✅ #AatmaNirbharBharat 3.0

#AatmaNirbharBharatRozgarYojana launched to incentivize job creation during #COVID19 recovery

EPFO registered establishments -if they take in new employees or those who lost jobs earlier - these employees will get some benefits

Effective Oct 1, 2020

#AatmaNirbharBharatRozgarYojana launched to incentivize job creation during #COVID19 recovery

EPFO registered establishments -if they take in new employees or those who lost jobs earlier - these employees will get some benefits

Effective Oct 1, 2020

Criteria for EPFO registered establishments to be eligible for benefits under #AatmaNirbharBharatRozgarYojana

If new employees of requisite number are recruited from Oct 1, 2020 to June 30, 2021, the establishments will be covered for next two years.

If new employees of requisite number are recruited from Oct 1, 2020 to June 30, 2021, the establishments will be covered for next two years.

Central govt. will give subsidy by way of EPF contributions for two years in respect of new eligible employees

Subsidy will be credited upfront in Aadhaar-seeded EPFO accounts.

Subsidy will be credited upfront in Aadhaar-seeded EPFO accounts.

Emergency Credit Line Guarantee Scheme for MSMEs, businesses, MUDRA borrowers and individuals (loans for business purposes), has been extended till March 31, 2021

Support scheme for health care sector and 26 sectors stressed due to #COVID19.

Entities will get additional credit up to 20% of outstanding credit, repayment can be done in five years' time (1 year moratorium + 4 years repayment)

Entities will get additional credit up to 20% of outstanding credit, repayment can be done in five years' time (1 year moratorium + 4 years repayment)

The Production-Linked Incentive scheme earlier launched for three sectors is being expanded to include 10 Champion Sectors with a total incentive of Rs 1.46 lakh crore.

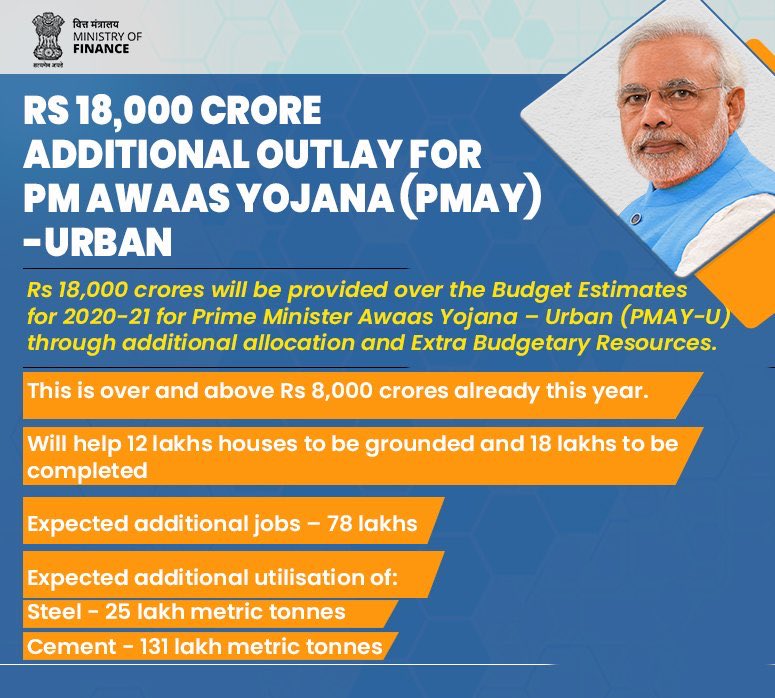

An additional Rs 18,000 crore will be provided under the PM Awaas Yojana - Urban over and above the Rs 8,000 crore allocated in the Budget Estimates.

This is expected to create an additional 78 lakh jobs and to significantly increase the utilisation of steel and cement.

This is expected to create an additional 78 lakh jobs and to significantly increase the utilisation of steel and cement.

In a big support for the construction and infrastructure sector, the government has announced a relaxation in the rules pertaining to Earnest Money Deposit and Performance Security on government tenders.

This move will reduce the locking up of capital for contractors and also reduce the cost of bank guarantees.

In a significant demand booster for the residential real estate sector, the govt has decided to make amendments in the Income Tax Act to help home-buyers as well as developers.

The government will invest Rs 6,000 crore in the NIIF debt platform, which will provide infrastructure project financing of Rs 1,10,000 crore.

The govt will provide Rs 65,000 crore to farmers to ensure adequate supply of fertiliser in the upcoming crop season.

In order to provide a further boost to rural employment, the govt will provide an additional outlay of Rs 10,000 crore for the Pradhan Mantri Garib Kalyan Rozgar Yojana.

The govt will release Rs 3,000 crore to EXIM Bank for the promotion of project exports through Lines of Credit under the IDEAS scheme.

An additional Rs 10,200 crore will be provided for capital and industrial expenditure mainly for domestic defence equipment, industrial incentives, industrial infrastructure, and green energy.

₹ 900 crore is being provided to @DBTIndia for research activities related to #COVID19 vaccine development

This does not include cost of vaccine or logistics for vaccine distribution (whatever is required for that will be provided)

#AatmaNirbharBharat 3.0

This does not include cost of vaccine or logistics for vaccine distribution (whatever is required for that will be provided)

#AatmaNirbharBharat 3.0

• • •

Missing some Tweet in this thread? You can try to

force a refresh