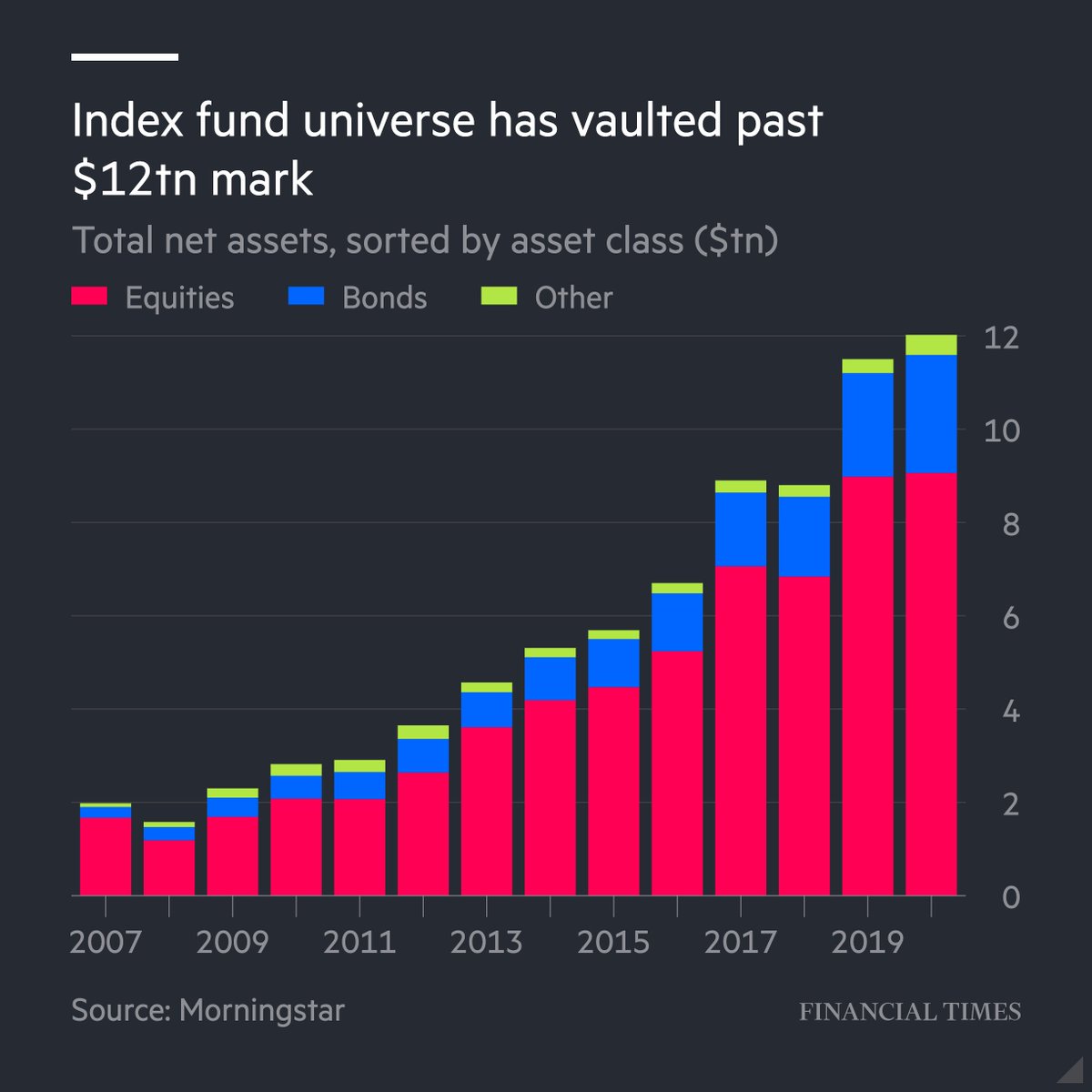

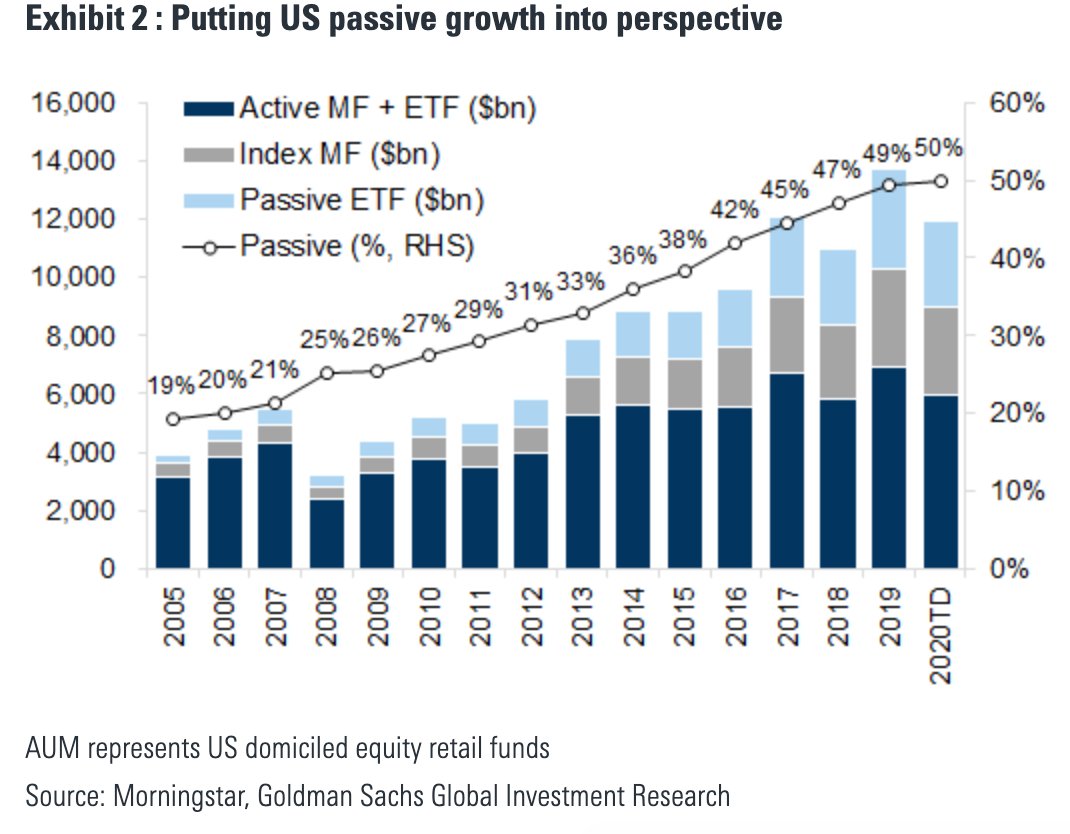

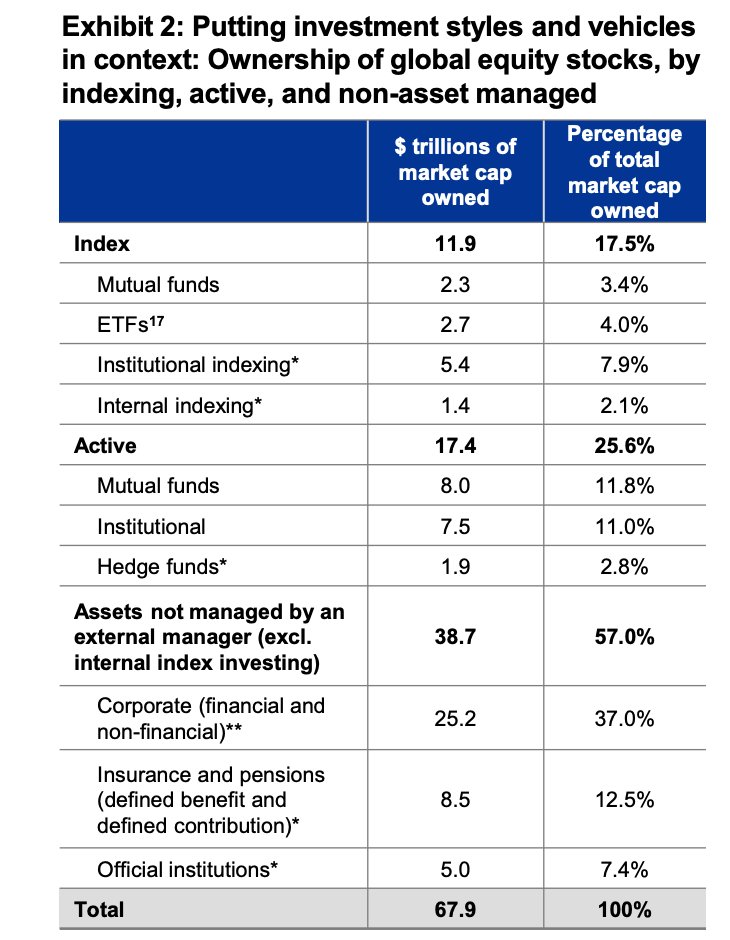

Even that underestimates their heft. BlackRock estimated in 2017 that there is another $6.8tn of institutional or internal indexed strategies just on the equities side, so we're almost certainly talking well over $20tn in total now. blackrock.com/corporate/lite…

