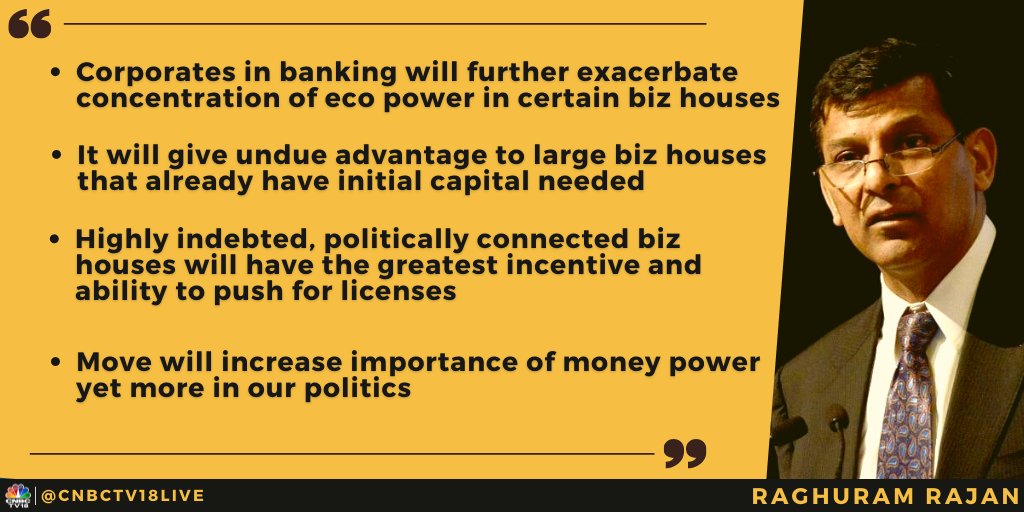

Many technical rationalisations proposed by RBI's Internal Working Group are worth adopting, while its main recommendation, to allow Indian corp houses into banking, is best left on the shelf, former @RBI Governor Raghuram Rajan argues

Fmr RBI Governor Raghumaram Rajan, Fmr Deputy Governor Viral Acharya write joint blog pointing to dangers of bank licences to corporates.

'The ove will increase importance of money power yet more in our politics. It will make us more likely to succumb to authoritarian cronyism'

'The ove will increase importance of money power yet more in our politics. It will make us more likely to succumb to authoritarian cronyism'

Fmr RBI Governor Raghumaram Rajan, Fmr Deputy Governor Viral Acharya timing of IWG when India is still trying to learn the lessons from failures like IL&FS & Yes Bank.

Fmr RBI Governor Raghuram Rajan, Fmr Deputy Governor Viral Acharya question the urgency to change regulation, especially given that committees rarely set up out of the blue.

• • •

Missing some Tweet in this thread? You can try to

force a refresh