You might think “avocado toast” or “participation trophies.” But they’re about to become the biggest adult cohort in America, and Wall Street wants to know if they can lead the U.S. economy (and stock market) to greater heights.

Thread!

bloomberg.com/graphics/2019-…

Using Fed data and other statistics, we can see how young Americans (under 35) now compare to those of the past. And how they compare to older generations.

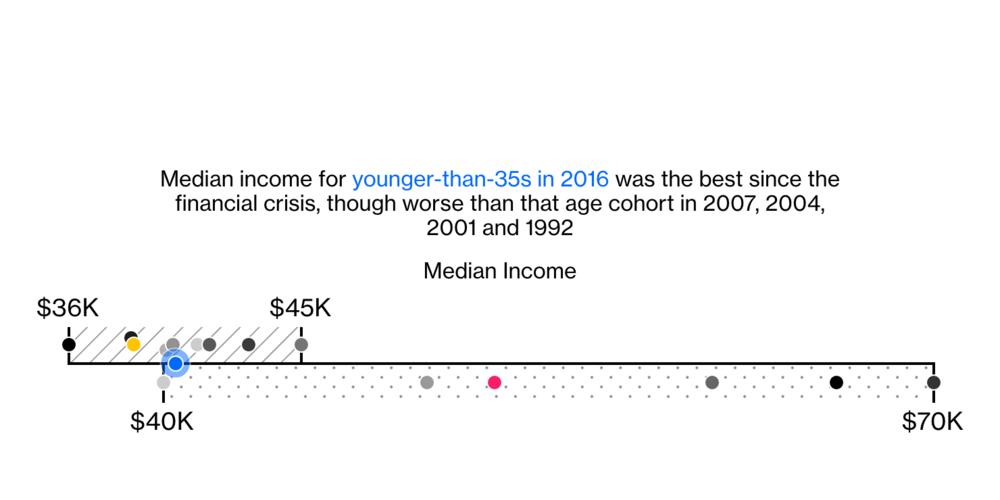

The unemployment rate has declined and wage growth has somewhat picked up in recent years. So median income is finally bouncing back after a big drop in the wake of the Great Recession.

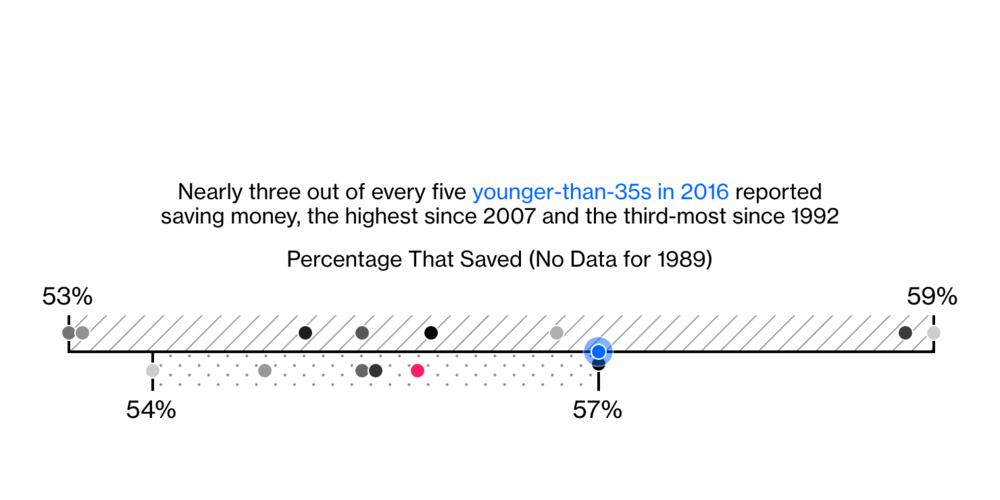

57% of millennials report saving money. That’s the most for the youngest cohort since 2007. They’re right there with 35-44 year olds, who had the advantage of entering the job market before the financial crisis.

