What is the main driver of this Bitcoin bull run?

Some speculate that Chinese miners haven't been able to sell their BTC because of a regulatory crackdown, and that has led to a "liquidity crunch"

Lots of anecdotes, but here is some empirical evidence ⬇️

Some speculate that Chinese miners haven't been able to sell their BTC because of a regulatory crackdown, and that has led to a "liquidity crunch"

Lots of anecdotes, but here is some empirical evidence ⬇️

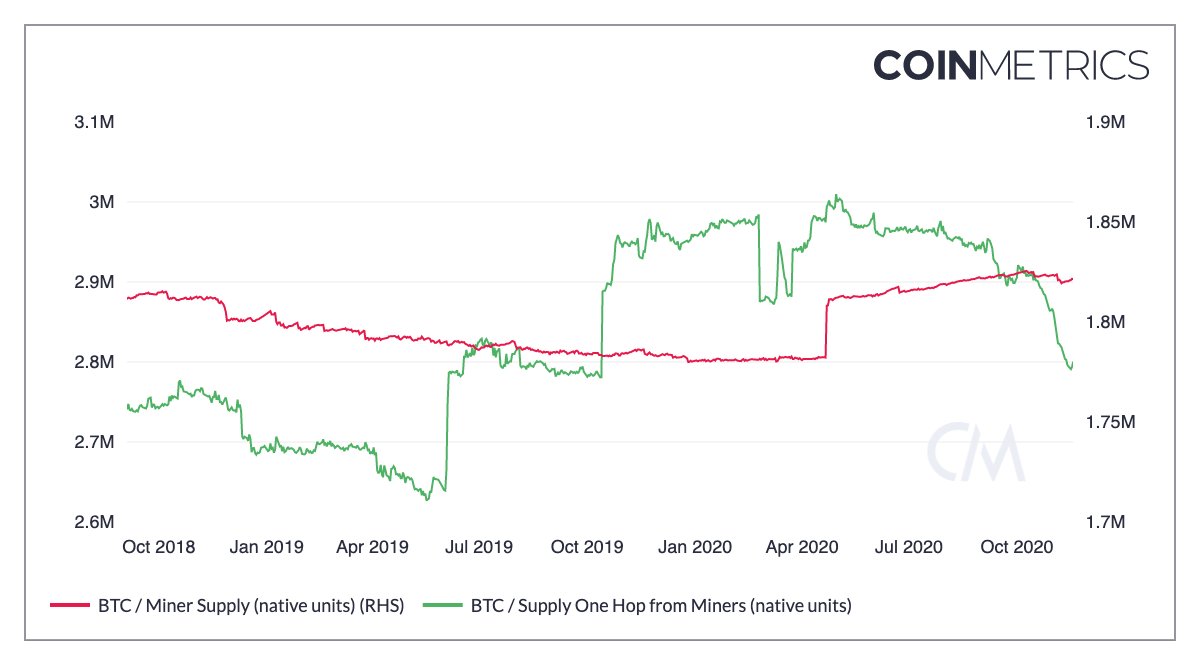

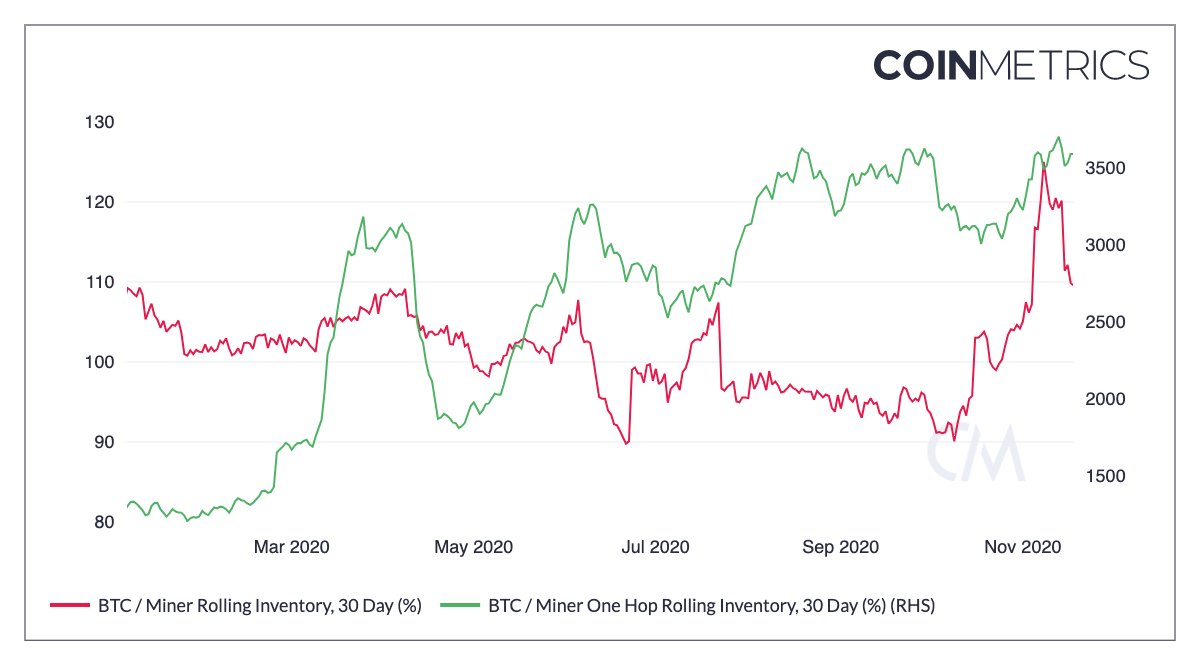

1\ First, let's look at supply held by Mining Pools (red line) and individual Miners (green line).