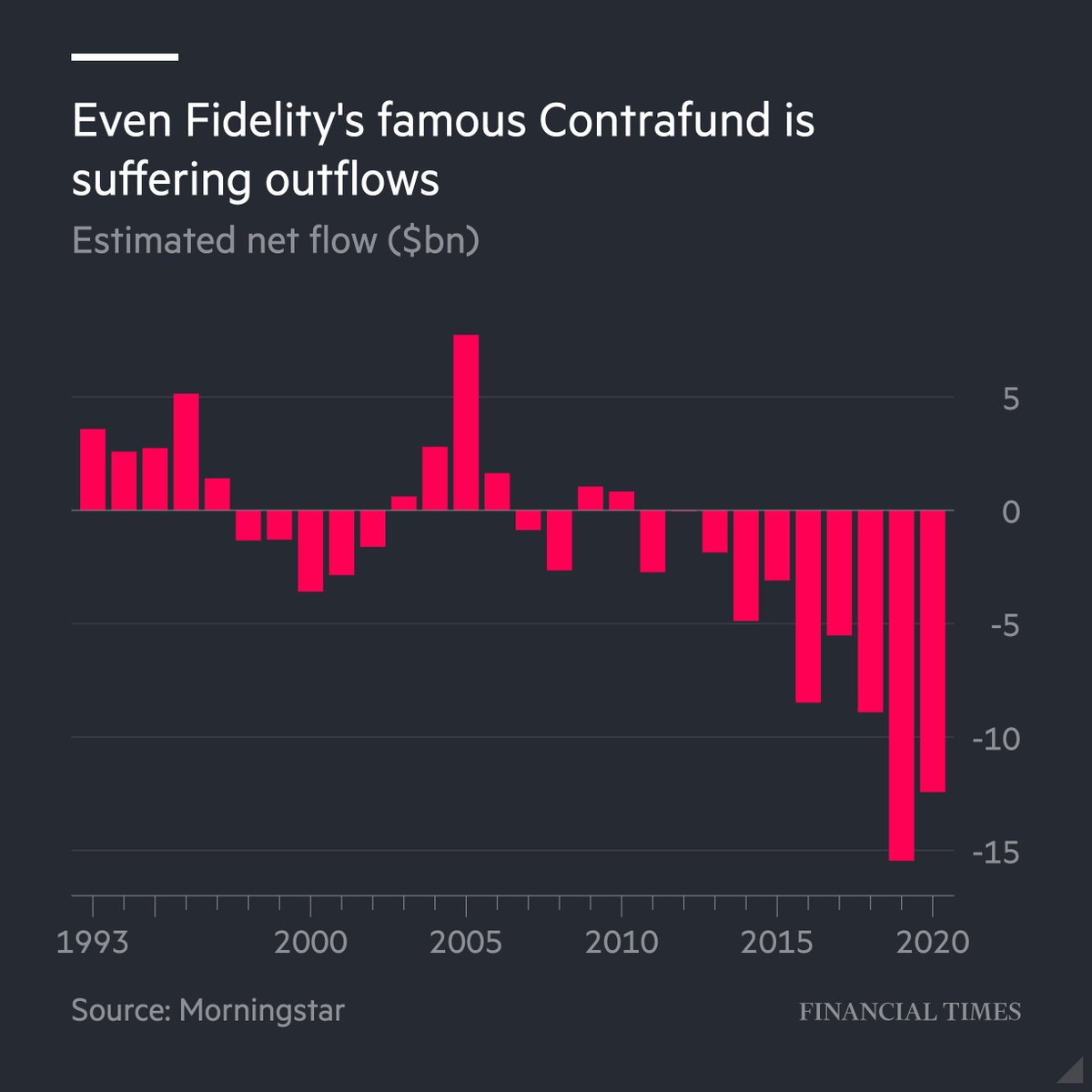

Even William Danoff's Fidelity Contrafund - the biggest active equity fund in the world - is suffering multi-billion dollar outflows these days, despite his frankly staggering 30-year track record. (Good profile of Will here: barrons.com/articles/fidel…)

It's just getting harder and harder to keep assets even for stock-pickers that are doing well or have a prized four or five-star Morningstar rating.

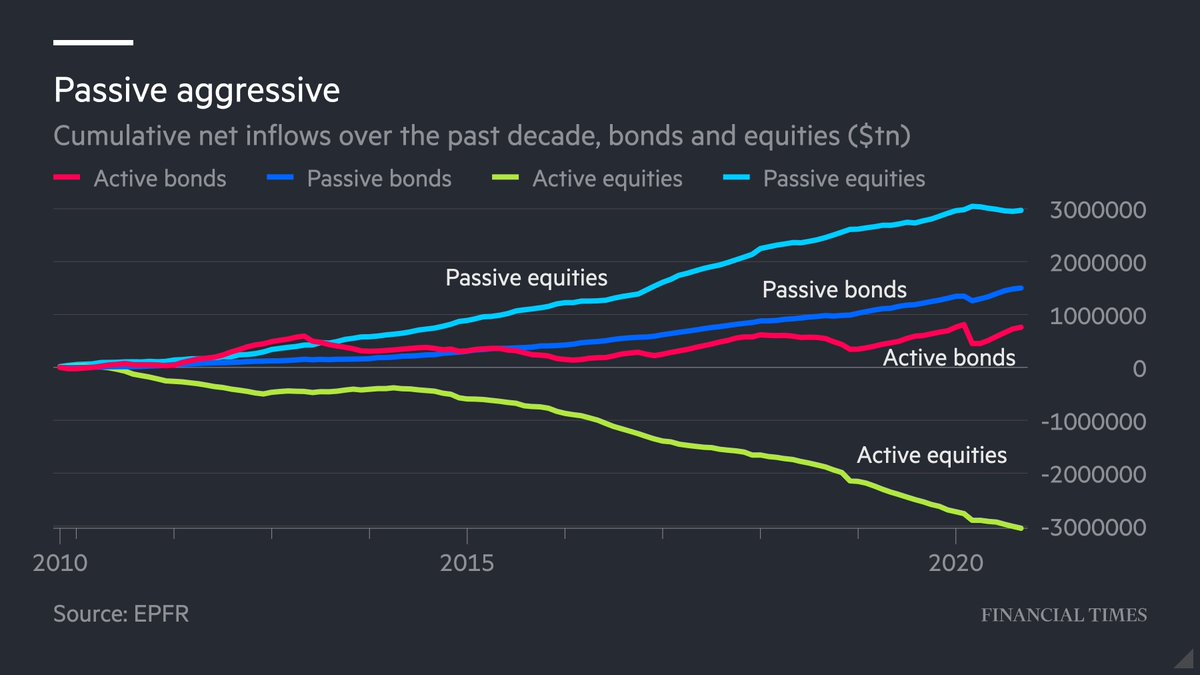

But even bond fund managers are coming under increasing pressure, as fixed income ETFs have become more attractive after demonstrating some resilience this year.

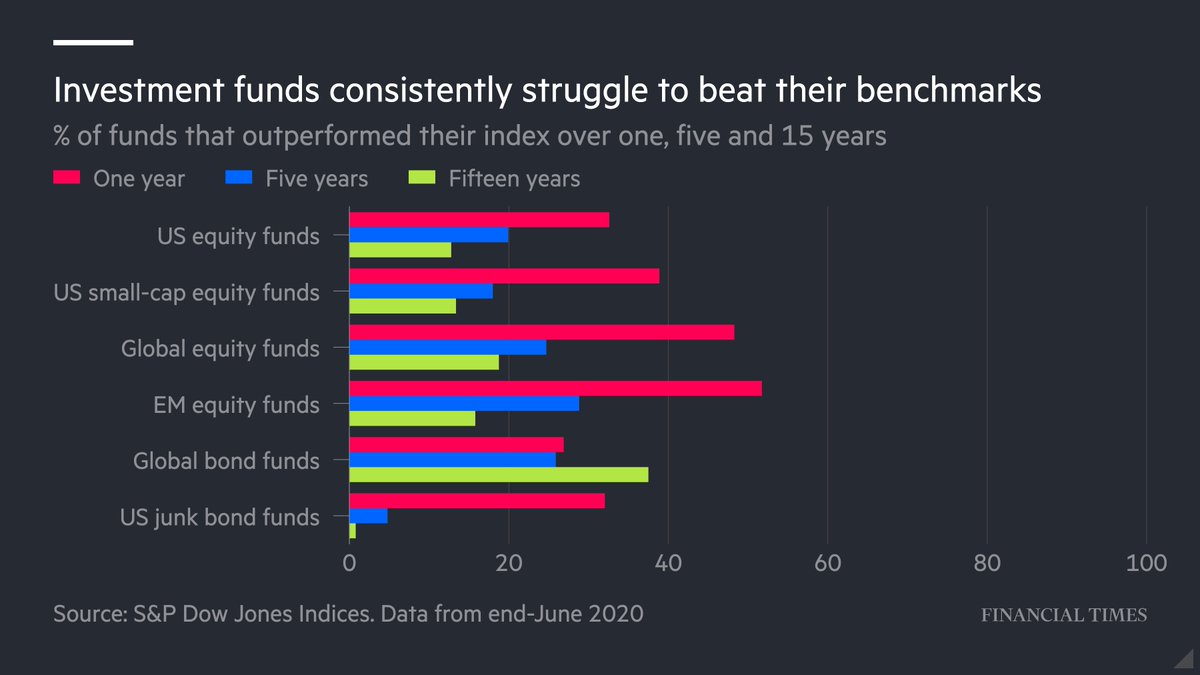

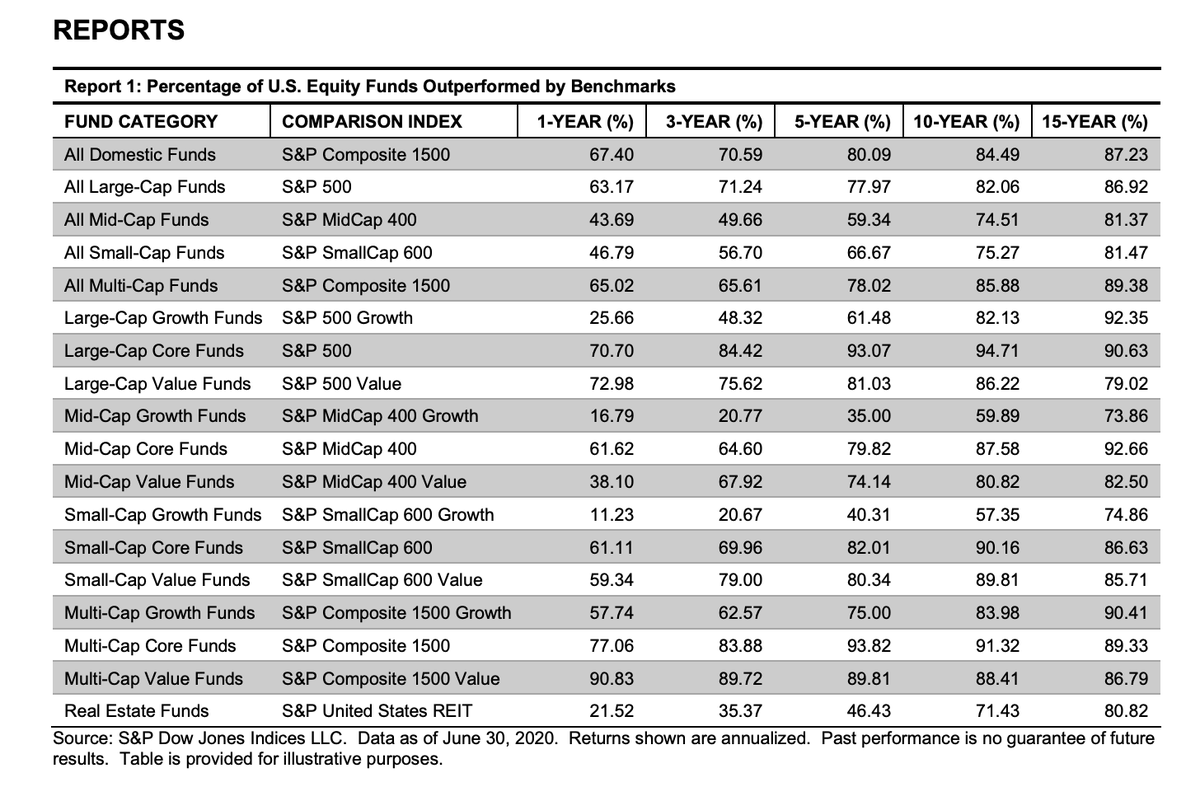

Large cap US equity funds are the centre of the storm, but most equity funds struggle to beat their benchmarks over time, as S&PDJI's Spiva scorecard shows. spindices.com/spiva/#/

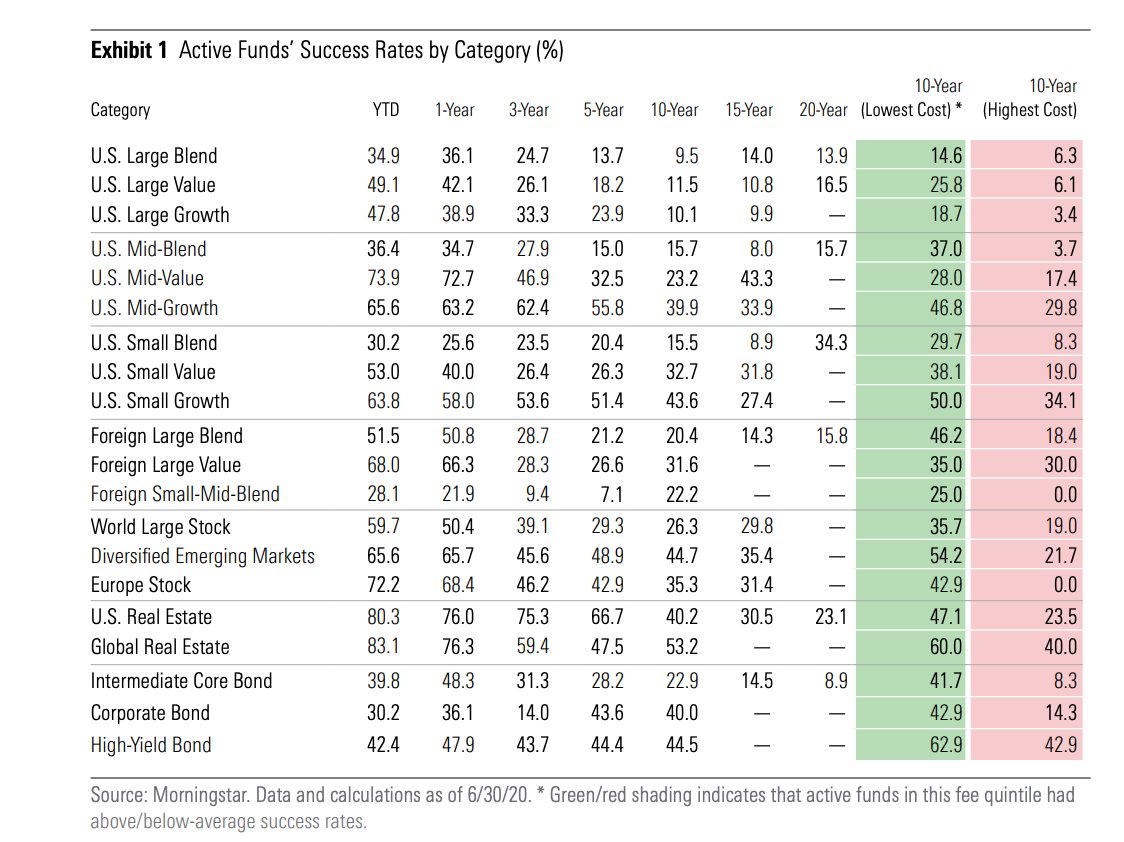

Morningstar's Active-Passive Barometer shows that this is true for most markets internationally as well (and also shows the impact of costs on an investor's net performance). morningstar.com/lp/active-pass…

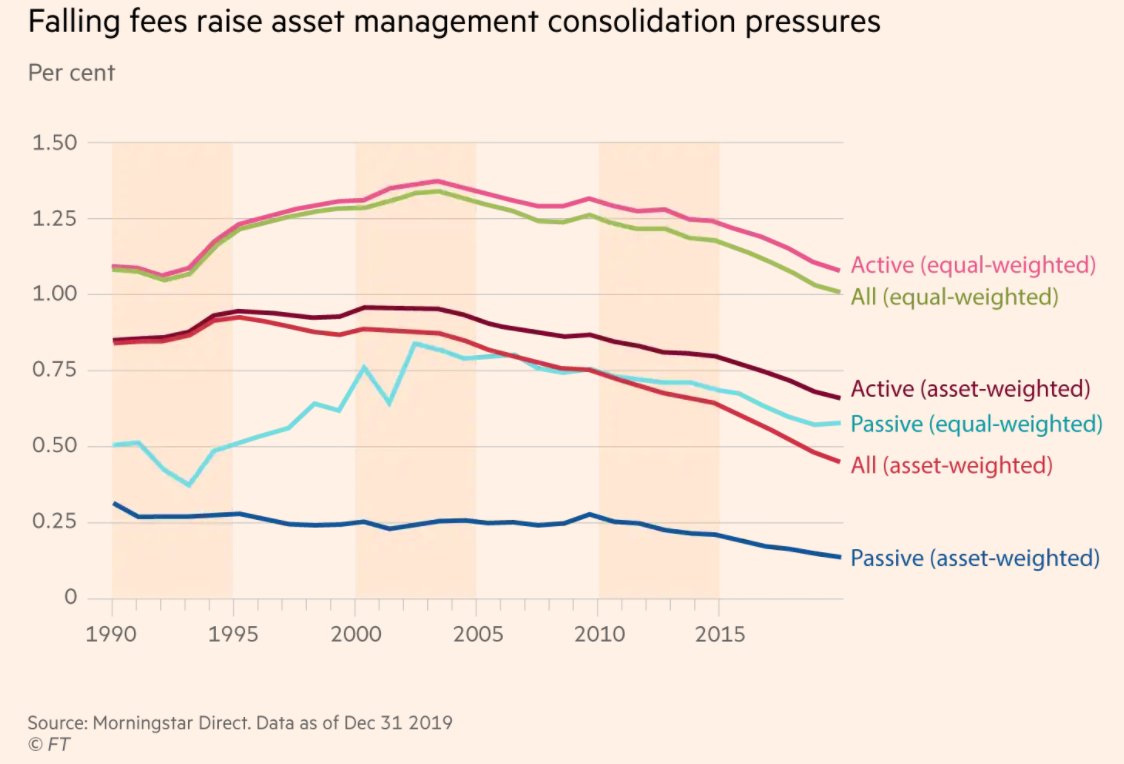

The result is rising and rising fee pressure across the board. newsroom.morningstar.com/newsroom/news-…