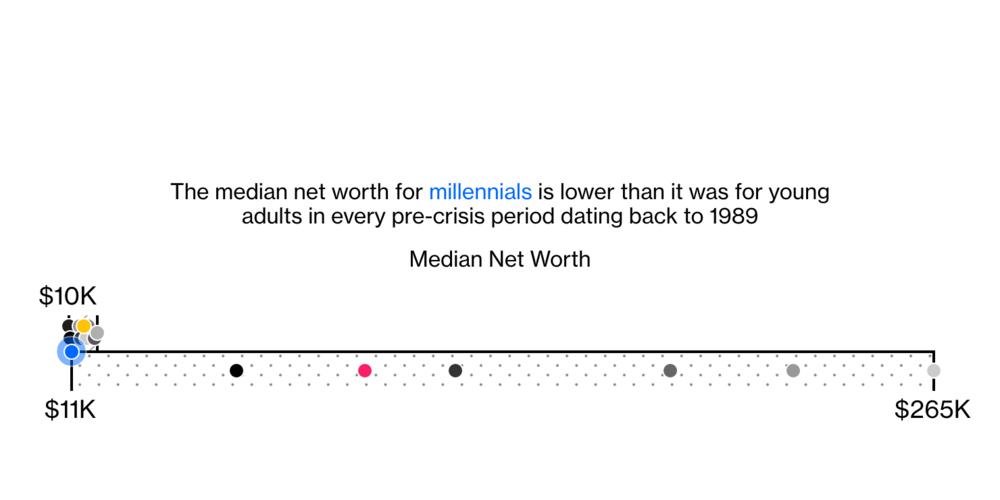

Adjusted for inflation, their median net worth of $11,000 is lower than it was for young adults in every pre-crisis period dating back to 1989.

We’ll break down what’s holding them back.

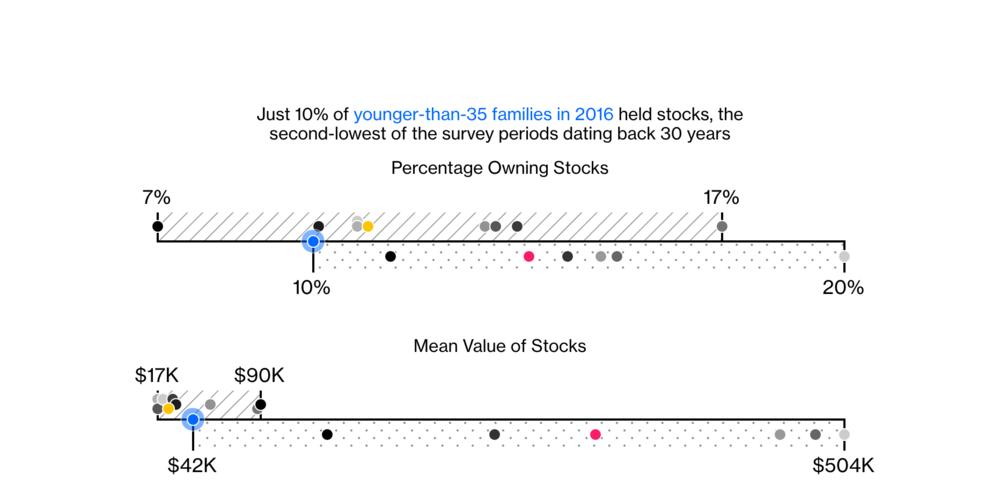

At first glance, it looks like they’re shunning the stock market like few younger generations before them.

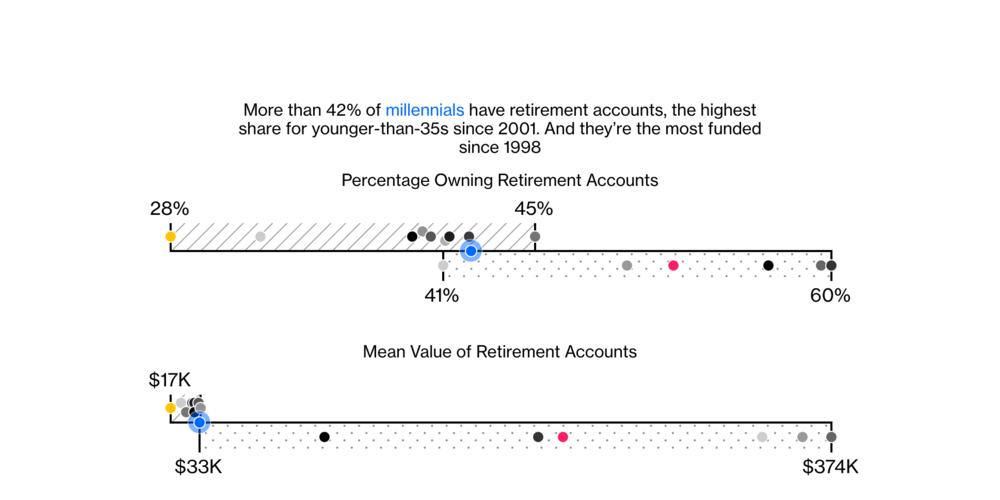

More young people own retirement accounts than any time since 2001. And they’re the most well-funded since 1998.

Also, Fidelity found that 69% of millennials are all-in on target date funds, which are loaded up with stocks.

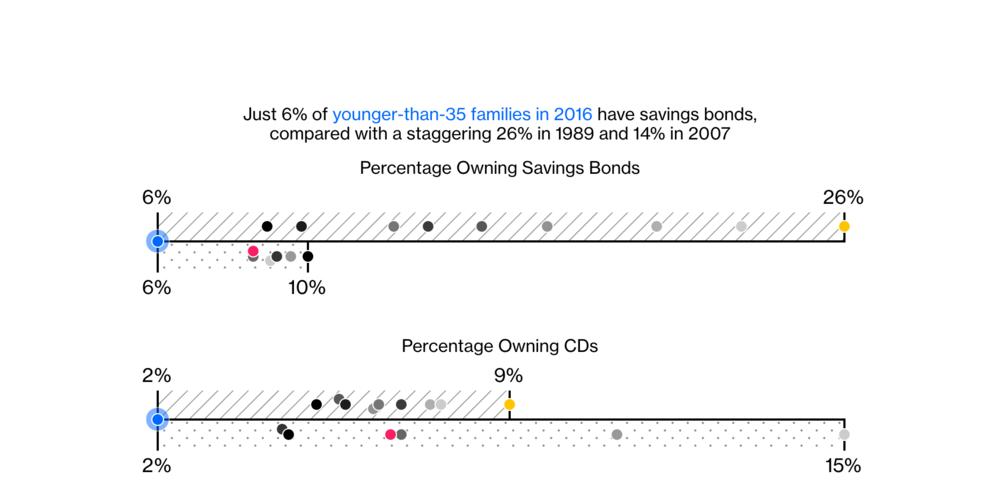

Millennials don’t do savings bonds or CDs. And if interest rates stay as low as they are now, they possibly never will.

