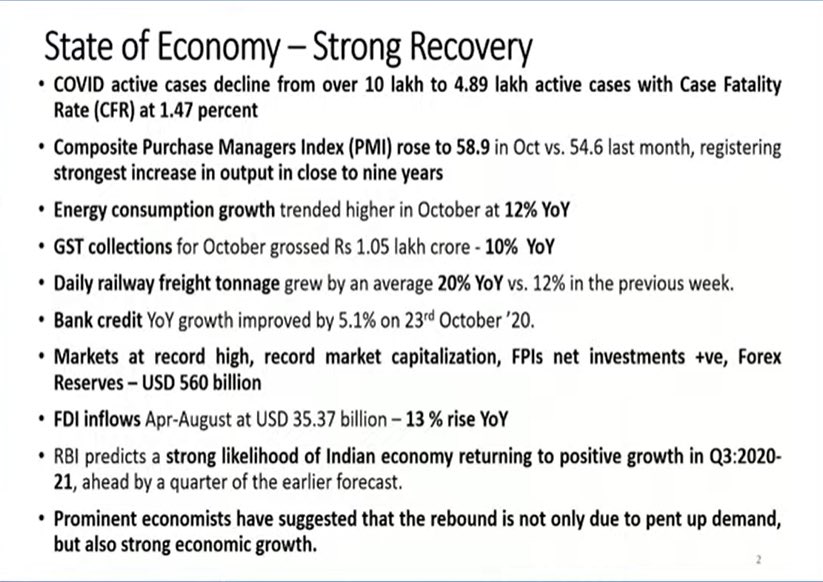

Various economic indicators which show the presence of a strong pitch for recovery in the economy.

Announcements by @FinMinIndia underway.

| @nsitharaman @ianuragthakur |

Announcements by @FinMinIndia underway.

| @nsitharaman @ianuragthakur |

. @MoodysInvSvc has reassessed India's 2020 GDP growth at -8.9% (as against -9.6% earlier)

For 2021, they have revised estimate to 8.6% (from 8.1% earlier)

This shows that a positive correction is happening as regards our economic prospects.

For 2021, they have revised estimate to 8.6% (from 8.1% earlier)

This shows that a positive correction is happening as regards our economic prospects.

28 states have been brought under #OneNationOneRationCard scheme, 68.6 crore beneficiaries can hence lift food grains from any of these 28 states/UTs

Around 14 lakh loans have been sanctioned under #PMSVANidhi scheme for street vendors.

Around 14 lakh loans have been sanctioned under #PMSVANidhi scheme for street vendors.

₹ 25,000 crore has been distributed to help farmers prepare for Rabi sowing, this is over and above the budget allocation

Under Emergency Credit Liquidity Guarantee Scheme, a total amount of ₹2.05 lakh crore has been sanctioned to 61 lakh borrowers, out of which ₹ 1.52 lakh crore has been disbursed.

Utsav Cards being issued by @TheOfficialSBI for festival advance

Many employees availing LTC Voucher Scheme

Many steps being taken by @MORTHIndia and @DefenceMinIndia for utilizing ₹ 25,000 crore capital expenditure

Progress of #AatmaNirbharBharat 2.0

Many employees availing LTC Voucher Scheme

Many steps being taken by @MORTHIndia and @DefenceMinIndia for utilizing ₹ 25,000 crore capital expenditure

Progress of #AatmaNirbharBharat 2.0

• • •

Missing some Tweet in this thread? You can try to

force a refresh