💥@FHFA THINKS IT CAN WAIVE HERA's RESTRICTION ON CAPITAL DISTRIBUTIONS BECAUSE IT SUSPENDED THE CAPITAL CLASSIFICATIONS IN 2008

Because the Restr,surprisingly,appears inside the Sec:Capital Classifications,whereas copycat FDI Act is an indep provision.#Fanniegate @TheJusticeDept

Because the Restr,surprisingly,appears inside the Sec:Capital Classifications,whereas copycat FDI Act is an indep provision.#Fanniegate @TheJusticeDept

FHFA isn't empowered to suspend the application of statutory provisions.

Also,it can't approve(July2011)another exception to the same restriction,adding up(1)for Recap,primarily because Recap is achieved w/ the restriction itself(Retained Earngs)=Law intent.

Dtr,fired.@WhiteHouse

Also,it can't approve(July2011)another exception to the same restriction,adding up(1)for Recap,primarily because Recap is achieved w/ the restriction itself(Retained Earngs)=Law intent.

Dtr,fired.@WhiteHouse

Clearly,it wasn't the FHFA's interpretation of the Restriction On Capital Distributions outlined in its 2011 Final Rule,that aimed at "clarifying","seek transparency" over this Restriction.

We can read that it knows quite well that the shareholders(Equity holders)can't get a div.

We can read that it knows quite well that the shareholders(Equity holders)can't get a div.

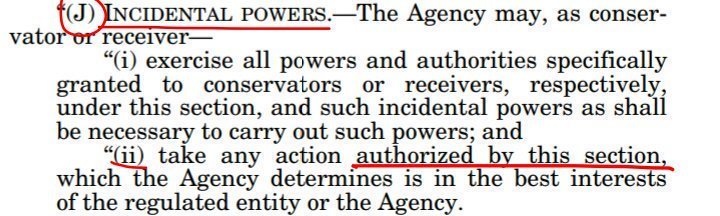

In the first post, a second screenshot was missing to see how HERA Section 1142: Capital Classifications (a)(5), inserted into the FHEFSSA Section 1364 Capital Classifications (e), the RESTRICTION ON CAPITAL DISTRIBUTIONS.

We have enough data to fire the Dtr & wind down the FHFA.

We have enough data to fire the Dtr & wind down the FHFA.

It's important to highlight that,prior struck by Pelosi's HERA,the FHFA-C's Powers were

-CRP

-Restr On Capital Distr

Now,the Restr appears inside the Sec:Capital Classifications & the CRP is its Power:"put(restore)FnF in a sound & solvent condition"

So,the same as before.FHFA=Mob

-CRP

-Restr On Capital Distr

Now,the Restr appears inside the Sec:Capital Classifications & the CRP is its Power:"put(restore)FnF in a sound & solvent condition"

So,the same as before.FHFA=Mob

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh