1/ “Hey, Tren, hey, how about a little something, you know, more specific about which stocks were bought by Todd and Ted in the Berkshire 13F, you know.”

I replied “Oh, uh, there won’t be any list, but I will give you the questions to ask, which is nice." sec.gov/Archives/edgar…

I replied “Oh, uh, there won’t be any list, but I will give you the questions to ask, which is nice." sec.gov/Archives/edgar…

2/ For example: How big is the purchase or sale? If a sale, what's the holding period? Is it in Buffet/Munger's circle of competence? Margin of safety given the purchase price? Is the business understandable? Does it have a sustainable moat? Is it a franchise Buffett/Munger love?

3/ Determining what is Todd and Ted is a process of elimination. Munger has said Todd and Ted are free to make their own decisions since Buffett would have hated it at their age. Todd and Ted only have so much capital. That's a clue.

Final exam: who made the pharma investments?

Final exam: who made the pharma investments?

4/ The 13F states Berkshire wasn't required to disclose the name of a stock they are still accumulating.

What's your guess?

"How would you feel if you had to announce every story idea you had?” Warren Buffett

They did this on their IBM mistake. dealbook.nytimes.com/2011/11/14/one…

What's your guess?

"How would you feel if you had to announce every story idea you had?” Warren Buffett

They did this on their IBM mistake. dealbook.nytimes.com/2011/11/14/one…

5/ Buffett: "We try not to affect the price. We usually buy a given percentage of what trades every day.”

“There are only about three [investors] I’d like to know what they are doing. But I don’t feel entitled to know.” cnbc.com/2011/11/14/cnb…

“There are only about three [investors] I’d like to know what they are doing. But I don’t feel entitled to know.” cnbc.com/2011/11/14/cnb…

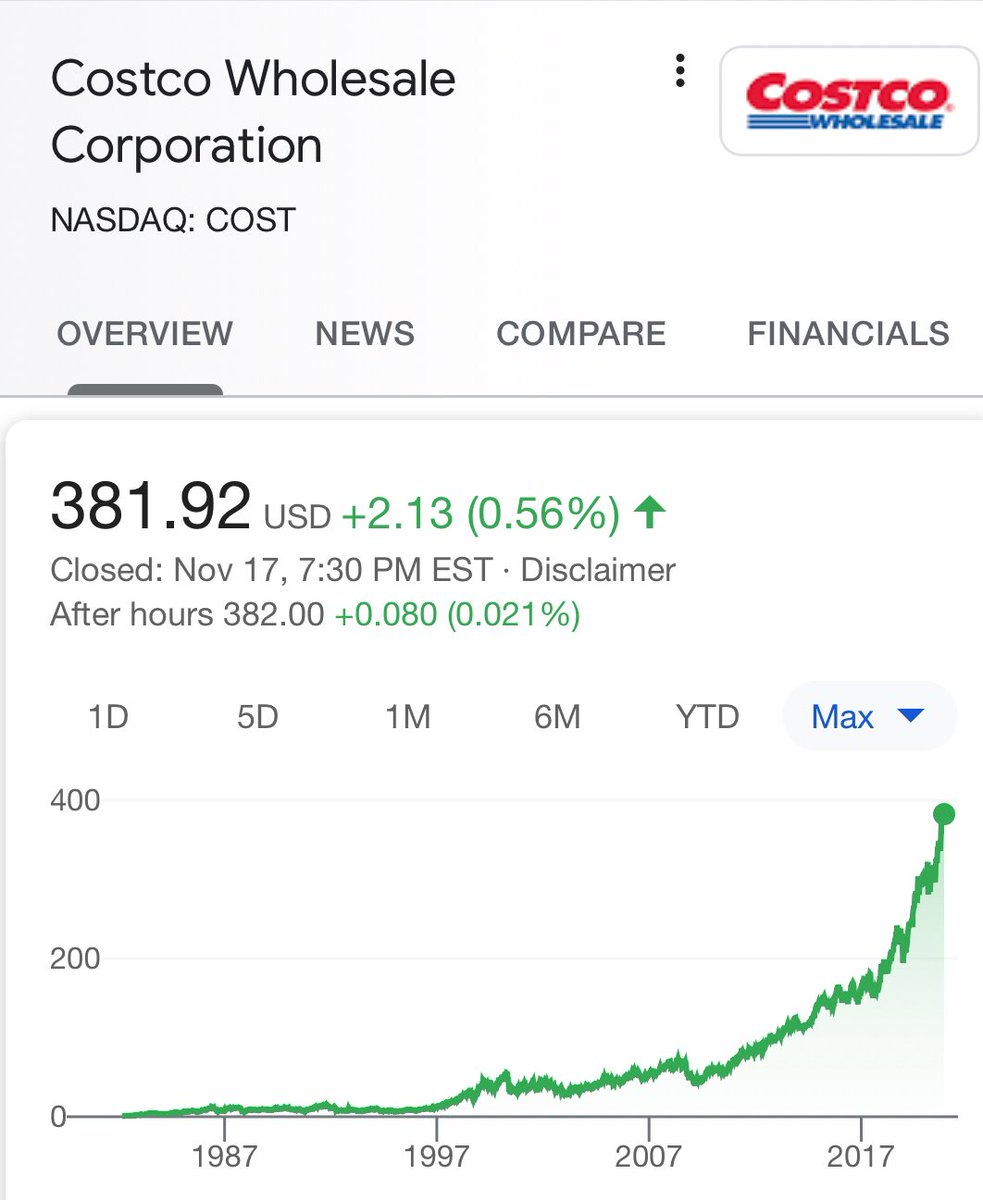

6/ The idea that it was Buffett/Munger that sold 4.3M Costco shares as noted in the 13F and not Todd or Ted makes me giggle. We all need a good laugh at a time like this, including me! Todd and Tedd have their own portfolios and make their own decisions. finance.yahoo.com/video/warren-b…

7/ I'm getting reports that the 4.3M shares of Costco are remnants of a Berkshire purchase of 24 million shares during the second quarter of 2000 with a basis of $28.62 per share. So the joke is on me. Which still makes me giggle, so I've got that goin for me, which is nice!

"...buys and sells of smaller positions of under $1 billion to $2 billion often reflect activity by Ted and Todd..." barrons.com/articles/what-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh