Crypto investing is hard.

In yesterday's daily, I covered the framework I use to analyse crypto investment opportunities

I then use this framework to show why I believe decentralised insurance as a sector is relatively undervalued compared to the DEX sector

Thread

👇

In yesterday's daily, I covered the framework I use to analyse crypto investment opportunities

I then use this framework to show why I believe decentralised insurance as a sector is relatively undervalued compared to the DEX sector

Thread

👇

1/ Unlike traditional investors, investors in the crypto space must analyse and underwrite a series of stacked risks when investing in projects

2/

👉 Will the project create value and attract users?

👉 Will the project be able to capture value from those users and establish a long-term, defensible moat?

👉 Will the value captured accrue to the token?

👉 Will the project create value and attract users?

👉 Will the project be able to capture value from those users and establish a long-term, defensible moat?

👉 Will the value captured accrue to the token?

3/ The first test is the easiest in the sense that it’s one investors in traditional markets are already used to making

Is the product useful and does it have product-market fit? Is the team experienced and capable?

Is the product useful and does it have product-market fit? Is the team experienced and capable?

4/ The second test is tougher. In traditional markets, investors can get away with being less rigorous about this as proprietary technology and strong teams can pose moats

Crypto's open nature means only network effects provide reliable long-term defensibility

Crypto's open nature means only network effects provide reliable long-term defensibility

5/ Ideally, as investors we want projects with multiple, compounding, unforkable moats that cumulatively mean the project has some form of increasing returns to scale, meaning it gets more difficult to unseat the bigger it is

delphidigital.io/reports/unfork…

delphidigital.io/reports/unfork…

6/ The third test is the one traditional investors have least experience with

Unlike equity which is likely to be valuable if the project passes the first 2 tests, the value of a token depends entirely on its design. Each token is different and must be analysed independently

Unlike equity which is likely to be valuable if the project passes the first 2 tests, the value of a token depends entirely on its design. Each token is different and must be analysed independently

7/ Good investments must pass all three tests, a daunting task made more difficult by the open, forkable nature of projects in the space

I believe #few in the space currently think about investments in these terms, leading to significant mispricings

I believe #few in the space currently think about investments in these terms, leading to significant mispricings

8/ We will now apply our framework to two different sectors: decentralised exchanges and insurance, focusing primarily on the second and third tests

9/ As I argued in my piece on DEX Wars and Aggregation Theory, DEX liquidity is “undifferentiated supply”, meaning it is highly price elastic as most traders care only about best execution

delphidigital.io/reports/dex-wa…

delphidigital.io/reports/dex-wa…

10/ While some users may interact with their favourite DEXes directly, we feel aggregators such as @1inchExchange , @DeBankDeFi will increasingly dominate since they allow users to get best execution on trades across all active DEXes

11/ While the supply side provides greater opportunity for differentiation on things like algorithm optimisations (@BreederDodo ), flexibility (@BalancerLabs ), types of assets (@thorchain_org ), LPs are still primarily interested in optimising yield

12/ As such, an exchange’s moat is liquidity since this means better execution, higher trading fees and better yield for LPs

However, liquidity is fluid and will flow towards the highest yield. Rent extraction to tokenholders hampers execution/yield and thus the exchange's moat

However, liquidity is fluid and will flow towards the highest yield. Rent extraction to tokenholders hampers execution/yield and thus the exchange's moat

13/ Now let’s compare this with insurance. Liquidity is also a moat for insurance in that more liquidity means greater capacity.

However, insurance has several additional moats

However, insurance has several additional moats

14/ Differentiated supply

Since insurance cover is underwritten for a given period of time, supply-side liquidity is less fluid as there must always be enough capacity to pay out existing claims (i.e. @NexusMutual's MCR)

Since insurance cover is underwritten for a given period of time, supply-side liquidity is less fluid as there must always be enough capacity to pay out existing claims (i.e. @NexusMutual's MCR)

15/ In addition, supply-siders have skin in the game and must accurately assess claims to ensure the long-term growth of the platform

This is very different from an LP passively providing liquidity in an AMM

This is very different from an LP passively providing liquidity in an AMM

16/ Differentiated Demand

Unlike exchanges in which traders care primarily about best execution and have little to no brand loyalty, insurance platforms are chosen based not just on pricing but also on a user’s confidence in the platform's ability to pay out

Unlike exchanges in which traders care primarily about best execution and have little to no brand loyalty, insurance platforms are chosen based not just on pricing but also on a user’s confidence in the platform's ability to pay out

17/ This brand moat can only be developed over years of paying out claims and cannot be forked or vampire attacked away

18/ Diversification & Efficiency

Unlike exchanges in which efficiency depends almost solely on liquidity, for insurance protocols efficiency relies on leverage: using $1 of capital to underwrite >$1 worth of risk

Unlike exchanges in which efficiency depends almost solely on liquidity, for insurance protocols efficiency relies on leverage: using $1 of capital to underwrite >$1 worth of risk

19/ Leverage can only be achieved by underwriting diversified risks

As such, not only is stealing liquidity difficult, new entrants will struggle to compete on price even if they attract liquidity as they will not have the diversification necessary to enable leverage

As such, not only is stealing liquidity difficult, new entrants will struggle to compete on price even if they attract liquidity as they will not have the diversification necessary to enable leverage

20/ This is also why we remain bearish on prediction market based insurance models which are capitalized 1:1

As we see it, these models will always remain either expensive for cover buyers or provide low yields to LPs

As we see it, these models will always remain either expensive for cover buyers or provide low yields to LPs

21/ Non-linear liquidity network effect

Unlike exchanges, the liquidity network effect for an insurance product scales non-linearly in that a platform with more liquidity does not just offer better pricing but is also capable of underwriting entirely new types of risks...

Unlike exchanges, the liquidity network effect for an insurance product scales non-linearly in that a platform with more liquidity does not just offer better pricing but is also capable of underwriting entirely new types of risks...

22/ ...e.g. protocol insurance for treasuries

Large capital pools can underwrite proprietary cover, diversifying their liabilities and enabling greater diversification. This in turn provides greater efficiency, generating the familiar network effect flywheel

Large capital pools can underwrite proprietary cover, diversifying their liabilities and enabling greater diversification. This in turn provides greater efficiency, generating the familiar network effect flywheel

23/ While both insurance and exchange will be massive sectors, we see insurance as being better positioned to capture value long-term

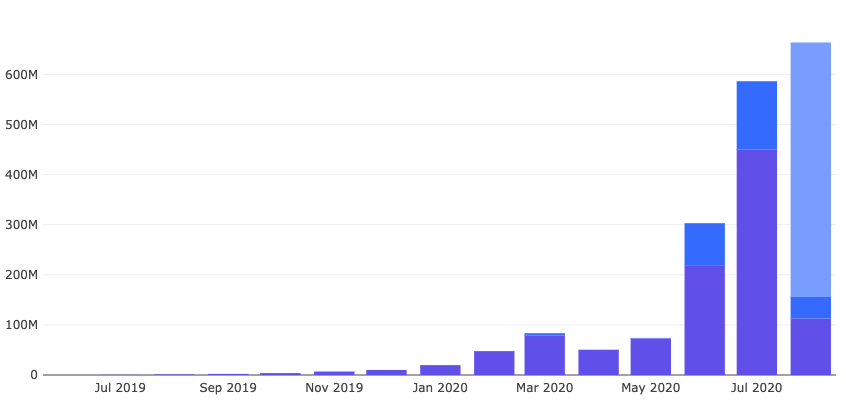

This is not reflected in prices right now as the cumulative market cap of DEXes is $2.7B compared to only ~$230M for insurance

This is not reflected in prices right now as the cumulative market cap of DEXes is $2.7B compared to only ~$230M for insurance

24/ While an imperfect comparison, it's worth remembering that in the real world insurance is a $6.3T industry and the largest segment within financial services alongside banking. Exchanges are far smaller by any measure

25/ It goes without saying that both DEXes and insurance have massive upside from here given the growth we expect in DeFi as a whole - we are interested in speaking with and investing in teams in both sectors

Disclaimer: Delphi Ventures is an investor in $RUNE, $NXM and Debank

Disclaimer: Delphi Ventures is an investor in $RUNE, $NXM and Debank

• • •

Missing some Tweet in this thread? You can try to

force a refresh