What does this mean for the asset management industry? Consolidation. There's hope that positioning oneself as an ESG shop will lead to stickier flows, and frenzied expectations for the potential in China and Asia, but consolidation is the name of the game right now. From MS:

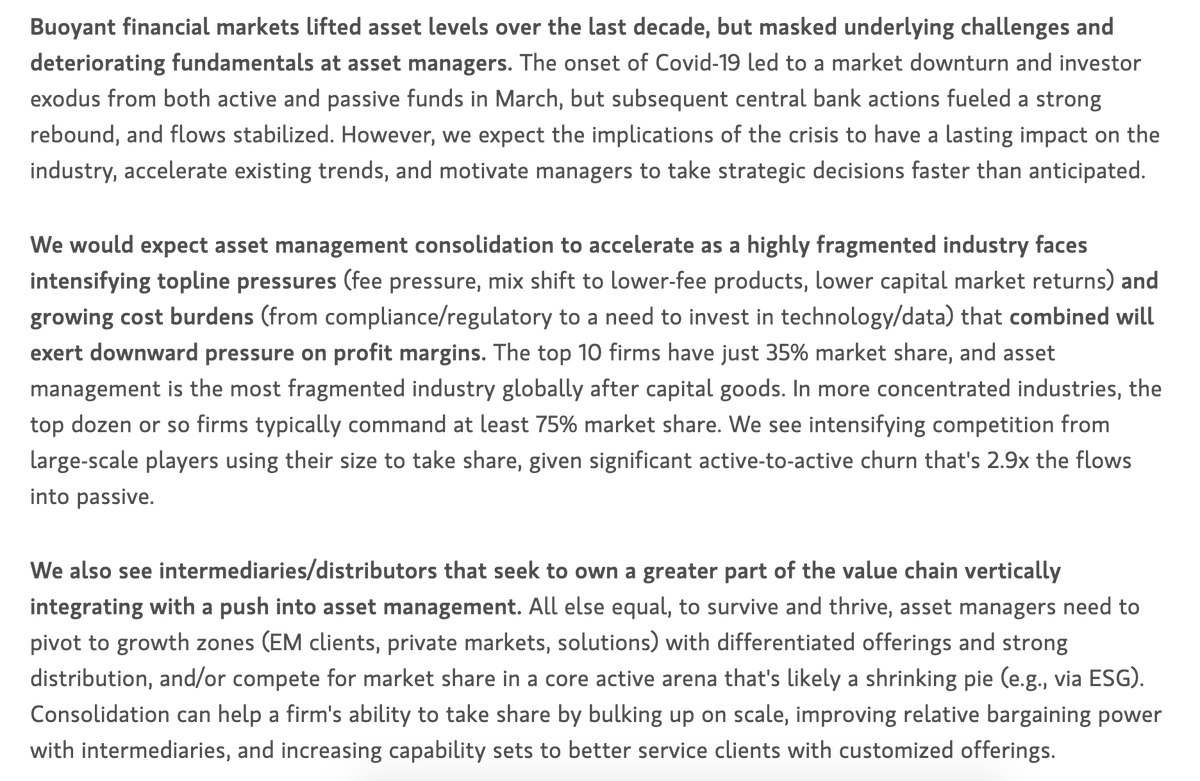

Here are Morgan Stanley's forecasts for the global investment industry's revenues over the next four years. Note how "core active" is expected to shrink both in absolute and relative terms.