As you can see, Pools (red) are not selling, but that's part of a long-term trend.

Individual miners (green) are selling, which goes against the narrative of a liquidity crunch.

As you can see, Pools (red) are not selling, but that's part of a long-term trend.

Individual miners (green) are selling, which goes against the narrative of a liquidity crunch.

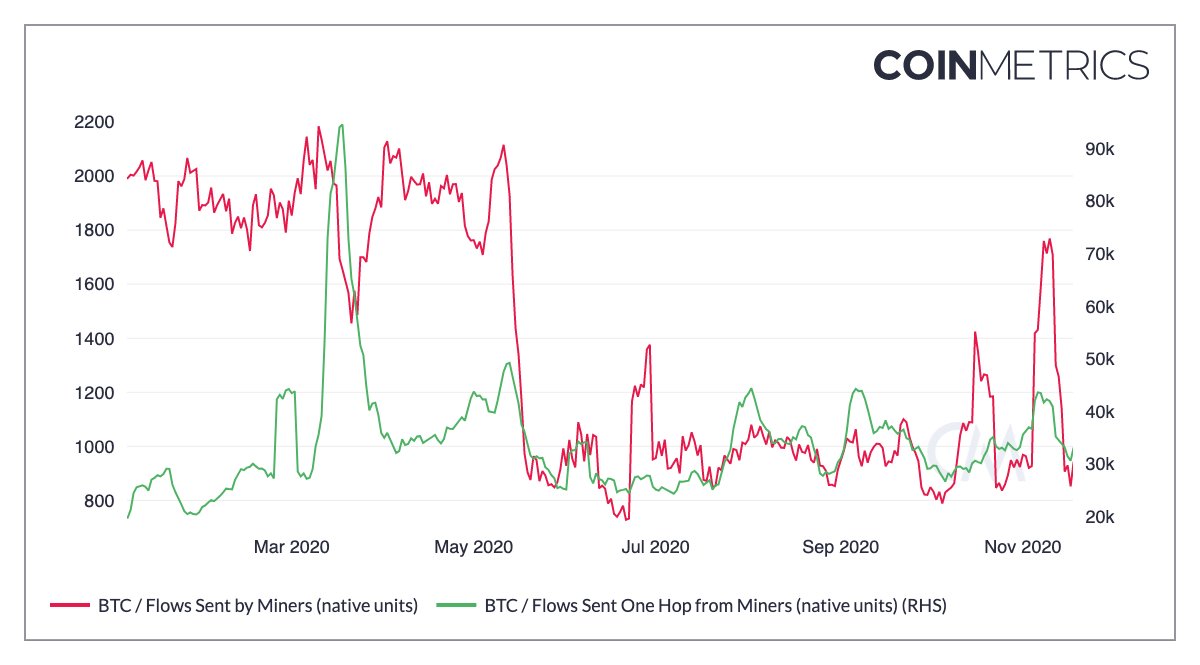

2\ Now, let's look at miner outflows, which directly measures outgoing payments from both Pools (red) and Individual miners (green)

Again, the data invalidates that narrative. The recent spikes in funds Sent shows that miners are moving assets, which signals ability to sell.