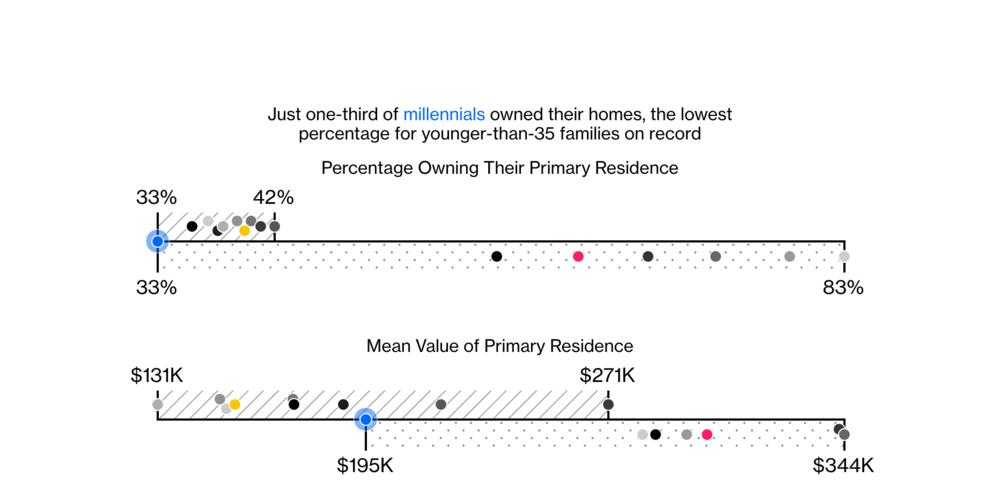

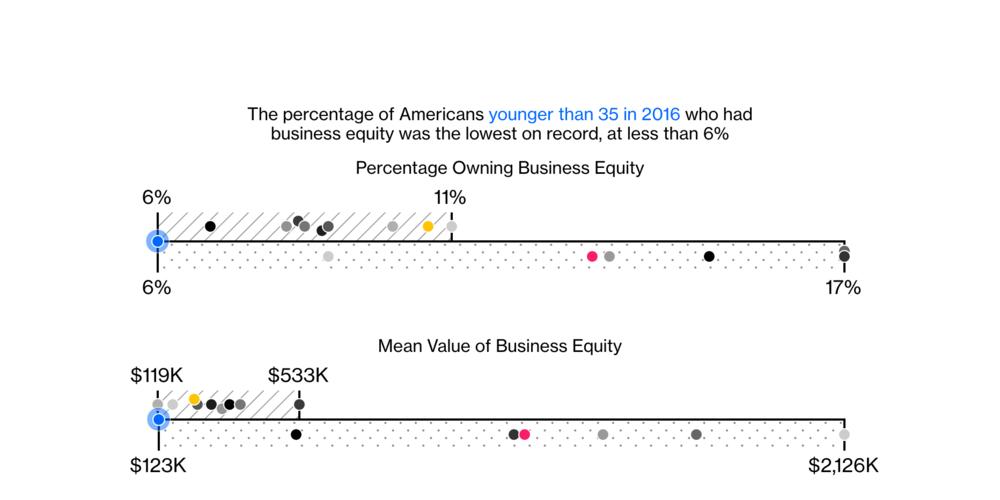

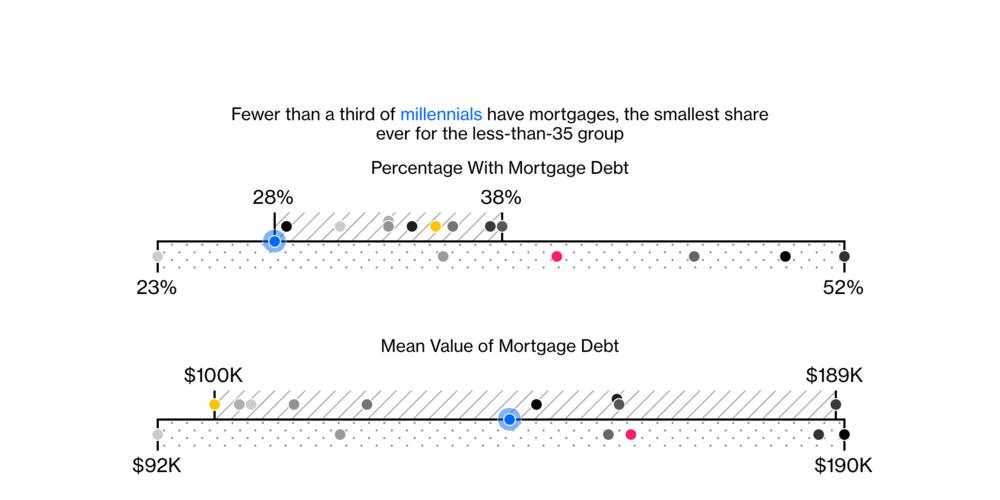

Never before have so few families under age 35 owned their primary residences. The same goes for business ownership.

