#CNBCTV18Market | CLSA believes #RBI Working Group's recommendations are pragmatic and non-disruptive. It feels that overall, the recommendations made by the panel are positive for smaller banks & SFBs

#CNBCTV18Market | Here is Jefferies' take on RBI Panel report which was released last week. It believes RBI committee has taken an open-minded approach; recommendations suggest relaxing slew of norms with safeguards.

#CNBCTV18Market | Investec believes changes recommended by RBI panel can have far reaching implications, both positive & negative. RBI is driving the consolidation of banking system; positive for large banks

#CNBCTV18Market | CLSA says pharma outlook commentary has been positive, Sun Pharma, Torrent Pharma & Dr Reddy's are its preferred picks

#CNBCTV18Market | On IT services sector, CLSA notes the healthy growth outlook & margin comfort. It expects the revenue momentum to remain healthy in the near-term

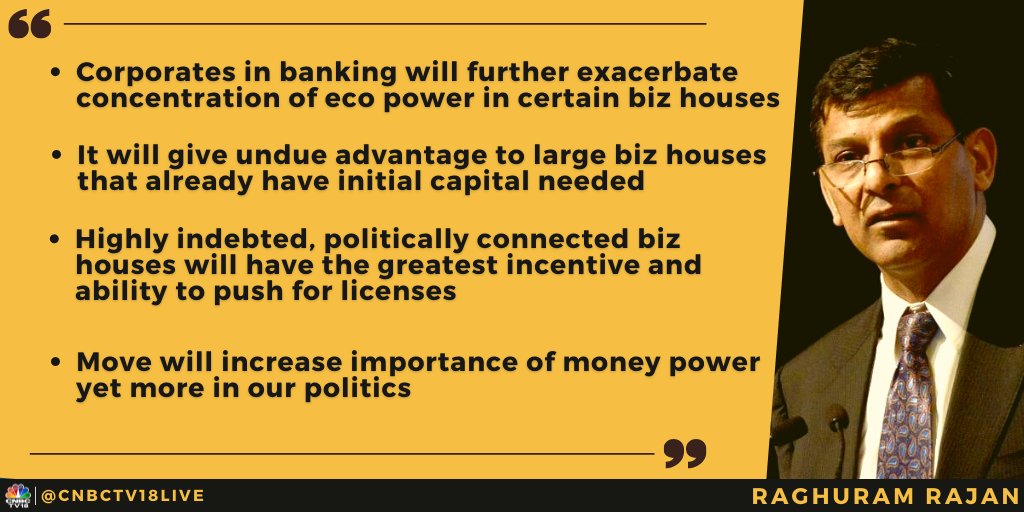

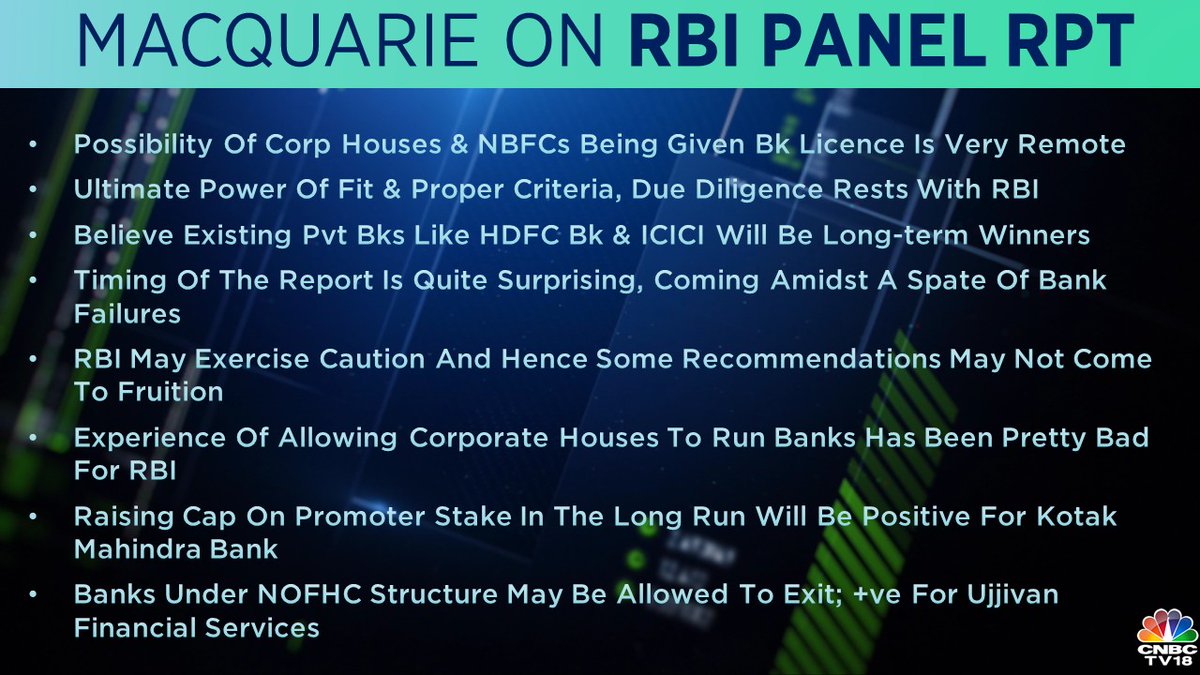

#CNBCTV18Market | Macquarie believes the possibility of corporate houses & NBFCs being given bank licence is very remote & that existing private banks like HDFC Bank & ICICI Bank will be long-term winners

#CNBCTV18Market | Credit Suisse believes recommendations such as those made by the RBI panel on Friday typically have a high likelihood of being accepted.

Surprising recommendation is to allow corporates ownership of banks, the brokerage says

Surprising recommendation is to allow corporates ownership of banks, the brokerage says

• • •

Missing some Tweet in this thread? You can try to

force a refresh