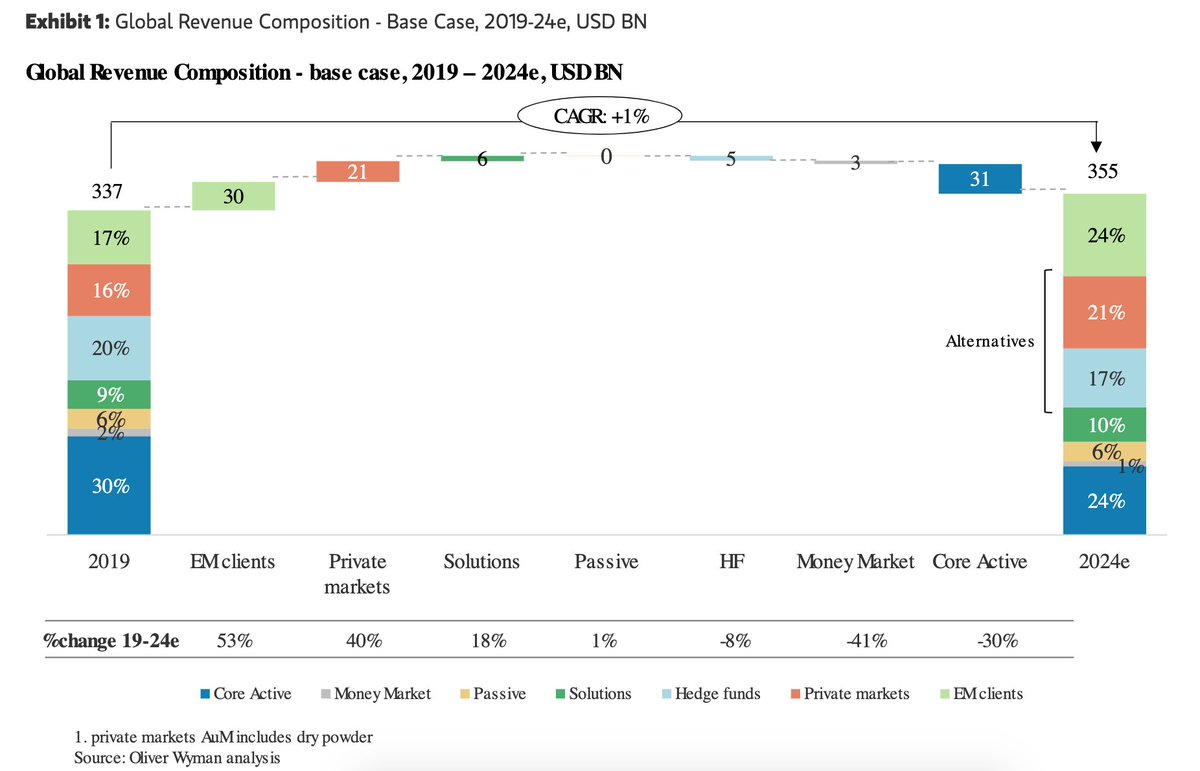

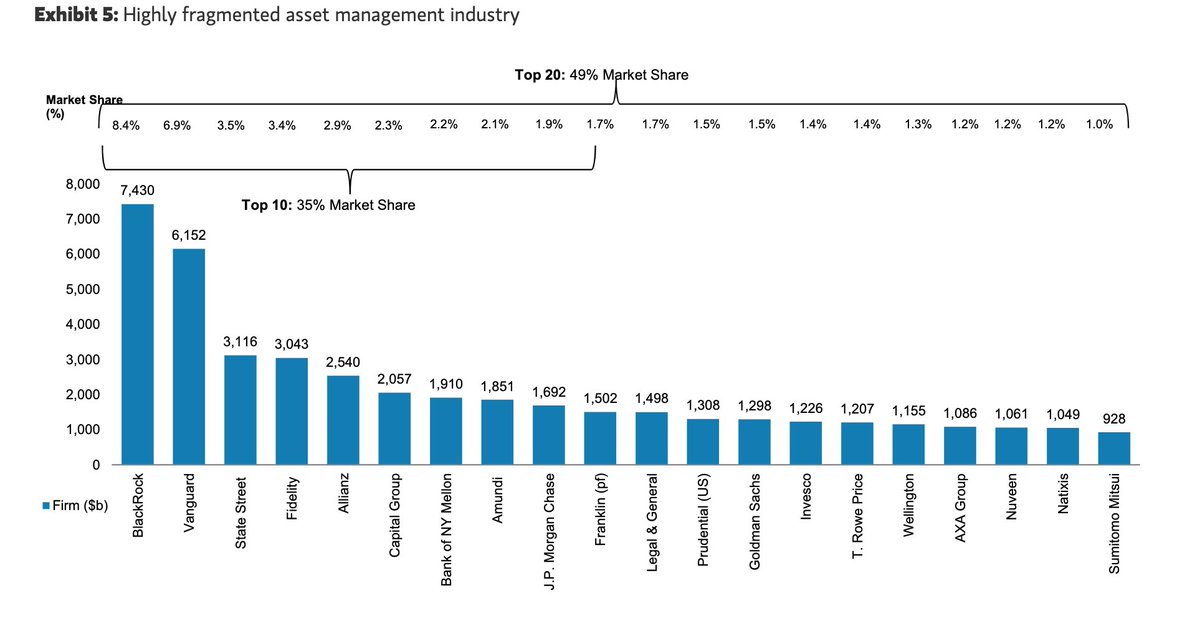

Despite a handful of YUGE players, such as BlackRock and Vanguard, the asset management industry is actually pretty fragmented. In the US only the capital goods sector is less concentrated.

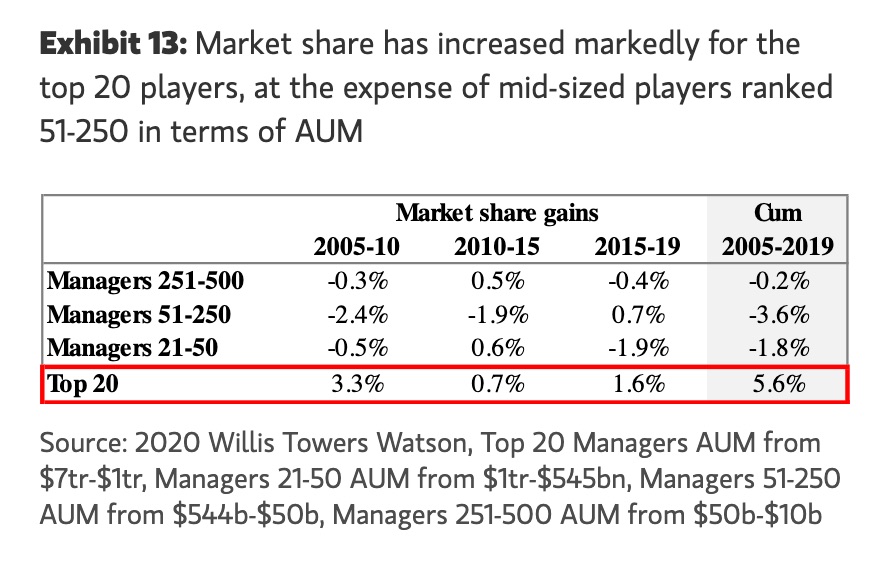

But the top 20 are winning the AUM game, which explains why we are seeing a flurry of deals to catapult asset managers into $1tn+ territory.

Asset management deals are infamously fraught with difficulty - i joked in a speech earlier this year that it requires "Olympian perseverance, Solomonic tact and wisdom, and Ghengis Khan levels of ruthlessness" - but there are definitely more coming.

Personally, I suspect that Morgan Stanley's purchase of Eaton Vance could be a sign of things to come. It's a fee-rich, capital-light, predictable business that works well for banks that often already have distribution capabilities.

Some smaller bank-owned asset managers (BMO, SocGen and Wells off the top of my head) are said to be up for purchase) and it makes sense for a bigger bank to acquire the AUM. Aside from that we will see more niche acquisitions, such as big players acquiring private market firms.