That’s a BIG item on the liabilities side of the balance sheet that’s missing among millennials.

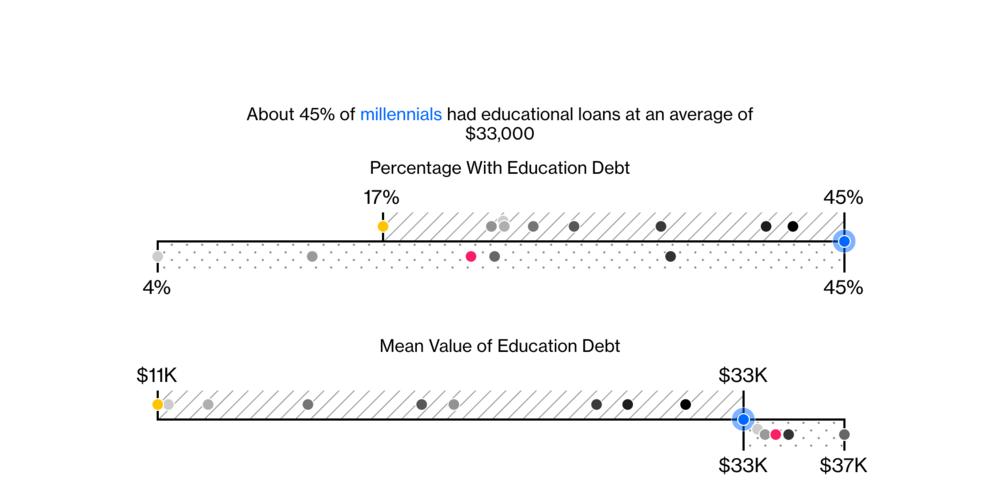

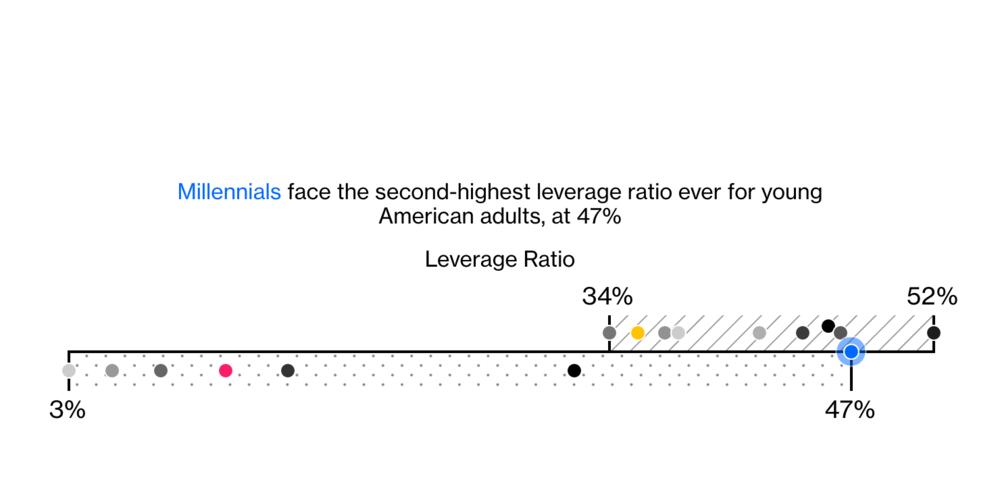

They are an ever-larger burden for millennials. 45% of people under-35 had education debt, with an average value of $33,000. Both of those are record highs.

