#OnCNBCTV18 | Sachin Chaturvedi, RBI Board Member: most important point is about the larger goal of reaching $5 tn economy & the role banks will play

#OnCNBCTV18 | PN Vasudevan, Equitas SFB: RBI has also recommended the listing period be extended to 6 years; that will be a relief to some SFBs

#OnCNBCTV18 | Bahram Vakil, AZB & Partners: Lot of large corporate houses may be able to meet the requirements for NBFCs conversion to Universal Banks

Not sure about how many corporates which are not NBFCs will immediately be able to apply for bank licenses

Not sure about how many corporates which are not NBFCs will immediately be able to apply for bank licenses

#OnCNBCTV18 | Abizer Diwanji, EY India says NBFC conversion to banks was never disallowed, but there was lack of clarity

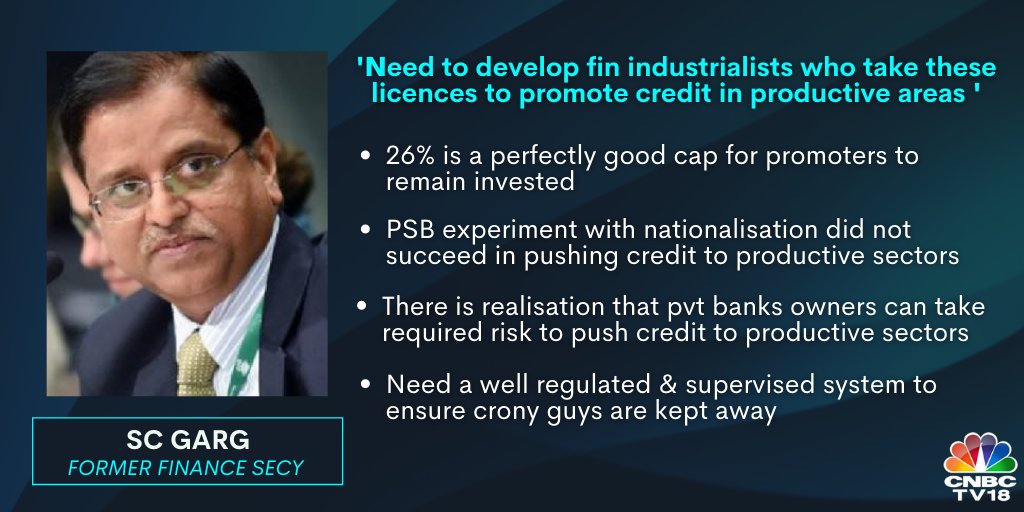

#OnCNBCTV18 | SC Garg, Former Finance Secy says PSB experiment with nationalisation did not succeed in pushing credit to productive sectors

#OnCNBCTV18 | HR Khan, Former RBI Deputy Governor: RBI has been revising & refining regulatory structure over the years

#OnCNBCTV18 | Rajnish Kumar, Former SBI Chairman: When the framework is out in place, important to simultaneously introduce strong corporate governance guidelines

Happy that LVB shareholders lost money instead of PSBs having to bail it out

Happy that LVB shareholders lost money instead of PSBs having to bail it out

• • •

Missing some Tweet in this thread? You can try to

force a refresh