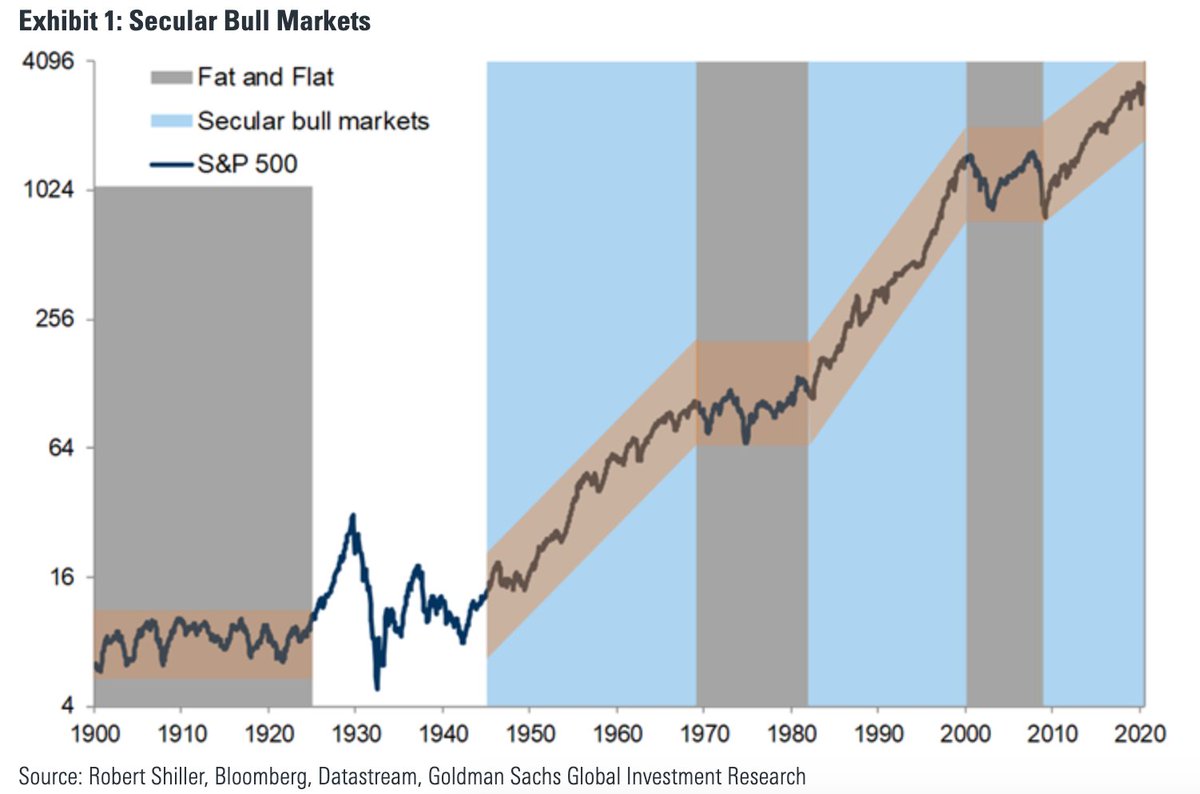

I should note that a lot of asset managers reckon the next decade will be a lot better for active funds than the last one. I'm personally sceptical though, as the data is pretty stark - whatever the market environment, active on average struggles.

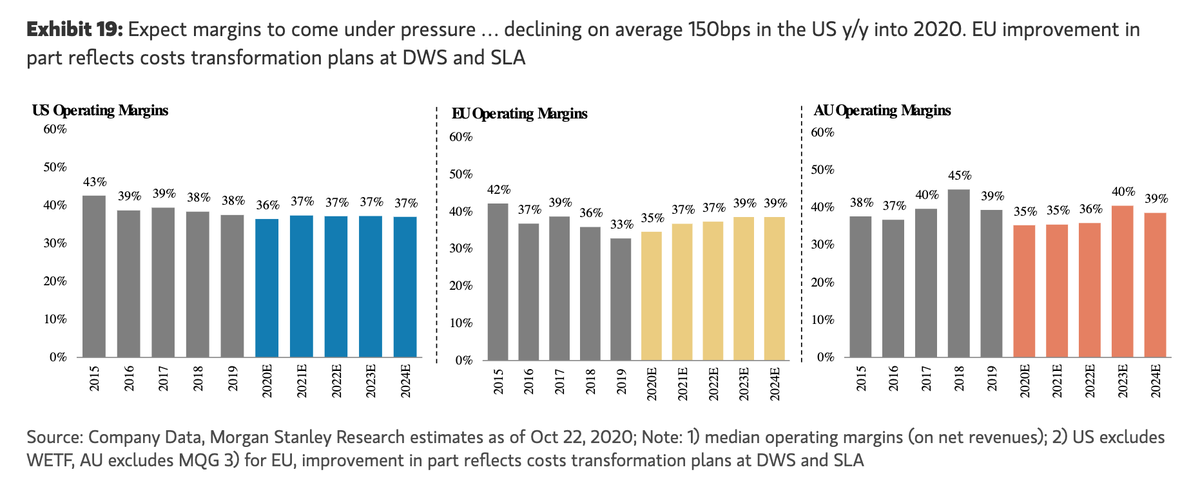

Forgot add that we shouldn't cry too much for the asset management industry anyway - it remains wildly profitable. For comparison, Apple, Facebook and Microsoft's operating margins are 24%, 34% and 37% respectively.

Another addendum: Didnt have space for it, but there's a fair amount of schadenfreude among traditional active managers that at least quants are having an even crappier year. ft.com/content/d59ffc…

• • •

Missing some Tweet in this thread? You can try to

force a refresh