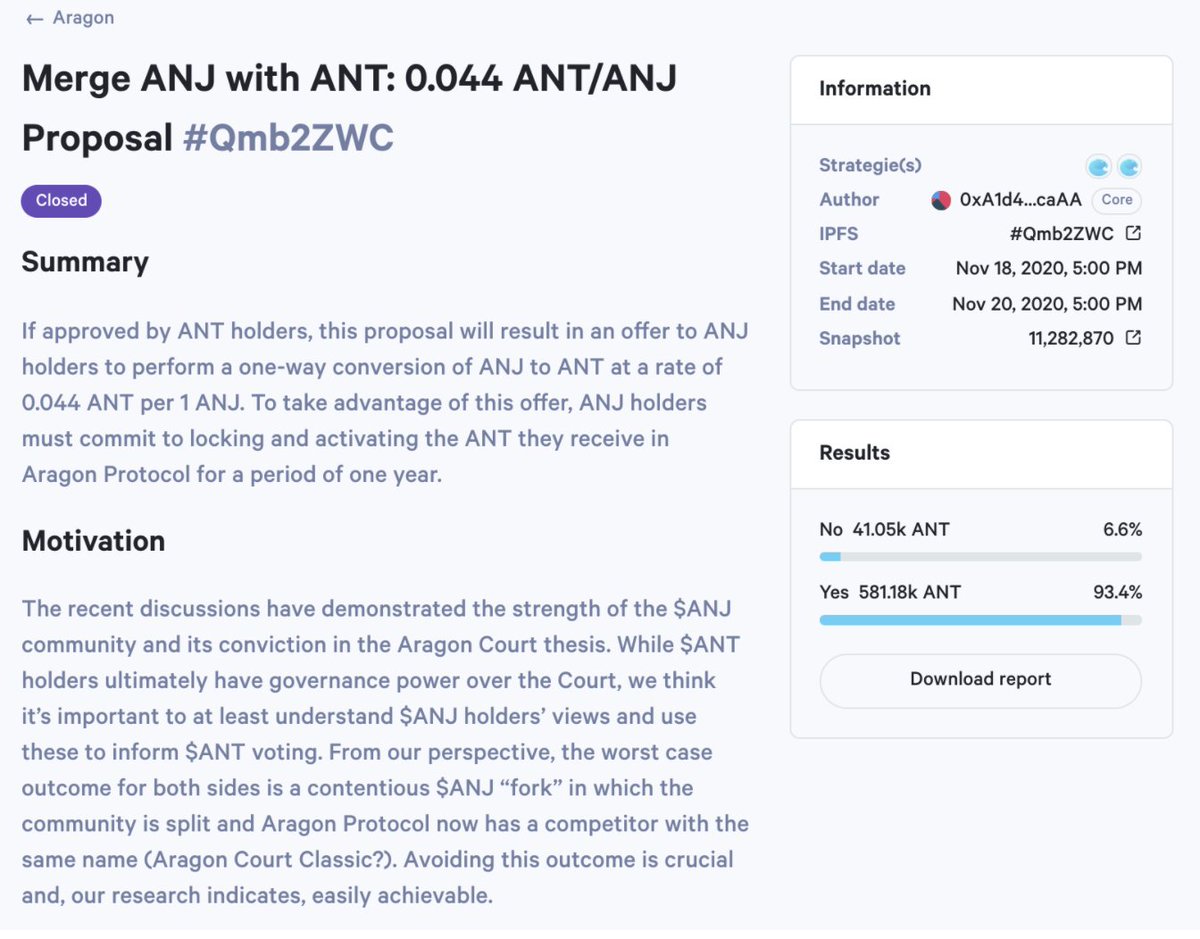

1/ Today, after 1 month of working closely with the @AragonProject team and community, our proposal to buyout $ANJ holders who lock their converted $ANT for 12 months was voted in at a conversion price of 0.044ANT/ANJ ($0.138 at current prices)

2/ This represents an excellent outcome for $ANJ holders who only 8 weeks ago were being forced to sell at 0.015 ANT ($0.05 at current prices)

The price of $ANJ has already reacted, up over 100% in the hours since the vote

The price of $ANJ has already reacted, up over 100% in the hours since the vote

3/ While this process has had its share of hiccups along the way, we’re proud of $ANT holders for listening to the $ANJ community, paying a multiple that appropriately reflects the commitment made by $ANJ holders and the upside given up via merging into $ANT

4/ According to our calculations, this premium can be paid with no more than ~9% dilution by $ANT holders (assuming all $ANJ holders choose to convert which is unlikely)

We believe that's a cheap price to pay to acquire an engaged community of committed supply-siders

We believe that's a cheap price to pay to acquire an engaged community of committed supply-siders

5/ @synthetix_io has already shown the power of token lock-ups and liquidity mining incentives in bootstrapping a strong supply-side and community

6/ With the merger behind us and a community of engaged supply-siders, the onus is now on the Aragon team and community to buidl and begin attracting users to the newly formed Aragon Protocol

7/ Governance is a multi-trillion dollar opportunity and while there are open questions regarding value capture and TAM, Aragon starts with a significant traction lead and a large war-chest

We look forward to helping Aragon capitalize on these advantages over the next year

We look forward to helping Aragon capitalize on these advantages over the next year

8/ This represents the first decentralised governance powered crypto M&A transaction, setting an important precedent going forwards

As crypto matures and token projects converge to the startup failure rate of 90%, we expect blue-chips to increasingly engage in M&A

As crypto matures and token projects converge to the startup failure rate of 90%, we expect blue-chips to increasingly engage in M&A

9/ Read the full post here: delphidigital.io/reports/our-an…

Stay tuned next week as we’ll be producing a full video walkthrough of the $ANJ merger process from beginning to end. Exclusively for @Delphi_Digital subscribers

Stay tuned next week as we’ll be producing a full video walkthrough of the $ANJ merger process from beginning to end. Exclusively for @Delphi_Digital subscribers

• • •

Missing some Tweet in this thread? You can try to

force a refresh