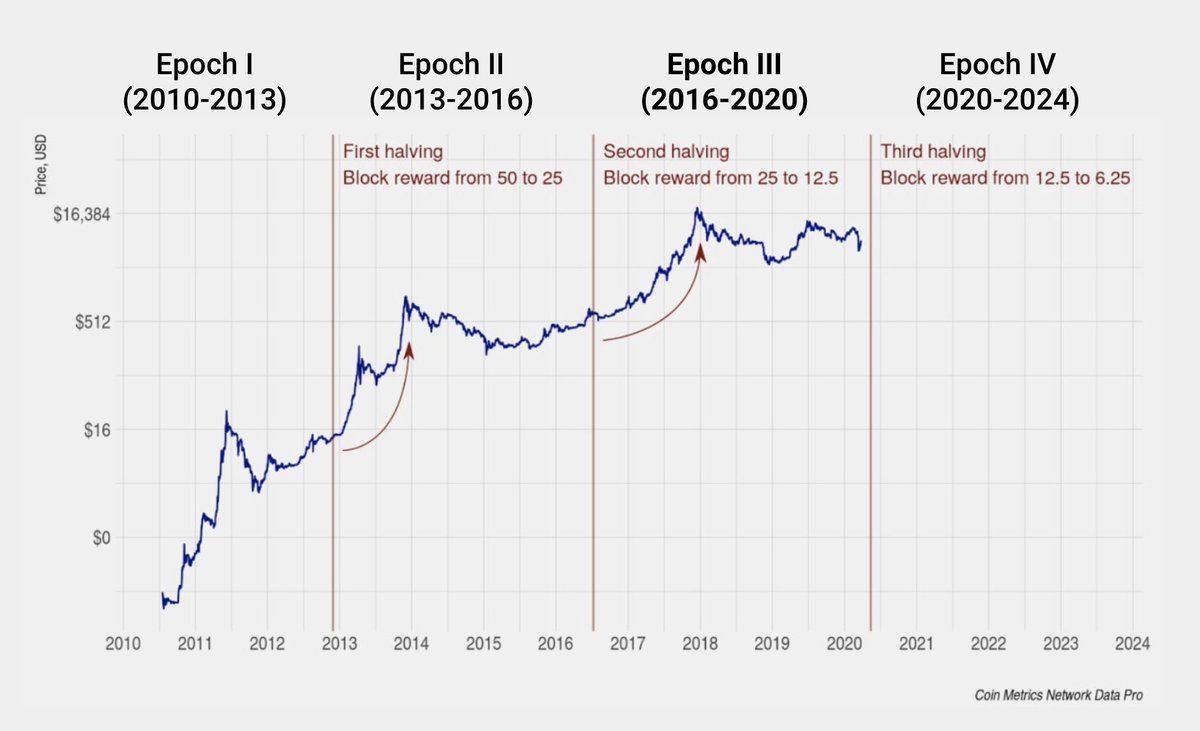

In previous Bull Markets, the MVRV ratio was one of the most reliable indicators of market tops.

It reached 3.96 in 2017 when Bitcoin flirted with $20k

MVRV-FF is currently at 1.96

If you believe history rhymes, this suggests we're not even close to the "euphoria" phase.

It reached 3.96 in 2017 when Bitcoin flirted with $20k

MVRV-FF is currently at 1.96

If you believe history rhymes, this suggests we're not even close to the "euphoria" phase.

This is not investment advice. MVRV simply tracks how the overall market valuation (market cap) compares against everyone's "cost basis" (realized cap).

It spikes when market value is disproportionately higher than the value being moved on-chain.

It spikes when market value is disproportionately higher than the value being moved on-chain.

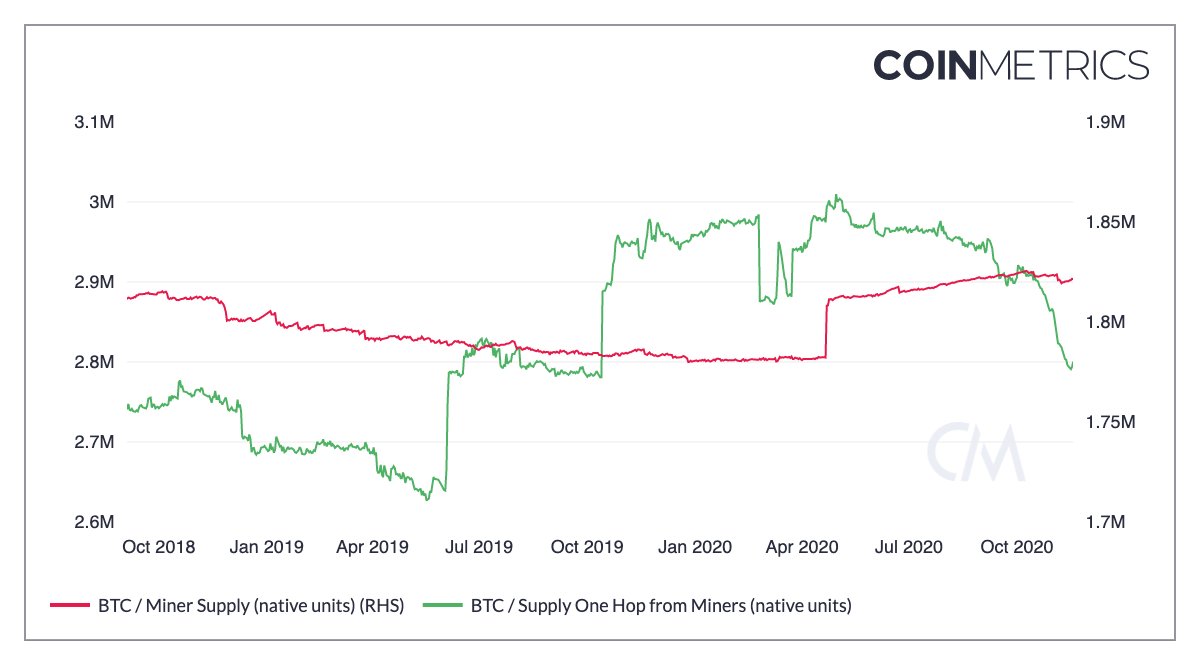

You may notice that our MVRV figures are different.

That's because we use Free Float (FF) Market Cap instead of "total" Market Cap to determine market valuation.

FF better represents liquidity, since it removes supply that's unlikely to be in the market (e.g. BTC from 2009)

That's because we use Free Float (FF) Market Cap instead of "total" Market Cap to determine market valuation.

FF better represents liquidity, since it removes supply that's unlikely to be in the market (e.g. BTC from 2009)

CoinMetric's @CelermajerB spearheaded this effort and wrote a post that's worth reading:

coinmetrics.io/introducing-fr…

coinmetrics.io/introducing-fr…

Also make sure to check out the seminal post on MVRV by @kenoshaking and @MustStopMurad ⬇️

medium.com/@kenoshaking/b…

medium.com/@kenoshaking/b…

• • •

Missing some Tweet in this thread? You can try to

force a refresh