Again, the data invalidates that narrative. The recent spikes in funds Sent shows that miners are moving assets, which signals ability to sell.

3\ The 30-day Miner Rolling Inventory also suggests that nothing out of ordinary is taking place in mining pools or their individual constituents.

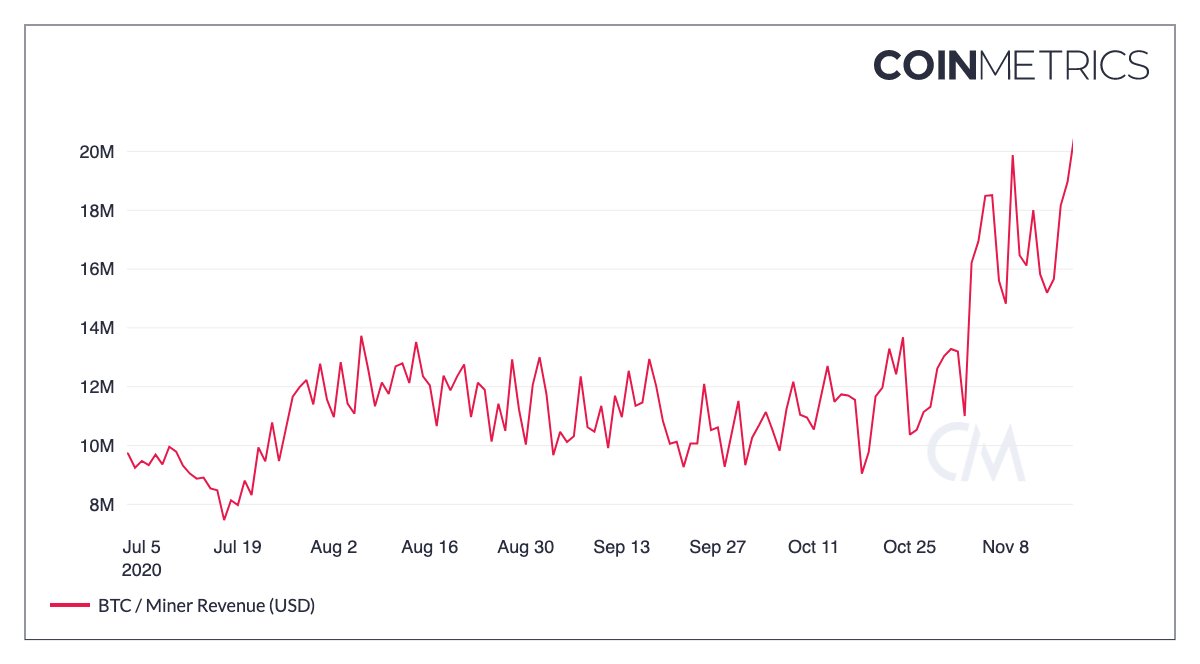

4\ Also, consider the size of Bitcoin markets vs miner rewards.

At the current volume (billions of USD), miners are unlikely to play this significant of a role in liquidity, as their daily payout rarely surpasses 20M USD.

At the current volume (billions of USD), miners are unlikely to play this significant of a role in liquidity, as their daily payout rarely surpasses 20M USD.

5\ So, based on this data, I find it unlikely that this rally is being driven by a liquidity crunch in China.

Other factors, such as increased institutional participation and macroeconomic concerns, are more likely the culprit.

Other factors, such as increased institutional participation and macroeconomic concerns, are more likely the culprit.

https://twitter.com/LucasNuzzi/status/1329429220221652993?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh