Wow. Major news coming out of the Treasury, as reported by @SalehaMohsin:

All emergency programs from the CARES Act will expire on Dec. 31. So that's:

Municipal Liquidity Facility

Main Street Lending Program

Primary and Secondary Market Corporate Credit Facilities

All emergency programs from the CARES Act will expire on Dec. 31. So that's:

Municipal Liquidity Facility

Main Street Lending Program

Primary and Secondary Market Corporate Credit Facilities

Oh also the Term Asset-Backed Securities Loan Facility.

There WILL be a 90-day extension of the Commercial Paper Funding Facility, Primary Dealer Credit Facility, Money Market Liquidity Facility and the Paycheck Protection Program Liquidity Facility.

There WILL be a 90-day extension of the Commercial Paper Funding Facility, Primary Dealer Credit Facility, Money Market Liquidity Facility and the Paycheck Protection Program Liquidity Facility.

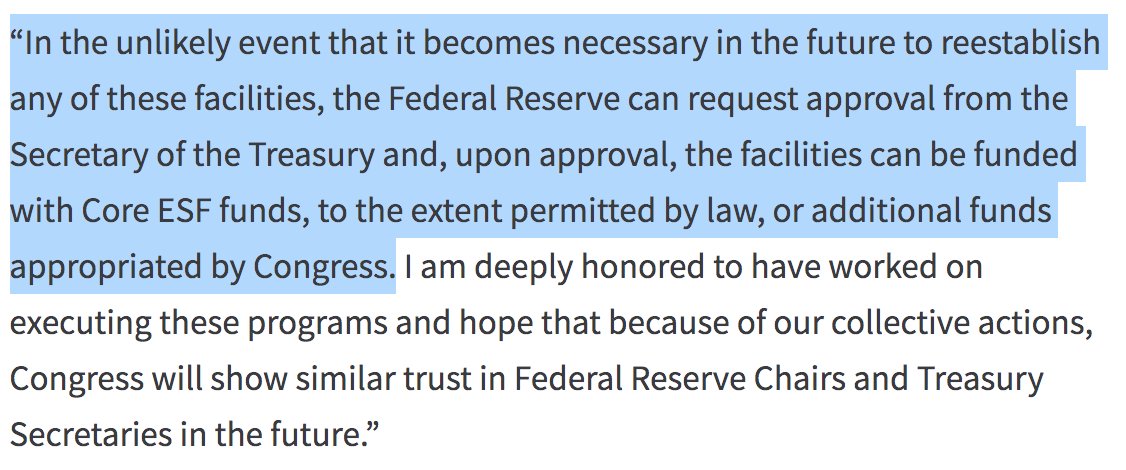

https://twitter.com/stevenmnuchin1/status/1329539416306618368

Moreover, Mnuchin is asking the Fed to return unused stimulus funds to the Treasury.

As I understand it, this would make it more difficult for President-elect Biden's Treasury Secretary to just "turn back on" the muni/corporate/Main Street facilities.

As I understand it, this would make it more difficult for President-elect Biden's Treasury Secretary to just "turn back on" the muni/corporate/Main Street facilities.

• • •

Missing some Tweet in this thread? You can try to

force a refresh