That’s a tough starting point for accumulating wealth.

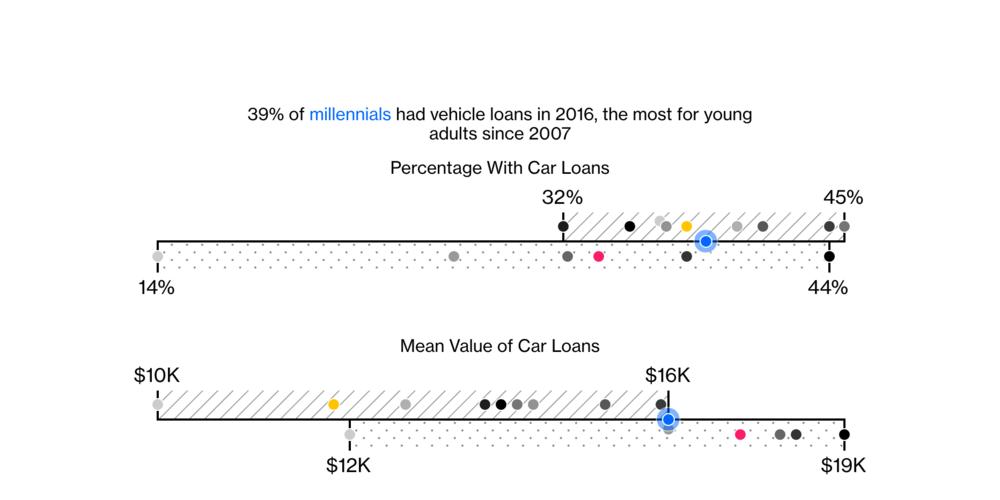

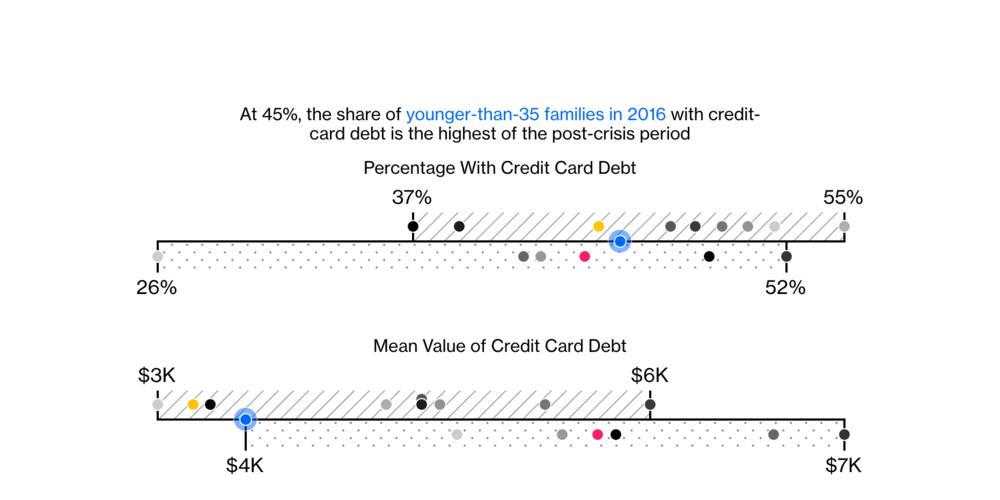

That’s a bit worrisome, especially given the record-low percentage of those with mortgage debt.

There’s no doubt millennials got off to a slower start than you’d otherwise expect. But it *seems* like they’re learning to deal with that.

For example, the fact that they’re putting money away in 401k plans is encouraging (even if it might be forced).

Whether you agree or not, demographics matter. It’ll be the youth that make or break investing in the years to come.

The end.

bloomberg.com/graphics/2019-…